Answered step by step

Verified Expert Solution

Question

1 Approved Answer

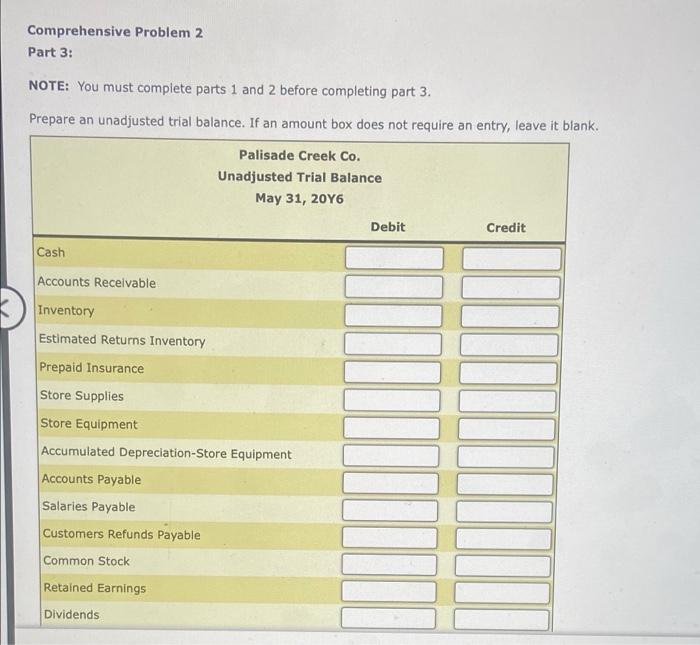

I need the unadjusted trial balance based on the info on the first picture & all of my journal entries Comprehensive Problem 2 Part 1

I need the unadjusted trial balance based on the info on the first picture & all of my journal entries

