i need the math with ut as well

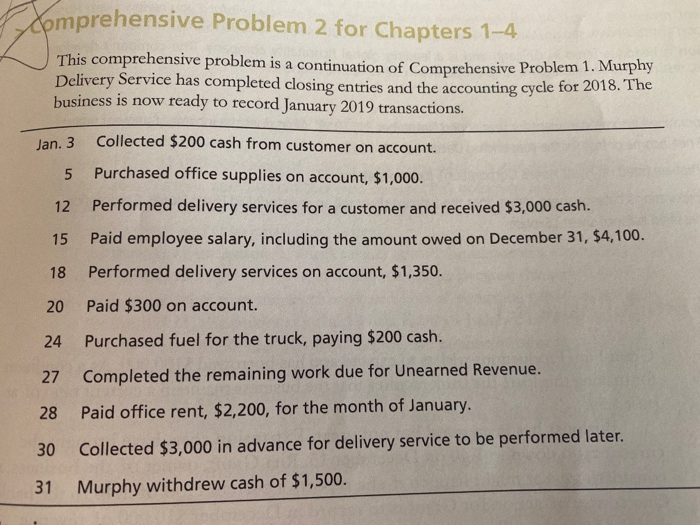

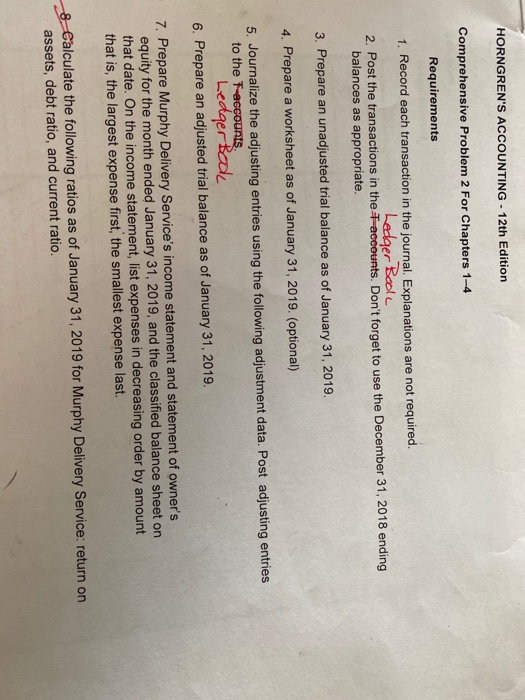

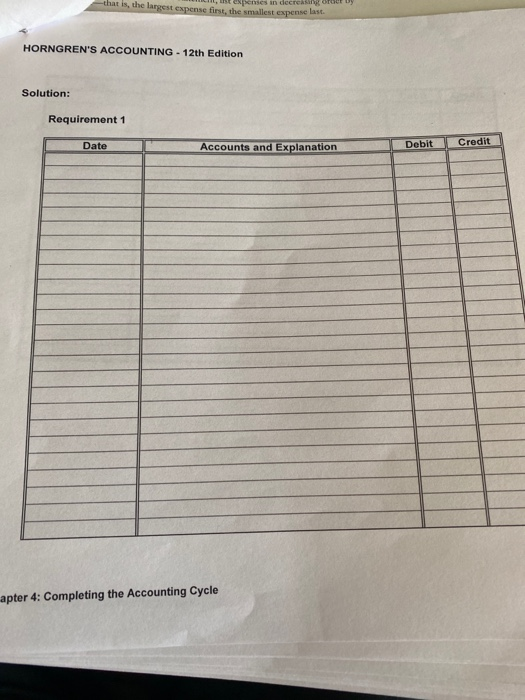

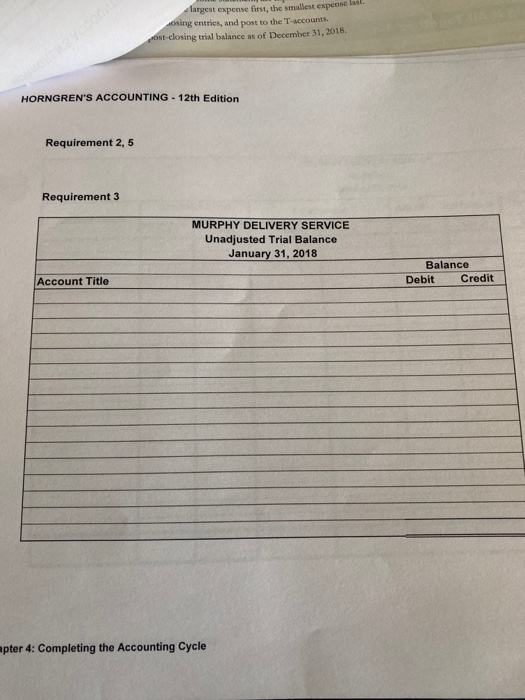

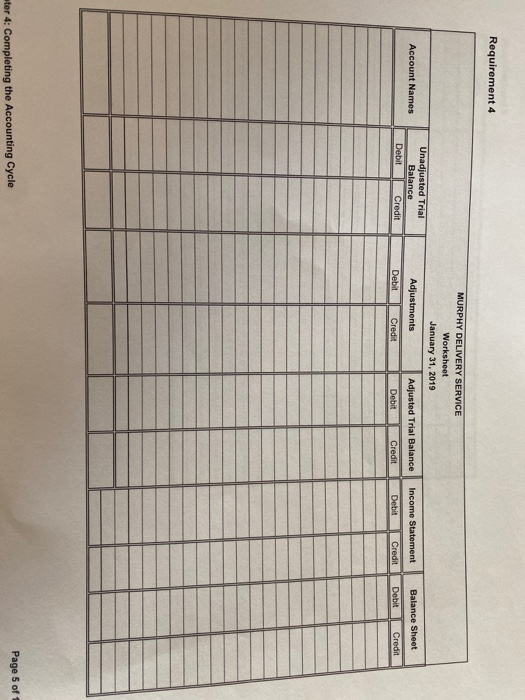

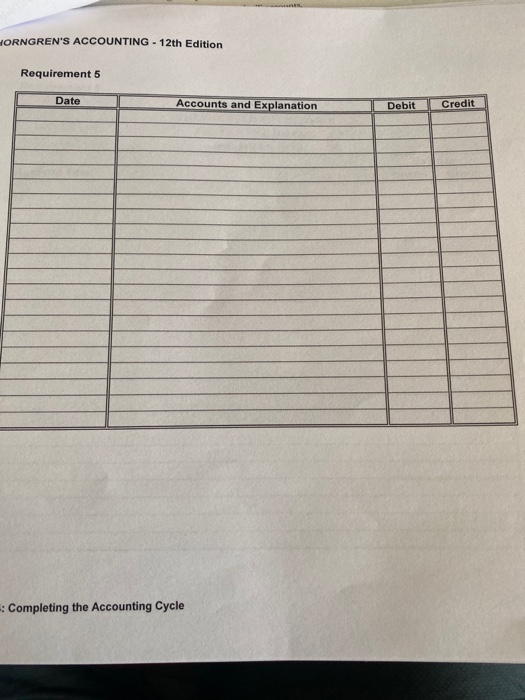

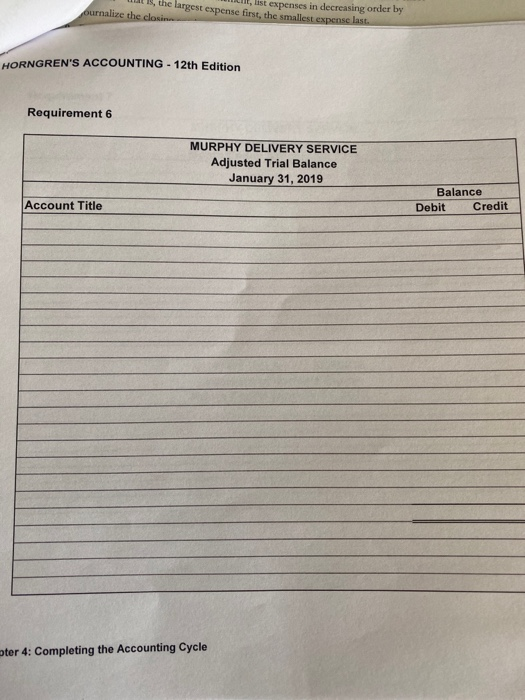

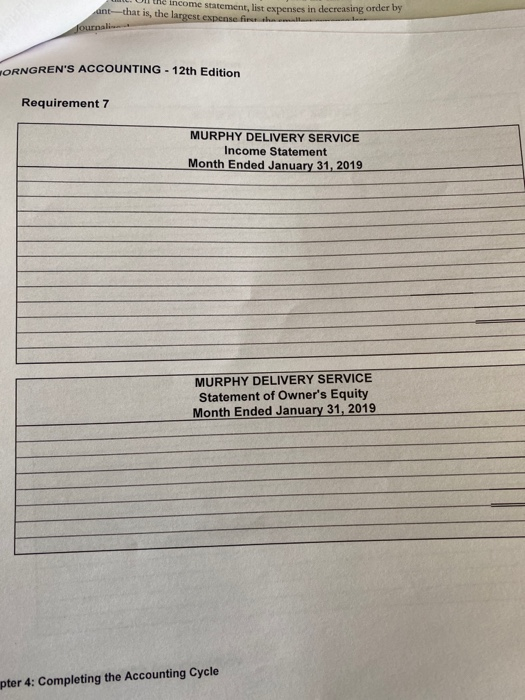

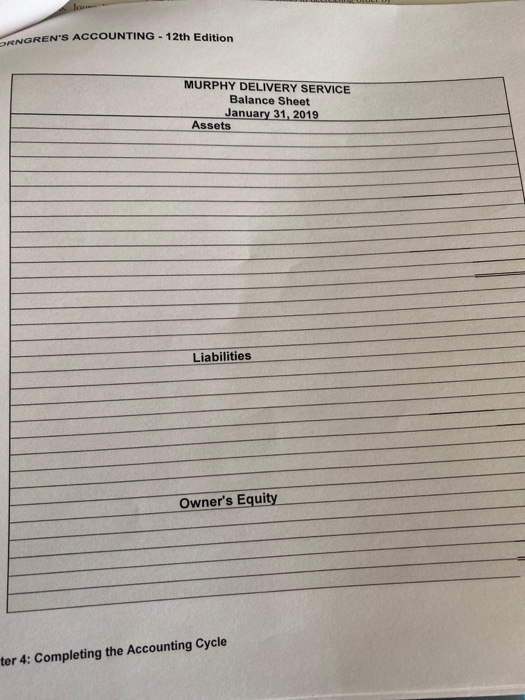

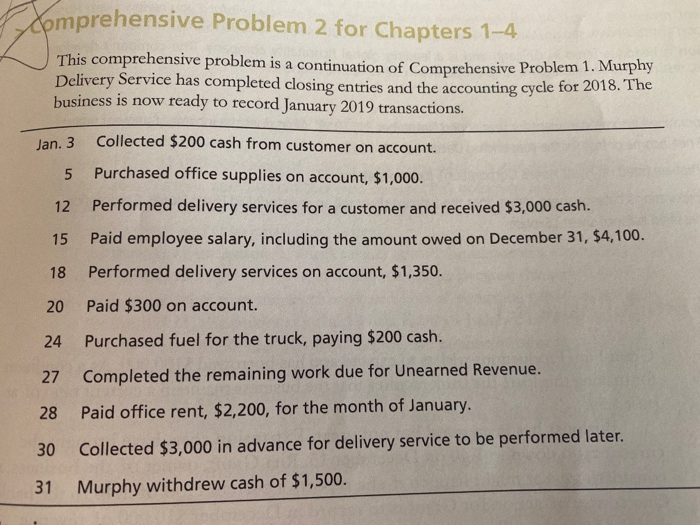

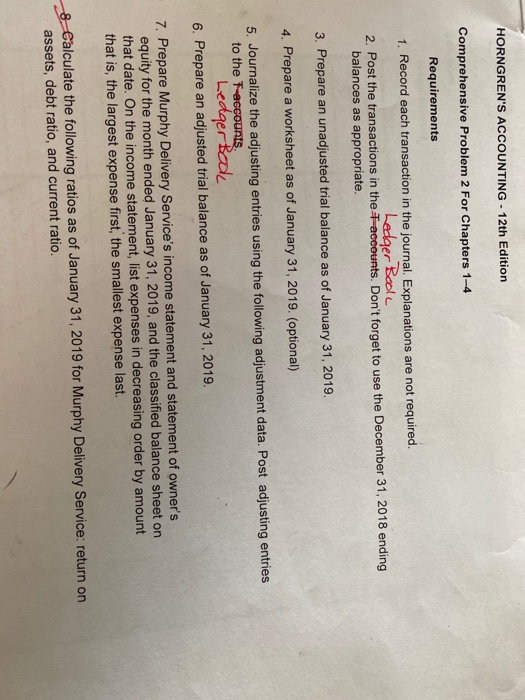

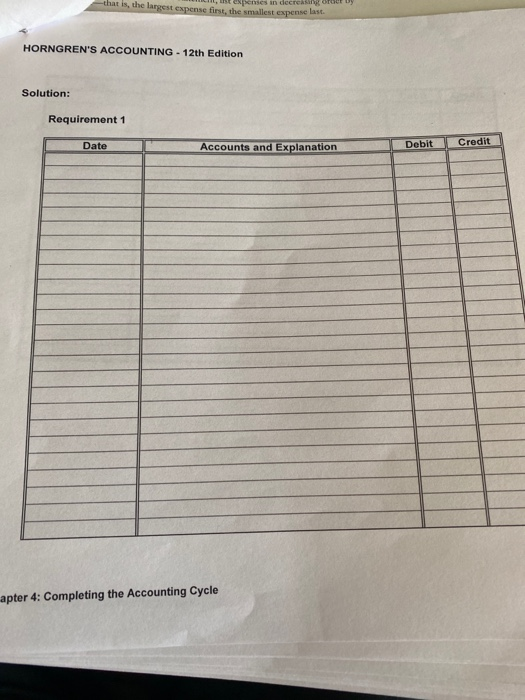

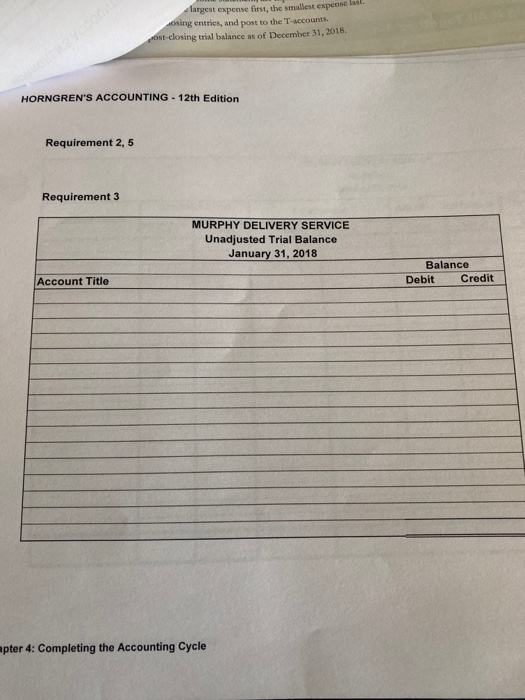

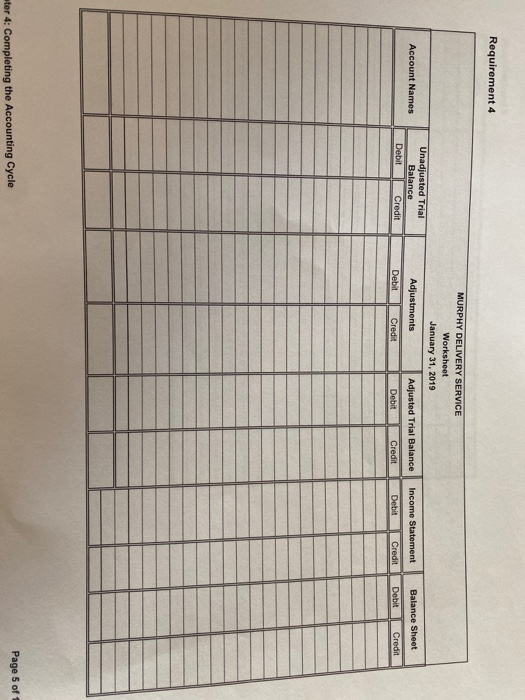

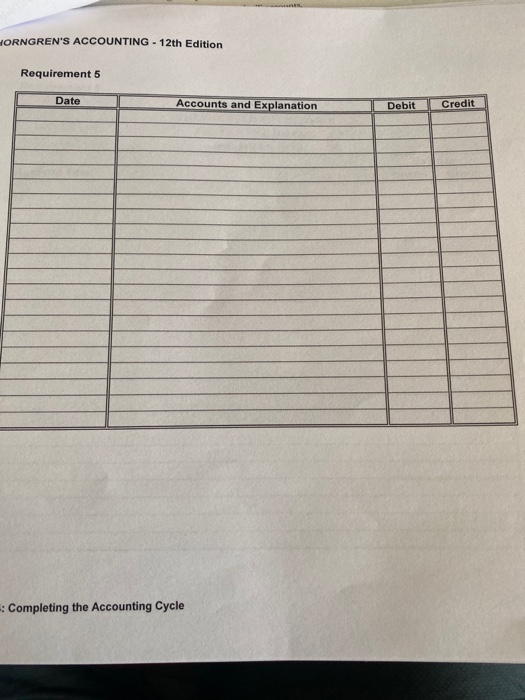

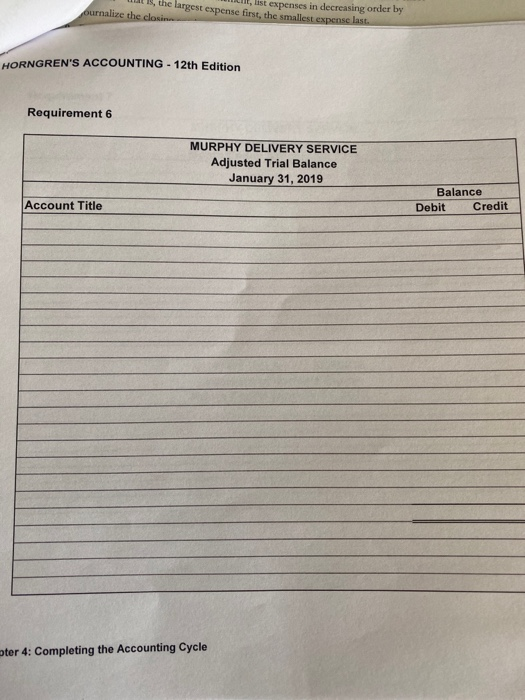

Xomprehensive Problem 2 for Chapters 1-4 This comprehensive problem is a continuation of Comprehensive Problem 1. Murphy Delivery Service has completed closing entries and the accounting cycle for 2018. The business is now ready to record January 2019 transactions. Jan. 3 5 12 15 18 20 Collected $200 cash from customer on account. Purchased office supplies on account, $1,000. Performed delivery services for a customer and received $3,000 cash. Paid employee salary, including the amount owed on December 31, $4,100. Performed delivery services on account, $1,350. Paid $300 on account. 