Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED THE QUESTIONS E AND F THANKS WITH ANALYTICAL CALCULATIONS THANKS Jim is an analyst evaluating Hellenic Water Company (HWC), which is a utility

I NEED THE QUESTIONS E AND F THANKS WITH ANALYTICAL CALCULATIONS THANKS

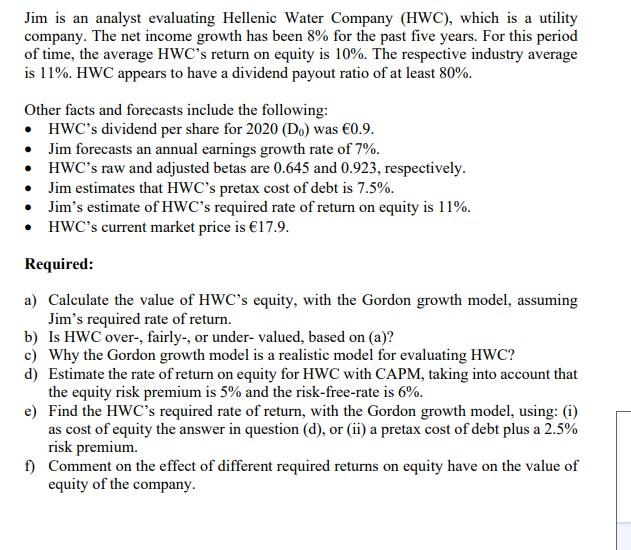

Jim is an analyst evaluating Hellenic Water Company (HWC), which is a utility company. The net income growth has been 8% for the past five years. For this period of time, the average HWC's return on equity is 10%. The respective industry average is 11%. HWC appears to have a dividend payout ratio of at least 80%. Other facts and forecasts include the following: HWC's dividend per share for 2020 (D) was 0.9. Jim forecasts an annual earnings growth rate of 7%. HWC's raw and adjusted betas are 0.645 and 0.923, respectively. Jim estimates that HWC's pretax cost of debt is 7.5%. Jim's estimate of HWC's required rate of return on equity is 11%. HWC's current market price is 17.9. Required: a) Calculate the value of HWC's equity, with the Gordon growth model, assuming Jim's required rate of return. b) Is HWC over-, fairly-, or under-valued, based on (a)? c) Why the Gordon growth model is a realistic model for evaluating HWC? d) Estimate the rate of return on equity for HWC with CAPM, taking into account that the equity risk premium is 5% and the risk-free-rate is 6%. e) Find the HWC's required rate of return, with the Gordon growth model, using: (i) as cost of equity the answer in question (d), or (ii) a pretax cost of debt plus a 2.5% risk premium. f) Comment on the effect of different required returns on equity have on the value of equity of the companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started