Answered step by step

Verified Expert Solution

Question

1 Approved Answer

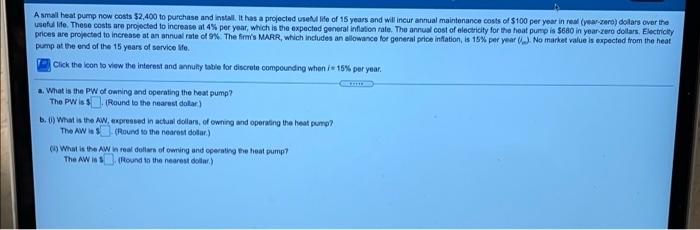

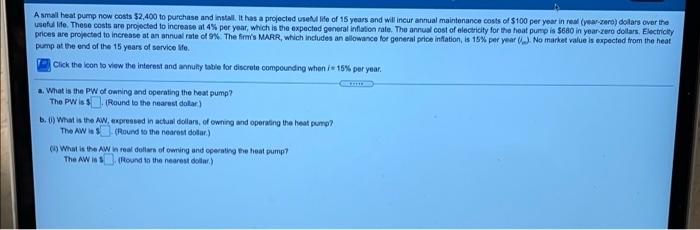

i need this asap i will rate A small heat pump now costs $2.400 to purchase and install. It has a projected use ife of

