Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need this done in less than 2 hours, please! Please input correct answers, not a copy of answers to a different problem, thank you.

I need this done in less than 2 hours, please!

Please input correct answers, not a copy of answers to a different problem, thank you.

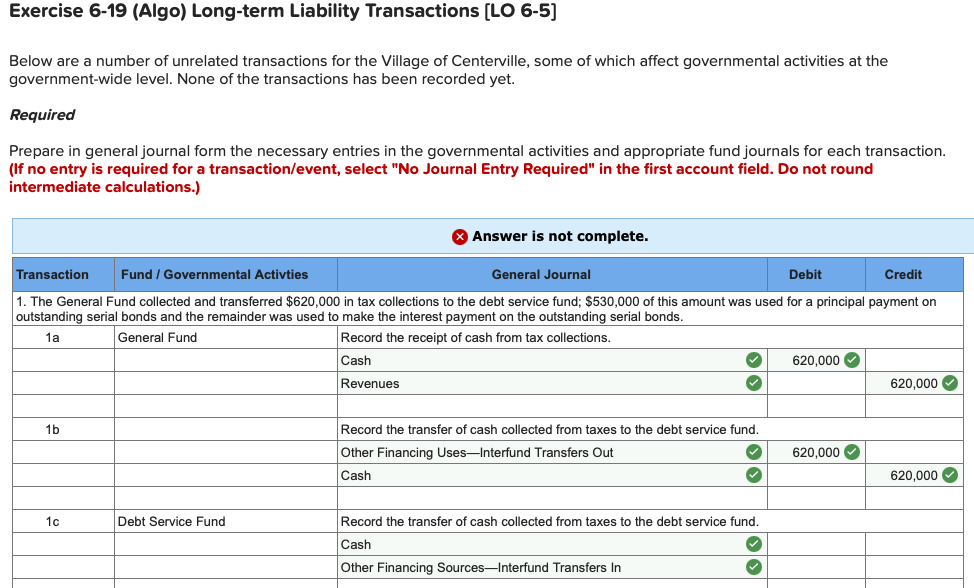

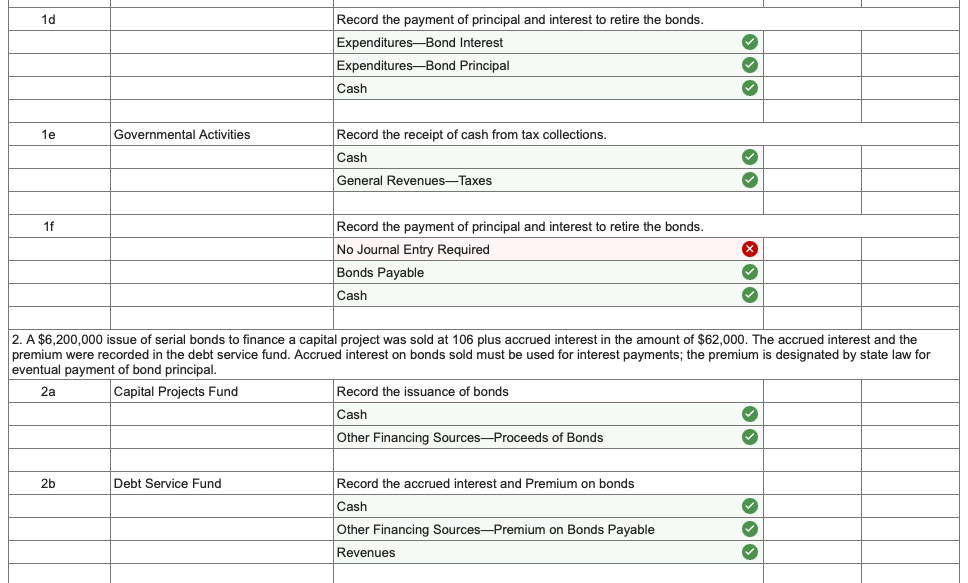

