I need this 6 exercises solve in excell sheet please

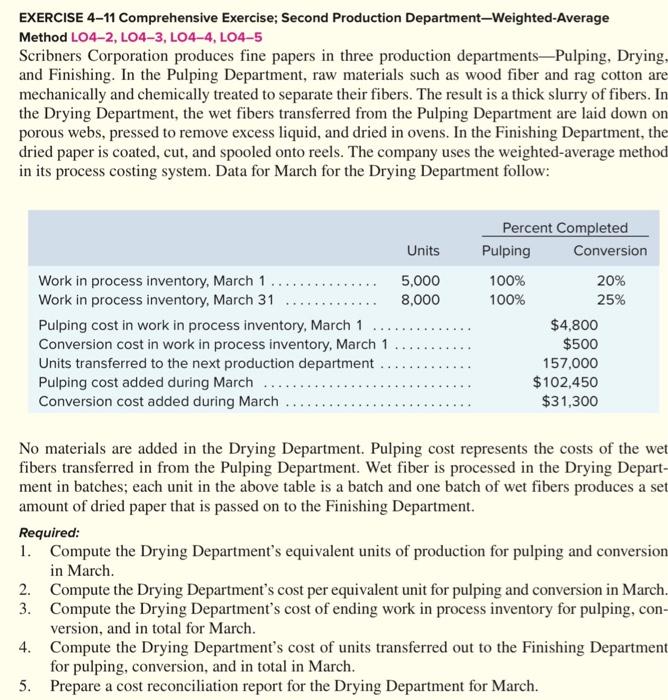

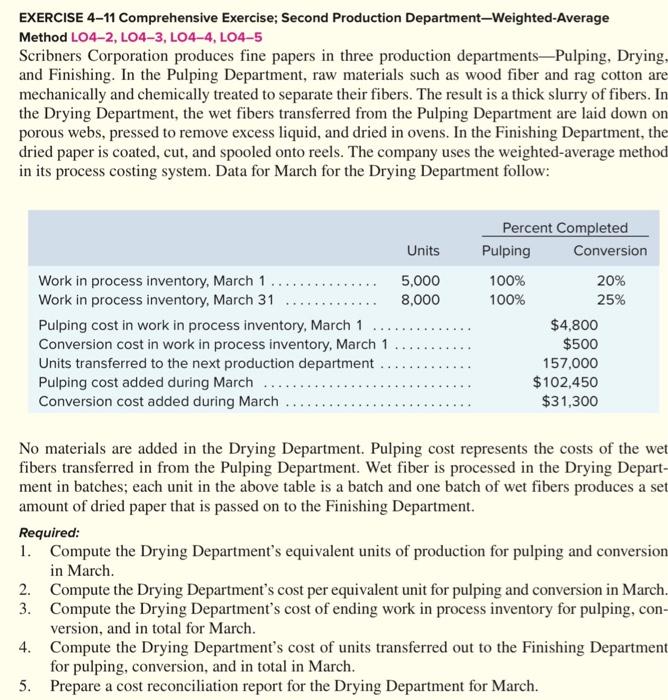

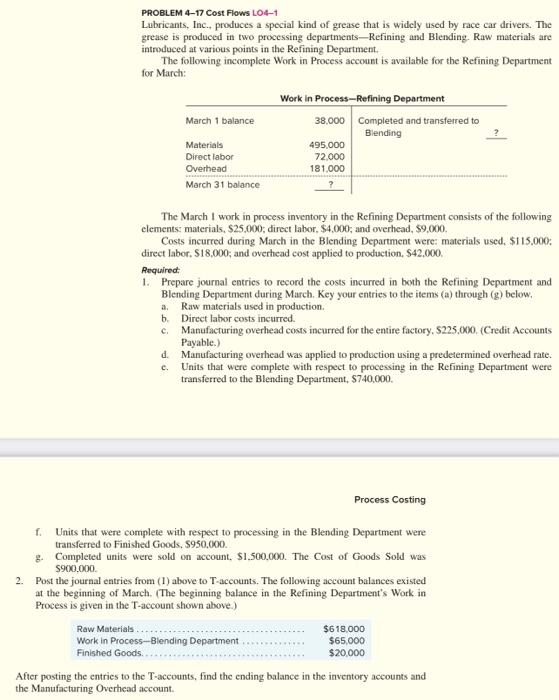

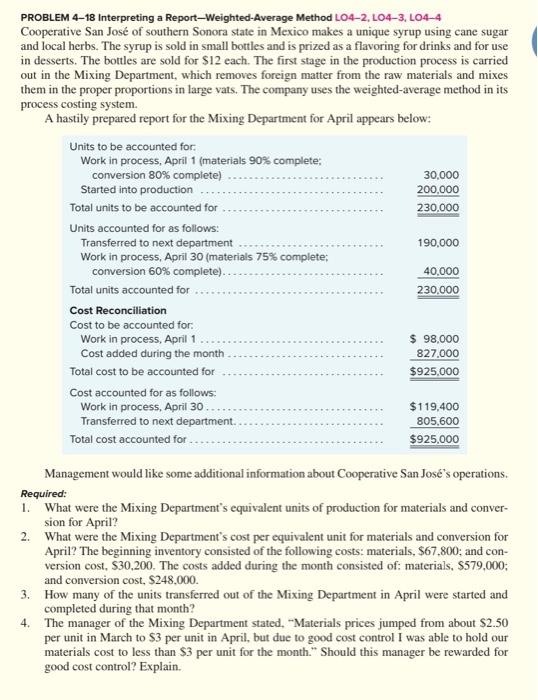

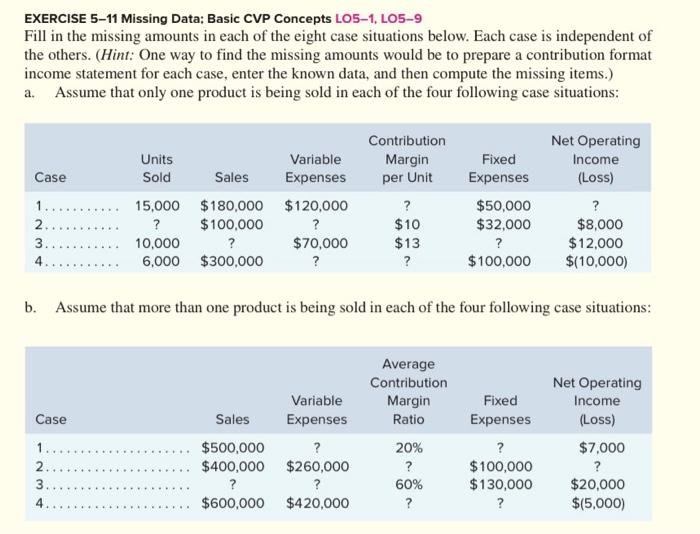

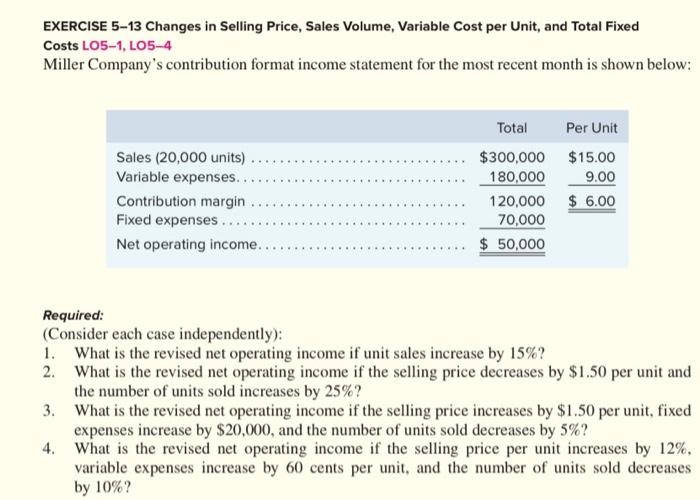

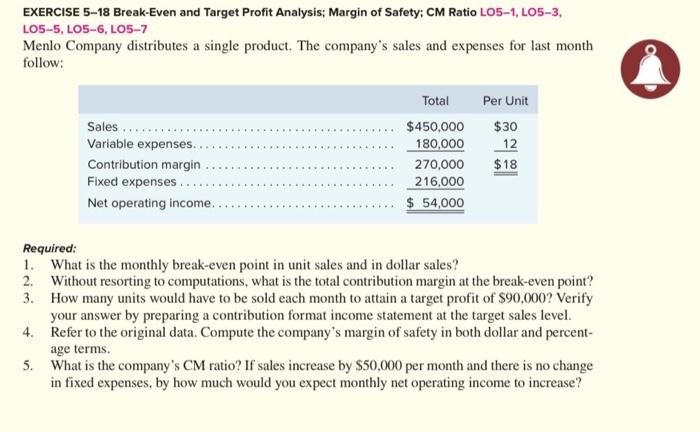

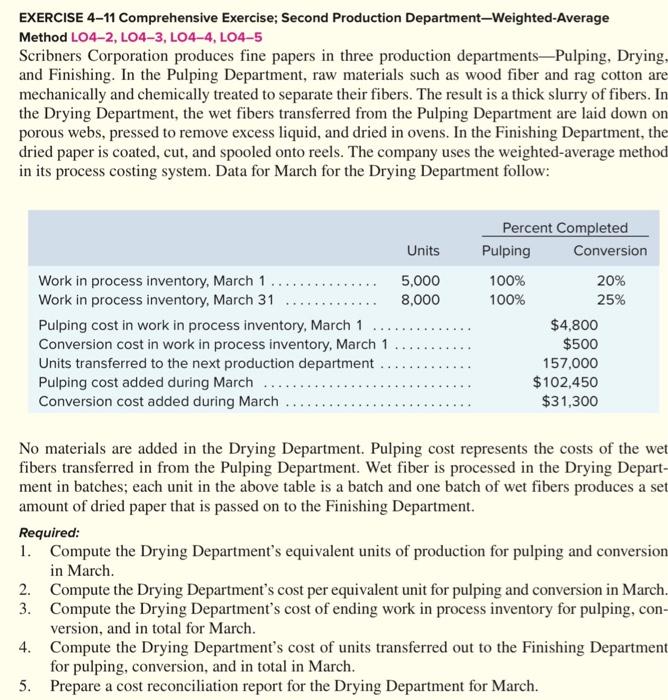

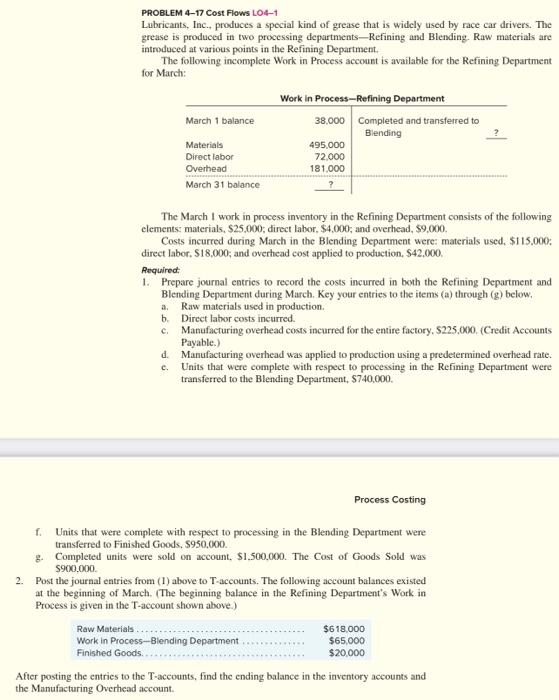

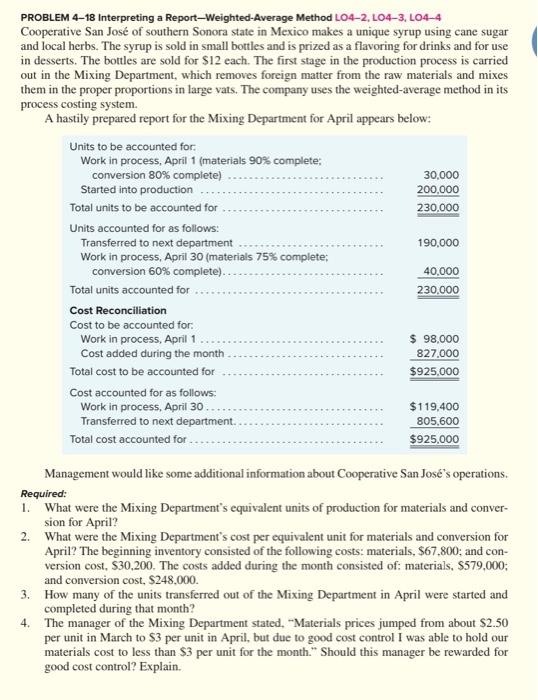

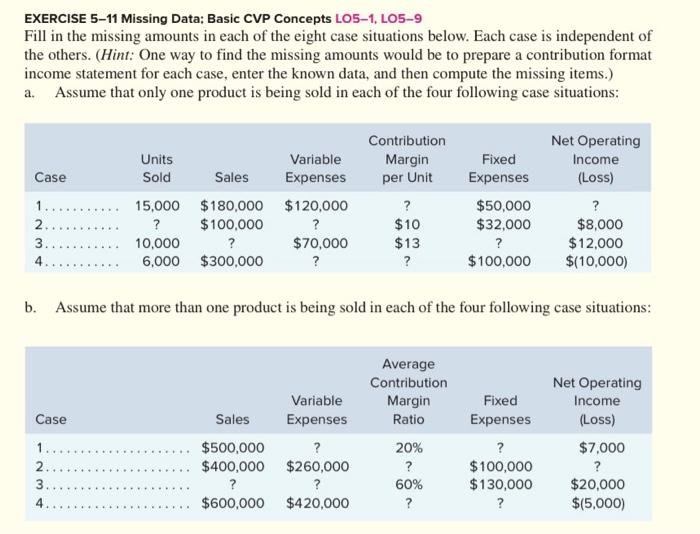

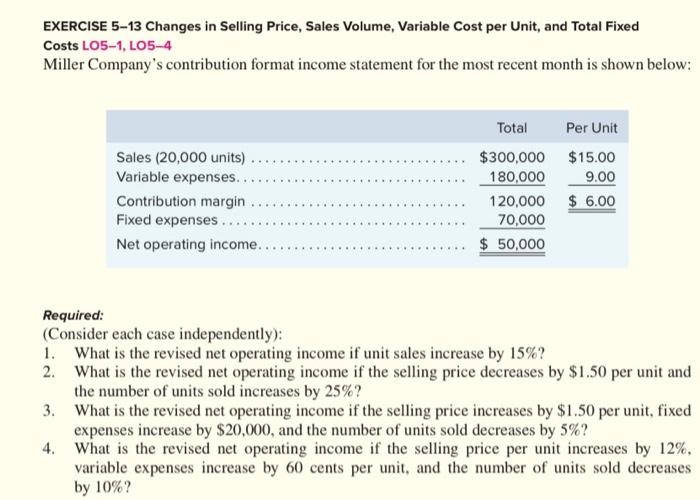

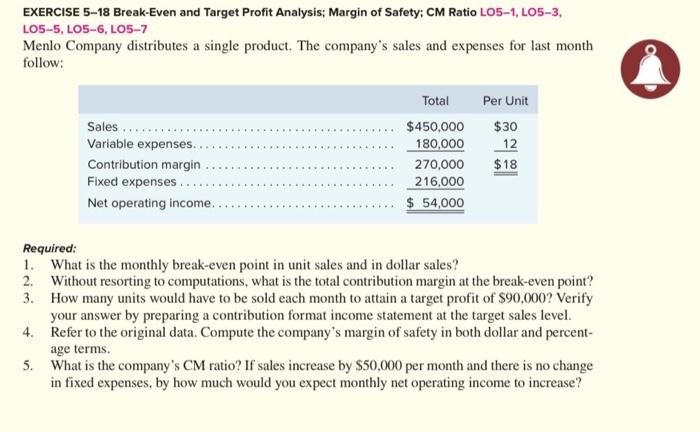

Department-Weighted-Average EXERCISE 4-11 Comprehensive Exercise; Second Production Method LO4-2, LO4-3, LO4-4, LO4-5 Scribners Corporation produces fine papers in three production departments-Pulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Pulping Conversion Units 5,000 100% 20% Work in process inventory, March 1 Work in process inventory, March 31 8,000 100% 25% $4,800 $500 Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department. Pulping cost added during March 157,000 $102,450 $31,300 Conversion cost added during March No materials are added in the Drying Department. Pulping cost represents the costs of the wet fibers transferred in from the Pulping Department. Wet fiber is processed in the Drying Depart- ment in batches; each unit in the above table is a batch and one batch of wet fibers produces a set amount of dried paper that is passed on to the Finishing Department. Required: 1. Compute the Drying Department's equivalent units of production for pulping and conversion in March. 