I need the explanation/solution for all questions except question number 15, 17 and 18. Thank you!

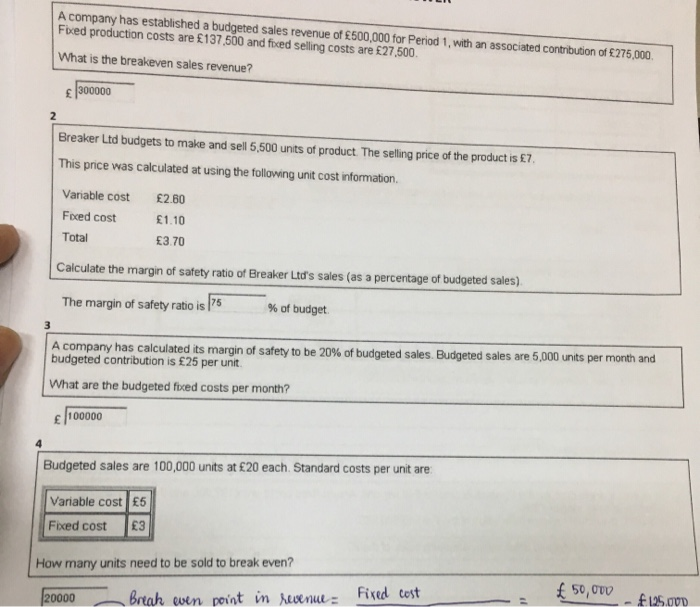

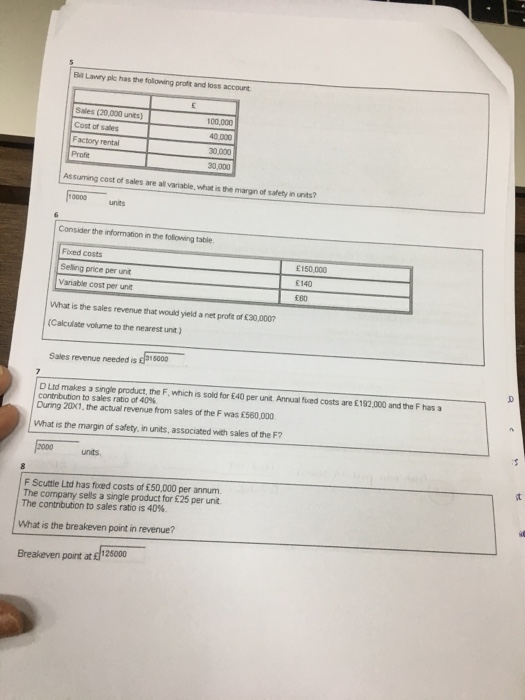

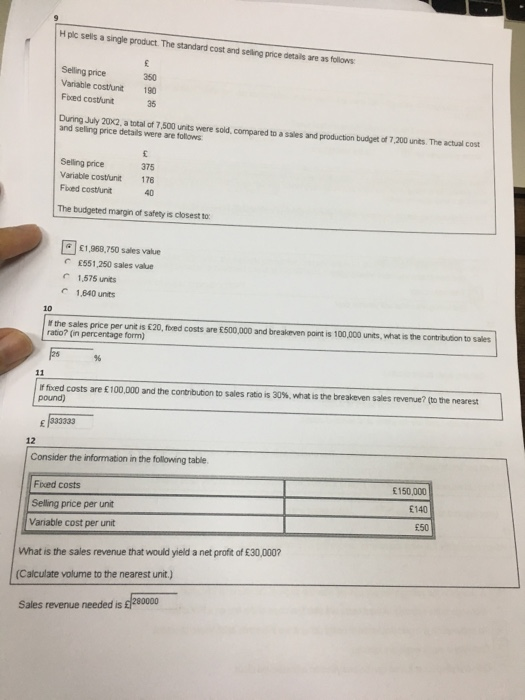

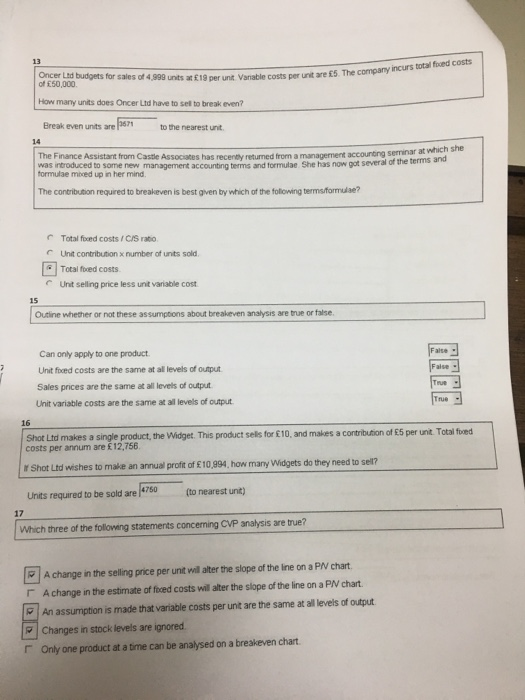

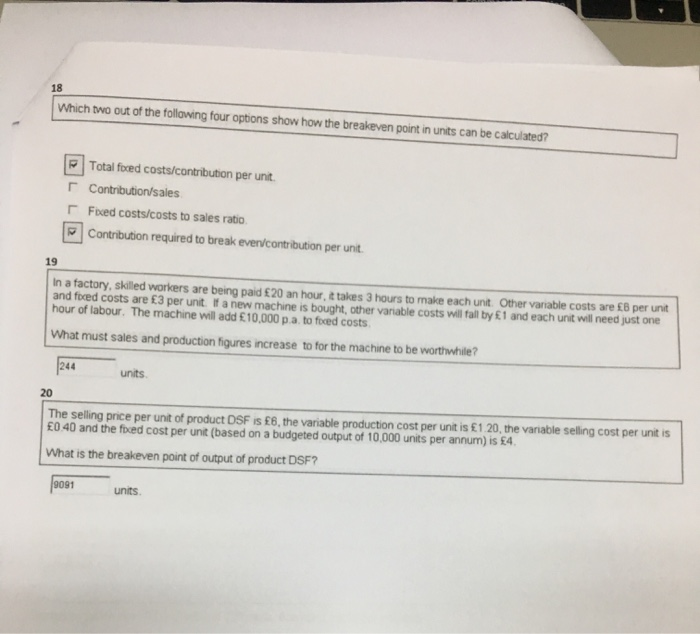

A company has established a budgeted sales revenue of 500,000 for Period 1, with an associated contribution of 275,000 Fbed production costs are 137,500 and fixed selling costs are 27,500 What is the breakeven sales revenue? 300000 Breaker Ltd budgets to make and sell 5,500 units of product. The selling price of the product is 7. This price was calculated at using the following unit cost information Variable cost Fixed cost Total 2.60 1.10 3.70 Calculate the margin of safety ratio of Breaker Ltd's sales (as a percentage of budgeted sales) The margin of safety ratio is 75 % of budget. A company has calculated its margin of safety to be 20% of budgeted sales, Budgeted sales are 5,000 units per month and budgeted contribution is 25 per unit What are the budgeted fixed costs per month? 100000 Budgeted sales are 100,000 units at 20 each. Standard costs per unit are: Variable cost Fixed cost How many units need to be sold to break even? 20000 Breah wen point in revenue - Fixed cost 50, OVO - 125.000 Lawry plc has the following profit and loss account 100.000 Sales (20 000 units) Cost of sales Factory rental Assuming cost of sales are all variable, what is the margin of safety in units? 10000 units Consider the information in the following table, Fbed costs E150 000 Selling price per unit Variable cost per unit What is the sales revenue that would yield a net profit of 30,0007 Calculate volume to the nearest unt) Sales revenue needed is 15000 Duld makes a single product, the F, which is sold for E40 per unit. Annual food costs are 192,000 and the F has a contribution to sales ratio of 40% During 20X1, the actual revenue from sales of the F was 560,000 What is the margin of safety, in units, associated with sales of the F? 2000 units F Scuttle Ltd has found costs of 50,000 per annum. The company sells a single product for 25 per unit The contribution to sales ratio is 40%. What is the breakeven point in revenue? Breakeven point at 126000 Hplc ses a single product. The standard cost and selling price details are as follows: Selling price Variable costunt Fored costunit 350 190 During July 2002. a total of 7,500 units were sold, compared to a sales and production budget of 7,200 units. The actual cost and selling price details were are follows 375 Selling price Variable costurit Food costunit 178 The budgeted margin of safety is closest to 1,968,750 sales value E551,250 sales value 1,575 units 1.640 units C the sales price per unit is 20, fored costs are 500.000 and breskeven part is 100.000 units what is the contribution to sales ratio? (in percentage form) foed costs are E100,000 and the contribution to sales ratio is 30%, what is the break even