Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the solution to solve these problems. Quodion 12 Not answered Marked out of 2.00 Currently the firm has total market value of debt

I need the solution to solve these problems.

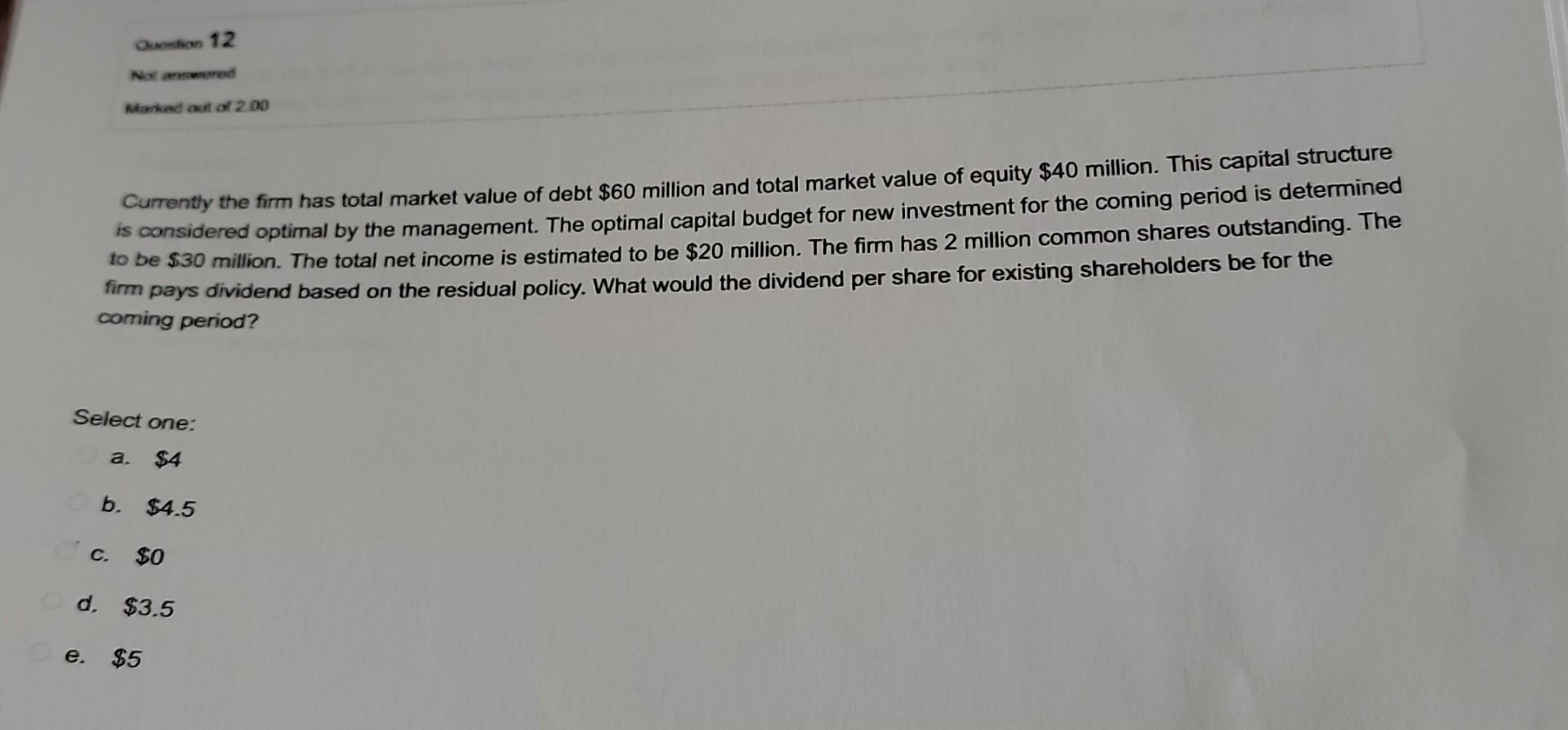

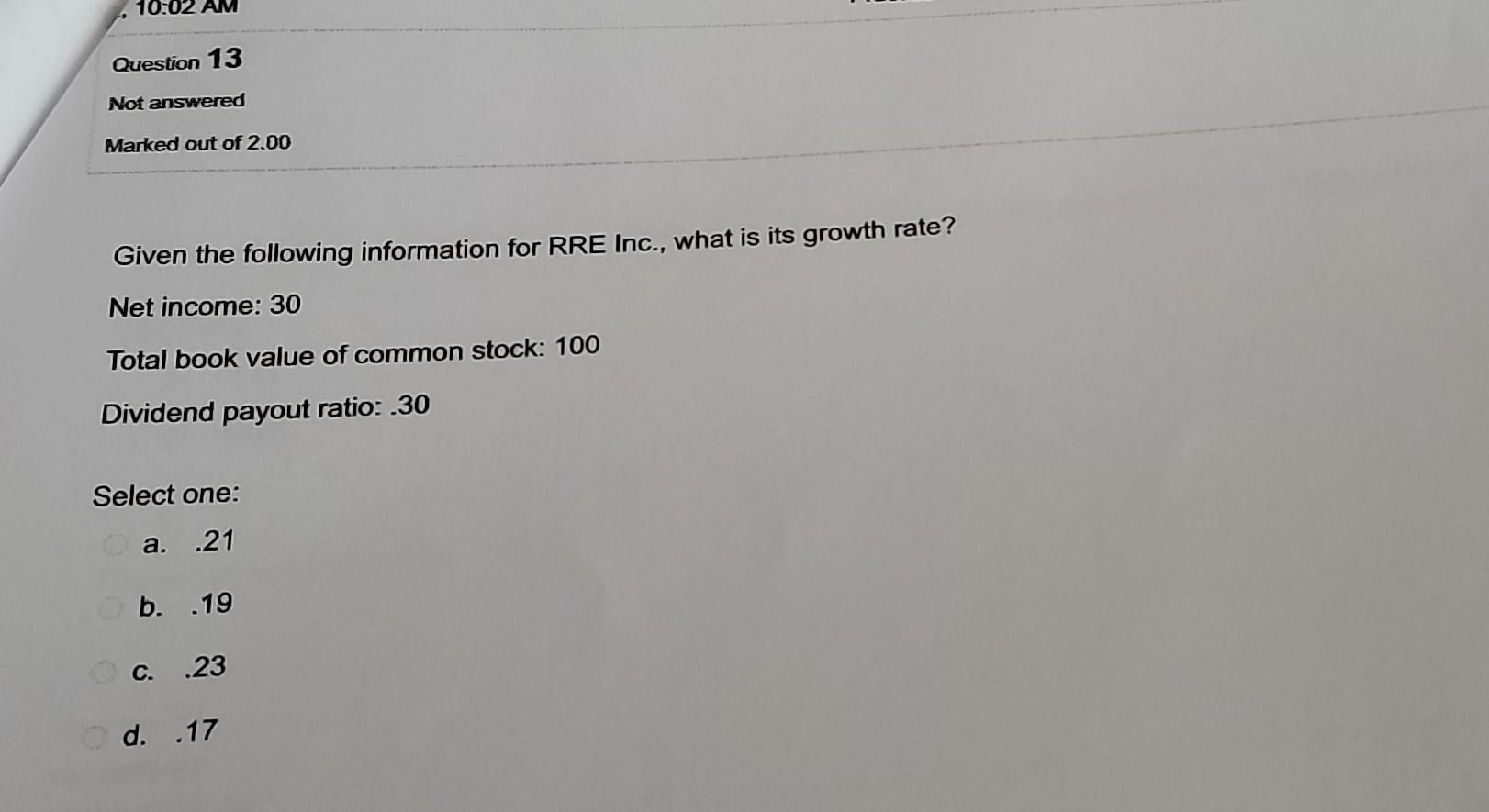

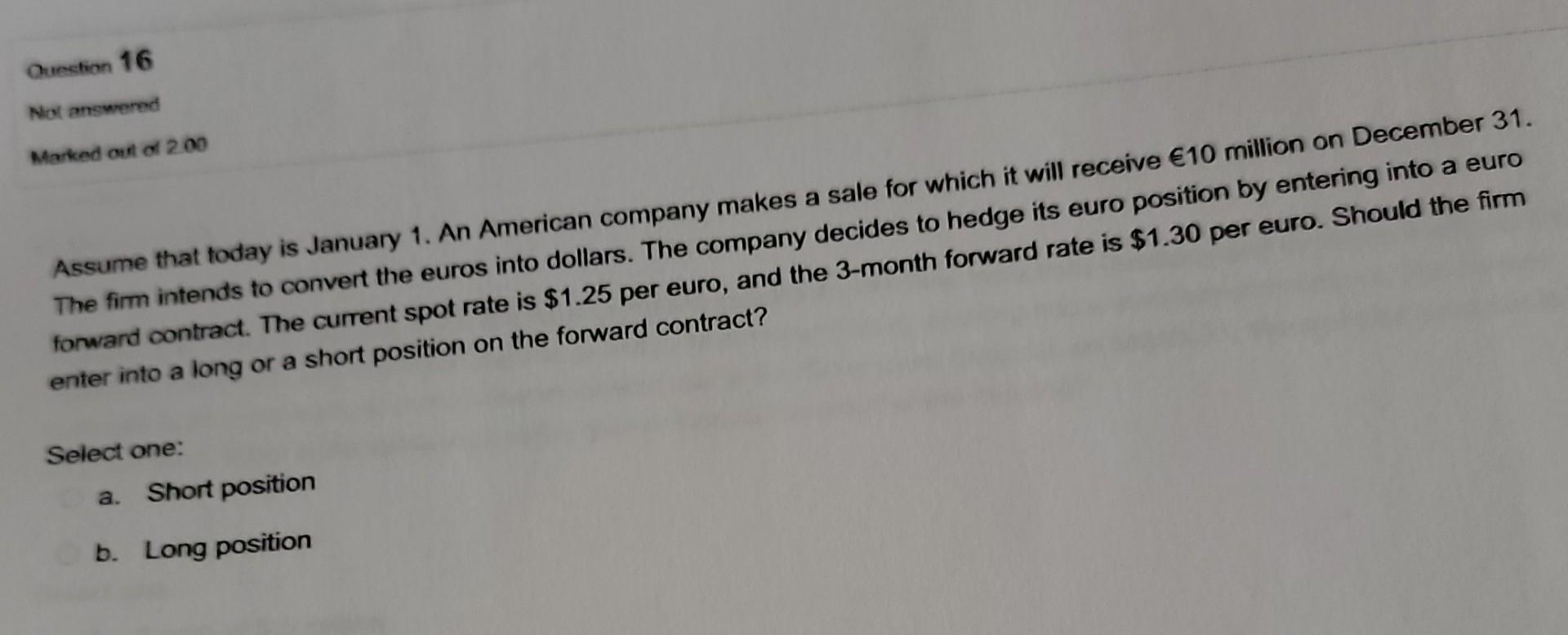

Quodion 12 Not answered Marked out of 2.00 Currently the firm has total market value of debt $60 million and total market value of equity $40 million. This capital structure is considered optimal by the management. The optimal capital budget for new investment for the coming period is determined to be $30 million. The total net income is estimated to be $20 million. The firm has 2 million common shares outstanding. The firm pays dividend based on the residual policy. What would the dividend per share for existing shareholders be for the coming period? Select one: a. $4 b. $4.5 c. $0 Od. $3.5 e. $5 10:02 AM Question 13 Not answered Marked out of 2.00 Given the following information for RRE Inc., what is its growth rate? Net income: 30 Total book value of common stock: 100 Dividend payout ratio: .30 Select one: a. .21 b. .19 C. .23 d. .17 Question 16 Not answered Marked out of 2.00 Assume that today is January 1. An American company makes a sale for which it will receive 10 million on December 31. The firm intends to convert the euros into dollars. The company decides to hedge its euro position by entering into a euro forward contract. The current spot rate is $1.25 per euro, and the 3-month forward rate is $1.30 per euro. Should the firm enter into a long or a short position on the forward contract? Select one: a. Short position b. Long position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started