2. 3. Compute the Drying Department's cost per equivalent unit for pulping and conversion in March. Compute the Drying Department's cost of ending work in process inventory for pulping, con- version, and in total for March. 4. Compute the Drying Department's cost of units transferred out to the Finishing Department for pulping, conversion, and in total in March. 5. Prepare a cost reconciliation report for the Drying Department for March. PROBLEM 4-17 Cost Flows LO4-1 Lubricants, Inc., produces a special kind of grease that is widely used by race car drivers. The grease is produced in two processing departments-Refining and Blending. Raw materials are introduced at various points in the Refining Department. The following incomplete Work in Process account is available for the Refining Department for March: Work in Process-Refining Department March 1 balance 38,000 Completed and transferred to Blending Materials 495,000 Direct labor 72,000 Overhead 181,000 March 31 balance The March I work in process inventory in the Refining Department consists of the following elements: materials, $25,000; direct labor, $4,000, and overhead, $9,000. Costs incurred during March in the Blending Department were: materials used, $115,000; direct labor, $18,000; and overhead cost applied to production, $42.000. Required: 1. Prepare journal entries to record the costs incurred in both the Refining Department and Blending Department during March. Key your entries to the items (a) through (g) below. a. Raw materials used in production. b. Direct labor costs incurred. c. Manufacturing overhead costs incurred for the entire factory, $225,000. (Credit Accounts Payable.) d. Manufacturing overhead was applied to production using a predetermined overhead rate. Units that were complete with respect to processing in the Refining Department were transferred to the Blending Department, $740,000. e. Process Costing f. Units that were complete with respect to processing in the Blending Department were transferred to Finished Goods, $950,000. g. Completed units were sold on account, $1,500,000. The Cost of Goods Sold was $900,000. 2. Post the journal entries from (1) above to T-accounts. The following account balances existed at the beginning of March. (The beginning balance in the Refining Department's Work in Process is given in the T-account shown above.) Raw Materials Work in Process-Blending Department... Finished Goods.. $618,000 $65,000 $20,000 After posting the entries to the T-accounts, find the ending balance in the inventory accounts and the Manufacturing Overhead account. PROBLEM 4-18 Interpreting a Report-Weighted-Average Method LO4-2, L04-3, LO4-4 Cooperative San Jos of southern Sonora state in Mexico makes a unique syrup using cane sugar and local herbs. The syrup is sold in small bottles and is prized as a flavoring for drinks and for use in desserts. The bottles are sold