Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the following question answered in the format provided. thank you Question: 1. Prepare a statement of cash flows for 20X4 in the format

I need the following question answered in the format provided. thank you

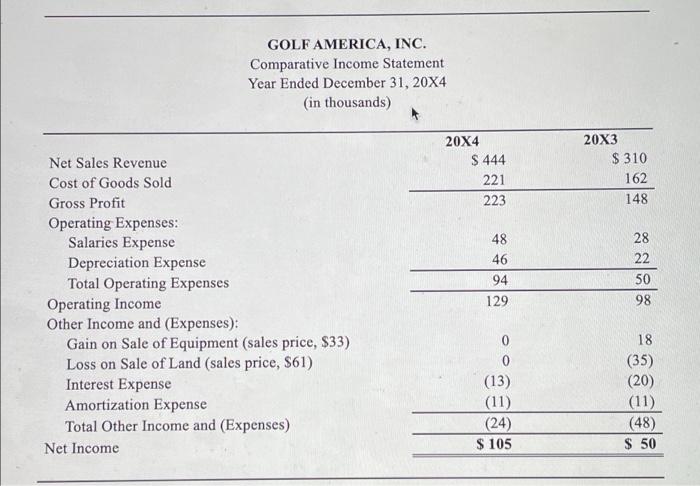

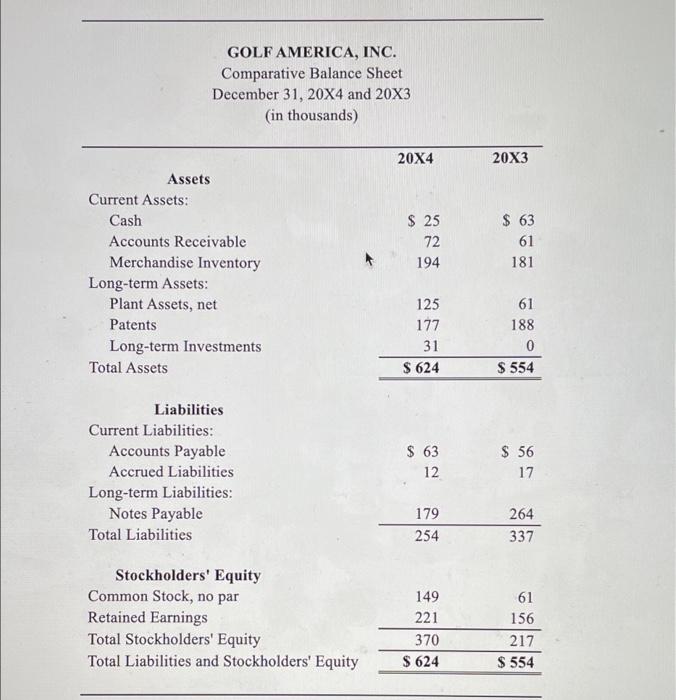

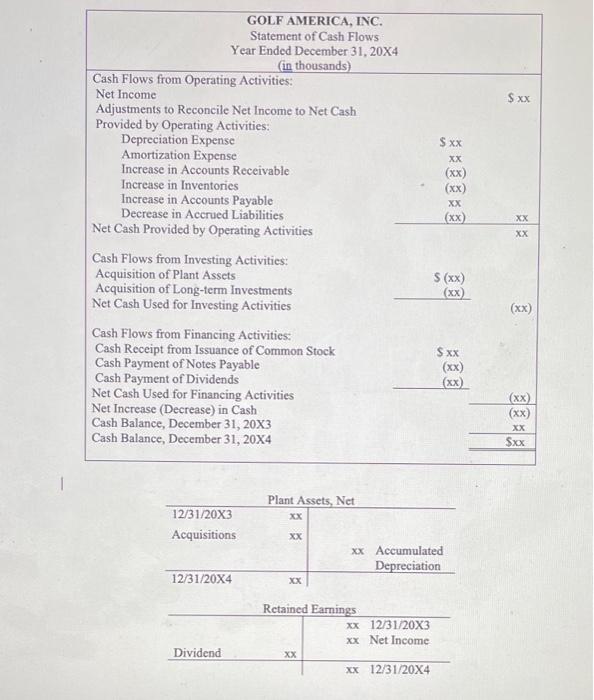

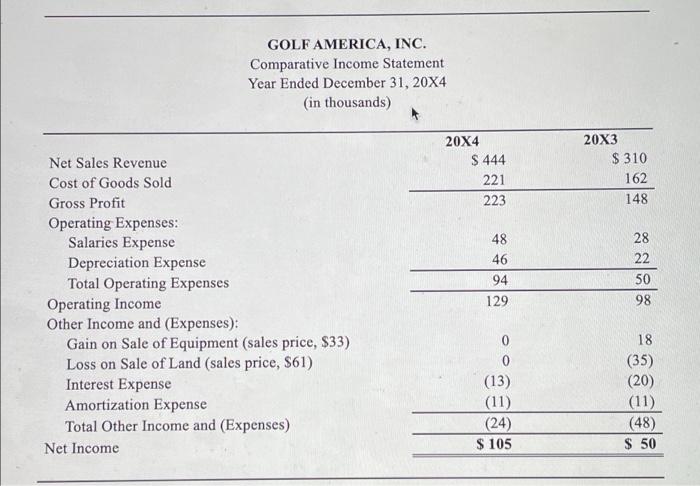

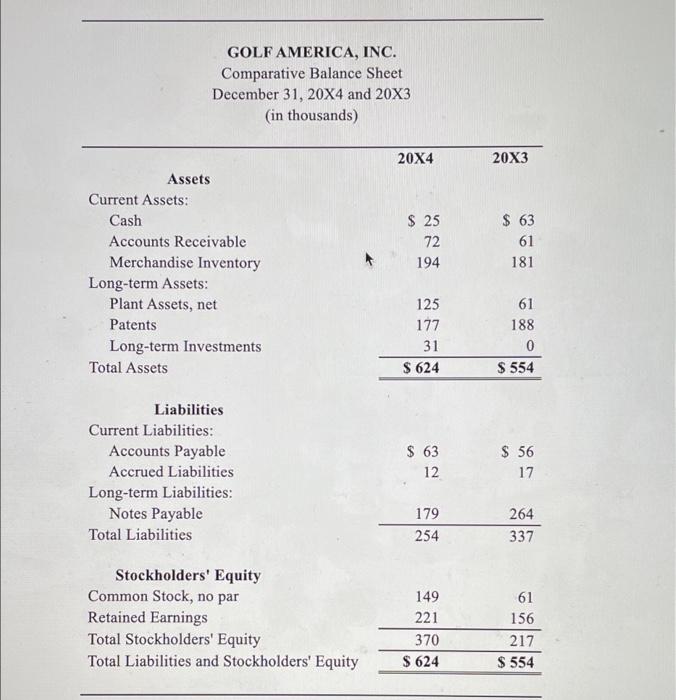

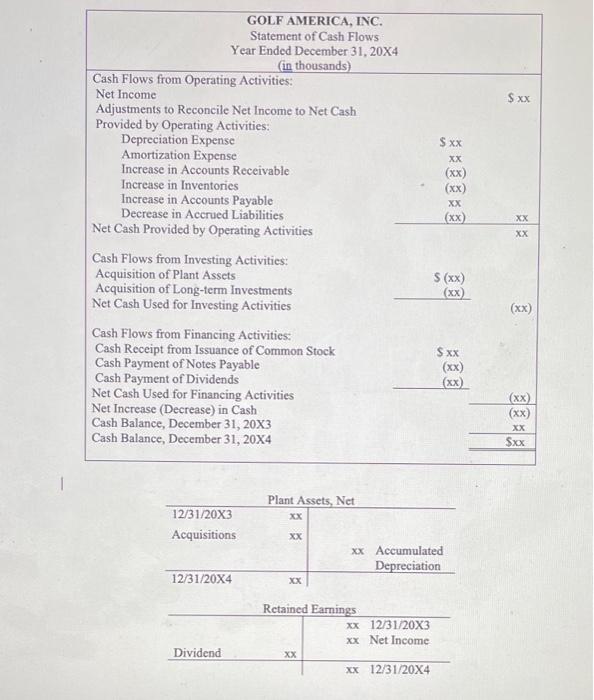

GOLF AMERICA, INC. Comparative Income Statement Year Ended December 31, 20X4 (in thousands) 20X4 $ 444 221 223 20X3 $ 310 162 148 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense Total Operating Expenses Operating Income Other Income and (Expenses): Gain on Sale of Equipment (sales price, $33) Loss on Sale of Land (sales price, $61) Interest Expense Amortization Expense Total Other Income and (Expenses) Net Income 48 46 94 129 28 22 50 98 0 0 (13) (11) (24) $ 105 18 (35) (20) (11) (48) $ 50 GOLF AMERICA, INC. Comparative Balance Sheet December 31, 20X4 and 20X3 (in thousands) 20X4 20X3 $ 25 72 194 $ 63 61 181 Assets Current Assets: Cash Accounts Receivable Merchandise Inventory Long-term Assets: Plant Assets, net Patents Long-term Investments Total Assets 125 177 31 $ 624 61 188 0 $ 554 Liabilities Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: Notes Payable Total Liabilities $ 63 12 $ 56 17 179 254 264 337 Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 