Answered step by step

Verified Expert Solution

Question

1 Approved Answer

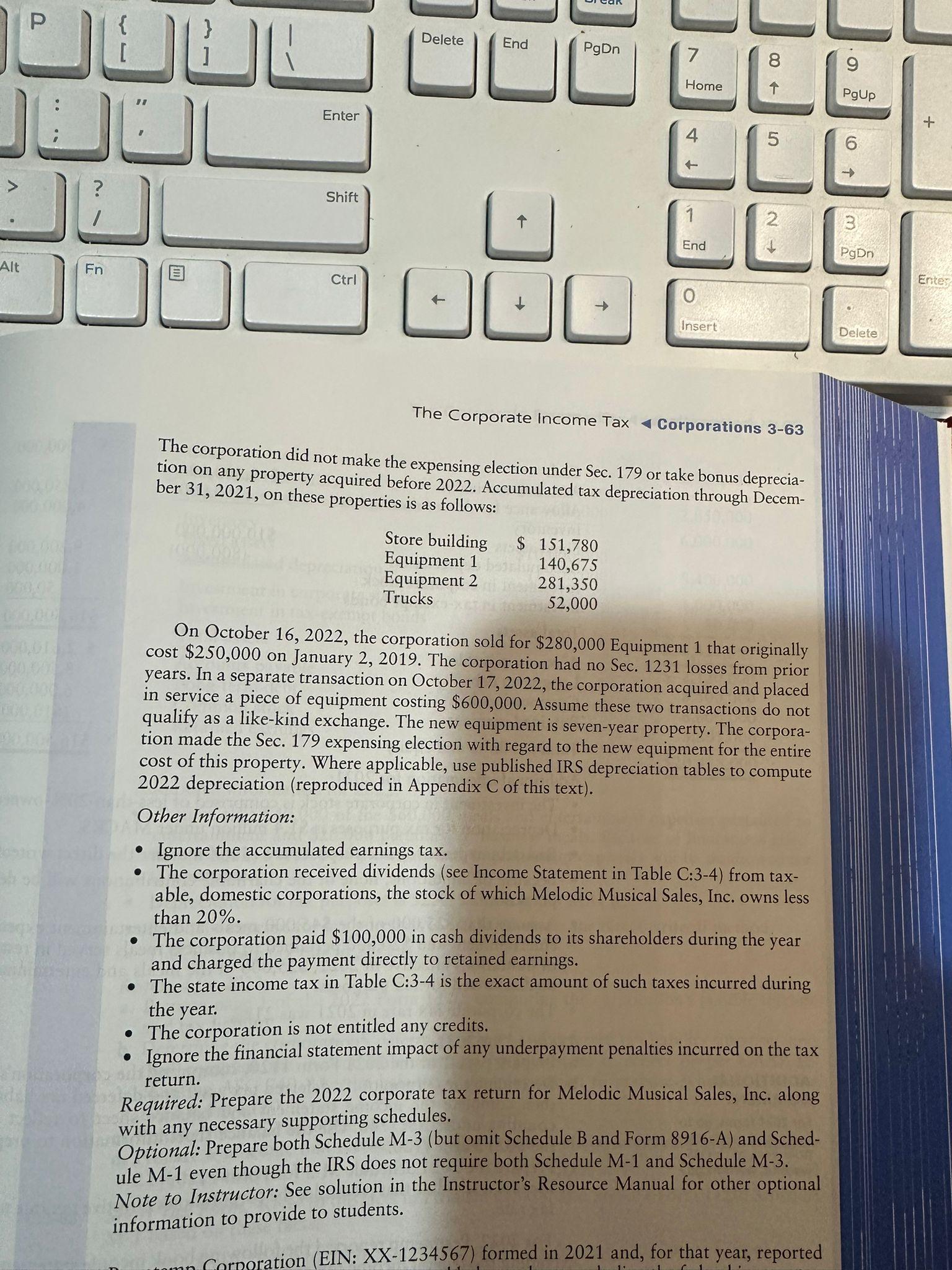

I need the tax return for the attached problem including form 1120 with schedules c,j,k,l,D - form 1125-A, form 1125-E, Form 2220, form 4797 ,

I need the tax return for the attached problem including form 1120 with schedules c,j,k,l,D - form 1125-A, form 1125-E, Form 2220, form 4797 , form 8949 , form 4562

