I need the answers in Excel format

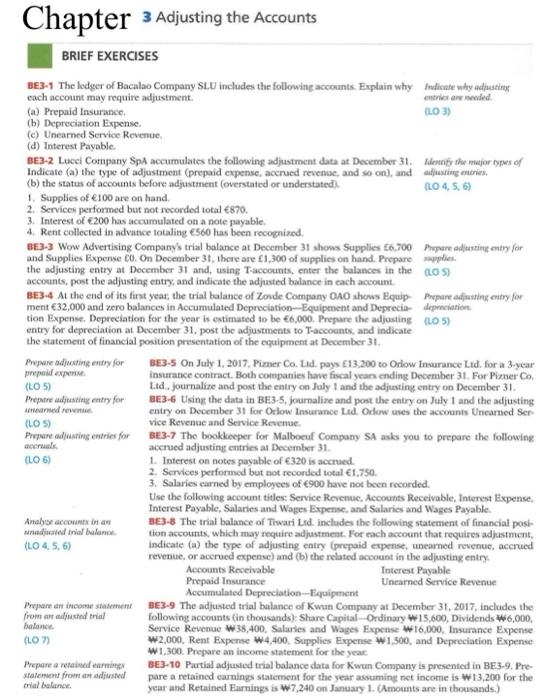

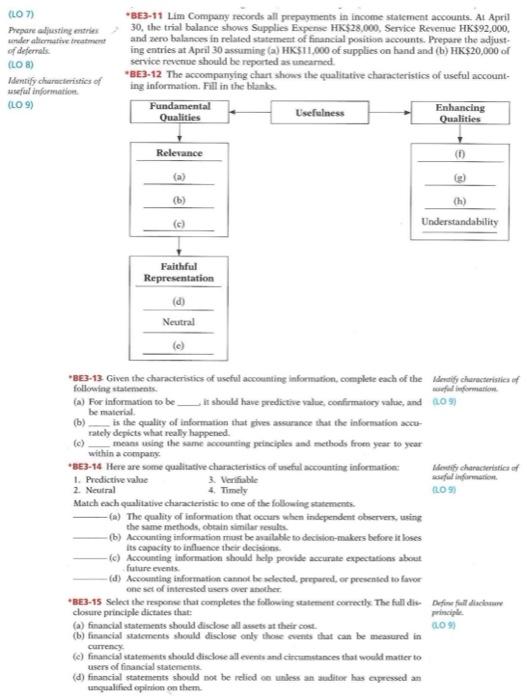

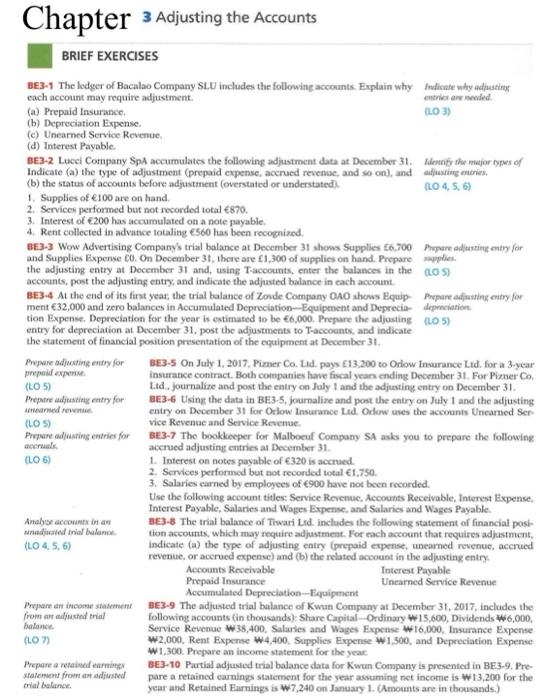

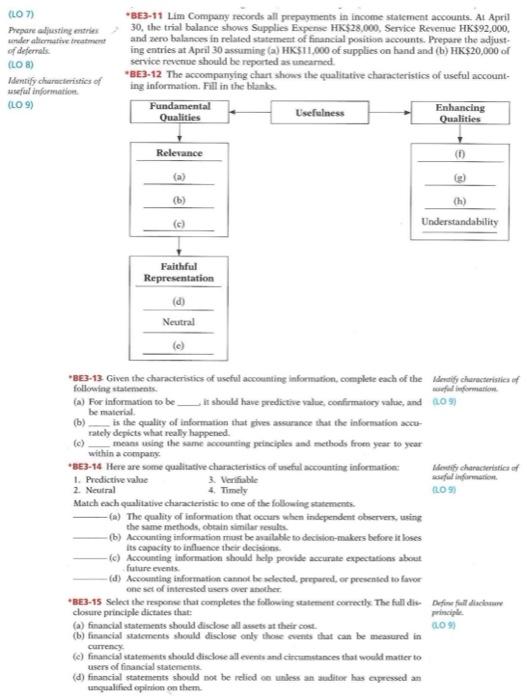

Chapter 3 Adjusting the Accounts BRIEF EXERCISES BE3-1 The ledger of Bacalao Company SLU includes the following accounts. Explain why indicate why adjusting each account may require adjustment entries are de (a) Prepaid Insurance (L03) (b) Depreciation Expense. (e) Uneared Service Revenue. (d) Interest Payable. BE3-2 Lucci Company SpA accumulates the following adjustment data at December 31. Identify the major types of Indicate (a) the type of adjustment (prepaid expense, accrued revenue, and so on), and adjusting entries, (b) the status of accounts before adjustment (overstated or understated) FLO45.6) 1. Supplies of 100 are on hand. 2. Services performed but not recorded total 870. 3. Interest of 200 has accumulated on a note payable. 4. Rent collected in advance totaling 560 has been recognized BE3-3 Wow Advertising Company's trial balance at December 31 shows Supplies (6,700 per adjusting entry for and Supplies Expense Co. On December 31, there are 1,300 of supplies on hand. Prepare applies the adjusting entry at December 31 and using Taccounts, enter the balances in the (LOS) accounts, post the adjusting entry, and indicate the adjusted balance in cach account. BE3-4 At the end of its first year, the trial balance of Zo de Company OAO shows Equip Prepare adjusting entry for ment 32,000 and zero balances in Accumulated Depreciation--Equipment and Deprecis depreciation tion Expense. Depreciation for the year is estimated to be 6,000. Prepare the adjusting (LO 5) entry for depreciation at December 31, post the adjustments to T-accounts, and indicate the statement of financial position presentation of the equipment at December 31. Prepare adjusting entry for BE3-5 On July 1, 2017. Pimer Co. Ltd. pays 13.200 to Orlow Insurance Ltd. for a 3-year prepaid ex insurance contract. Both companies have fiscal years ending December 31. For Pizner Co. (LO) I.td. journalise and post the entry on July 1 and the adjusting entry on December 31 Prepare adjusting entry for BE3-6 Using the data in BE3-5 journalive and post the entry on July 1 and the adjusting med rew entry on December 31 for Orlow Insurance Lid. Odow uses the accounts Uncarned Ser (LOS) vice Revenue and Service Revenue Prepare adating entries for BE3-7 The bookkeeper for Malboeuf Company SA asks you to prepare the following Gors accrued adjusting entries at December 31. (LO 6) 1. Interest on notes payable of 320 is accrued. 2. Services performed but not recorded total 1,750 3. Salaries carned by employees of 900 have not been recorded. Use the following account titles Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and Wages Payable. Anabor GCCOLI BE3-8 The trial balance of Tiwari Lid. includes the following statement of financial posi- uradjusted trial balance tion accounts, which may require adjustment. For each account that requires adjustment, (LO4,5,6) indicate (a) the type of adjusting entry (prepaid expense, unearned revenue, accrued revenue, or accrued expense) and (b) the related account in the adjusting entry Accounts Receivable Interest