I need this assignment

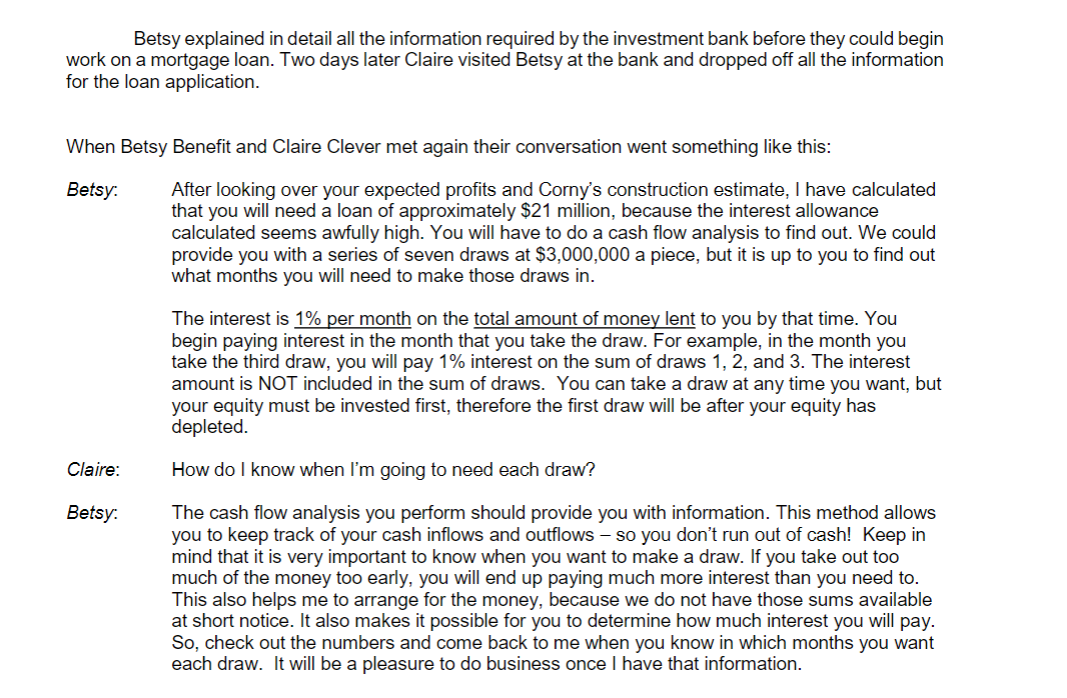

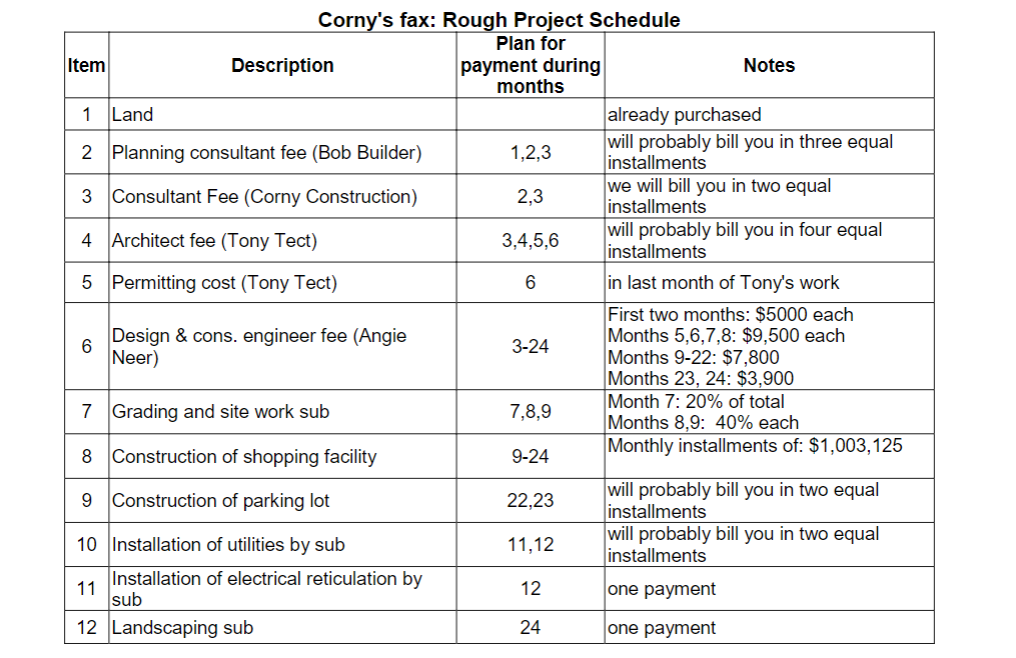

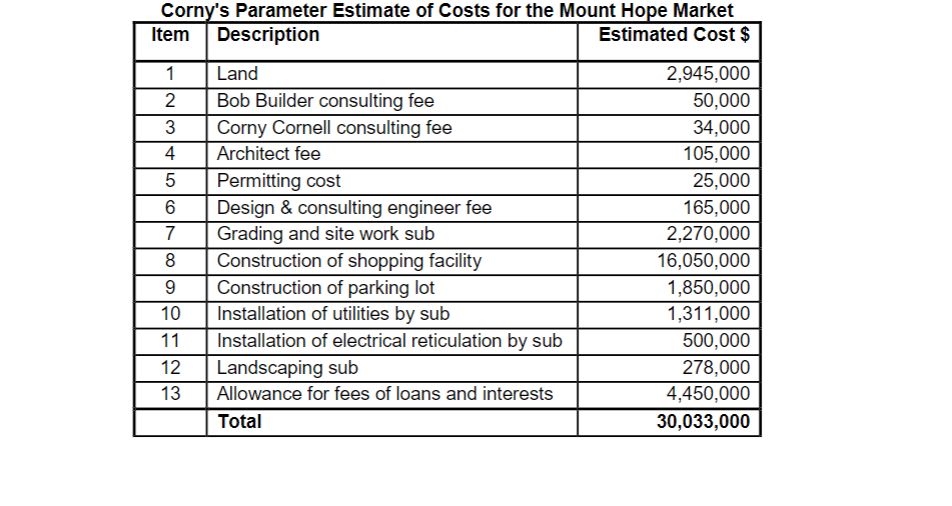

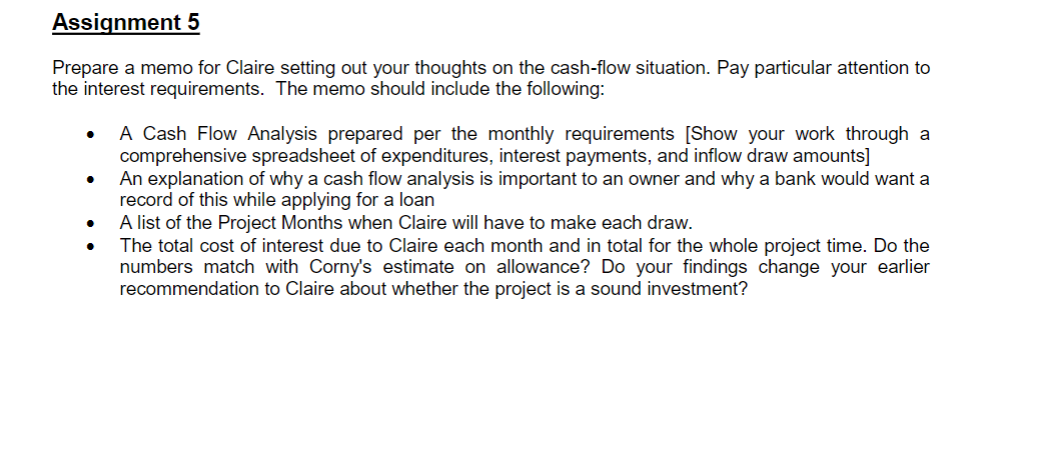

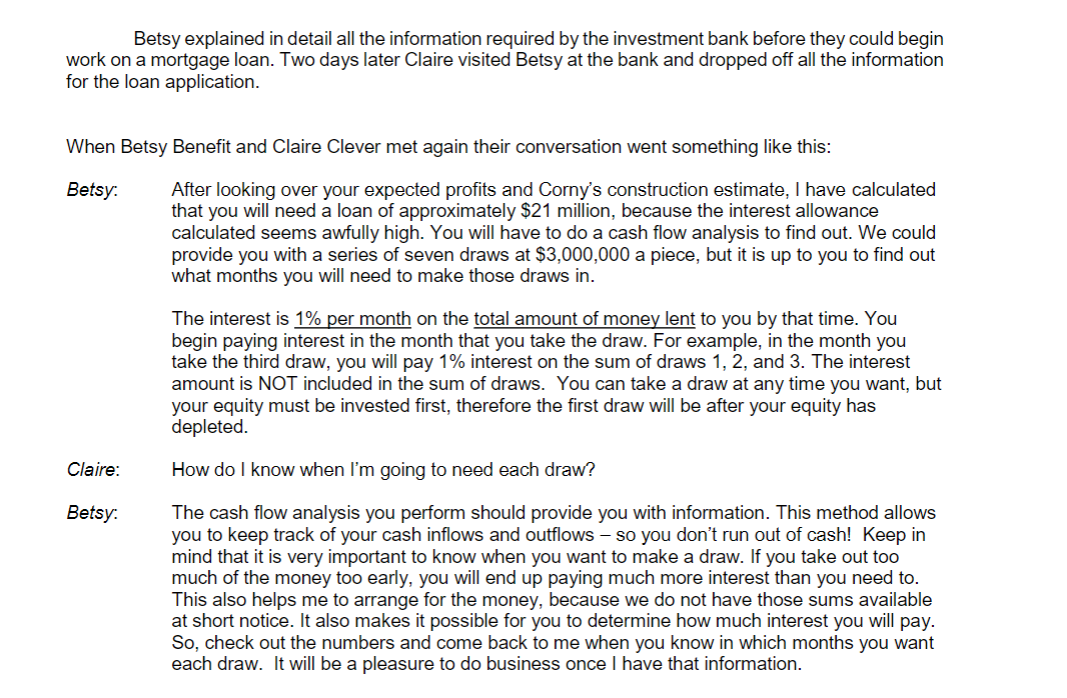

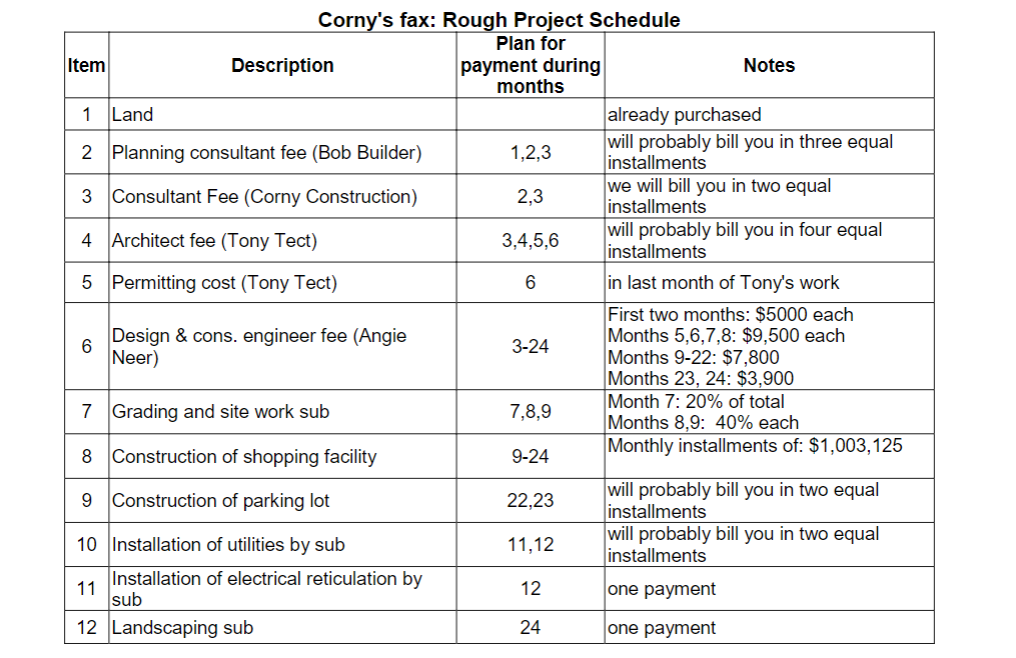

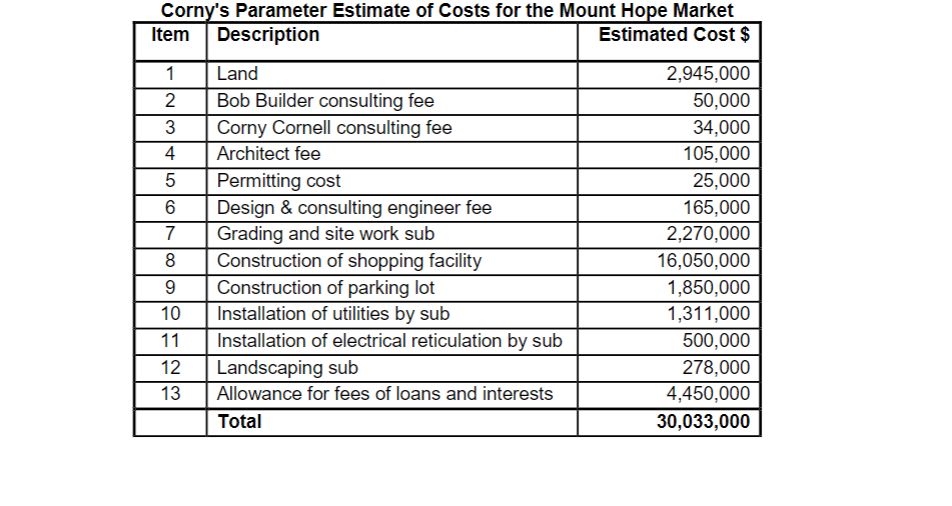

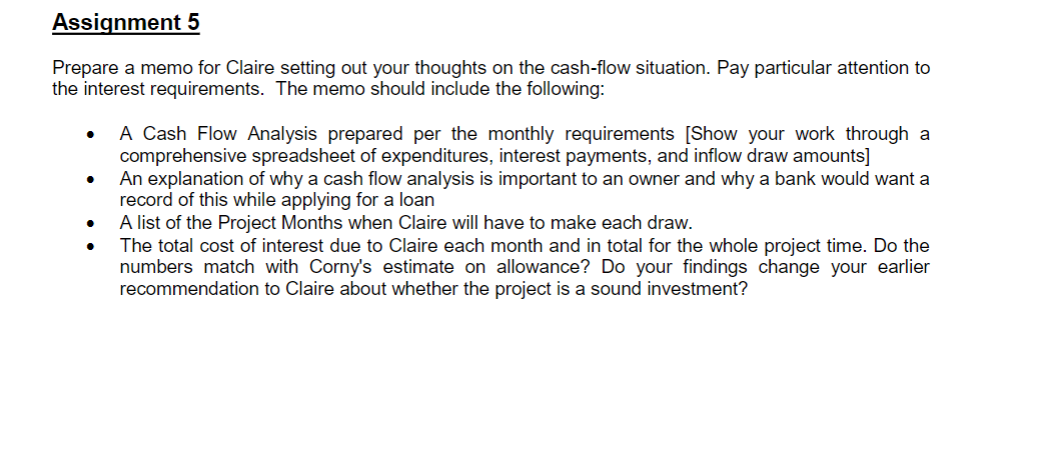

Betsy explained in detail all the information required by the investment bank before they could begin work on a mortgage loan. Two days later Claire visited Betsy at the bank and dropped off all the information for the loan application. When Betsy Benefit and Claire Clever met again their conversation went something like this: Betsy: After looking over your expected profits and Corny's construction estimate, I have calculated that you will need a loan of approximately $21 million, because the interest allowance calculated seems awfully high. You will have to do a cash flow analysis to find out. We could provide you with a series of seven draws at $3,000,000 a piece, but it is up to you to find out what months you will need to make those draws in. The interest is 1% per month on the total amount of money lent to you by that time. You begin paying interest in the month that you take the draw. For example, in the month you take the third draw, you will pay 1% interest on the sum of draws 1, 2, and 3. The interest amount is NOT included in the sum of draws. You can take a draw at any time you want, but your equity must be invested first, therefore the first draw will