I need the following accounting questions answered. Thank you so much!! I will give a thumbs up if you help me figure these out

undefined

undefined

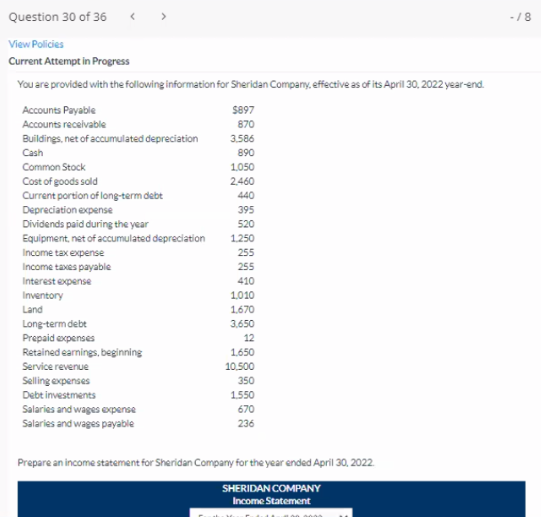

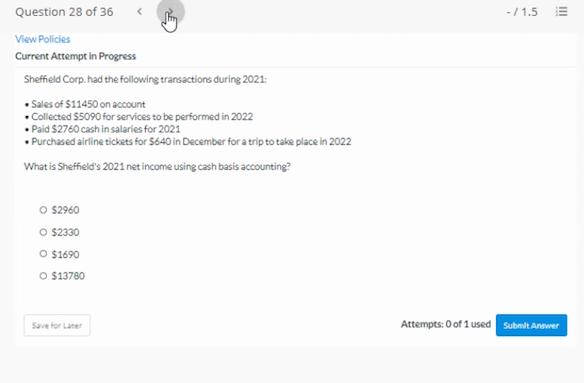

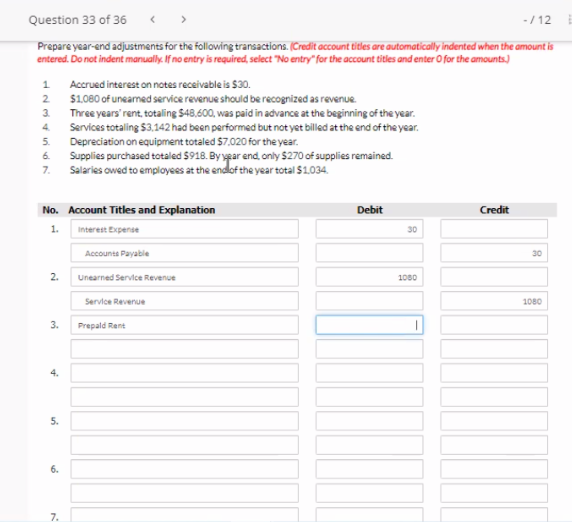

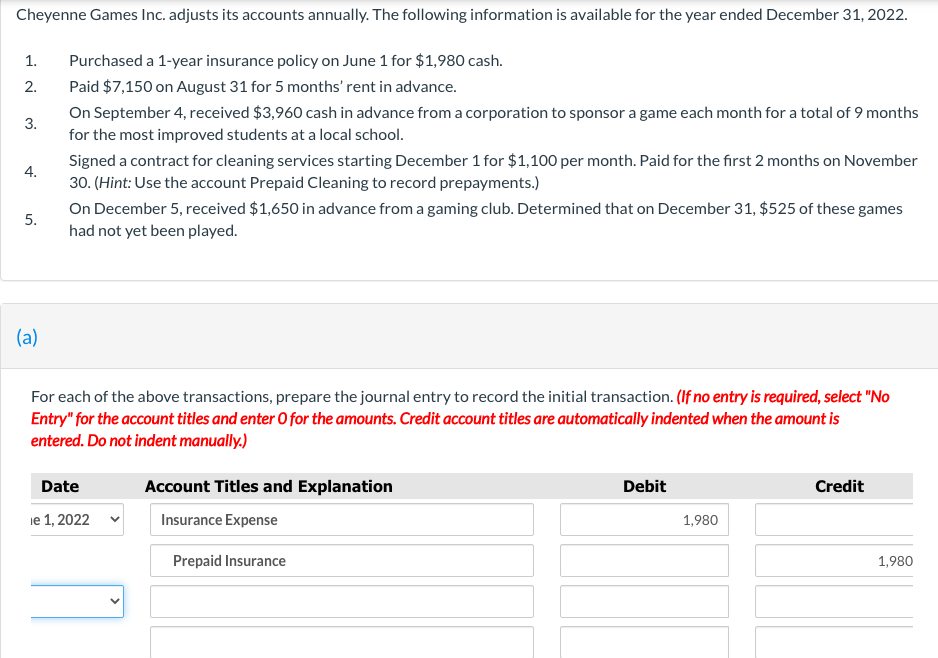

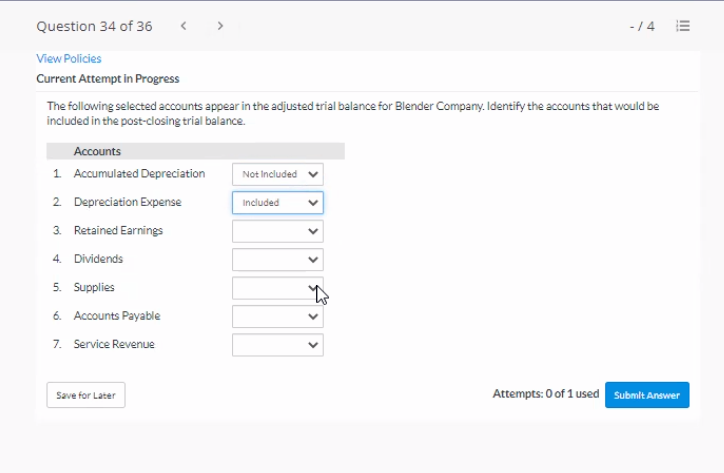

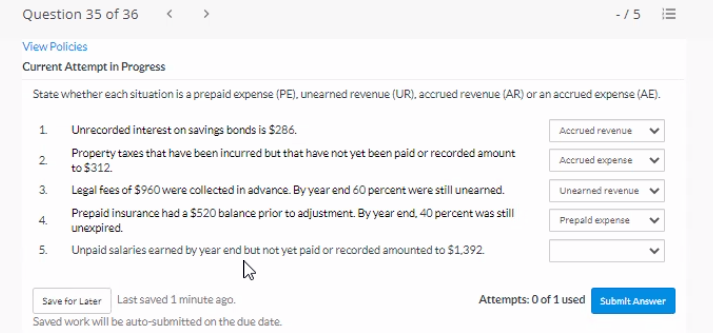

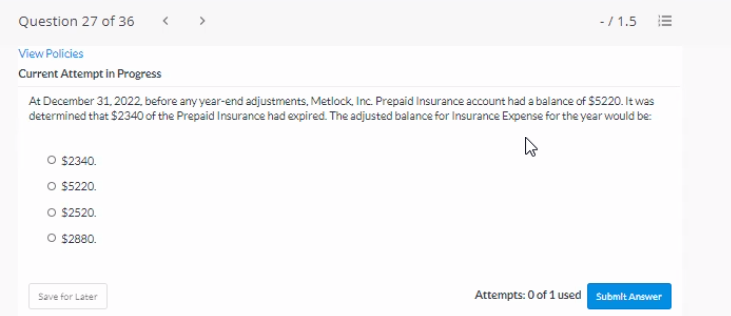

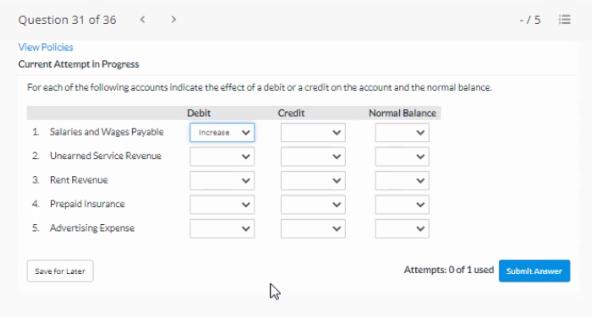

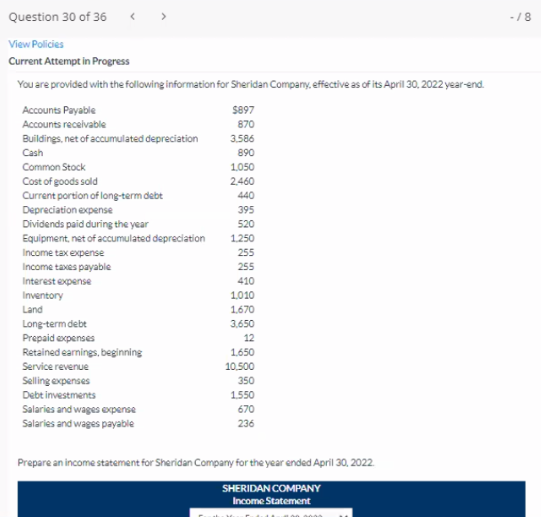

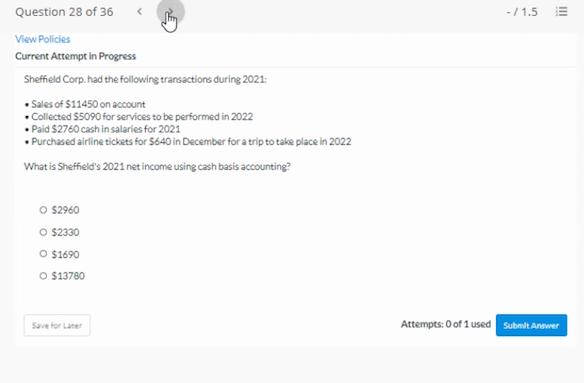

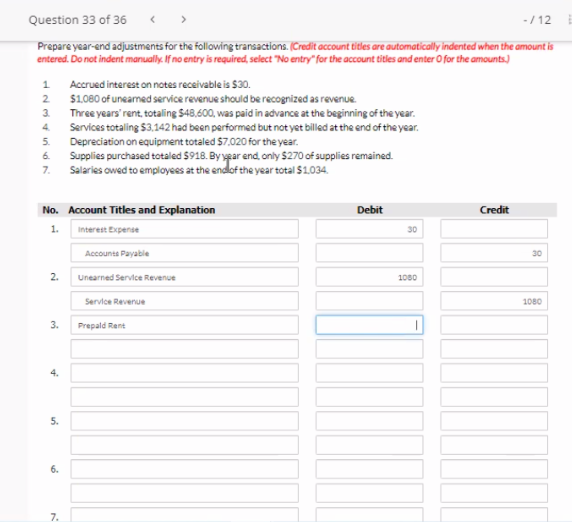

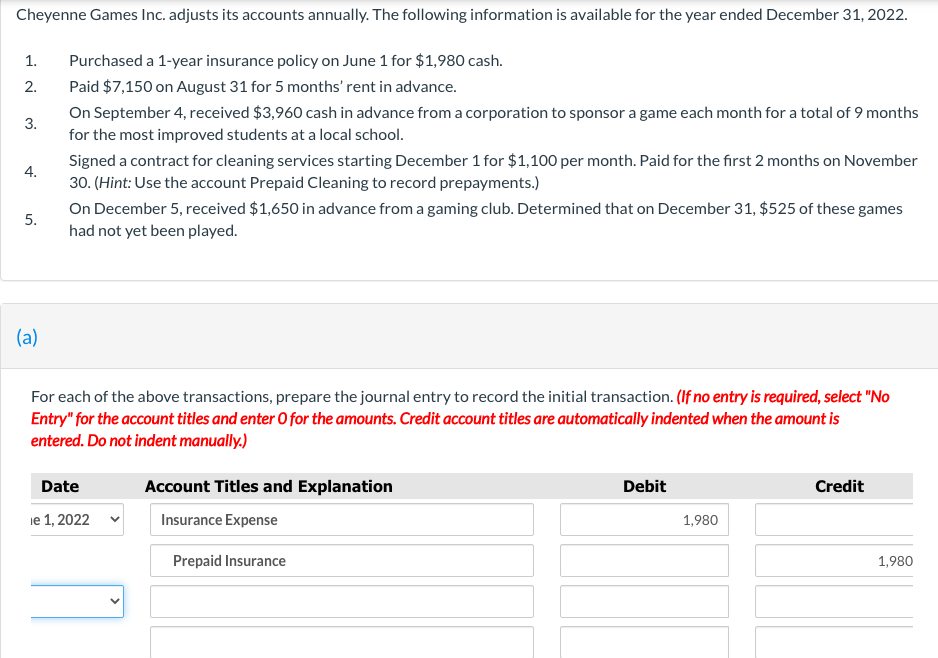

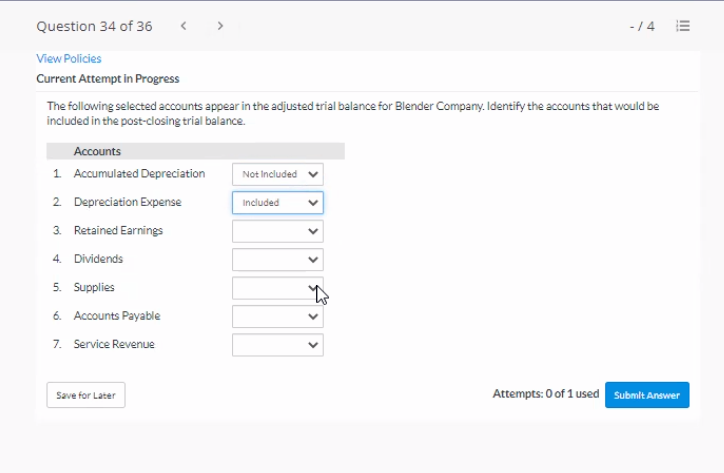

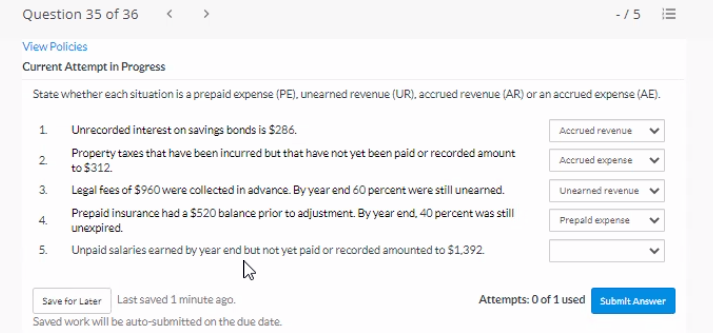

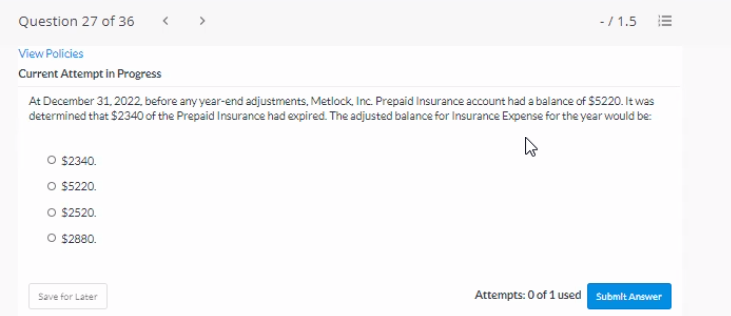

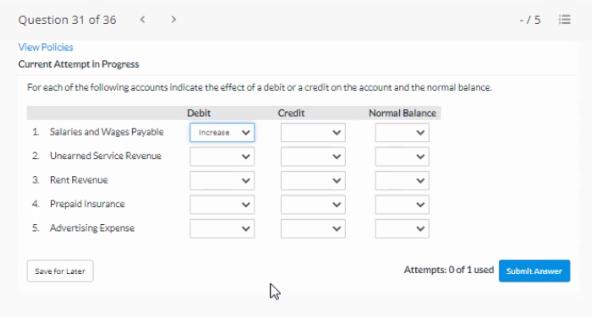