24 27 Purchased fuel for the truck, paying $200 cash. Completed the remaining work due for Unearned Revenue. 28 30 Paid office rent, $2,200, for the month of January. Collected $3,000 in advance for delivery service to be performed later. 31 Murphy withdrew cash of $1,500. HORNGREN'S ACCOUNTING - 12th Edition Comprehensive Problem 2 For Chapters 1-4 Requirements 1. Record each transaction in the journal. Explanations are not required. Ledger Boole 2. Post the transactions in the accounts. Don't forget to use the December 31, 2018 ending balances as appropriate. 3. Prepare an unadjusted trial balance as of January 31, 2019. 4. Prepare a worksheet as of January 31, 2019. (optional) 5. Journalize the adjusting entries using the following adjustment data. Post adjusting entries to the Taccounts. Ledger Book 6. Prepare an adjusted trial balance as of January 31, 2019. 7. Prepare Murphy Delivery Service's income statement and statement of owner's equity for the month ended January 31, 2019, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount that is, the largest expense first, the smallest expense last. 8 Calculate the following ratios as of January 31, 2019 for Murphy Delivery Service: return on assets, debt ratio, and current ratio. m eses the largest expense first, the smallest expense last HORNGREN'S ACCOUNTING - 12th Edition Solution: Requirement 1 Date Accounts and Explanation Debit Credit pter 4: Completing the Accounting Cycle largest expense first, the smallest expenses cosing entries, and post to the accounts ost-closing trial balance as of December 31, 2018 HORNGREN'S ACCOUNTING - 12th Edition Requirement 2,5 Requirement 3 MURPHY DELIVERY SERVICE Unadjusted Trial Balance January 31, 2018 Account Title Balance Debit Credit pter 4: Completing the Accounting Cycle Requirement 4 MURPHY DELIVERY SERVICE Worksheet January 31, 2019 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Unadjusted Trial Balance Debit Account Names Income Statement Debit Credit Balance Sheet Debit Credit Credit Page 5 of ter 4: Completing the Accounting Cycle IORNGREN'S ACCOUNTING - 12th Edition Requirement 5 Date Accounts and Explanation Debit Credit Completing the Accounting Cycle l, list expenses in decreasing order by the largest expense first the smallesterse last ournalize the closi HORNGREN'S ACCOUNTING - 12th Edition Requirement 6 MURPHY DELIVERY SERVICE Adjusted Trial Balance January 31, 2019 Account Title Balance Debit Credit ter 4: Completing the Accounting Cycle ant Come statement, list that is, the largest expense fish es in decreasing order by fournalism ORNGREN'S ACCOUNTING - 12th Edition Requirement 