for $12 each. The first stage in the production process is carried out in the Mixing Department, which removes foreign matter from the raw materials and mixes them in the proper proportions in large vats. The company uses the weighted-average method in its process costing system. A hastily prepared report for the Mixing Department for April appears below: Units to be accounted for: Work in process, April 1 (materials 90% complete; conversion 80% complete) 30,000 Started into production 200,000 Total units to be accounted for 230,000 Units accounted for as follows: Transferred to next department 190,000 Work in process, April 30 (materials 75% complete; conversion 60% complete).. 40,000 Total units accounted for 230,000 Cost Reconciliation Cost to be accounted for: Work in process, April 1 $ 98,000 827,000 Cost added during the month. Total cost to be accounted for $925,000 Cost accounted for as follows: Work in process, April 30. Transferred to next department. $119,400 805,600 $925.000 Total cost accounted for.. Management would like some additional information about Cooperative San Jos's operations. Required: 1. What were the Mixing Department's equivalent units of production for materials and conver- sion for April? 2. What were the Mixing Department's cost per equivalent unit for materials and conversion for April? The beginning inventory consisted of the following costs: materials, $67.800; and con- version cost, $30,200. The costs added during the month consisted of: materials, $579,000; and conversion cost, $248,000. 3. How many of the units transferred out of the Mixing Department in April were started and completed during that month? 4. The manager of the Mixing Department stated, "Materials prices jumped from about $2.50 per unit in March to $3 per unit in April, but due to good cost control I was able to hold our materials cost to less than $3 per unit for the month." Should this manager be rewarded for good cost control? Explain. EXERCISE 5-11 Missing Data: Basic CVP Concepts LO5-1, LO5-9 Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.) a. Assume that only one product is being sold in each of the four following case situations: Contribution Net Operating Income Units Variable Margin Fixed Case Sold Sales Expenses per Unit Expenses (Loss) 1 $180,000 $120,000 ? $50,000 ? 15,000 ? 2 $100,000 $10 $32,000 $8,000 ? $70,000 3 10,000 ? $13 $12,000 ? $100,000 4. 6,000 $300,000 ? ? $(10,000) b. Assume that more than one product is being sold in each of the four following case situations: Average Contribution Net Operating Income Variable Margin Fixed Case Sales Expenses Ratio Expenses (Loss) $500,000 20% ? $7,000 ? $260,000 ? ? $100,000 $400,000 ? ? 60% $130,000 $20,000 $600,000 $420,000 ? ? $(5,000) 234 ** EXERCISE 5-13 Changes in Selling Price, Sales Volume, Variable Cost per Unit, and Total Fixed Costs LO5-1, LO5-4 Miller Company's contribution format income statement for the most recent month is shown below: Total Per Unit $300,000 $15.00 Sales (20,000 units). Variable expenses.. Contribution margin 180,000 9.00 120,000 $ 6.00 Fixed expenses.... 70,000 Net operating income... $50,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 15%? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 25%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $20,000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 12%, variable expenses increase by 60 cents per unit, and the number of units sold decreases by 10%? EXERCISE 5-18 Break-Even and Target Profit Analysis; Margin of Safety; CM Ratio LO5-1, LO5-3, LO5-5, LO5-6, LO5-7 Menlo Company distributes a single product. The company's sales and expenses for last month follow: Total Per Unit Sales... $450,000 $30 Variable expenses. 180,000 12 Contribution margin 270,000 $18 216,000 Fixed expenses.... Net operating income.. $ 54,000 Required: 1. 3. What is the monthly break-even point in unit sales and in dollar sales? 2. Without resorting to computations, what is the total contribution margin at the break-even point? How many units would have to be sold each month to attain a target profit of $90,000? Verify your answer by preparing a contribution format income statement at the target sales level. Refer to the original data. Compute the company's margin of safety in both dollar and percent- age terms. 4. 5. What is the company's CM ratio? If sales increase by $50,000 per month and there is no change in fixed expenses, by how much would you expect monthly net operating income to increase