I need the red boxes fixed, please.

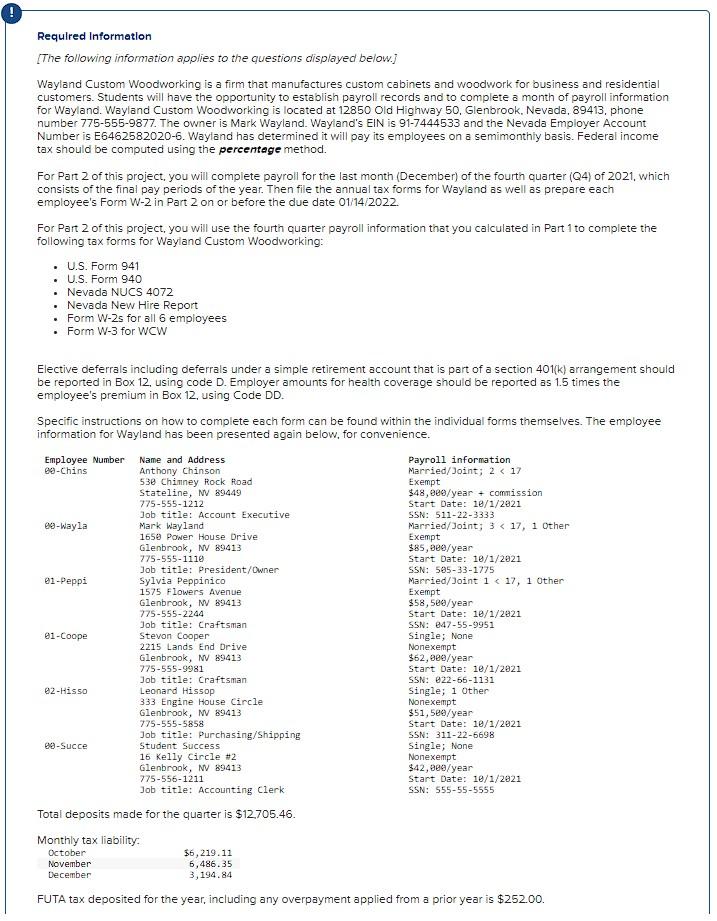

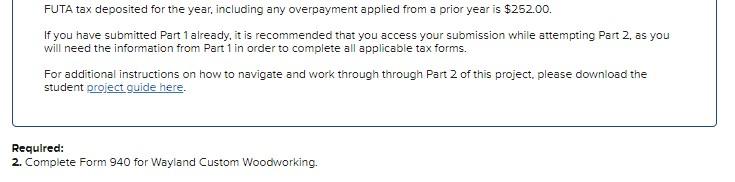

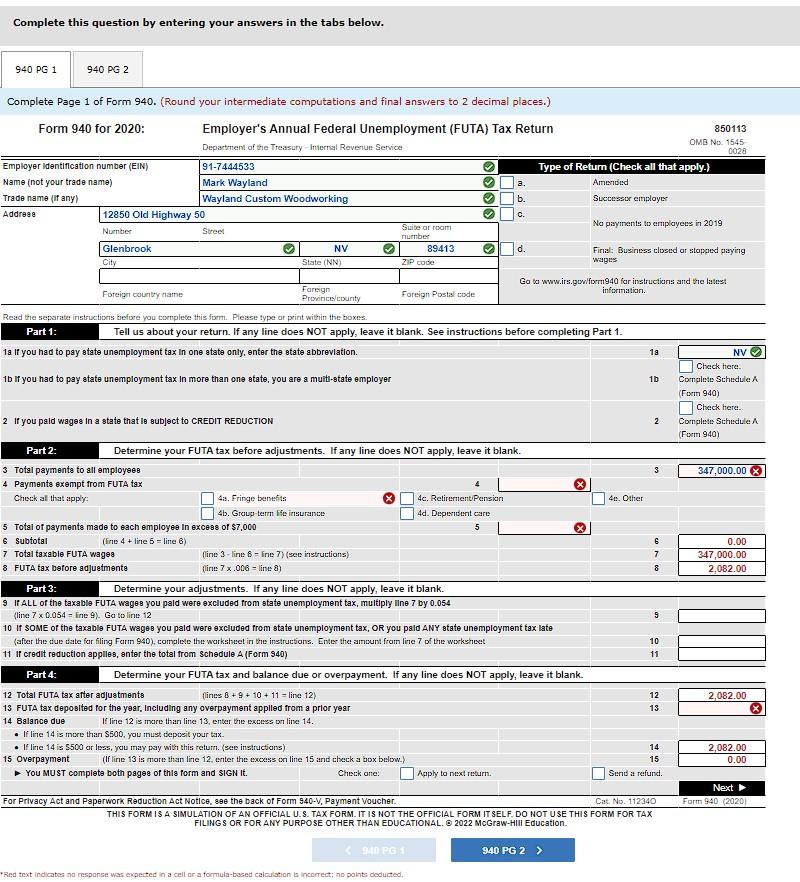

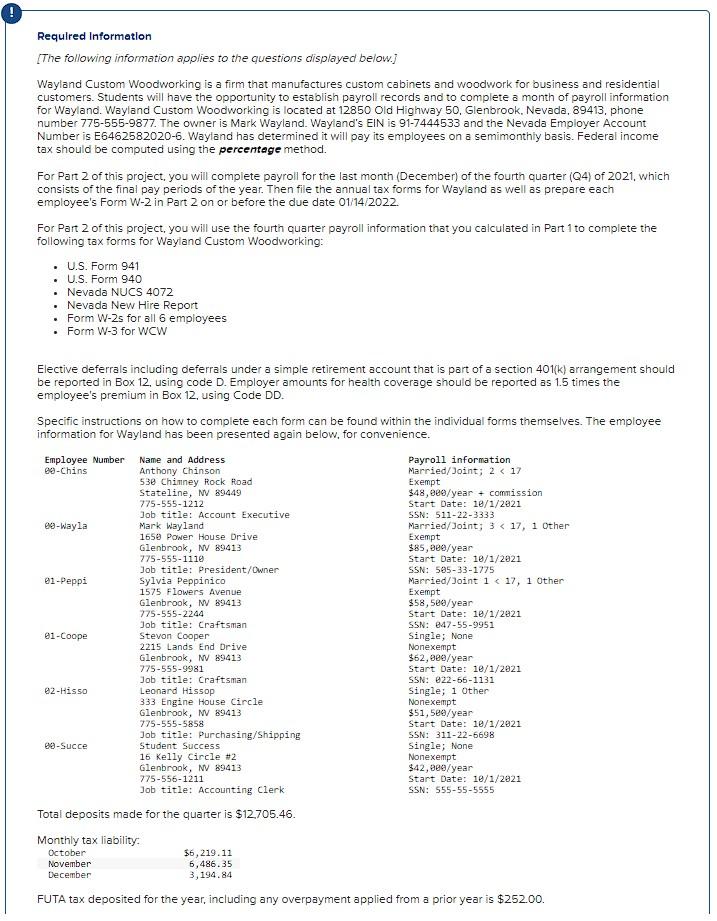

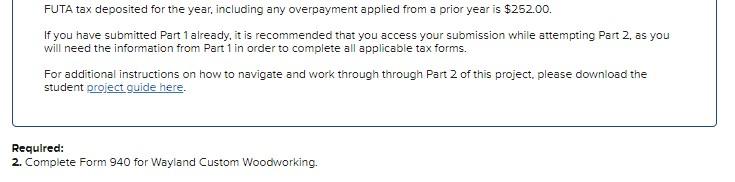

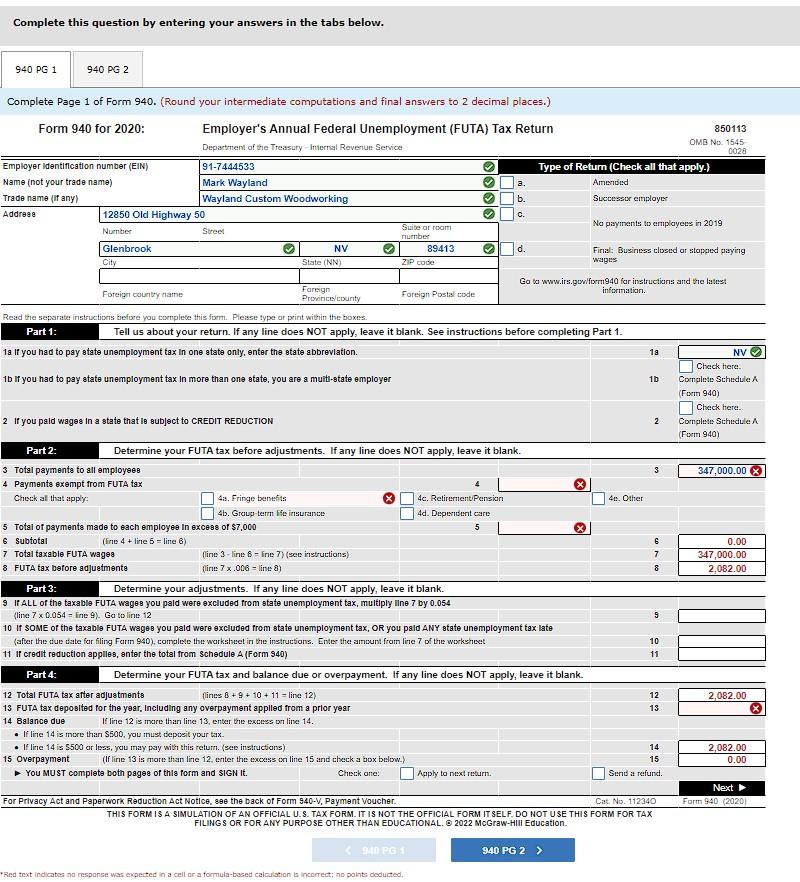

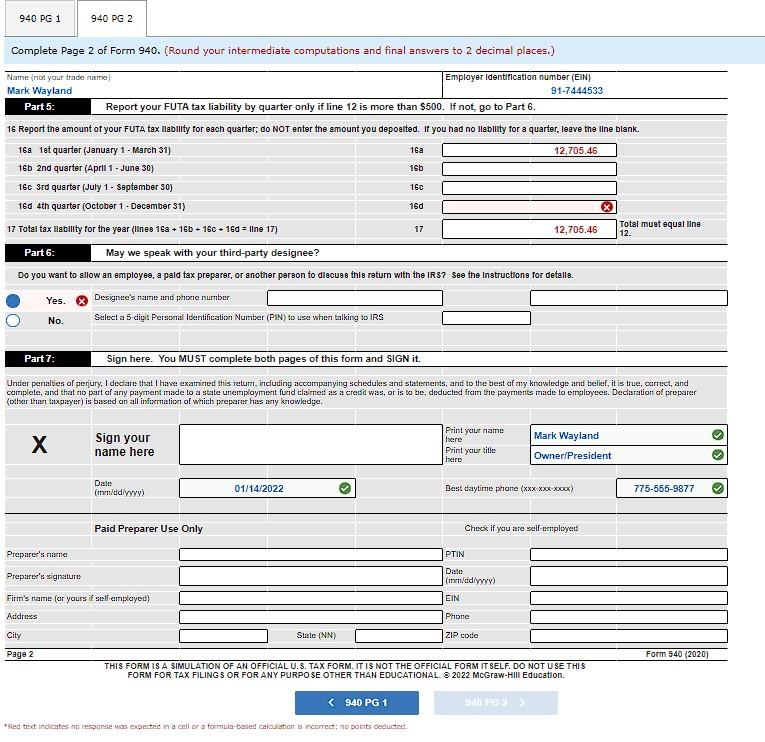

Required Information [The following information applies to the questions displayed below.] Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland. Wayland Custom Woodworking is located at 12850 Old Highway 50 , Glenbrook, Nevada, 89413, phone number 775-555-9877. The owner is Mark Wayland. Wayland's EIN is 91-7444533 and the Nevada Employer Account Number is E6462582020-6. Wayland has determined it will pay its employees on a semimonthly basis. Federal income tax should be computed using the percentege method. For Part 2 of this project, you will complete payroll for the last month (December) of the fourth quarter (Q4) of 2021 , which consists of the final pay periods of the year. Then file the annual tax forms for Wayland as well as prepare each employee's Form W-2 in Part 2 on or before the due date 01/14/2022. For Part 2 of this project, you will use the fourth quarter payroll information that you calculated in Part 1 to complete the following tax forms for Wayland Custom Woodworking: - U.S. Form 941 - U.S. Form 