I need the following table filled out please

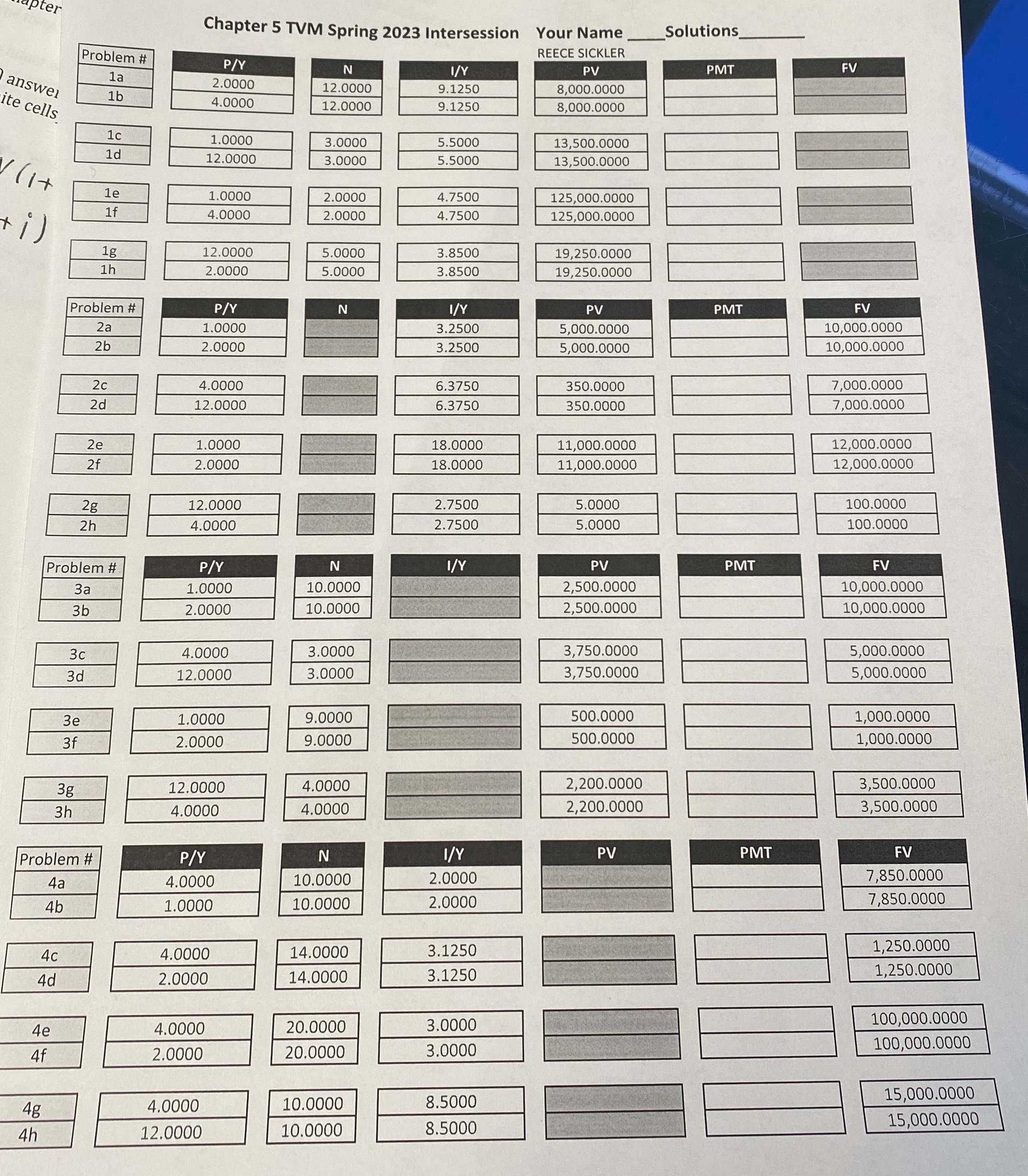

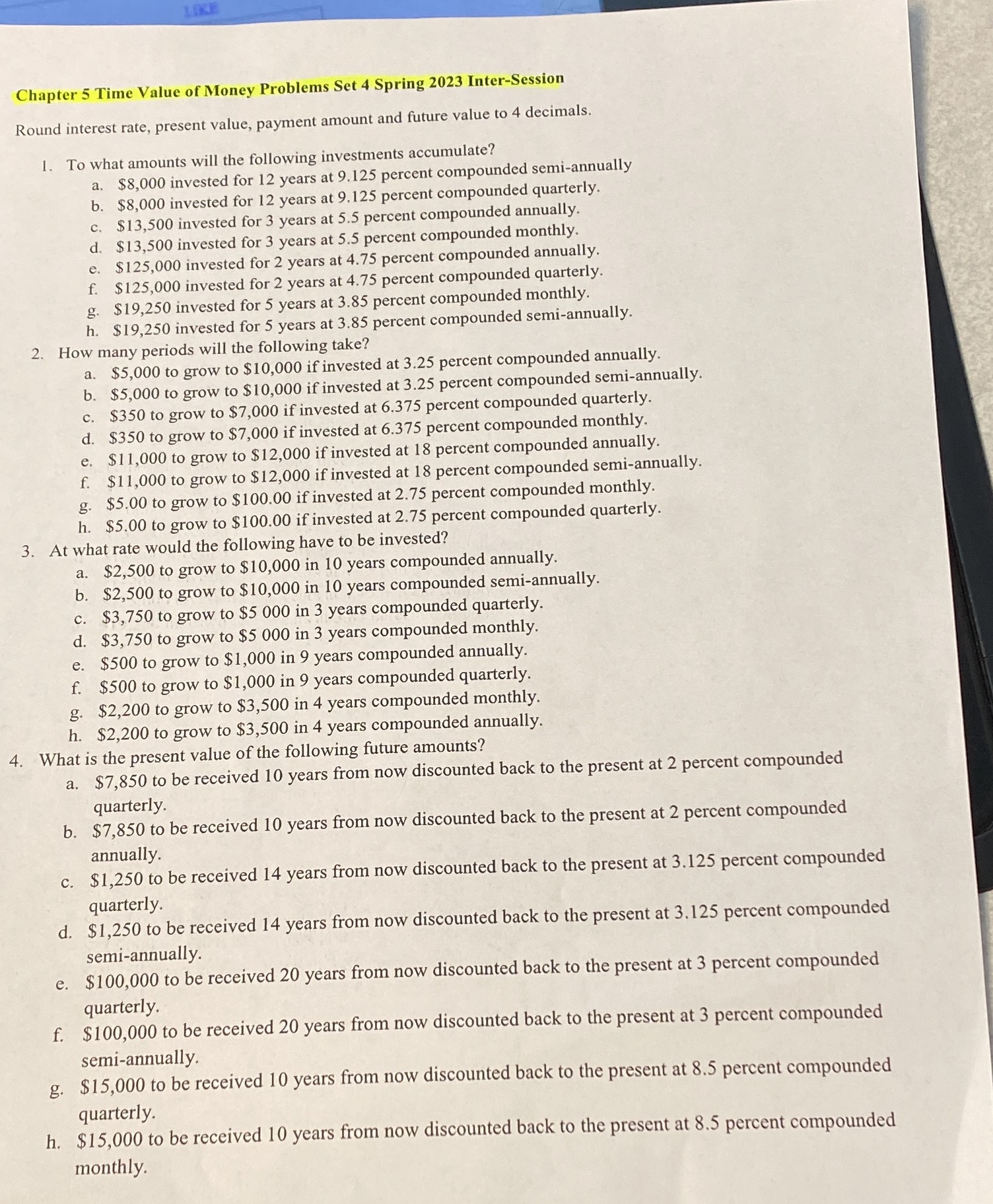

ter Chapter 5 TVM Spring 2023 Intersession Your Name Solutions Problem # P/Y REECE SICKLER N 1/Y answel la PV 2.0000 PMT FV 1b 12.0000 9.1250 ite cells 4.0000 8,000.0000 12.0000 9.1250 8,000.0000 1c 1d 1.000 3.0000 5.5000 13,500.0000 12.0000 3.0000 5.5000 13,500.0000 1e 1.0000 2.0000 If 4.7500 125,000.0000 4.0000 2.0000 1.7500 125,000.0000 18 2.0000 5.0000 3.8500 1h 19,250.0000 2.0000 5.0000 3.8500 19,250.0000 Problem # P/Y I/Y PV PMT FV 2a 1.0000 3.2500 2b 5,000.0000 10,000.0000 2.0000 3.2500 5,000.0000 10,000.0000 2c 4.0000 6.3750 350.0000 2d 7,000.0000 12.0000 .3750 350.0000 7,000.0000 2e .0000 18.0000 11,000.0000 2f 12,000.0000 2.0000 18.0000 11,000.0000 12,000.0000 28 12.0000 2.7500 5.0000 100.0000 2h 4.0000 2.7500 5.0000 100.0000 Problem # P/Y IY PV PMT FV 3a 1.0000 10.0000 2,500.0000 10,000.0000 3b 2.0000 10.0000 2,500.0000 10,000.0000 3c 4.0000 3.0000 3,750.0000 5,000.0000 3d 12.0000 3.0000 3,750.0000 5,000.0000 3e 1.0000 9.0000 500.0000 1,000.0000 3f 2.0000 9.0000 500.0000 1,000.0000 38 12.0000 4.0000 2,200.0000 3,500.0000 3h 4.0000 4.0000 2,200.0000 3,500.0000 Problem # P/Y N V/Y PV PM FV 4.0000 10.0000 2.0000 7,850.0000 4b 1.0000 10.0000 2.0000 7,850.0000 4c 4.0000 14.0000 3.1250 1,250.0000 4d 2.0000 14.0000 3.1250 1,250.0000 4e 4.0000 20.0000 3.0000 100,000.0000 4f 2.0000 20.0000 3.0000 100,000.0000 4g 4.0000 10.0000 8.5000 15,000.0000 