Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need this case study and each part of it clearly should clearly answer .. thanks Koka Koka Tea House is a beverage producer in

i need this case study and each part of it clearly should clearly answer ..thanks

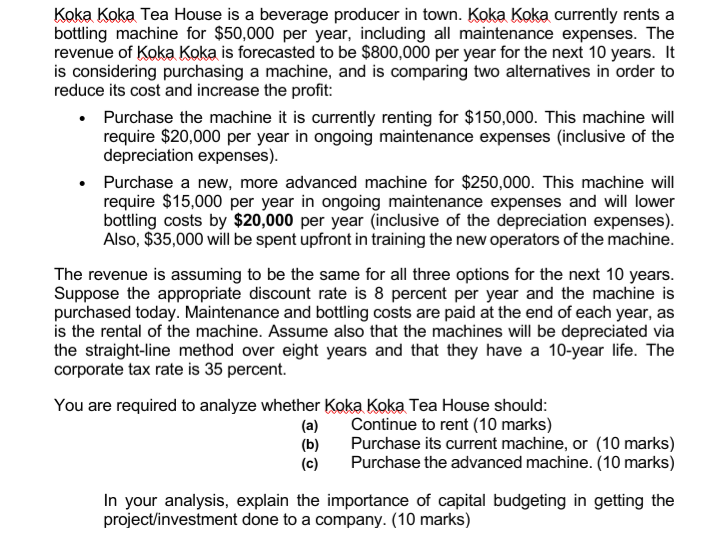

Koka Koka Tea House is a beverage producer in town. Koka Koka currently rents a bottling machine for $50,000 per year, including all maintenance expenses. The revenue of Koka Koka is forecasted to be $800,000 per year for the next 10 years. It is considering purchasing a machine, and is comparing two alternatives in order to reduce its cost and increase the profit: Purchase the machine it is currently renting for $150,000. This machine will require $20,000 per year in ongoing maintenance expenses (inclusive of the depreciation expenses). Purchase a new, more advanced machine for $250,000. This machine will require $15,000 per year in ongoing maintenance expenses and will lower bottling costs by $20,000 per year (inclusive of the depreciation expenses). Also, $35,000 will be spent upfront in training the new operators of the machine. The revenue is assuming to be the same for all three options for the next 10 years. Suppose the appropriate discount rate is 8 percent per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over eight years and that they have a 10-year life. The corporate tax rate is 35 percent. You are required to analyze whether Koka Koka Tea House should: (a) Continue to rent (10 marks) (b) Purchase its current machine, or (10 marks) (c) Purchase the advanced machine. (10 marks) In your analysis, explain the importance of capital budgeting in getting the project/investment done to a company. (10 marks) Koka Koka Tea House is a beverage producer in town. Koka Koka currently rents a bottling machine for $50,000 per year, including all maintenance expenses. The revenue of Koka Koka is forecasted to be $800,000 per year for the next 10 years. It is considering purchasing a machine, and is comparing two alternatives in order to reduce its cost and increase the profit: Purchase the machine it is currently renting for $150,000. This machine will require $20,000 per year in ongoing maintenance expenses (inclusive of the depreciation expenses). Purchase a new, more advanced machine for $250,000. This machine will require $15,000 per year in ongoing maintenance expenses and will lower bottling costs by $20,000 per year (inclusive of the depreciation expenses). Also, $35,000 will be spent upfront in training the new operators of the machine. The revenue is assuming to be the same for all three options for the next 10 years. Suppose the appropriate discount rate is 8 percent per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over eight years and that they have a 10-year life. The corporate tax rate is 35 percent. You are required to analyze whether Koka Koka Tea House should: (a) Continue to rent (10 marks) (b) Purchase its current machine, or (10 marks) (c) Purchase the advanced machine. (10 marks) In your analysis, explain the importance of capital budgeting in getting the project/investment done to a company. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started