7 MURPHY DELIVERY SERVICE Income Statement Month Ended January 31, 2019 MURPHY DELIVERY SERVICE Statement of Owner's Equity Month Ended January 31, 2019 er 4: Completing the Accounting Cycle ANGREN'S ACCOUNTING - 12th Edition MURPHY DELIVERY SERVICE Balance Sheet January 31, 2019 Assets Liabilities Owner's Equity 4: Completing the Accounting Cycle Xomprehensive Problem 2 for Chapters 1-4 This comprehensive problem is a continuation of Comprehensive Problem 1. Murphy Delivery Service has completed closing entries and the accounting cycle for 2018. The business is now ready to record January 2019 transactions. Jan. 3 5 12 15 18 20 Collected $200 cash from customer on account. Purchased office supplies on account, $1,000. Performed delivery services for a customer and received $3,000 cash. Paid employee salary, including the amount owed on December 31, $4,100. Performed delivery services on account, $1,350. Paid $300 on account. 24 27 Purchased fuel for the truck, paying $200 cash. Completed the remaining work due for Unearned Revenue. 28 30 Paid office rent, $2,200, for the month of January. Collected $3,000 in advance for delivery service to be performed later. 31 Murphy withdrew cash of $1,500. HORNGREN'S ACCOUNTING - 12th Edition Comprehensive Problem 2 For Chapters 1-4 Requirements 1. Record each transaction in the journal. Explanations are not required. Ledger Boole 2. Post the transactions in the accounts. Don't forget to use the December 31, 2018 ending balances as appropriate. 3. Prepare an unadjusted trial balance as of January 31, 2019. 4. Prepare a worksheet as of January 31, 2019. (optional) 5. Journalize the adjusting entries using the following adjustment data. Post adjusting entries to the Taccounts. Ledger Book 6. Prepare an adjusted trial balance as of January 31, 2019. 7. Prepare Murphy Delivery Service's income statement and statement of owner's equity for the month ended January 31, 2019, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount that is, the largest expense first, the smallest expense last. 8 Calculate the following ratios as of January 31, 2019 for Murphy Delivery Service: return on assets, debt ratio, and current ratio. m eses the largest expense first, the smallest expense last HORNGREN'S ACCOUNTING - 12th Edition Solution: Requirement 1 Date Accounts and Explanation Debit Credit pter 4: Completing the Accounting Cycle largest expense first, the smallest expenses cosing entries, and post to the accounts ost-closing trial balance as of December 31, 2018 HORNGREN'S ACCOUNTING - 12th Edition Requirement 2,5 Requirement 3 MURPHY DELIVERY SERVICE