be after your equity has depleted. How do I know when I'm going to need each draw? The cash flow analysis you perform should provide you with information. This method allows you to keep track of your cash inflows and outflows - so you don't run out of cash! Keep in mind that it is very important to know when you want to make a draw. If you take out too much of the money too early, you will end up paying much more interest than you need to. This also helps me to arrange for the money, because we do not have those sums available at short notice. It also makes it possible for you to determine how much interest you will pay. So, check out the numbers and come back to me when you know in which months you want each draw. It will be a pleasure to do business once I have that information. Claire: Betsy: Corny's fax: Rough Project Schedule Plan for payment during months 1,2,3 2,3 3,4,5,6 6 3-24 7,8,9 9-24 22,23 11,12 12 24 Item Description 1 Land 2 Planning consultant fee (Bob Builder) 3 Consultant Fee (Corny Construction) 4 Architect fee (Tony Tect) 5 Permitting cost (Tony Tect) 6 Design & cons. engineer fee (Angie Neer) 7 Grading and site work sub 8 Construction of shopping facility 9 Construction of parking lot 10 Installation of utilities by sub 11 Installation of electrical reticulation by sub 12 Landscaping sub Notes already purchased will probably bill you in three equal installments we will bill you in two equal installments will probably bill you in four equal installments in last month of Tony's work First two