Cheyenne Games Inc. adjusts its accounts annually. The following information is available for the year ended December 31, 2022. 1. 2. 3. Purchased a 1-year insurance policy on June 1 for $1,980 cash. Paid $7,150 on August 31 for 5 months' rent in advance. On September 4, received $3,960 cash in advance from a corporation to sponsor a game each month for a total of 9 months for the most improved students at a local school. Signed a contract for cleaning services starting December 1 for $1,100 per month. Paid for the first 2 months on November 30. (Hint: Use the account Prepaid Cleaning to record prepayments.) On December 5, received $1,650 in advance from a gaming club. Determined that on December 31, $525 of these games had not yet been played. 4. 5. (a) For each of the above transactions, prepare the journal entry to record the initial transaction. (If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Debit Credit Account Titles and Explanation Insurance Expense le 1, 2022 1,980 Prepaid Insurance 1,980 Question 34 of 36 - / 4 View Policies Current Attempt in Progress The following selected accounts appear in the adjusted trial balance for Blender Company. Identify the accounts that would be included in the post-closing trial balance. Accounts 1. Accumulated Depreciation Not Included 2 Depreciation Expense Included 3. Retained Earnings 4. Dividends 5. Supplies 6. Accounts Payable 7. Service Revenue Save for Later Attempts: 0 of 1 used Submit Answer Question 35 of 36 -/5 E View Policies Current Attempt in Progress State whether each situation is a prepaid expense (PE), unearned revenue (UR). accrued revenue (AR) or an accrued expense (AE). 1. 2 3. > Unrecorded interest on savings bonds is $286. Accrued revenue Property taxes that have been incurred but that have not yet been paid or recorded amount Accrued expense to $312. Legal fees of $960 were collected in advance. By year end 60 percent were still unearned. Unearned revenue Prepaid insurance had a 5520 balance prior to adjustment. By year end. 40 percent was still 4. Prepald expense unexpired. 