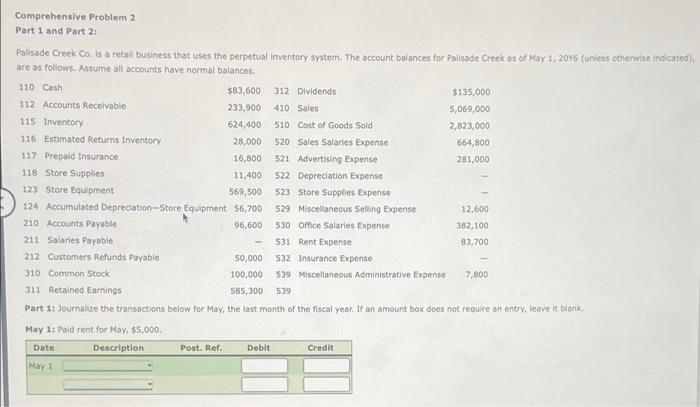

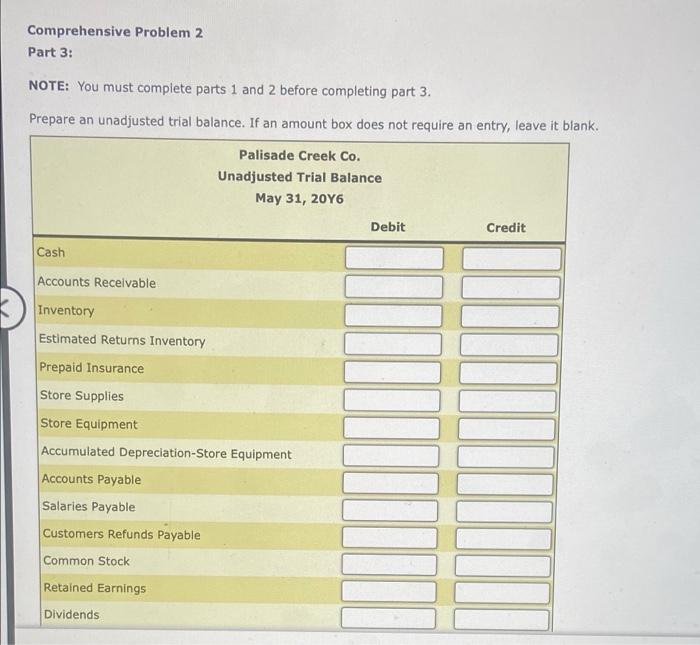

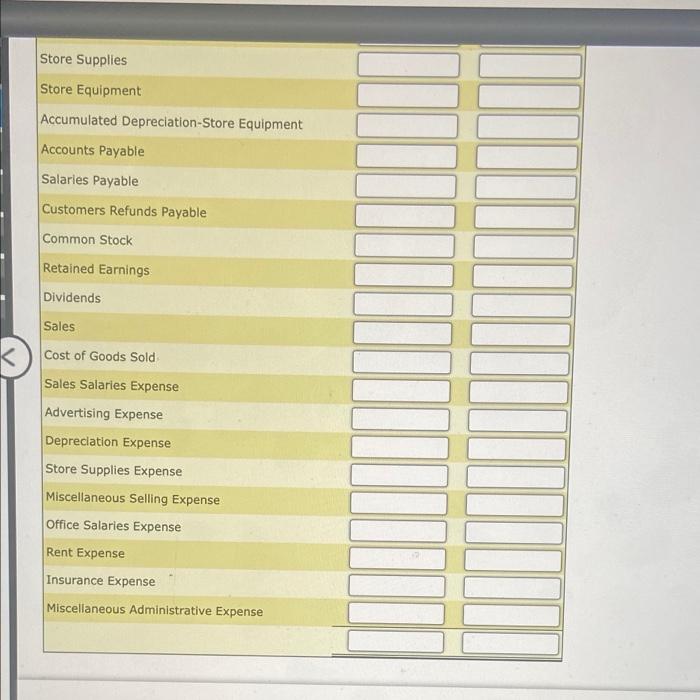

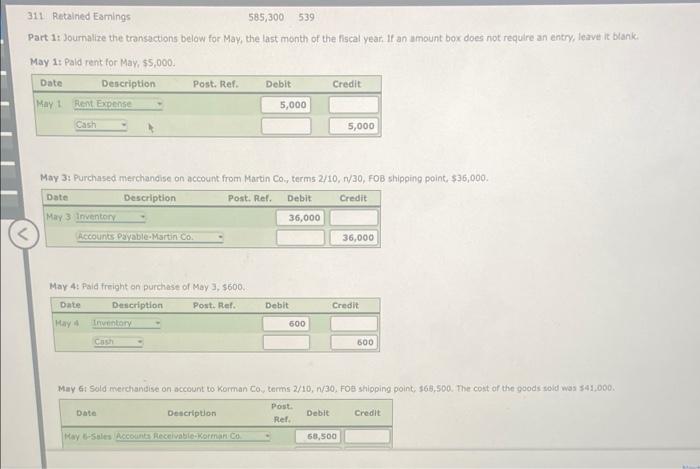

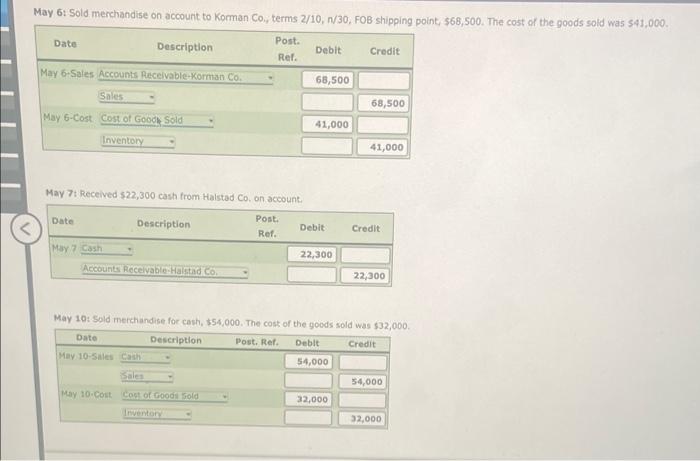

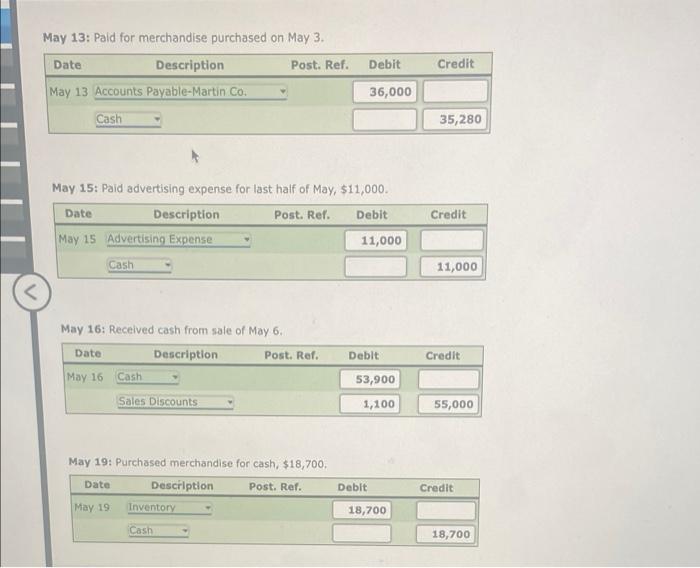

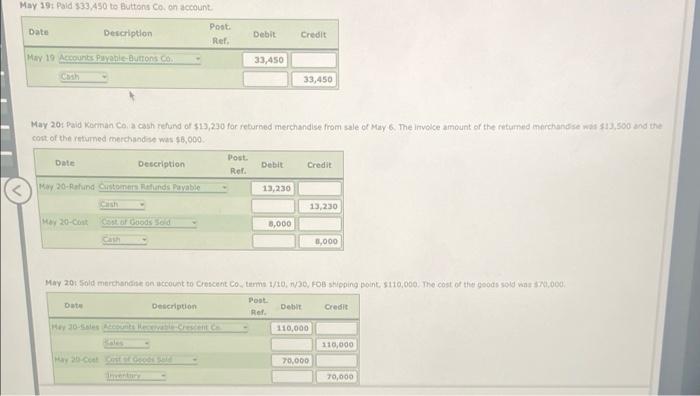

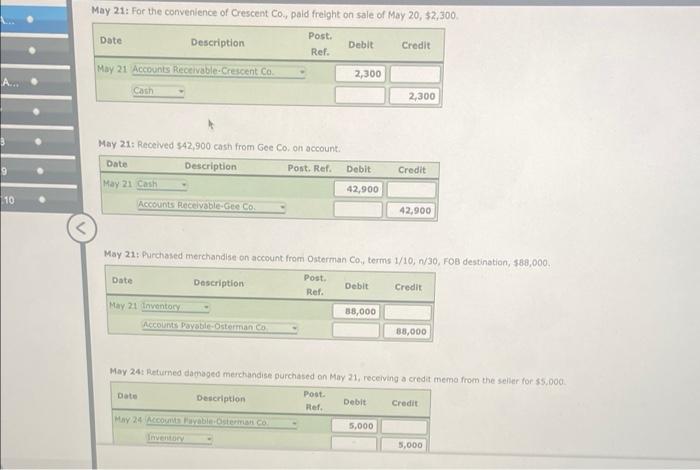

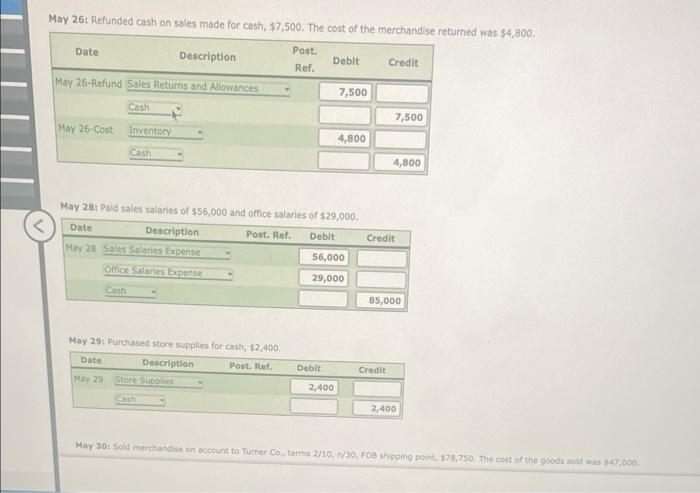

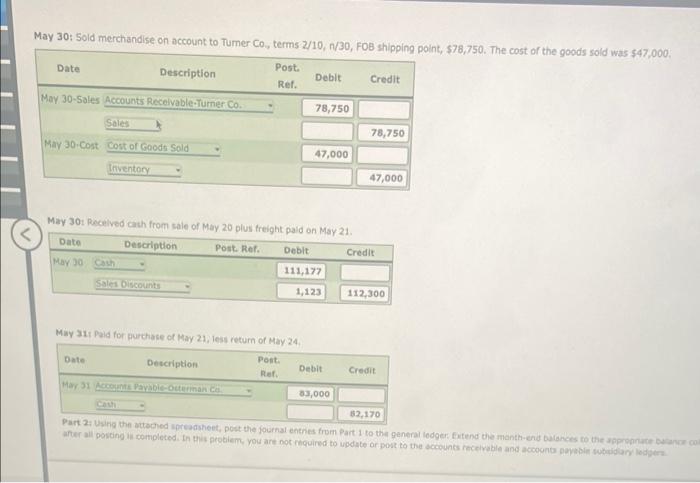

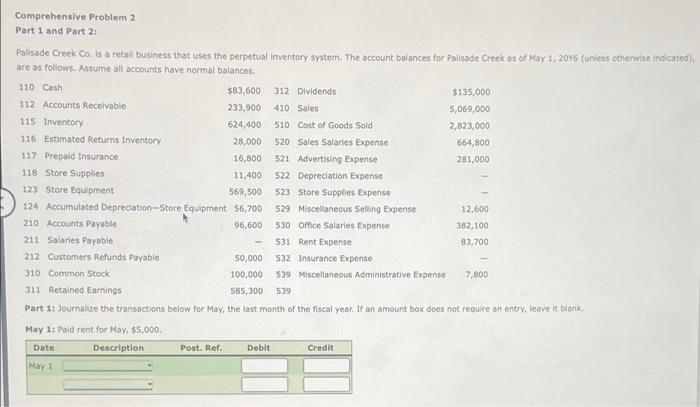

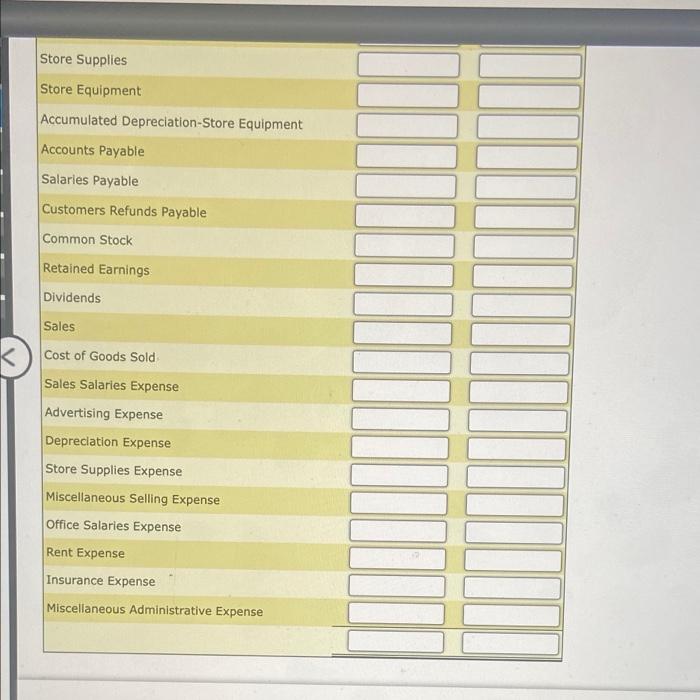

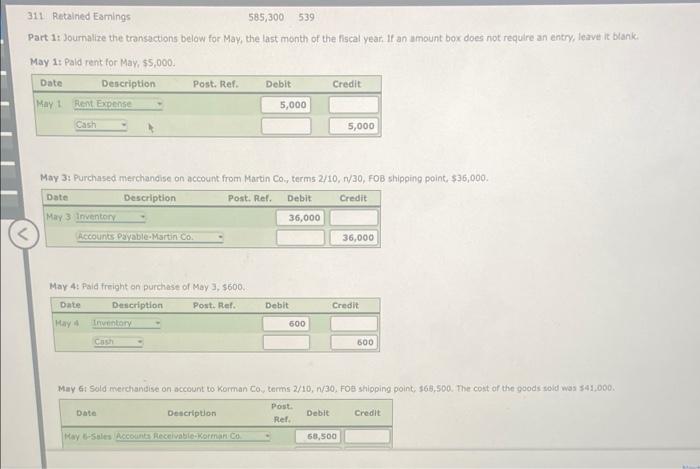

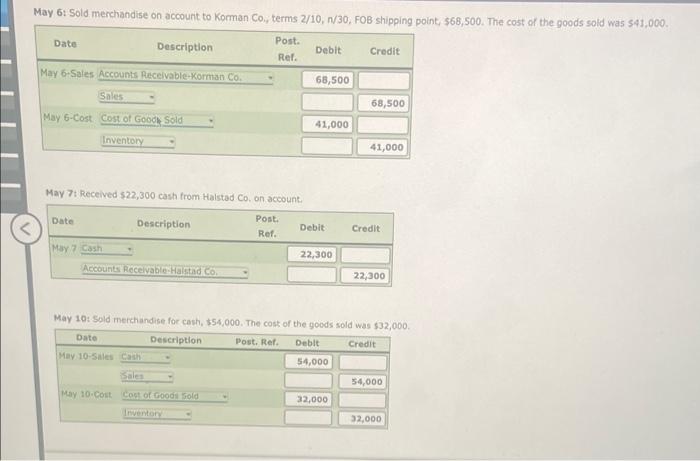

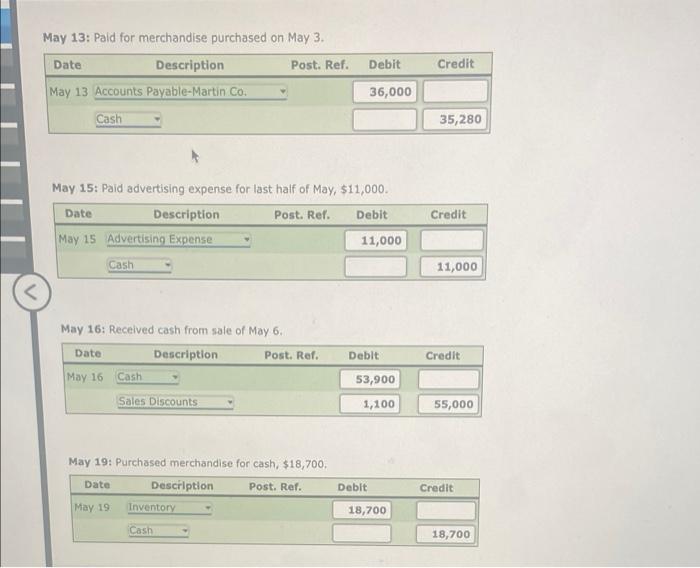

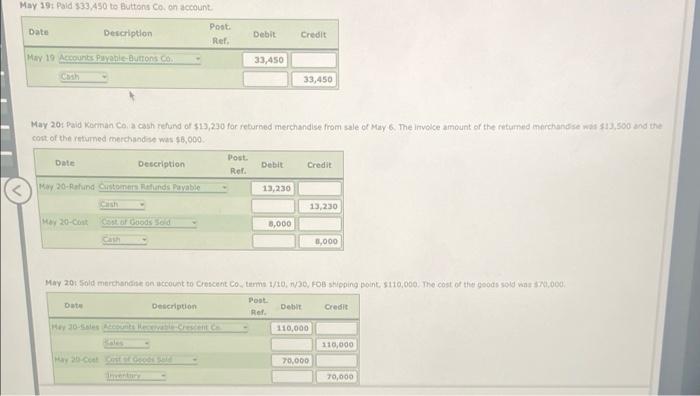

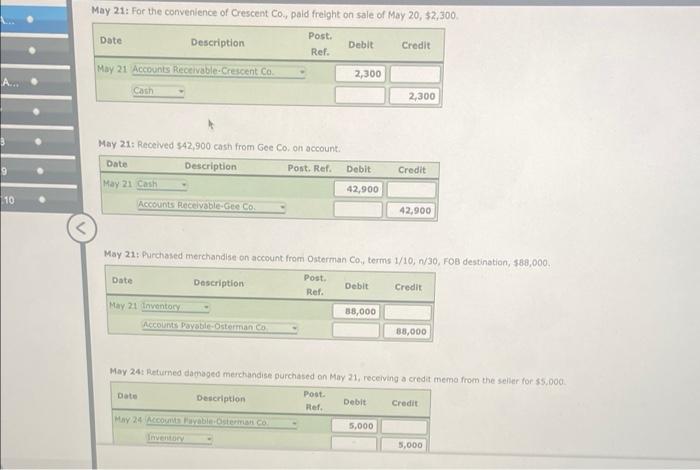

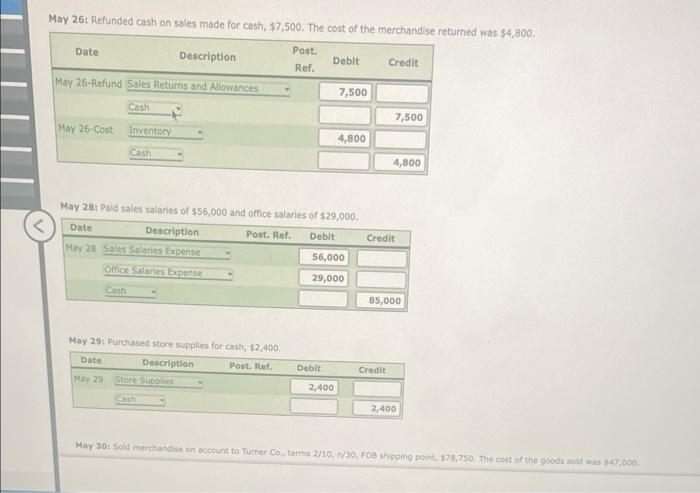

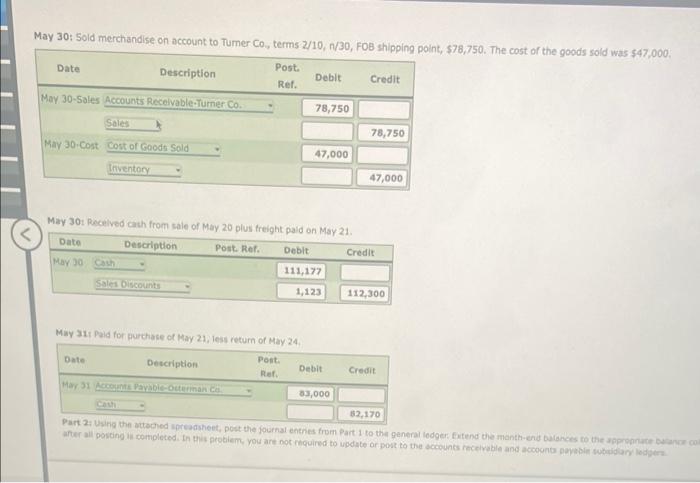

Comprehensive Problem 2 Part 1 and Part 2: Palisade Creek Co, Is a retall business that uses the perpetual inventory system. The account balances for Pallsade Creek as of May 1, 2016 (unless otherwise indicated) are as follows. Assume all accounts have normal balances. 