Answered step by step

Verified Expert Solution

Question

1 Approved Answer

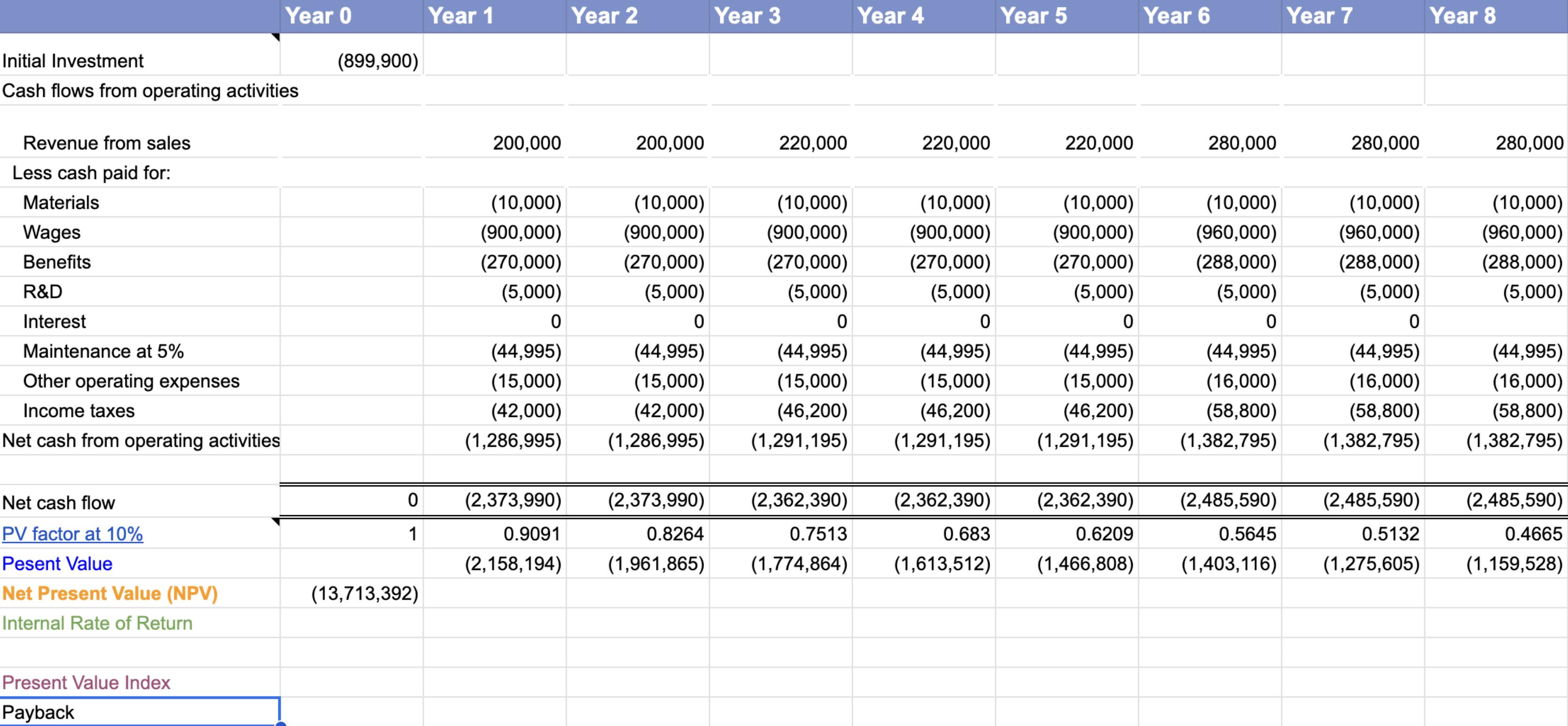

I need the payback row for all years and the explanation on how to do it. Initial Investment Cash flows from operating activities Revenue from

I need the payback row for all years and the explanation on how to do it.

Initial Investment Cash flows from operating activities Revenue from sales Less cash paid for: Materials Wages Benefits R&D Interest Maintenance at 5% Other operating expenses Income taxes Net cash from operating activities Net cash flow PV factor at 10% Pesent Value Net Present Value (NPV) Internal Rate of Return Year 0 Present Value Index Payback (899,900) 0 1 (13,713,392) Year 1 200,000 (10,000) (900,000) (270,000) (5,000) 0 (44,995) (15,000) (42,000) (1,286,995) Year 2 200,000 (10,000) (900,000) (270,000) (5,000) 0 Year 3 (2,373,990) (2,373,990) 0.9091 (2,158,194) 0.8264 (1,961,865) 220,000 (10,000) (900,000) (270,000) (5,000) 0 Year 4 (10,000) (900,000) (270,000) (5,000) 0 (44,995) (44,995) (44,995) (15,000) (15,000) (15,000) (42,000) (46,200) (46,200) (1,286,995) (1,291,195) (1,291,195) (2,362,390) 0.7513 (1,774,864) 220,000 (2,362,390) 0.683 (1,613,512) Year 5 220,000 (10,000) (900,000) (270,000) (5,000) 0 Year 6 280,000 (10,000) (960,000) (288,000) (5,000) 0 (44,995) (44,995) (15,000) (16,000) (46,200) (58,800) (1,291,195) (1,382,795) (2,362,390) (2,485,590) 0.5645 0.6209 (1,466,808) (1,403,116) Year 7 280,000 (10,000) (960,000) (288,000) (5,000) 0 (44,995) (16,000) (58,800) (1,382,795) (2,485,590) 0.5132 (1,275,605) Year 8 280,000 (10,000) (960,000) (288,000) (5,000) (44,995) (16,000) (58,800) (1,382,795) (2,485,590) 0.4665 (1,159,528)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the payback period for each year you need to follow these steps Calculate the cumulative cash flows for each year by summing up the cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started