sales revenue to the nearest pound) 333333 12 Consider the information in the following table Foed costs 150.000 Selling price per unit Variable cost per unit What is the sales revenue that would yield a net profit of 30,000? (Calculate volume to the nearest unit.) Sales revenue needed is 280000 Oncer Led budgets for sales of 4.999 units of 50,000 nerunt Variable costs per unit are 5. The company sts per unit are 5. The company incurs total food costs How many units does Oncer Lid have to set to break even? Break even units are 571 to the nearest unit. at which she The Finance Assistant from Castle Associates has recent returned from a management accounting seminar at which WOODced to some new management accounting med formae Chesnow of several of the terms formulae moed up in her mind The contribution required to breakeven is best given by which of the following terms formulae? Total foced costs / CIS ratio Unit contribution x number of units sold Total foved costs Unit selling price less unit variable cost Outline whether or not these assumptions about breakeven analysis are true or false. Faise - Can only apply to one product. Unit foed costs are the same at all levels of output Sales prices are the same at all levels of output Unit variable costs are the same at all levels of output Twe- True : Shot Ltd makes a single product, the Widget. This product sels for 10, and makes a contribution of 5 peruntTotalfred costs per annum are 12,756 Shot Ltd wishes to make an annual profit of 10,994, how many Widgets do they need to sell? Units required to be sold are *760 (to nearest unit) Which three of the following statements concerning CVP analysis are true? A change in the selling price per unit will alter the slope of the line on a PN chart A change in the estimate of foced costs wil alter the slope of the line on a PN chart. An assumption is made that variable costs per unt are the same at all levels of output Changes in stock levels are ignored. Only one product at a time can be analysed on a breakeven chart. Which two out of the following four options show how the breakeven point in units can be calculated? Total fored costs/contribution per unit Contribution/sales Foed costs/costs to sales ratio Contribution required to break even/contribution per unit. In a factory, skilled workers are being paid 20 an hour, t takes 3 hours to make each unit Other variable costs are 6 per unit and foced costs are 3 per unit. Ia new machine is bought, other variable costs will fall by 1 and each unit will need just one hour of labour. The machine will add 10,000 p a to foced costs What must sales and production figures increase to for the machine to be worthwhile? 244 units The selling price per unit of product DSF is 8, the variable production cost per unit is 120, the variable selling cost per unit is 0.40 and the faced cost per unit (based on a budgeted output of 10.000 units per annum) is 4. What is the breakeven point of output of product DSF? 9091 units