110 Cash $83,600 312 Dividends $135,000 112 Accounts Receivable 233,900 410 Sales 5,069,000 115 Inventory 624,400 510 Cost of Goods Sold 2,823,000 116 Estimated Returns Inventory 28,000 520 Sales Salaries Expense 664.800 117 Prepaid Insurance 16,800 521 Advertising Expense 281,000 118 Store Supplies 11,400 522 Depreciation Expense 123 Store Equipment 569,500 523 Store Supplies Expense 124 Accumulated Depreciation Store Equipment 56,700 529 Miscellaneous Selling Expense 12,600 210 Accounts Payable 96,600 530 Omice Salaries Expense 382,100 211 Salaries Payable 531 Rent Expense 83,700 212 Customers Refunds Payable 50,000 532 Insurance Expense 310 Common Stock 100,000 539 Miscellaneous Administrative Expense 7,800 311 Retained Earnings 585,300 539 Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank May 1: Paid rent for May, $5,000 Date Description Post. Ref. Debit Credit May 1 Comprehensive Problem 2 Part 3: NOTE: You must complete parts 1 and 2 before completing part 3. Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. Palisade Creek Co. Unadjusted Trial Balance May 31, 20Y6 Debit Credit Cash Accounts Receivable Inventory Estimated Returns Inventory Prepaid Insurance Store Supplies Store Equipment Accumulated Depreciation Store Equipment Accounts Payable Salaries Payable Customers Refunds Payable Common Stock Retained Earnings Dividends Store Supplies Store Equipment Accumulated Depreciation-Store Equipment Accounts Payable Salaries Payable Customers Refunds Payable Common Stock Retained Earnings Dividends Sales k Cost of Goods Sold Sales Salaries Expense Advertising Expense Depreciation Expense Store Supplies Expense Miscellaneous Selling Expense Office Salaries Expense Rent Expense Insurance Expense Miscellaneous Administrative Expense 311 Retained Earnings 585,300 539 Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank