I need the solutions of these 3 questions

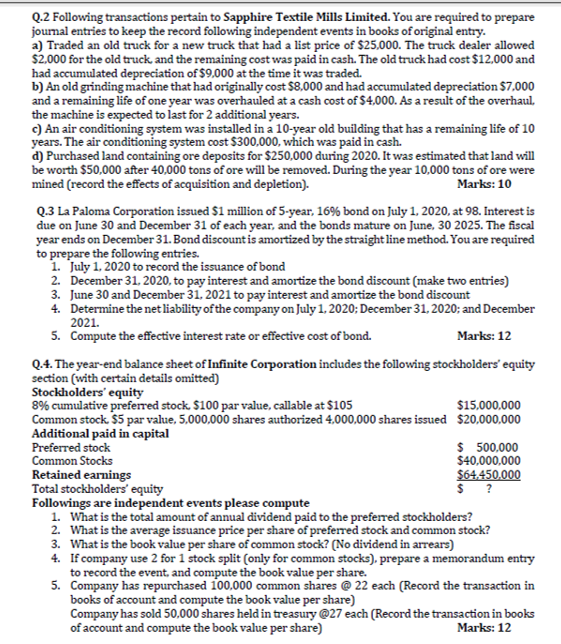

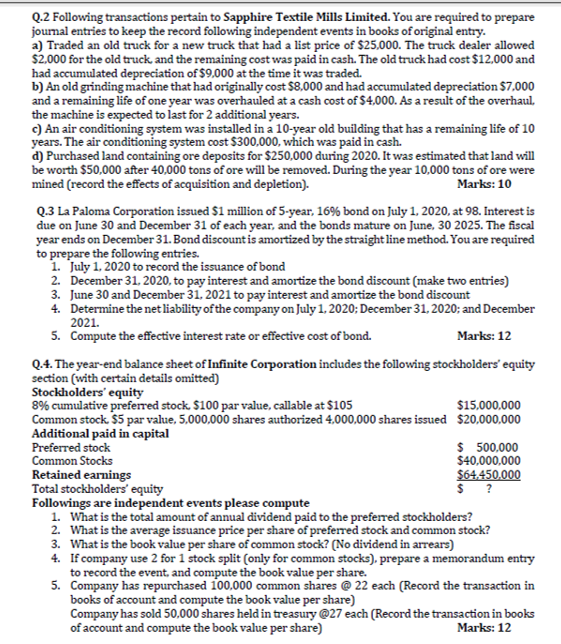

Q.2 Following transactions pertain to Sapphire Textile Mills Limited. You are required to prepare journal entries to keep the record following independent events in books of original entry. a) Traded an old truck for a new truck that had a list price of $25,000. The truck dealer allowed $2.000 for the old truck, and the remaining cost was paid in cash. The old truck had cost $12.000 and had accumulated depreciation of $9.000 at the time it was traded. b) An old grinding machine that had originally cost $8.000 and had accumulated depreciation $7,000 and a remaining life of one year was overhauled at a cash cost of $4.000. As a result of the overhaul. the machine is expected to last for 2 additional years. c) An air conditioning system was installed in a 10-year old building that has a remaining life of 10 years. The air conditioning system cost $300,000, which was paid in cash. d) Purchased land containing ore deposits for $250,000 during 2020. It was estimated that land will be worth $50,000 after 40,000 tons of ore will be removed. During the year 10,000 tons of ore were mined (record the effects of acquisition and depletion). Marks: 10 Q.3 La Paloma Corporation issued $1 million of 5-year, 16% bond on July 1, 2020, at 98. Interest is due on June 30 and December 31 of each year, and the bonds mature on June 30 2025. The fiscal year ends on December 31. Bond discount is amortized by the straight line method. You are required to prepare the following entries. 1. July 1, 2020 to record the issuance of bond 2. December 31, 2020. to pay interest and amortize the bond discount (make two entries) 3. June 30 and December 31, 2021 to pay interest and amortize the bond discount 4. Determine the net liability of the company on July 1, 2020; December 31, 2020; and December 2021. 5. Compute the effective interest rate or effective cost of bond. Marks: 12 Q.4. The year-end balance sheet of Infinite Corporation includes the following stockholders' equity section with certain details omitted) Stockholders' equity 8% cumulative preferred stock. $100 par value, callable at $105 $15.000.000 Common stock $5 par value. 5.000.000 shares authorized 4,000,000 shares issued $20.000.000 Additional paid in capital Preferred stock $ 500,000 Common Stocks $40,000,000 Retained earnings $64.450,000 Total stockholders' equity $ ? Followings are independent events please compute 1. What is the total amount of annual dividend paid to the preferred stockholders? 2. What is the average issuance price per share of preferred stock and common stock? 3. What is the book value per share of common stock? (No dividend in arrears) 4. If company use 2 for 1 stock split (only for common stocks), prepare a memorandum entry to record the event and compute the book value per share. 