i need this asap i will rate

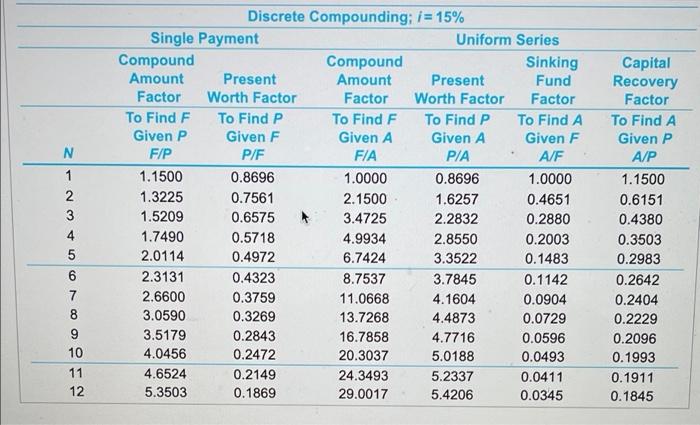

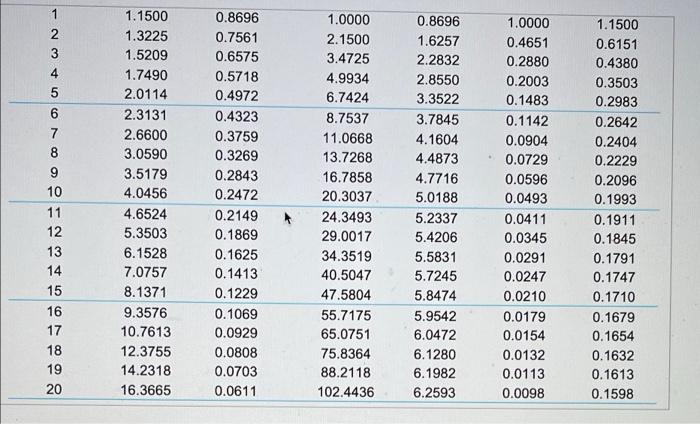

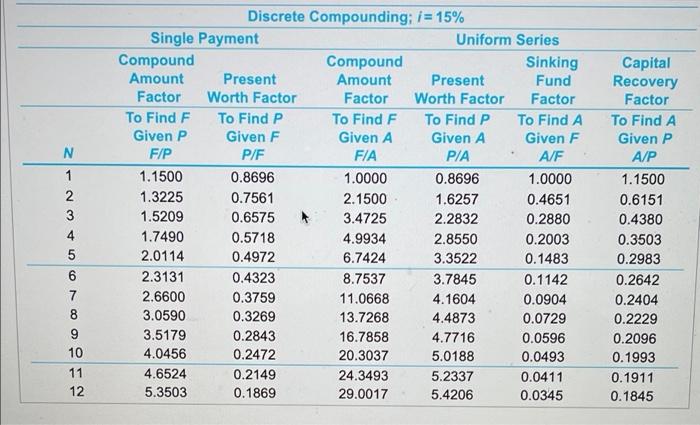

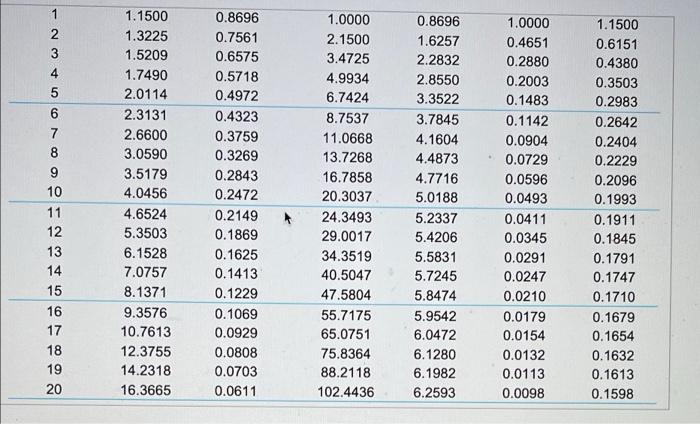

A small heat pump now costs $2.400 to purchase and install. It has a projected use ife of 15 years and will incur annual maintenance costs of $100 per year in real year.zero) dollars over the useful life. These costs are projected to increase at 4% per year, which is the expected general inflation rate. The annual cost of electricity for the heat pump is 5680 in year.zero dollars. Electricity prices are projected to increase at an annual rate of 9% The firm' MARR, which includes an allowance for general price inflation is 15% per year (..). No market value is expected from the heat pump at the end of the 15 years of service fo. Click the icon to view the interest and annuty table for docrote compounding when /* 15% per year. a. What is the PW of owning and operating the heat pump? The PWRound to the nearest dolar) b.) What is the AW, expressed in chun dollars, of owning and operating the heat pump? The AW (Round to the nearest dolar) c) What is the AW in real dollar of owning and operating the heat pump? The AW is (Round to the nearest dollar) OWNZ N 1 2 3 4 5 6 Discrete Compounding; 1= 15% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/F FIA P/A A/F 1.1500 0.8696 1.0000 0.8696 1.0000 1.3225 0.7561 2.1500 1.6257 0.4651 1.5209 0.6575 3.4725 2.2832 0.2880 1.7490 0.5718 4.9934 2.8550 0.2003 2.0114 0.4972 6.7424 3.3522 0.1483 2.3131 0.4323 8.7537 3.7845 0.1142 2.6600 0.3759 11.0668 4.1604 0.0904 3.0590 0.3269 13.7268 4.4873 0.0729 3.5179 0.2843 16.7858 4.7716 0.0596 4.0456 0.2472 20.3037 5.0188 0.0493 4.6524 0.2149 24.3493 5.2337 0.0411 5.3503 0.1869 29.0017 5.4206 0.0345 Capital Recovery Factor To Find A Given P A/P 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 9 10 11 12 2 3 von AWN 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 4.0456 4.6524 5.3503 6.1528 7.0757 8.1371 9.3576 10.7613 12.3755 14.2318 16.3665 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1229 0.1069 0.0929 0.0808 0.0703 0.0611 1.0000 2.1500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 24.3493 29.0017 34.3519 40.5047 47.5804 55.7175 65.0751 75.8364 88.2118 102.4436 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 5.2337 5.4206 5.5831 5.7245 5.8474 5.9542 6.0472 6.1280 6.1982 6.2593 1.0000 0.4651 0.2880 0.2003 0.1483 0.1142 0.0904 0.0729 0.0596 0.0493 0.0411 0.0345 0.0291 0.0247 0.0210 0.0179 0.0154 0.0132 0.0113 0.0098 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 0.1911 0.1845 0.1791 0.1747 0.1710 0.1679 0.1654 0.1632 0.1613 0.1598

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started