Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need the best case, worst case, most likely case and break even analysis. as well ad the npv, dcf, and irr Question #1: WACC

i need the best case, worst case, most likely case and break even analysis. as well ad the npv, dcf, and irr

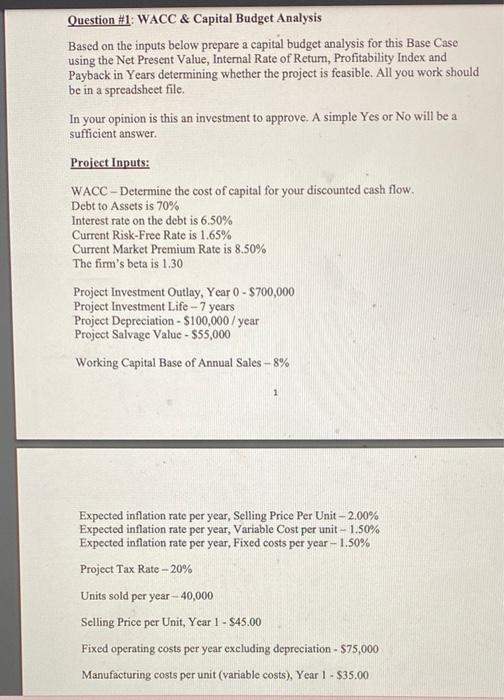

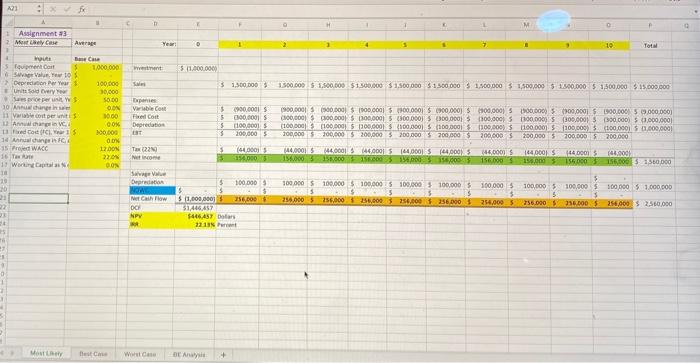

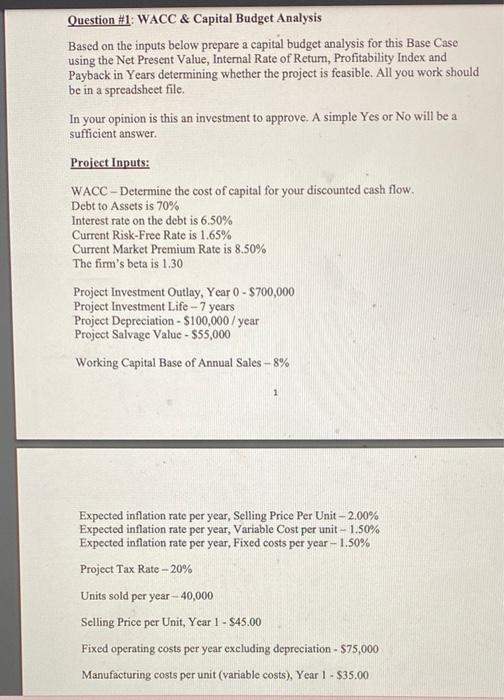

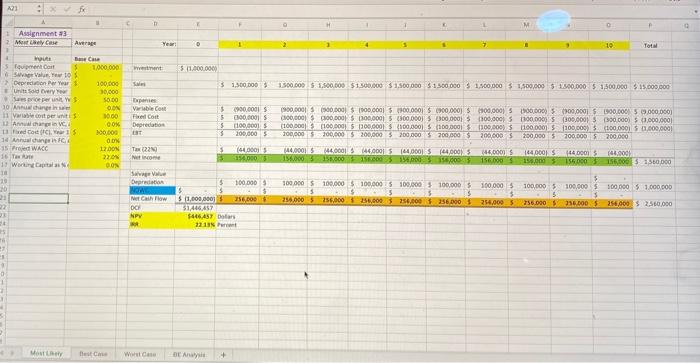

Question #1: WACC & Capital Budget Analysis Based on the inputs below prepare a capital budget analysis for this Base Case using the Net Present Value, Internal Rate of Return, Profitability Index and Payback in Years determining whether the project is feasible. All you work should be in a spreadsheet file. In your opinion is this an investment to approve. A simple Yes or No will be a sufficient answer. Project Inputs: WACC - Determine the cost of capital for your discounted cash flow. Debt to Assets is 70% Interest rate on the debt is 6.50% Current Risk-Free Rate is 1.65% Current Market Premium Rate is 8.50% The firm's beta is 1.30 Project Investment Outlay, Year 0 - $700,000 Project Investment Life - 7 years Project Depreciation - $100,000/year Project Salvage Value - $55,000 Working Capital Base of Annual Sales 8% 1 Expected inflation rate per year, Selling Price Per Unit - 2.00% Expected inflation rate per year, Variable Cost per unit - 1.50% Expected inflation rate per year, Fixed costs per year - 1.50% Project Tax Rate - 20% Units sold per year - 40,000 Selling Price per Unit, Year 1 - $45.00 Fixed operating costs per year excluding depreciation - $75,000 Manufacturing costs per unit (variable costs), Year 1 - $35.00 21 3 1 M Assignment My Care Year . 1 2 5 10 Tot we 5. 11.000.000 300.000 30.000 $ 1.500.000 1500.000 $ 1.500.000 $1.500.000 $ 1.500.000 $ 1.500.000 $ 1.500.000 $ 1.500,000 $100.000 1.500.000 1.000.000 5 1 $ 0000 VariableCom Tel Cort Depreciation OOK Be Care fou com 1.000.000 Sve Value Two Depren Year Unit Solder 50.00 seper 10 change in OON 11 Variable cost per units 12 AVC 1 tot 100,000 14 Annualcune info 15 WACC 16 To 22.0 11 Wocuin Capital DON 18 20 30 23 22 S 0900.000 000,000 100,000 200000 5 5 3 (900,000 900,000 100.000 500.000 000.000 100.000 500.000 1909.000 5 100.000 500.000.0001 0,0001 000.000 100.000 5300.000 $300,000 $100.000 500.000 300.000 300.000 50.000.000 (100000 100000 100.000 100.000 100.000 100.000 100.000 100.000 100.0001 5 1,000,000 700,000 $300,000 $100,000 300.000 200.000 200,000 $ 200,000 200.000 200.000 13 DON Tax 0220 No (44000 154.000 144000S 155.000 144,000 44.000 51000 5 144.000) 5 000 000 IST C'ES0005 DOSE 44,000 $ 156.000 144.000$ 155.000 155.000 144.0001 155,000 31560 DOO 100.000 Savage Der 100.000 Metalow 1,000,000) 356000 DO 51486457 NPY $466457 