4h 12.0000 10.0000 8.5000 15,000.0000 Money Problems Set 4 Spring 2023 Inter-Session Chapter 5 Time Value of payment amount and future value to 4 decimals. Round interest rate. present value, To what amounts will the following investments accumulate? 9.125 percent compounded semi-annually a. $8,000 invested for 12 years at 125 percent compounded quarterly. b. $8,000 invested for 12 years at 9. 5 percent compounded annually. c. $13,500 invested for 3 years at 5. d. $13,500 invested for 3 years at 5.5 percent compounded monthly. e. $125,000 invested for 2 years at 4.75 percent compounded annually. t compounded quarterly. f. $125,000 invested for 2 years at 4.75 percen compounded monthly. g. $19,250 invested for 5 years at 3.85 percent 11. $19,250 invested for 5 years at 3.85 percent compounded semiann 2. How many periods will the following take? a. $5,000 to grow to $10,000 if invested at 3.25 percent compounded annually. (1 at 3.25 percent compounded semi-annually. b. $5,000 to grow to $10,000 ifinveste c. $350 to grow to $7,000 if invested at 6.375 percent compounded quarterly. c1. $350 to grow to $7,000 if invested at 6.375 percent compounded monthly. e. $1 1,000 to grow to $12,000 if invested at 18 percent compounded annually. f. $11,000 to grow to $12,000 if invested at 18 percent compounded semi-annually. g. $5.00 to grow to $100.00 if invested at 2.75 percent compounded monthly. 11. $5.00 to grow to $100.00 if invested at 2.75 percent compounded quarterly. 