months: $5000 each Months 5,6,7,8: $9,500 each Months 9-22: $7,800 Months 23, 24: $3,900 Month 7: 20% of total Months 8,9: 40% each Monthly installments of: $1,003,125 will probably bill you in two equal installments will probably bill you in two equal installments one payment one payment Corny's Parameter Estimate of Costs for the Mount Hope Market Item Description Estimated Cost $ 1 Land 2,945,000 2 Bob Builder consulting fee 50,000 3 34,000 Corny Cornell consulting fee Architect fee 4 105,000 5 Permitting cost 25,000 6 Design & consulting engineer fee 165,000 7 Grading and site work sub 2,270,000 8 Construction of shopping facility 16,050,000 9 Construction of parking lot 1,850,000 10 Installation of utilities by sub 1,311,000 11 Installation of electrical reticulation by sub 500,000 12 Landscaping sub 278,000 13 Allowance for fees of loans and interests 4,450,000 Total 30,033,000 Assignment 5 Prepare a memo for Claire setting out your thoughts on the cash-flow situation. Pay particular attention to the interest requirements. The memo should include the following: A Cash Flow Analysis prepared per the monthly requirements [Show your work through a comprehensive spreadsheet of expenditures, interest payments, and inflow draw amounts] An explanation of why a cash flow analysis is important to an owner and why a bank would want a record of this while applying for a loan A list of the Project Months when Claire will have to make each draw. The total cost of interest due to Claire each month and in total for the whole