i need these answered elaborately, like finance for dummies, terms explain and all. professor doesn't speak english very need all the help in the world

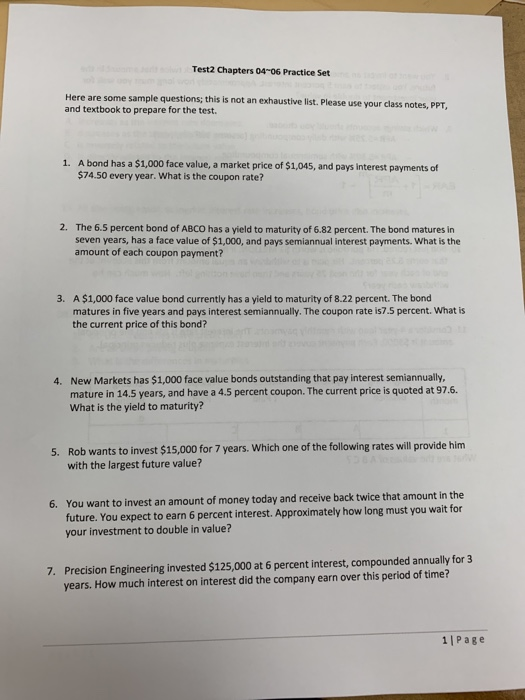

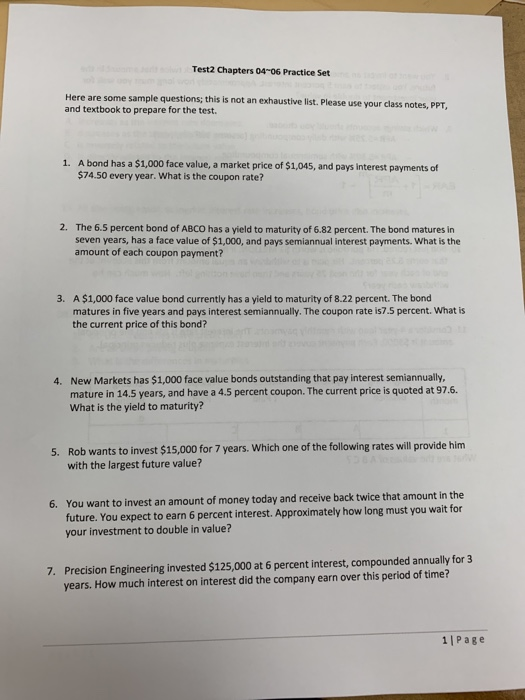

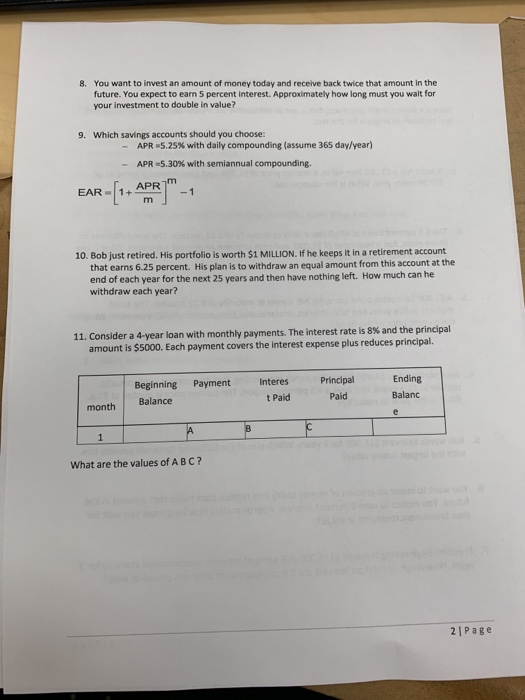

Test2 Chapters 04-06 Practice Set Here are some sample questions; this is not an exhaustive list. Please use your class notes, PPT, and textbook to prepare for the test. 1. A bond has a $1,000 face value, a market price of $1,045, and pays Interest payments of $74.50 every year. What is the coupon rate? 2. The 6.5 percent bond of ABCO has a yield to maturity of 6.82 percent. The bond matures in seven years, has a face value of $1,000, and pays semiannual interest payments. What is the amount of each coupon payment? 3. A $1,000 face value bond currently has a yield to maturity of 8.22 percent. The bond matures in five years and pays interest semiannually. The coupon rate is7.5 percent. What is the current price of this bond? 4. New Markets has $1,000 face value bonds outstanding that pay interest semiannually, mature in 14.5 years, and have a 4.5 percent coupon. The current price is quoted at 97.6. What is the yield to maturity? 5. Rob wants to invest $15,000 for 7 years. Which one of the following rates will provide him with the largest future value? 6. You want to invest an amount of money today and receive back twice that amount in the future. You expect to earn 6 percent interest. Approximately how long must you wait for your investment to double in value? 7. Precision Engineering invested $125,000 at 6 percent interest, compounded annually for 3 years. How much interest on interest did the company earn over this period of time? 1 Page 8. You want to invest an amount of money today and receive back twice that amount in the future. You expect to earn 5 percent interest. Approximately how long must you wait for your investment to double in value? 9. Which savings accounts should you choose: - APR -5.25% with daily compounding (assume 365 day/year) - APR -5.30% with semiannual compounding. EAR-1+APR 10. Bob just retired. His portfolio is worth $1 MILLION. If he keeps it in a retirement account that earns 6.25 percent. His plan is to withdraw an equal amount from this account at the end of each year for the next 25 years and then have nothing left. How much can he withdraw each year? 11. Consider a 4-year loan with monthly payments. The interest rate is 8% and the principal amount is $5000. Each payment covers the interest expense plus reduces principal Payment Beginning Balance Interes t Paid Principal Paid Ending Balanc month What are the values of ABC? 2 Page