May 1: Paid rent for May, $5,000. Post Ref: Debit Credit Date Description Mayt Rent Expense Cash 5,000 5,000 May 3: Purchased merchandise on account from Martin Co, terms 2/10, 1/30, FOB shipping point. $36,000 Description Post. Rel. Debit Credit May 3 Inventory 36,000 Date Accounts Payable Martin Co 36,000 May 4: Pald freight on purchase of May 3, 5600 Date Description Post. Ref. Maya Inventory Debit Credit 600 Cu 600 May G! Sold merchandise on account to Korman Co, terms 2/10,n30. Foe shoping point, 565,500 The cost of the goods sold was 341.000 Data Description Post Ref. Debit Credit May Sales Accounts Receivabilo.Kormano - 50,500 May 6: Sold merchandise on account to Koeman Co., terms 2/10, 1/30, FOB shipping point $68,500. The cost of the goods sold was 541,000 Post. Date Description Debit Credit Rel. May 6-Sales Accounts Receivable-Korman Co. 68,500 Sales 68,500 May 6-Cost Cost of Good Sold 41,000 Inventory 41,000 May 7t Received $22,300 cash from Halstad Co. on account. Date Description Post Ref. Debit Credit (Maya Cash 22,300 Accounts Receivable. Halstad Co. 22,300 May 10: Sold merchandise for cash, 54,000. The cost of the goods sold was $32,000 Date Description Post. Ref. Debit Credit May 10-Sales Cash 54,000 Sales 54,000 May 10 Cost Cost of Good old 22,000 32,000 Debit Credit May 13: Paid for merchandise purchased on May 3. Date Description Post. Ref. May 13 Accounts Payable-Martin Co. Cash 36,000 35,280 May 15: Paid advertising expense for last half of May, $11,000. Date Description Post. Ref. Debit May 15 Advertising Expense 11,000 Credit Cash 11,000 Debit Credit May 16: Received cash from sale of May 6, Date Description Post. Ref. May 16 Cash Sales Discounts 53,900 1,100 55,000 May 19: Purchased merchandise for cash, $18,700, Date Description Post. Ref. Debit Credit May 19 Inventory 18,700 Cash 18,700 May 39: Pald 33/450 to Buttons Co, on account Date Description Post Ret Debit Credit May 19 Accounts Payable-Buttons.com 33,450 33,450 May 201 Pald Karman Caracash refund of $13,230 for returned merchandise from sale of May the involce amount of the returned merchandise ws 13,500 and the cost of the returned merchandise was 58.000 Date Description Post. Ref. Debit Credit 13,230 May 20-round thundevable Ch 13,230 May 20-con cast of Good 3,000 0,000 May 201 Sold merchandise on account to Crescent Comme 1/10, 1/30, FB shipping point 5110,000. The cost of the goods sold 3.000 Date Post Description Debt Ref Credit 110,000 110,000 70,000 70,000 May 21: For the convenience of Crescent Co., paid freight on sale of May 20, $2,300 Date Description Post Ref. Debit Credit May 21 Accounts Receivable-Crescent Co. 2,300 Cash 2,300 May 21: Reolved $42,900 cash from Gee Co. on account. Date Description Post. Ref. May 21 Cash Debit Credit 42,900 10 Accounts Receivable Gee Co. 42,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started