Question

******I need the formulas for the following problem in the book.****** Assume that a parent company acquired 100% of a subsidiary on 1/1/X1. The purchase

******I need the formulas for the following problem in the book.******

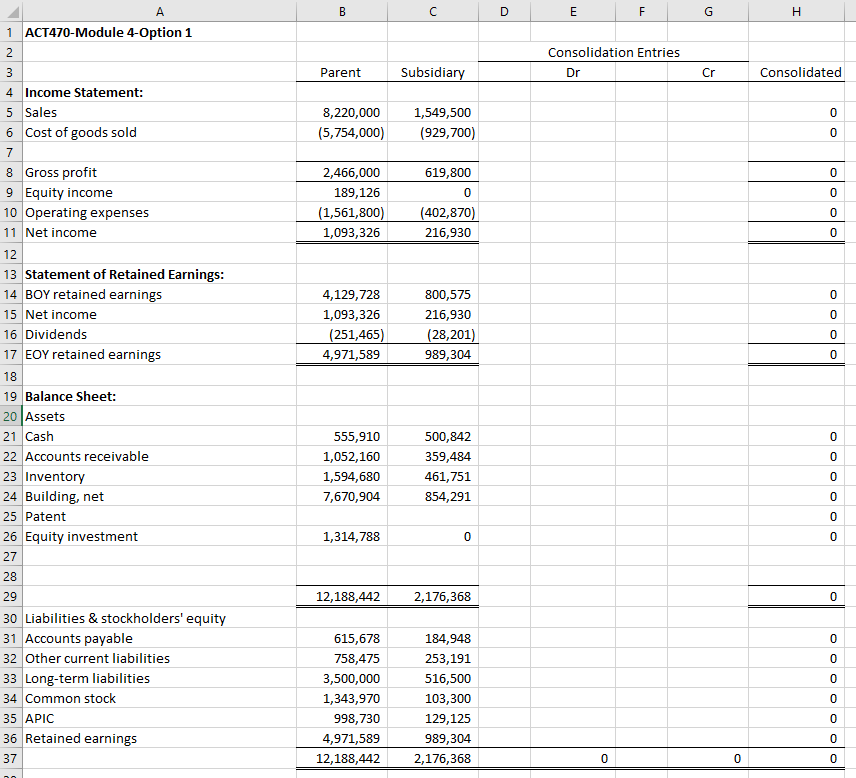

Assume that a parent company acquired 100% of a subsidiary on 1/1/X1. The purchase price was $175,000 in excess of the subsidiary's book value of net assets on the acquisition date and the excess was assigned entirely to an unrecorded patent. The life of the patent is 10 years. Assume the subsidiary sells inventory to the parent. The parent ultimately sells the inventory to outside customers. The following relates to the years X2 and X3:

| Inventory Sales | GP of unsold inventory | Receivable (Payable) | |

| X3 | $103,300 | $29,441 | $41,320 |

| X2 | $87,900 | $19,137 | $27,986 |

Requirements:

- Prepare the consolidated financial statements at 12/31/X3 by placing the appropriate entries in their respective debit/credit column cells.

- Indicate, in the blank column cell to the left of the debit and credit column cells if the entry is a [C], [E], [A], [D] or [I]entry.

- Use Excel formulas to derive the Consolidated column amounts and totals.

- The financial statements for the parent and subsidiary for the year ended 12/31/X3 are attached in the Excel spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started