I need the third one. Thank you

I need the third one. Thank you

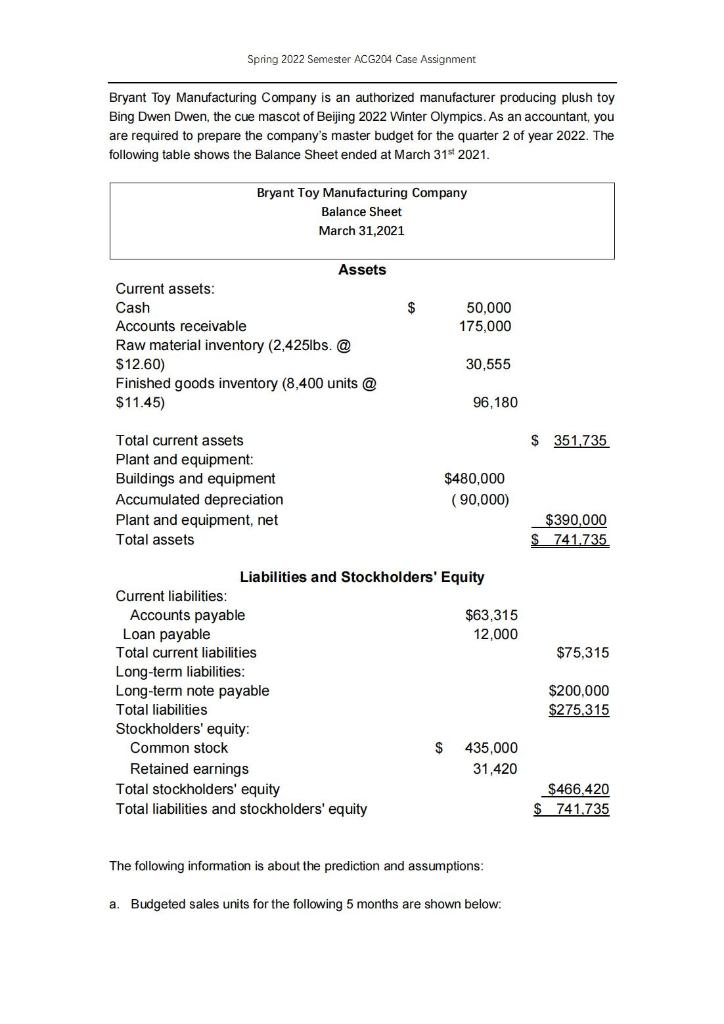

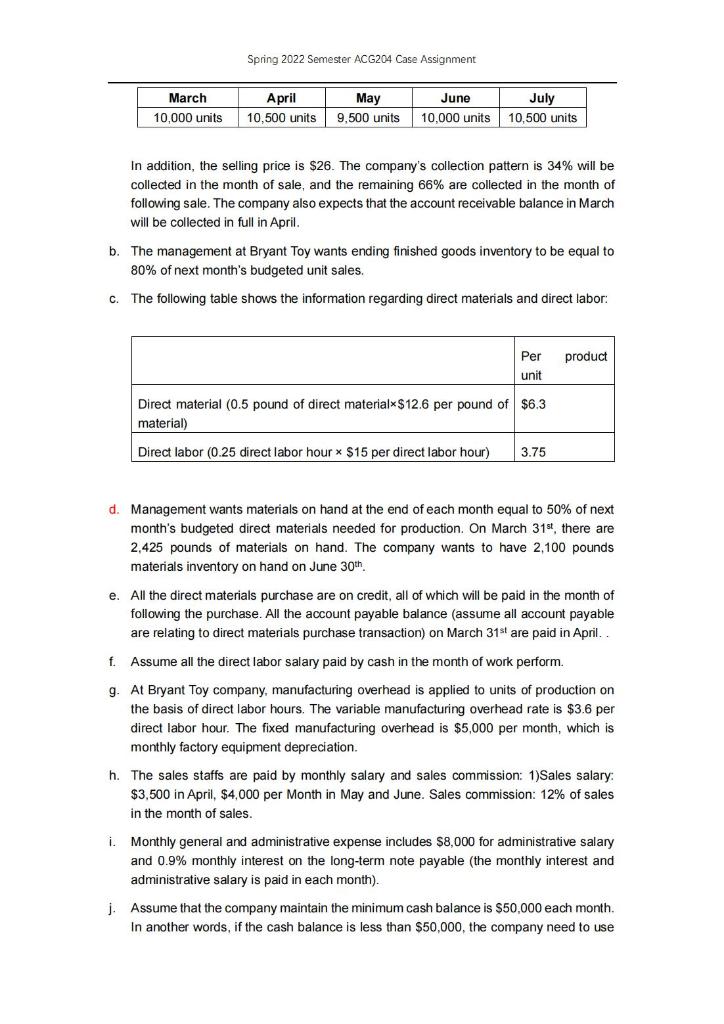

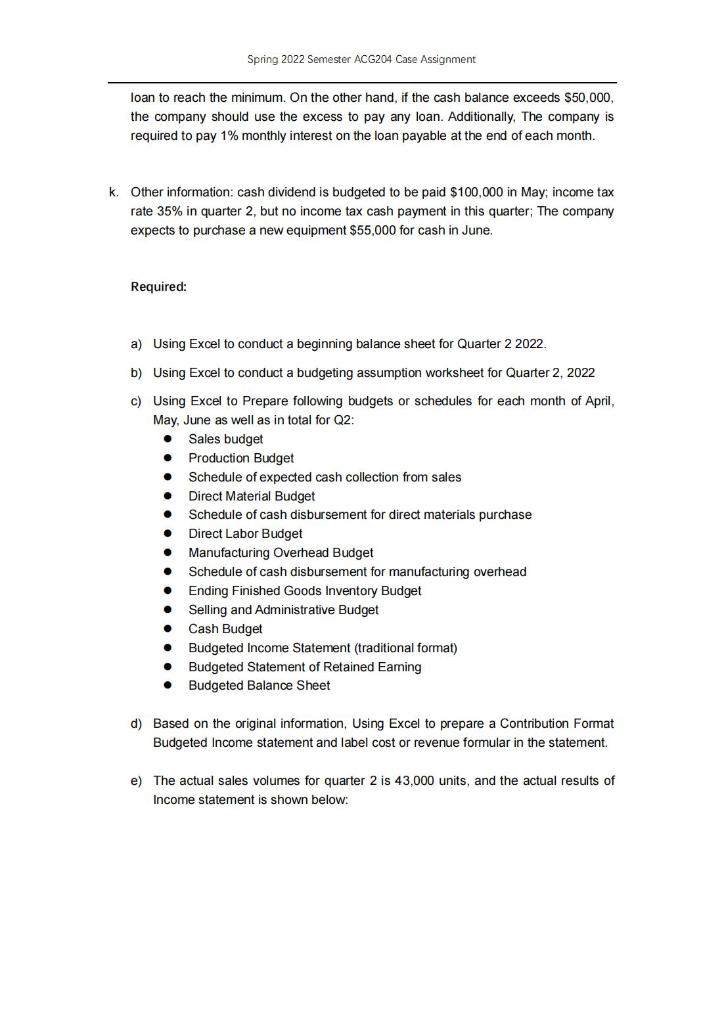

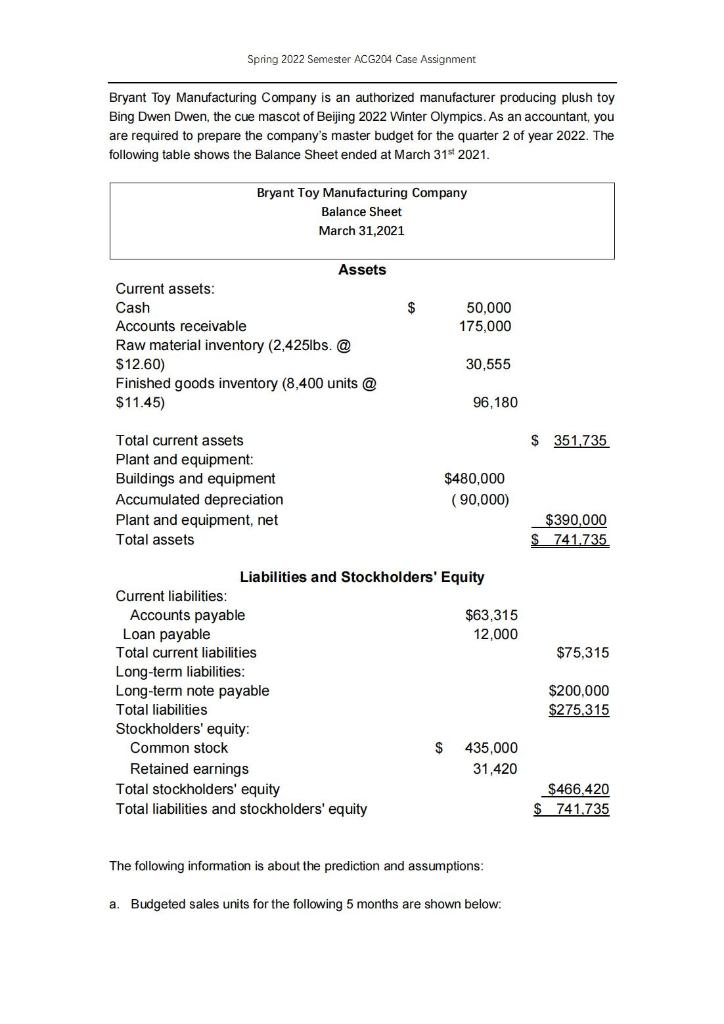

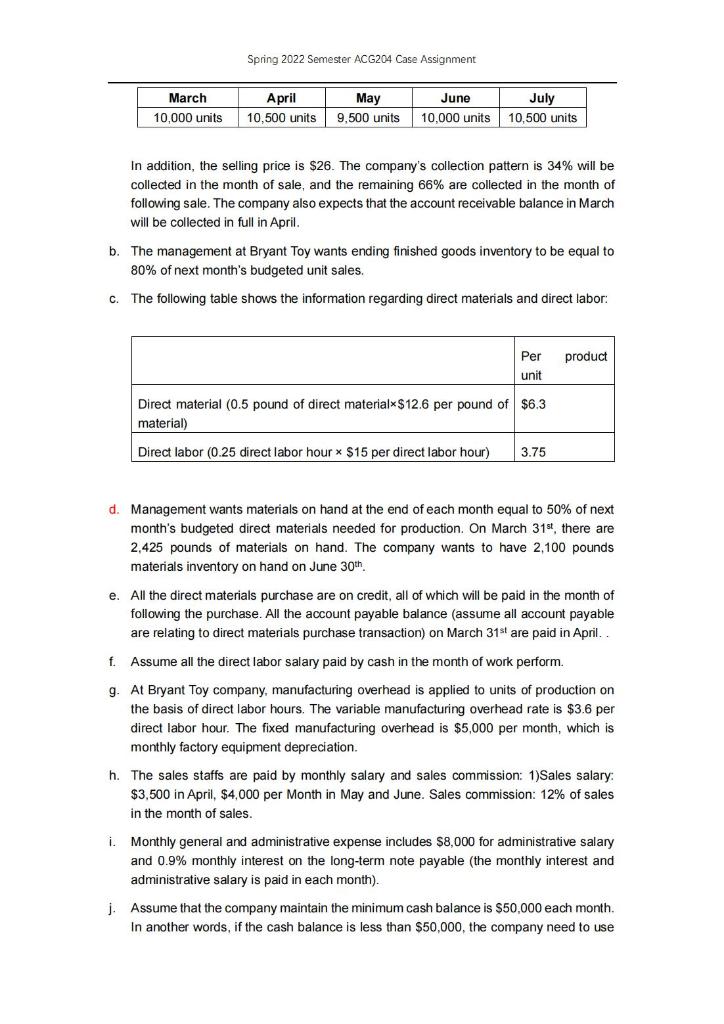

Spring 2022 Semester ACG204 Case Assignment Bryant Toy Manufacturing Company is an authorized manufacturer producing plush toy Bing Dwen Dwen, the cue mascot of Beijing 2022 Winter Olympics. As an accountant, you are required to prepare the company's master budget for the quarter 2 of year 2022. The following table shows the Balance Sheet ended at March 31st 2021. Bryant Toy Manufacturing Company Balance Sheet March 31,2021 $ 50,000 175,000 Assets Current assets: Cash Accounts receivable Raw material inventory (2,425lbs. @ $12.60) Finished goods inventory (8,400 units @ $11.45) 30,555 96,180 $ 351,735 Total current assets Plant and equipment: Buildings and equipment Accumulated depreciation Plant and equipment, net Total assets $480,000 (90,000) $390,000 $ 741.735 $75,315 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $63,315 Loan payable 12,000 Total current liabilities Long-term liabilities: Long-term note payable Total liabilities Stockholders' equity: Common stock $ 435,000 Retained earnings 31,420 Total stockholders' equity Total liabilities and stockholders' equity $200.000 $275,315 $466,420 $ 741.735 The following information is about the prediction and assumptions: a. Budgeted sales units for the following 5 months are shown below: Spring 2022 Semester ACG204 Case Assignment March 10,000 units April 10.500 units May 9,500 units June 10,000 units July 10,500 units In addition, the selling price is $26. The company's collection pattern is 34% will be collected in the month of sale, and the remaining 66% are collected in the month of following sale. The company also expects that the account receivable balance in March will be collected in full in April. b. The management at Bryant Toy wants ending finished goods inventory to be equal to 80% of next month's budgeted unit sales. c. The following table shows the information regarding direct materials and direct labor product Per unit Direct material (0.5 pound of direct materialx $12.6 per pound of $6.3 material) Direct labor (0.25 direct labor hour x $15 per direct labor hour) 3.75 d. Management wants materials on hand at the end of each month equal to 50% of next month's budgeted direct materials needed for production. On March 31st, there are 2,425 pounds of materials on hand. The company wants to have 2,100 pounds materials inventory on hand on June 30th. e. All the direct materials purchase are on credit, all of which will be paid in the month of following the purchase. All the account payable balance (assume all account payable are relating to direct materials purchase transaction) on March 31st are paid in April. f. Assume all the direct labor salary paid by cash in the month of work perform g. At Bryant Toy company, manufacturing overhead is applied to units of production on the basis of direct labor hours. The variable manufacturing overhead rate is $3.6 per direct labor hour. The fixed manufacturing overhead is $5,000 per month, which is monthly factory equipment depreciation. h. The sales staffs are paid by monthly salary and sales commission: 1)Sales salary: $3,500 in April, $4,000 per month in May and June. Sales commission: 12% of sales in the month of sales. i. Monthly general and administrative expense includes $8,000 for administrative salary and 0.9% monthly interest on the long-term note payable (the monthly interest and administrative salary is paid in each month). j. Assume that the company maintain the minimum cash balance is $50,000 each month. In another words, if the cash balance is less than $50,000, the company need to use Spring 2022 Semester ACG204 Case Assignment loan to reach the minimum. On the other hand, if the cash balance exceeds $50,000, the company should use the excess to pay any loan. Additionally. The company is required to pay 1% monthly interest on the loan payable at the end of each month. k. Other information: cash dividend is budgeted to be paid $100,000 in May, income tax rate 35% in quarter 2, but no income tax cash payment in this quarter; The company expects to purchase a new equipment $55,000 for cash in June. Required: a) Using Excel to conduct a beginning balance sheet for Quarter 2 2022. . . b) Using Excel to conduct a budgeting assumption worksheet for Quarter 2, 2022 c) Using Excel to Prepare following budgets or schedules for each month of April, May, June as well as in total for Q2: Sales budget Production Budget Schedule of expected cash collection from sales Direct Material Budget Schedule of cash disbursement for direct materials purchase Direct Labor Budget Manufacturing Overhead Budget Schedule of cash disbursement for manufacturing overhead Ending Finished Goods Inventory Budget Selling and Administrative Budget Cash Budget Budgeted Income Statement (traditional format) Budgeted Statement of Retained Eaming Budgeted Balance Sheet . d) Based on the original information, Using Excel to prepare a Contribution Format Budgeted Income statement and label cost or revenue formular in the statement e) The actual sales volumes for quarter 2 is 43,000 units, and the actual results of Income statement is shown below

I need the third one. Thank you

I need the third one. Thank you