I need the answers to all the 3 parts with detailed explanation. Please provide it

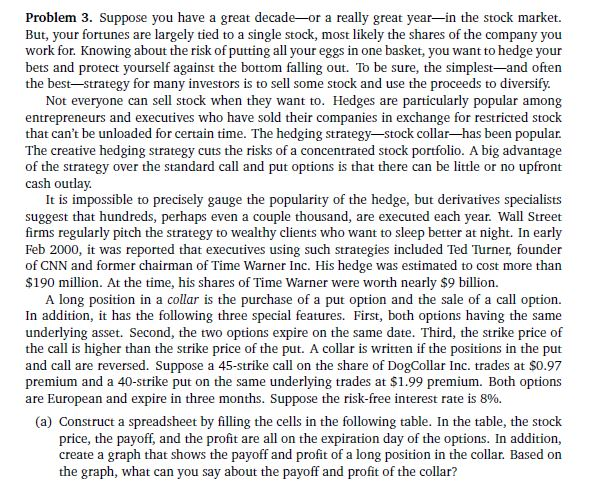

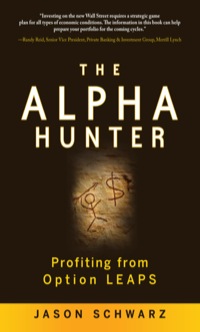

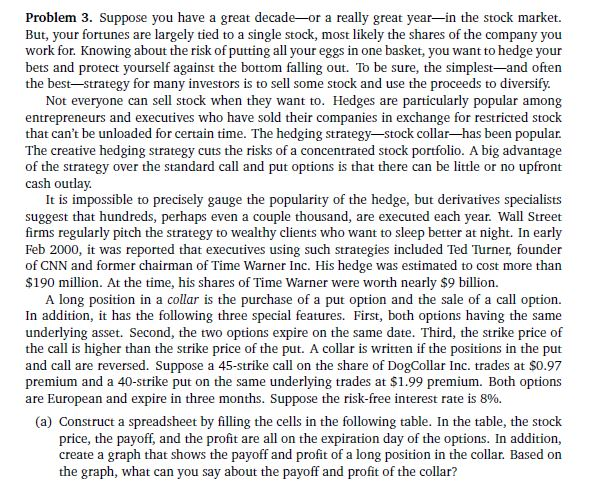

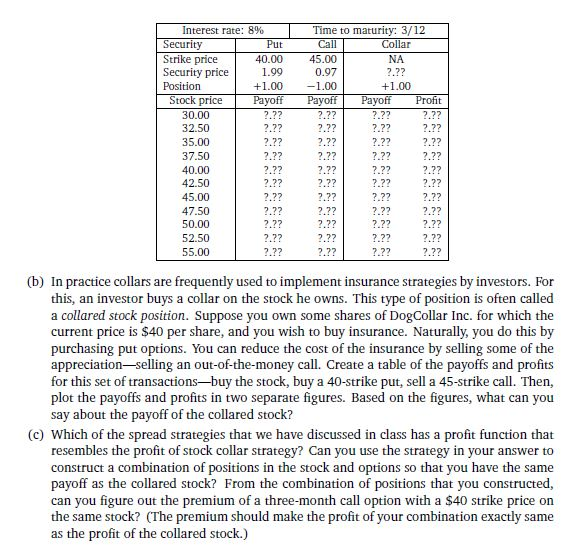

Problem 3. Suppose you have a great decade-or a really great year-in the stock market. But, your fortunes are largely tied to a single stock, most likely the shares of the company you work for. Knowing about the risk of putting all your eggs in one basket, you want to hedge your bets and protect yourself against the bottom falling out. To be sure, the simplest-and often the best-strategy for many investors is to sell some stock and use the proceeds to diversify Not everyone can sell stock when they want to. Hedges are particularly popular among entrepreneurs and executives who have sold their companies in exchange for restricted stock that can't be unloaded for certain time. The hedging strategy-stock collar-has been popular. The creative hedging strategy cuts the risks of a concentrated stock portfolio. A big advantage of the strategy over the standard call and put options is that there can be little or no upfront cash outlay It is impossible to precisely gauge the popularity of the hedge, but derivatives specialists suggest that hundreds, perhaps even a couple thousand, are executed each year. Wall Street firms regularly pitch the strategy to wealthy clients who want to sleep better at night. In early Feb 2000, it was reported that executives using such strategies included Ted Turner, founder of CNN and former chairman of Time Warner Inc. His hedge was estimated to cost more than $190 million. At the time, his shares of Time Warner were worth nearly $9 billion. A long position in a collar is the purchase of a put option and the sale of a call option In addition, it has the following three special features. First, both options having the same underlying asset. Second, the two options expire on the same date. Third, the strike price of the call is higher than the strike price of the put. A collar is written if the positions in the put and call are reversed. Suppose a 45-strike call on the share of DogCollar Inc. trades at $0.97 premium and a 40-strike put on the same underlying trades at $1.99 premium. Both options are European and expire in three months. Suppose the risk-free interest rate is 8% (a) Construct a spreadsheet by filling the cells in the following table. In the table, the stock price, the payoff, and the profit are all on the expiration day of the options. In addition, create a graph that shows the payoff and profit of a long position in the collar. Based on the graph, what can you say about the payoff and profit of the collar