Answered step by step

Verified Expert Solution

Question

1 Approved Answer

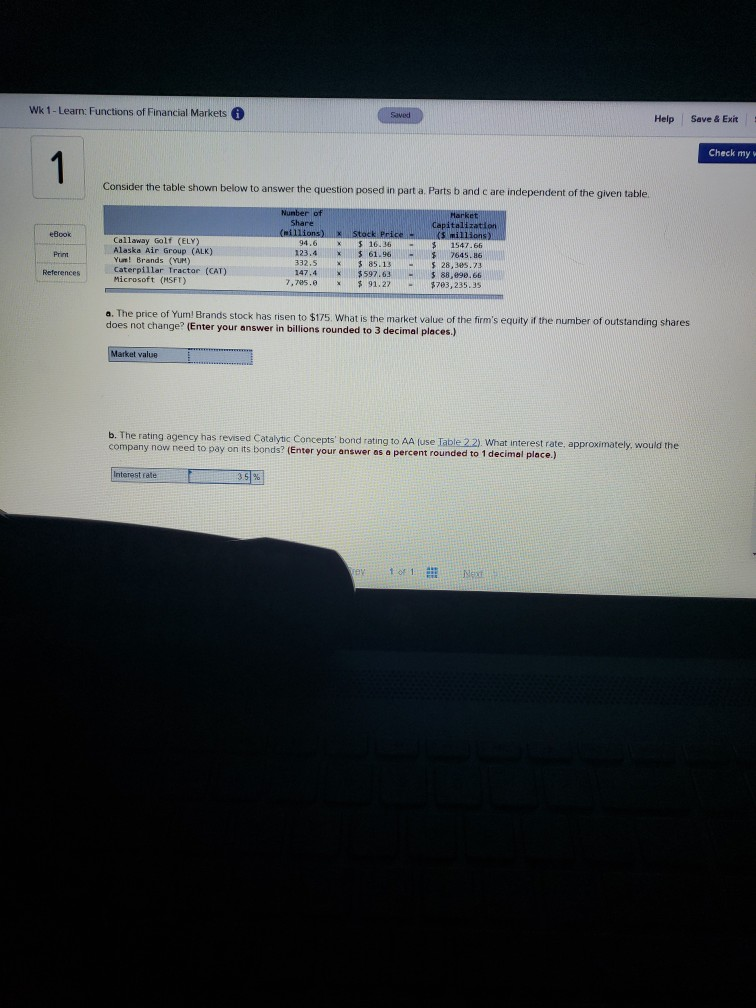

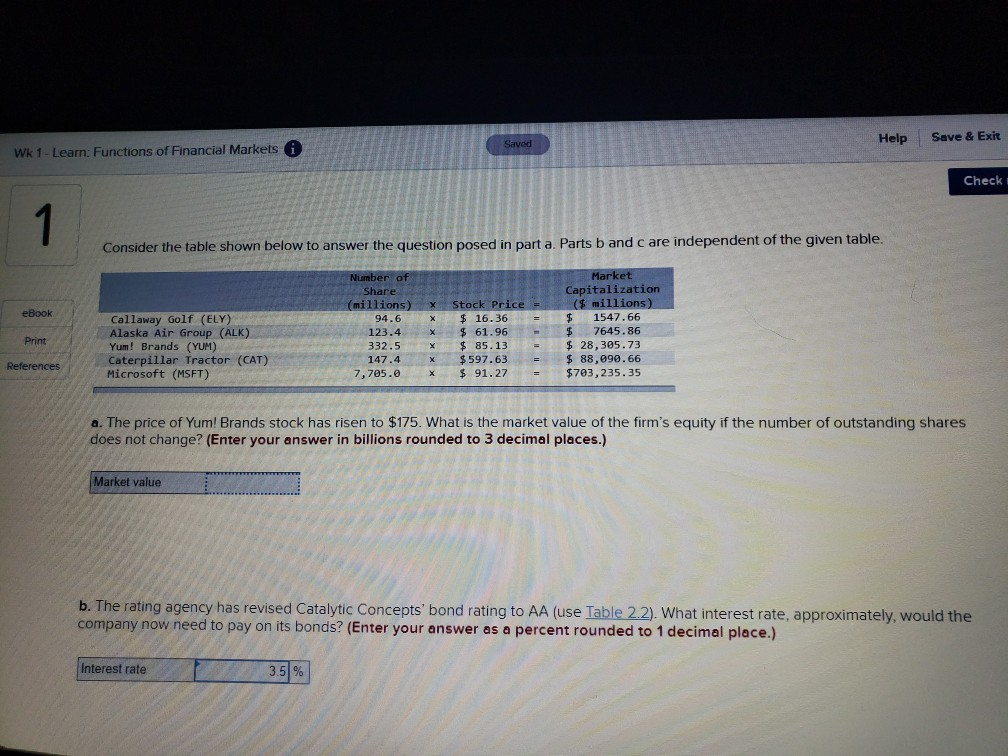

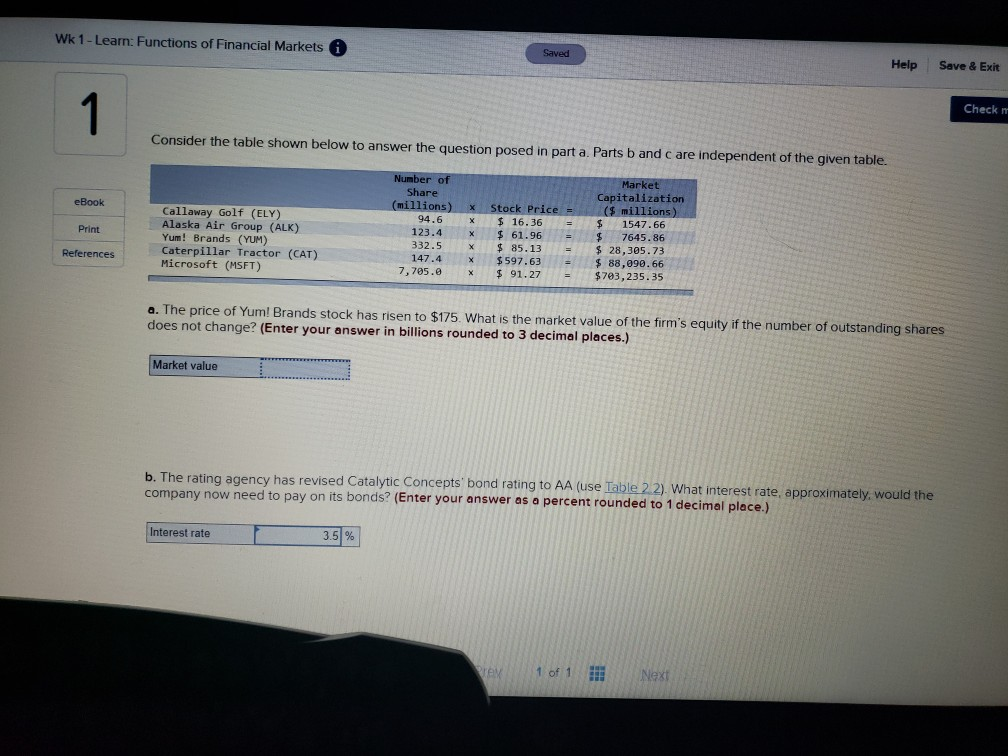

I NEED THIS ANSWERED TONITE. SORRY OTHER PICTURES BAD. Wk 1 - Learn: Functions of Financial Markets Saved Help Save & Exit Check my 1

I NEED THIS ANSWERED TONITE. SORRY OTHER PICTURES BAD.

Wk 1 - Learn: Functions of Financial Markets Saved Help Save & Exit Check my 1 Consider the table shown below to answer the question posed in part a Parts b and care independent of the given table eBook X X Number of Share (millions) 94.6 123.4 332.5 147.4 7,705.0 Callaway Golf (ELY) Alaska Air Group (ALK) Yur! Brands (YUM) Caterpillar Tractor (CAT) Microsoft (HSFT) Print Stock Price - 5 16.36 - $ 61.96 $ 85.13 $597.63 - $ 91.22 - Market Capitalization K5 millions $ 1547.66 $ 7645.36 $ 28,305.73 $ 88,090.66 $703,235.35 References a. The price of Yum! Brands stock has risen to $175. What is the market value of the firm's equity if the number of outstanding shares does not change? (Enter your answer in billions rounded to 3 decimal places.) Market value b. The rating agency has revised Catalytic Concepts' bond rating to AA (use Table 22). What interest rate, approximately, would the company now need to pay on its bonds? (Enter your answer as a percent rounded to 1 decimal place.) Interest rate SAV Ne Saved Help Save & Exit Wk 1 - Learn: Functions of Financial Markets a Check 1 Consider the table shown below to answer the question posed in part a Parts b and care independent of the given table. eBook X Number of Share (millions) 94.6 123.4 332.5 147.4 7,705.0 Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar Tractor (CAT) Microsoft (MSFT) Market Capitalization ($ millions) $ 1547.66 $ 7645.86 $ 28, 305.73 $ 88,090.66 $703,235.35 Print Stock Price $ 16.36 $ 61.96 $ 85.13 $597.63 $ 91.27 = References X X a. The price of Yum! Brands stock has risen to $175. What is the market value of the firm's equity if the number of outstanding shares does not change? (Enter your answer in billions rounded to 3 decimal places.) Market value b. The rating agency has revised Catalytic Concepts' bond rating to AA (use Table 2.2). What interest rate, approximately, would the company now need to pay on its bonds? (Enter your answer as a percent rounded to 1 decimal place.) Interest rate 3.5 % Wk 1 - Learn: Functions of Financial Markets i Saved Help Save & Exit 1 Check Consider the table shown below to answer the question posed in part a. Parts b and care independent of the given table. eBook Print Number of Share (millions) 94.6 123.4 332.5 147.4 7,705.0 Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar Tractor (CAT) Microsoft (MSFT) x X Market Capitalization ($ millions) $ 1547.66 $ 7645.86 $ 28,305.73 $ 88,090.66 $703,235.35 Stock Price = $ 16.36 $ 61.96 $ 85.13 $ 597.63 $ 91.27 = References X X a. The price of Yum! Brands stock has risen to $175. What is the market value of the firm's equity if the number of outstanding shares does not change? (Enter your answer in billions rounded to 3 decimal places.) Market value b. The rating agency has revised Catalytic Concepts' bond rating to AA (use Table 2.2). What interest rate, approximately, would the company now need to pay on its bonds? (Enter your answer as a percent rounded to 1 decimal place.) Interest rate 3.5 % VEN 1 of 1 ! NextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started