940 - Nevada NUCS 4072 - Nevada New Hire Report - Form W-2s for all 6 employees - Form W3 for WCW Elective deferrals including deferrals under a simple retirement account that is part of a section 401(k) arrangement should be reported in Box 12, using code D. Employer amounts for health coverage should be reported as 1.5 times the employee's premium in Box 12, using Code DD. Specific instructions on how to complete each form can be found within the individual forms themselves. The employee information for Wayland has been presented again below, for convenience. Iotal deposits made tor the quarter is 31,7 Us.46. FUTA tax deposited for the year, including any overpayment applied from a prior year is $252.00. FUTA tax deposited for the year, including any overpayment applied from a prior year is $252.00. If you have submitted Part 1 already, it is recommended that you access your submission while attempting Part 2, as you will need the information from Part 1 in order to complete all applicable tax forms. For additional instructions on how to navigate and work through through Part 2 of this project, please download the student project guide here. Required: 2. Complete Form 940 for Wayland Custom Woodworking. Complete this question by entering your answers in the tabs below. EnNzAcTn 18 1b 2 * Red text Indicates na respanee was evpertec in a cell af a formula-based calnurtion is incortect; no points deducted. Required Information [The following information applies to the questions displayed below.] Wayland Custom Woodworking is a firm that manufactures custom cabinets and woodwork for business and residential customers. Students will have the opportunity to establish payroll records and to complete a month of payroll information for Wayland. Wayland Custom Woodworking is located at 12850 Old Highway 50 , Glenbrook, Nevada, 89413, phone number 775-555-9877. The owner is Mark Wayland. Wayland's EIN is 91-7444533 and the Nevada Employer Account Number is E6462582020-6. Wayland has determined it will pay its employees on a semimonthly basis. Federal income tax should be computed using the percentege method. For Part 2 of this project, you will complete payroll for the last month (December) of the fourth quarter (Q4) of 2021 , which consists of the final pay periods of the year. Then file the annual tax forms for Wayland as well as prepare each employee's Form W-2 in Part 2 on or before the due date 01/14/2022. For Part 2 of this project, you will use the fourth quarter payroll information that you calculated in Part 1 to complete the following tax forms for Wayland Custom Woodworking: - U.S. Form 941 - U.S. Form 940 - Nevada NUCS 4072 - Nevada New Hire Report - Form W-2s for all 6 employees - Form W3 for WCW Elective deferrals including deferrals under a simple retirement account that is part of a section 401(k) arrangement should be reported in Box 12, using code D. Employer amounts for health coverage should be reported as 1.5 times the employee's premium in Box 12, using Code DD. Specific instructions on how to complete each form can be found within the individual forms themselves. The employee information for Wayland has been presented again below, for convenience. Iotal deposits made tor the quarter is 31,7 Us.46. FUTA tax deposited for the year, including any overpayment applied from a prior year is $252.00. FUTA tax deposited for the year, including any overpayment applied from a prior year is $252.00. If you have submitted Part 1 already, it is recommended that you access your submission while attempting Part 2, as you will need the information from Part 1 in order to complete all applicable tax forms. For additional instructions on how to navigate and work through through Part 2 of this project, please download the student project guide here. Required: 2. Complete Form 940 for Wayland Custom Woodworking. Complete this question by entering your answers in the tabs below. EnNzAcTn 18 1b 2 * Red text Indicates na respanee was evpertec in a cell af a formula-based calnurtion is incortect; no points deducted