5. Company has repurchased 100,000 common shares @ 22 each (Record the transaction in books of account and compute the book value per share) Company has sold 50,000 shares held in treasury @27 each (Record the transaction in books of account and compute the book value per share) Marks: 12 Q.2 Following transactions pertain to Sapphire Textile Mills Limited. You are required to prepare journal entries to keep the record following independent events in books of original entry. a) Traded an old truck for a new truck that had a list price of $25,000. The truck dealer allowed $2.000 for the old truck, and the remaining cost was paid in cash. The old truck had cost $12.000 and had accumulated depreciation of $9.000 at the time it was traded. b) An old grinding machine that had originally cost $8.000 and had accumulated depreciation $7,000 and a remaining life of one year was overhauled at a cash cost of $4.000. As a result of the overhaul. the machine is expected to last for 2 additional years. c) An air conditioning system was installed in a 10-year old building that has a remaining life of 10 years. The air conditioning system cost $300,000, which was paid in cash. d) Purchased land containing ore deposits for $250,000 during 2020. It was estimated that land will be worth $50,000 after 40,000 tons of ore will be removed. During the year 10,000 tons of ore were mined (record the effects of acquisition and depletion). Marks: 10 Q.3 La Paloma Corporation issued $1 million of 5-year, 16% bond on July 1, 2020, at 98. Interest is due on June 30 and December 31 of each year, and the bonds mature on June 30 2025. The fiscal year ends on December 31. Bond discount is amortized by the straight line method. You are required to prepare the following entries. 1. July 1, 2020 to record the issuance of bond 2. December 31, 2020. to pay interest and amortize the bond discount (make two entries) 3. June 30 and December 31, 2021 to pay interest and amortize the bond discount 4. Determine the net liability of the company on July 1, 2020; December 31, 2020; and December 2021. 5. Compute the effective interest rate or effective cost of bond. Marks: 12 Q.4. The year-end balance sheet of Infinite Corporation includes the following stockholders' equity section with certain details omitted) Stockholders' equity 8% cumulative preferred stock. $100 par value, callable at $105 $15.000.000 Common stock $5 par value. 5.000.000 shares authorized 4,000,000 shares issued $20.000.000 Additional paid in capital Preferred stock $ 500,000 Common Stocks $40,000,000 Retained earnings $64.450,000 Total stockholders' equity $ ? Followings are independent events please compute 1. What is the total amount of annual dividend paid to the preferred stockholders? 2. What is the average issuance price per share of preferred stock and common stock? 3. What is the book value per share of common stock? (No dividend in arrears) 4. If company use 2 for 1 stock split (only for common stocks), prepare a memorandum entry to record the event and compute the book value per share. 5. Company has repurchased 100,000 common shares @ 22 each (Record the transaction in books of account and compute the book value per share) Company has sold 50,000 shares held in treasury @27 each (Record the transaction in books of account and compute the book value per share) Marks: 12