Payable Prepaid Insurance Uncanned Service Revenue Accumulated Depreciation Equipment Prepare an income statement BE3-9 The adjusted trial balance of Kwun Company at December 31, 2017 includes the from an adjusted trial following accounts in thousands): Share Capital Ordinary 15,600. Dividends W6,000, balance Service Revenue W38,400, Salaries and Wages Expense W16,000, Insurance Expense (LO) w2,000, Rent Expense w4,400. Supplies Expense W1,500, and Depreciation Expense W1,300. Prepare an income statement for the year Prepare a fined in BE3-10 Partial adjusted trial balance data for Kwun Company is presented in BE3-9. Pre- statement from an adjusted pare a retained carning statement for the year assuming net income is W13,200 for the trial balance year and Retained Earnings is W7,240 on January 1. (Amounts are in thousands.) (LO7) BE3-11 Lam Company records all prepayments in income statement accounts. At April Prepare adjusting entries 30, the trial balance shoes Supplies Expense HK$28.000, Service Revenue HK$92,000, under alternative treatment and zero balances in related statement of financial position accounts. Prepare the adjust of deferrals ing entries at April 30 assuming (a) HK$11,000 of supplies on hand and (b) HK$20,000 of (LO) service revenue should be reported as uneared Identify characteristics of "BE3-12 The accompanying chan shows the qualitative characteristics of useful account useful information ing information. Fill in the banke (LO 9) Fundamental Qualities Usefulness Enhancing Qualities Relevance (D) (a) (h) Understandability Faithful Representation (d Neutral BE3-13 Given the characteristics of useful accounting information, complete each of the deafy characteristics of following statements {a) For information to be It should have predictive value confirmatory value, and 109 be material (b) is the quality of information that pives assurance that the information rately depicts what really happened. means using the same accounting peinciples and methods froen year to year within a company *8E3-14 Here are some qualitative characteristics of useful accounting information: Muharacteristics of 1. Predictive value 3. Verifiable seful information 2. Neutral 4 Timely LO Match each qualitative characteristic to me of the following statements {a) The quality of information that occurs when independent observers, using the same methods, obtain similar results. (b) Accounting information must be available to decision-makers before it loses its capacity to influence their decisions (c) Accounting information should help provide accurate expectations about future events (d) Accounting information cannot be dected, prepared or presented to favor one set of interested users over bother BE3-15 Select the response that completes the following statement correctly. The full di Define full disciente closure dictates (a) financial statements should disclose all assets at their cont. LO (b) financial statements should disclose only these events that can be measured in (e) financial statements should disclose all events and circumstances that would matter to users of financial statement (d) financial statements should not be relied on unless an auditor has expressed an unqualified opinion on them Currency