project time. Do the numbers match with Corny's estimate on allowance? Do your findings change your earlier recommendation to Claire about whether the project is a sound investment? Betsy explained in detail all the information required by the investment bank before they could begin work on a mortgage loan. Two days later Claire visited Betsy at the bank and dropped off all the information for the loan application. When Betsy Benefit and Claire Clever met again their conversation went something like this: Betsy: After looking over your expected profits and Corny's construction estimate, I have calculated that you will need a loan of approximately $21 million, because the interest allowance calculated seems awfully high. You will have to do a cash flow analysis to find out. We could provide you with a series of seven draws at $3,000,000 a piece, but it is up to you to find out what months you will need to make those draws in. The interest is 1% per month on the total amount of money lent to you by that time. You begin paying interest in the month that you take the draw. For example, in the month you take the third draw, you will pay 1% interest on the sum of draws 1, 2, and 3. The interest amount is NOT included in the sum of draws. You can take a draw at any time you want, but your equity must be invested first, therefore the first draw will be after your equity has depleted. How do I know when I'm going to need each draw? The cash flow analysis you perform should provide you with information. This method allows you to keep track of your cash inflows and outflows - so you don't run out of cash! Keep in mind that it is very important to know when you want to make a draw. If you take out too much of the money too early, you will end up paying much more interest than you need to. This also helps me to arrange for the money, because we do not have those sums available at short notice. It also makes it possible for you to determine how much interest you will pay. So, check out the numbers and come back to me when you know in which months you want each draw. It will be a pleasure to do business once I have that information. Claire: Betsy: Corny's fax: Rough Project Schedule Plan for payment during months 1,2,3 2,3 3,4,5,6 6 3-24 7,8,9 9-24 22,23 11,12 12 24 Item Description 1 Land 2 Planning consultant fee (Bob Builder) 3 Consultant Fee (Corny Construction) 4 Architect fee (Tony Tect) 5 Permitting cost (Tony Tect) 6 Design & cons. engineer fee (Angie Neer) 7 Grading and site work sub 8 Construction of shopping facility 9 Construction of parking lot 10 Installation of utilities by sub 11 Installation of electrical reticulation by sub 12 Landscaping sub Notes already purchased will probably bill you in three equal installments we will bill you in two equal installments will probably bill you in four equal installments in last month of Tony's work First two months: $5000 each Months 5,6,7,8: $9,500 each Months 9-22: $7,800 Months 23, 24: $3,900 Month 7: 20% of total Months 8,9: 40% each Monthly installments of: $1,003,125 will probably