Answered step by step

Verified Expert Solution

Question

1 Approved Answer

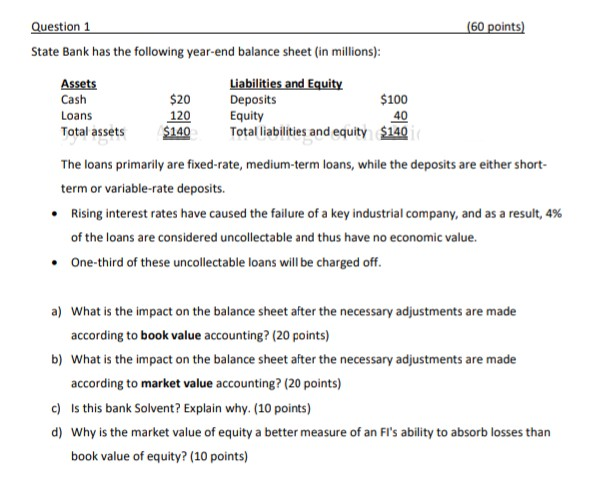

i need the solution on priority please $20 Question 1 (60 points) State Bank has the following year-end balance sheet (in millions): Assets Liabilities and

i need the solution on priority please

$20 Question 1 (60 points) State Bank has the following year-end balance sheet (in millions): Assets Liabilities and Equity Cash Deposits $100 Loans 120 Equity 40 Total assets $140 Total liabilities and equity $140 The loans primarily are fixed-rate, medium-term loans, while the deposits are either short- term or variable-rate deposits. Rising interest rates have caused the failure of a key industrial company, and as a result, 4% of the loans are considered uncollectable and thus have no economic value. One-third of these uncollectable loans will be charged off. a) What is the impact on the balance sheet after the necessary adjustments are made according to book value accounting? (20 points) b) What is the impact on the balance sheet after the necessary adjustments are made according to market value accounting? (20 points) c) Is this bank Solvent? Explain why. (10 points) d) Why is the market value of equity a better measure of an Fi's ability to absorb losses than book value of equity? (10 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started