Unadjusted Trial Balance January 31, 2018 Account Title Balance Debit Credit pter 4: Completing the Accounting Cycle Requirement 4 MURPHY DELIVERY SERVICE Worksheet January 31, 2019 Adjustments Adjusted Trial Balance Debit Credit Debit Credit Unadjusted Trial Balance Debit Account Names Income Statement Debit Credit Balance Sheet Debit Credit Credit Page 5 of ter 4: Completing the Accounting Cycle IORNGREN'S ACCOUNTING - 12th Edition Requirement 5 Date Accounts and Explanation Debit Credit Completing the Accounting Cycle l, list expenses in decreasing order by the largest expense first the smallesterse last ournalize the closi HORNGREN'S ACCOUNTING - 12th Edition Requirement 6 MURPHY DELIVERY SERVICE Adjusted Trial Balance January 31, 2019 Account Title Balance Debit Credit ter 4: Completing the Accounting Cycle ant Come statement, list that is, the largest expense fish es in decreasing order by fournalism ORNGREN'S ACCOUNTING - 12th Edition Requirement 7 MURPHY DELIVERY SERVICE Income Statement Month Ended January 31, 2019 MURPHY DELIVERY SERVICE Statement of Owner's Equity Month Ended January 31, 2019 er 4: Completing the Accounting Cycle ANGREN'S ACCOUNTING - 12th Edition MURPHY DELIVERY SERVICE Balance Sheet January 31, 2019 Assets Liabilities Owner's Equity 4: Completing the Accounting Cycle