5. Unpaid salaries earned by year end but not yet paid or recorded amounted to $1.392 h Save for Later Last saved 1 minute ago. Attempts: 0 of 1 used Saved work will be auto-submitted on the due date. Submit Answer Question 27 of 36 - / 1.5 E View Policies Current Attempt in Progress At December 31, 2022 before any year-end adjustments, Metlock, Inc. Prepaid Insurance account had a balance of 55220. It was determined that $2340 of the Prepaid Insurance had expired. The adjusted balance for Insurance Expense for the year would be O $2340. $5220 O $2520. O $2880 Save for Later Attempts: 0 of 1 used Submit Answer > -/5 III Question 31 of 36 View Policies Current Attempt in Progress For each of the following accounts indicate the effect of a debit or a credit on the account and the normal belance Debit Credit Normal Balance 1 Salaries and Wages Payable 2 Unearned Service Revenue 3. Rent Revenue 4. Prepaid Insurance 5. Avertising Expense Increase Save for Later Attempts: 0 of 1 used Submit Answer -18 Cash 440 395 Question 30 of 36 Question 33 of 36 -/12 Prepare year-end adjustments for the following transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts.) 1 Accrued interest on notes receivable is $30. $1.080 of uneamed service revenue should be recognized as revenue. 3. Three years' rent, totaling $48,600, was paid in advance at the beginning of the year. Services totaling $3,142 had been performed but not yet billed at the end of the year. Depreciation on equipment totaled $7.020 for the year. 6. Supplies purchased totaled $918. By year end only $270 of supplies remained Salaries owed to employees at the endof the year total $1.034. 2 5. 7 Debit Credit No. Account Titles and Explanation Interest Expense 1. 30 Accounts Payable 30 2. Unearned Service Revenue 1080 Service Revenue 1080 3. Prepald Rent 4. 5. 6. 7

undefined

undefined