149 221 370 $ 624 61 156 217 $ 554 Sxx Sxx XX (xx) (xx) XX (XX) GOLF AMERICA, INC. Statement of Cash Flows Year Ended December 31, 20X4 in thousands) Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Depreciation Expense Amortization Expense Increase in Accounts Receivable Increase in Inventories Increase in Accounts Payable Decrease in Accrued Liabilities Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Acquisition of Plant Assets Acquisition of Long-term Investments Net Cash Used for Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Notes Payable Cash Payment of Dividends Net Cash Used for Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 20X3 Cash Balance, December 31, 20X4 XX XX S (xx) (xx) (xx) Sxx (xx) (xx) (xx) (xx) XX Sxx Plant Assets, Net 12/31/20X3 Acquisitions XX xx Accumulated Depreciation 12/31/20X4 XOX Retained Earnings xx 12/31/20X3 xx Net Income XX XX 12/31/20X4 Dividend Question:

1. Prepare a statement of cash flows for 20X4 in the format that best shows the

relationship between net income and net cash flows from operating activities.

The company sold no plant assets or long-term investments and issued no notes

payable during 20X4. There were no non-cash investing and financing

transactions during the year. Show all amounts in thousands.

2. Considering net income and the company's cash flows during 20X4, was it a

good year or a bad year? Give your reasons.

Format:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started