3. At what rate would the following have to be invested? a. $2,500 to grow to $10,000 in 10 years compounded annually. b. $2,500 to grow to $10,000 in 10 years compounded semi-annually. $3,750 to grow to $5 000 in 3 years compounded quarterly. n 3 years compounded monthly. ded annually. ually. c. (1. $3,750 to grow to $5 000 i 6 $500 to grow to $1,000 in 9 years compoun 1'. $500 to grow to $1,000 in 9 years compounded quarterly. $3,500 in 4 years compounded monthly. g. $2,200 to grow to 0 in 4 years compounded annually. h. $2,200 to grow to 33,50 4. What is the present value of the fell a. $7,850 to be received 10 years quarterly. 13. $7,850 to be received 10 years from now discounted back to the present at 2 percent compo owing future amounts? from now discounted back to the present at 2 percent compounded unded annually. back to the present at 3.125 percent compounded $1,250 to be received 14 years from now discounted ent compounded quarterly. d. $1,250 to be received 14 years from now discounted back to the present at 3.125 perc semi-annually. e. $100,000 to be received 20 years from now discounted back to the present at 3 percent compounded quarterly. 1'. $100,000 to be received 20 years from now discounted back to the present at 3 percent compounded semi-annually. g. $15,000 to be received 10 years from now discounted back to the present at 8.5 percent compounded quarterly. h. $15,000 to be received 10 years from now discounted back to the present at 8.5 percent compounded monthly