Datas 100.000 100.000 100.000 $ 100.000 100.000 $ 256.000 5 256.000 5 255.000 256.000 36000 5 100,0005 5 256.000 5 100,000 $100.000 1.000.000 5 336.000 $ 256,000 2.500.000 254.000 5 1 Best Wate DEA + Question #1: WACC & Capital Budget Analysis Based on the inputs below prepare a capital budget analysis for this Base Case using the Net Present Value, Internal Rate of Return, Profitability Index and Payback in Years determining whether the project is feasible. All you work should be in a spreadsheet file. In your opinion is this an investment to approve. A simple Yes or No will be a sufficient answer. Project Inputs: WACC - Determine the cost of capital for your discounted cash flow. Debt to Assets is 70% Interest rate on the debt is 6.50% Current Risk-Free Rate is 1.65% Current Market Premium Rate is 8.50% The firm's beta is 1.30 Project Investment Outlay, Year 0 - $700,000 Project Investment Life - 7 years Project Depreciation - $100,000/year Project Salvage Value - $55,000 Working Capital Base of Annual Sales 8% 1 Expected inflation rate per year, Selling Price Per Unit - 2.00% Expected inflation rate per year, Variable Cost per unit - 1.50% Expected inflation rate per year, Fixed costs per year - 1.50% Project Tax Rate - 20% Units sold per year - 40,000 Selling Price per Unit, Year 1 - $45.00 Fixed operating costs per year excluding depreciation - $75,000 Manufacturing costs per unit (variable costs), Year 1 - $35.00 21 3 1 M Assignment My Care Year . 1 2 5 10 Tot we 5. 11.000.000 300.000 30.000 $ 1.500.000 1500.000 $ 1.500.000 $1.500.000 $ 1.500.000 $ 1.500.000 $ 1.500.000 $ 1.500,000 $100.000 1.500.000 1.000.000 5 1 $ 0000 VariableCom Tel Cort Depreciation OOK Be Care fou com 1.000.000 Sve Value Two Depren Year Unit Solder 50.00 seper 10 change in OON 11 Variable cost per units 12 AVC 1 tot 100,000 14 Annualcune info 15 WACC 16 To 22.0 11 Wocuin Capital DON 18 20 30 23 22 S 0900.000 000,000 100,000 200000 5 5 3 (900,000 900,000 100.000 500.000 000.000 100.000 500.000 1909.000 5 100.000 500.000.0001 0,0001 000.000 100.000 5300.000 $300,000 $100.000 500.000 300.000 300.000 50.000.000 (100000 100000 100.000 100.000 100.000 100.000 100.000 100.000 100.0001 5 1,000,000 700,000 $300,000 $100,000 300.000 200.000 200,000 $ 200,000 200.000 200.000 13 DON Tax 0220 No (44000 154.000 144000S 155.000 144,000 44.000 51000 5 144.000) 5 000 000 IST C'ES0005 DOSE 44,000 $ 156.000 144.000$ 155.000 155.000 144.0001 155,000 31560 DOO 100.000 Savage Der 100.000 Metalow 1,000,000) 356000 DO 51486457 NPY $466457 Datas 100.000 100.000 100.000 $ 100.000 100.000 $ 256.000 5 256.000 5 255.000 256.000 36000 5 100,0005 5 256.000 5 100,000 $100.000 1.000.000 5 336.000 $ 256,000 2.500.000 254.000 5 1 Best Wate DEA +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started