bill you in two equal installments will probably bill you in two equal installments one payment one payment Corny's Parameter Estimate of Costs for the Mount Hope Market Item Description Estimated Cost $ 1 Land 2,945,000 2 Bob Builder consulting fee 50,000 3 34,000 Corny Cornell consulting fee Architect fee 4 105,000 5 Permitting cost 25,000 6 Design & consulting engineer fee 165,000 7 Grading and site work sub 2,270,000 8 Construction of shopping facility 16,050,000 9 Construction of parking lot 1,850,000 10 Installation of utilities by sub 1,311,000 11 Installation of electrical reticulation by sub 500,000 12 Landscaping sub 278,000 13 Allowance for fees of loans and interests 4,450,000 Total 30,033,000 Assignment 5 Prepare a memo for Claire setting out your thoughts on the cash-flow situation. Pay particular attention to the interest requirements. The memo should include the following: A Cash Flow Analysis prepared per the monthly requirements [Show your work through a comprehensive spreadsheet of expenditures, interest payments, and inflow draw amounts] An explanation of why a cash flow analysis is important to an owner and why a bank would want a record of this while applying for a loan A list of the Project Months when Claire will have to make each draw. The total cost of interest due to Claire each month and in total for the whole project time. Do the numbers match with Corny's estimate on allowance? Do your findings change your earlier recommendation to Claire about whether the project is a sound investment