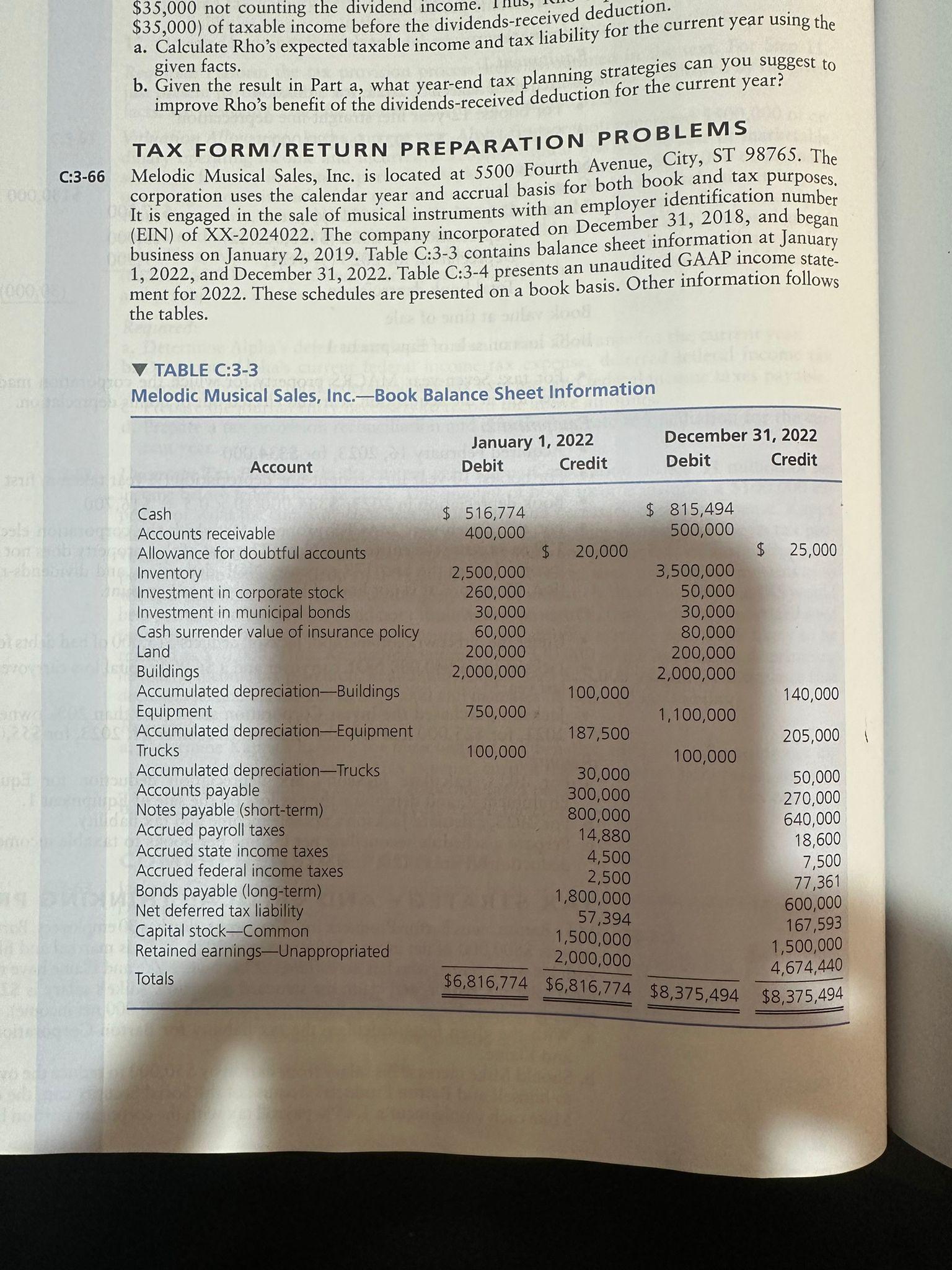

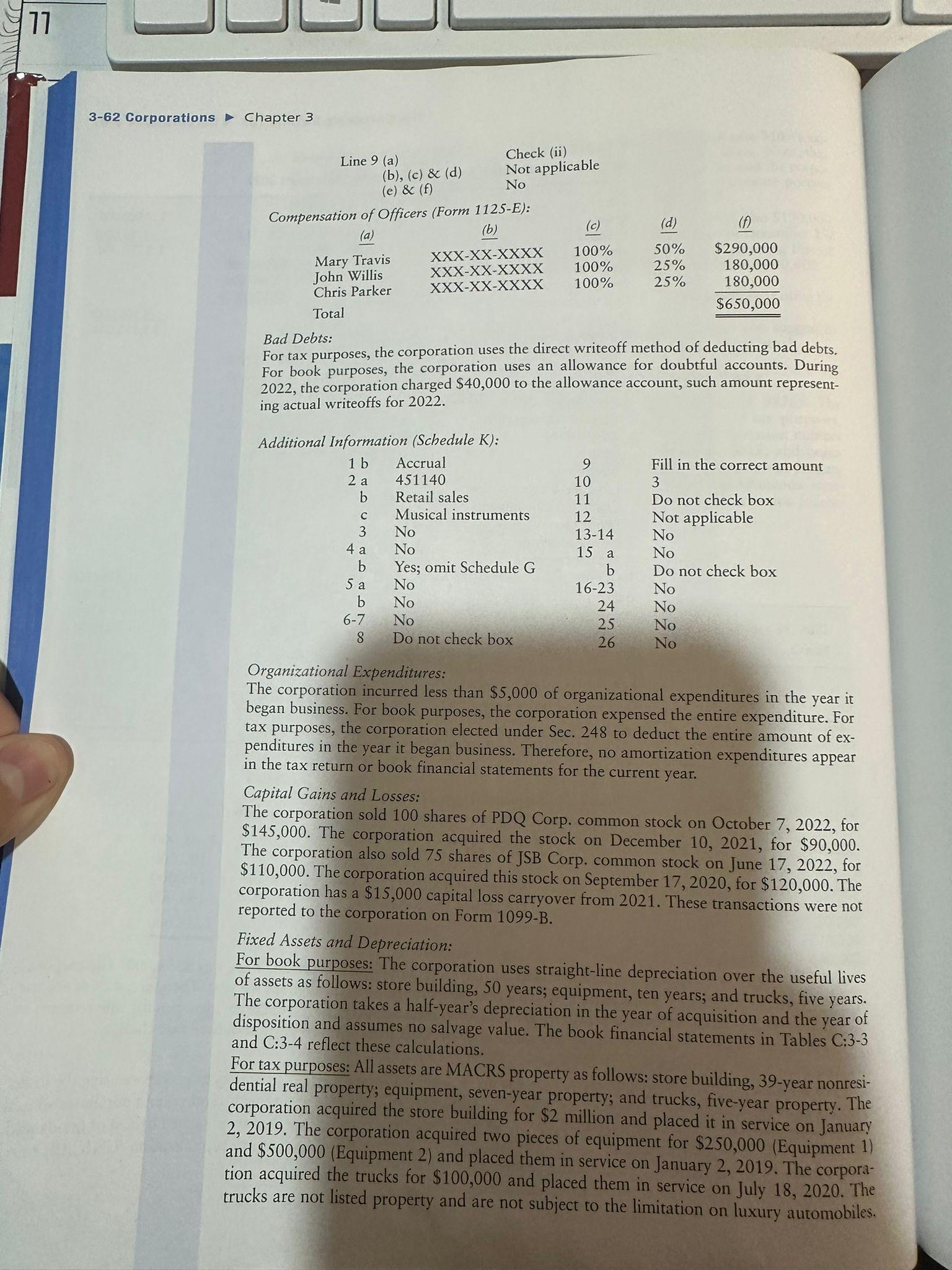

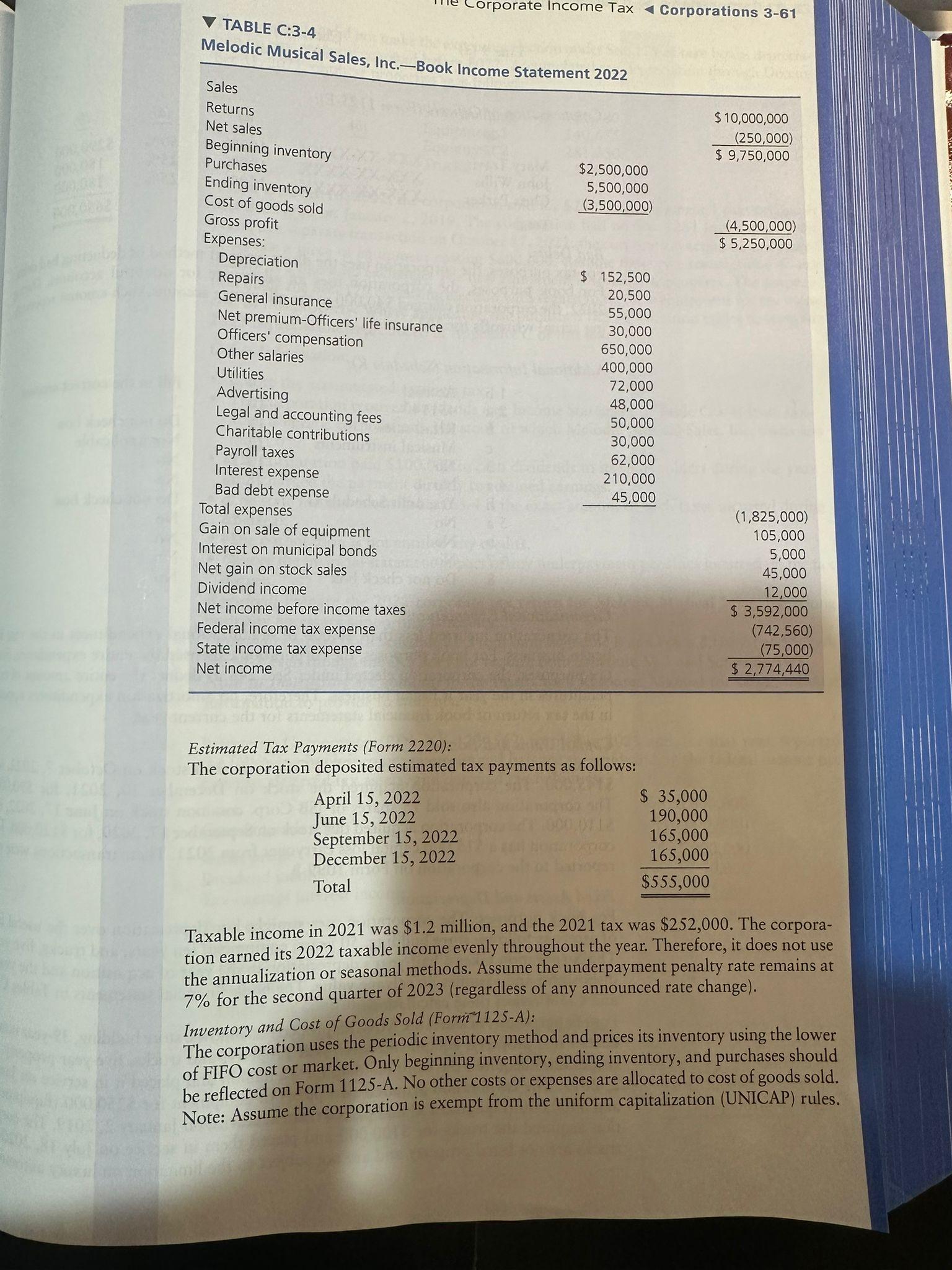

C:3-66 000 08/12 (00005) $35,000 not counting the dividend income. $35,000) of taxable income before the dividends-received deduction a. Calculate Rho's expected taxable income and tax liability for the current year using the given facts. b. Given the result in Part a, what year-end tax planning strategies can you suggest to improve Rho's benefit of the dividends-received deduction for the current year? TAX FORM/RETURN PREPARATION PROBLEMS Melodic Musical Sales, Inc. is located at 5500 Fourth Avenue, City, ST 98765. The corporation uses the calendar year and accrual basis for both book and tax purposes. It is engaged in the sale of musical instruments with an employer identification number (EIN) of XX-2024022. The company incorporated on December 31, 2018, and began business on January 2, 2019. Table C:3-3 contains balance sheet information at January 1, 2022, and December 31, 2022. Table C:3-4 presents an unaudited GAAP income state- ment for 2022. These schedules are presented on a book basis. Other information follows the tables. TABLE C:3-3 Melodic Musical Sales, Inc.-Book Balance Sheet Information Account January 1, 2022 Debit Credit December 31, 2022 Debit Credit 1211 GO Cash $ 516,774 Accounts receivable 400,000 $ 815,494 500,000 Allowance for doubtful accounts $ 20,000 $ 25,000 Inventory 2,500,000 3,500,000 Investment in corporate stock 260,000 50,000 Investment in municipal bonds 30,000 30,000 Cash surrender value of insurance policy 60,000 80,000 kend Land 200,000 200,000 Buildings 2,000,000 2,000,000 Accumulated depreciation-Buildings Equipment 100,000 140,000 750,000 1,100,000 2220 Accumulated depreciation-Equipment 187,500 205,000 Trucks 100,000 100,000 Accumulated depreciation-Trucks 30,000 50,000 up Accounts payable 300,000 270,000 Notes payable (short-term) 800,000 640,000 Accrued payroll taxes 14,880 18,600 Accrued state income taxes 4,500 7,500 Accrued federal income taxes 2,500 77,361 Bonds payable (long-term) 1,800,000 Net deferred tax liability 600,000 57,394 Capital stock-Common 167,593 1,500,000 Retained earnings-Unappropriated 1,500,000 2,000,000 4,674,440 Totals $6,816,774 $6,816,774 $8,375,494 $8,375,494

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears that you have provided a complex tax scenario that would require the completion of several tax forms for Melodic Musical Sales Inc includin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started