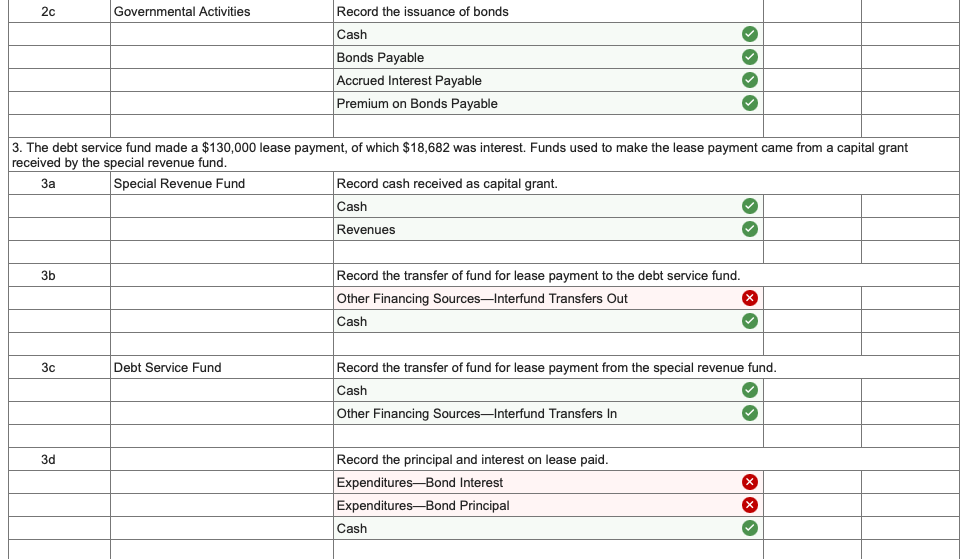

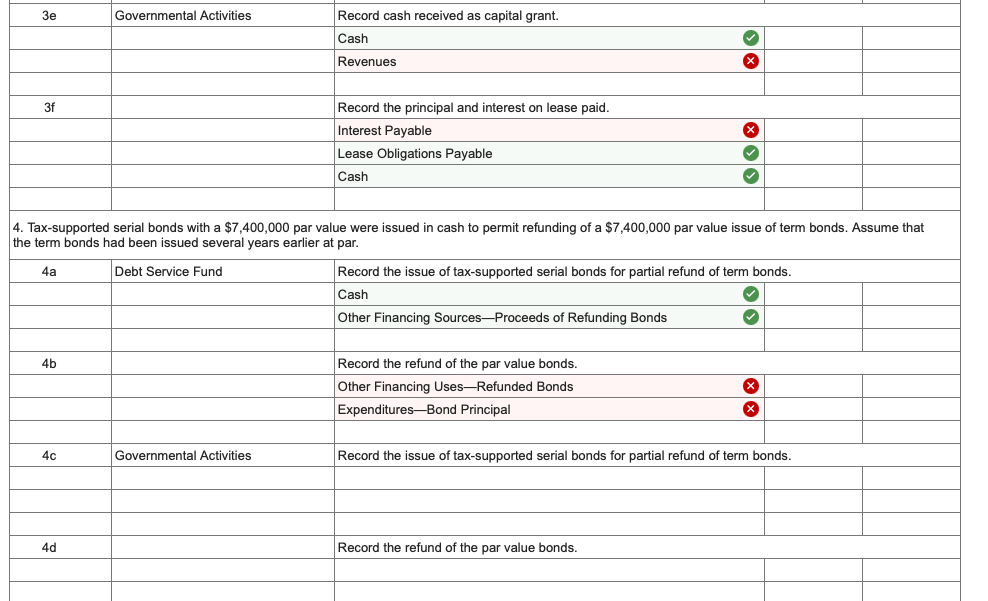

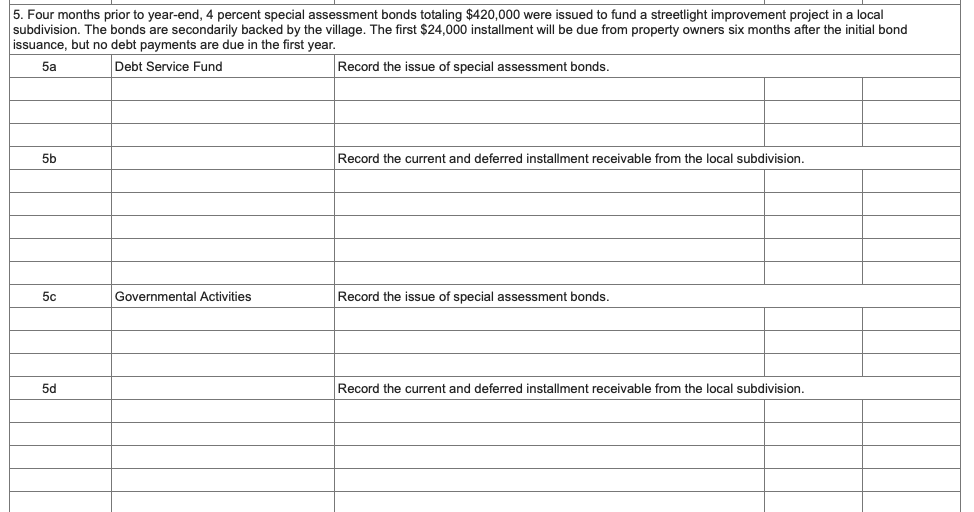

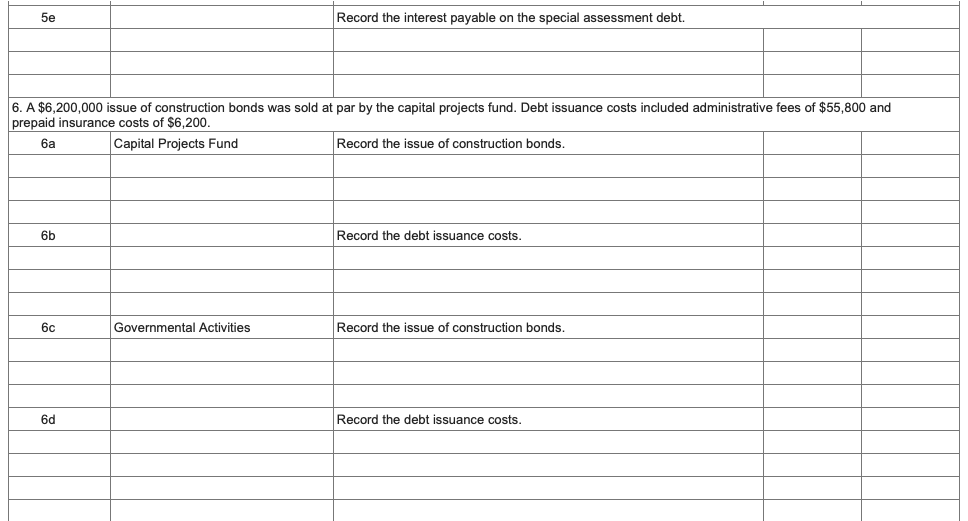

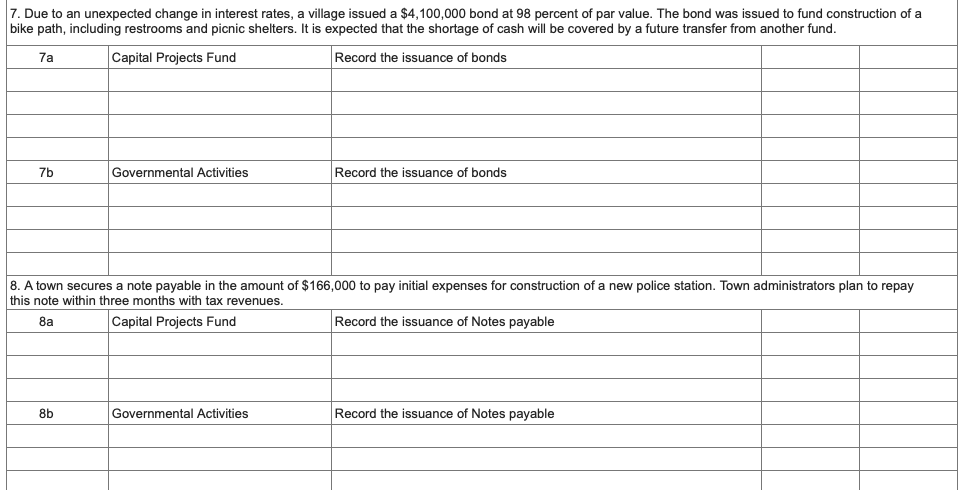

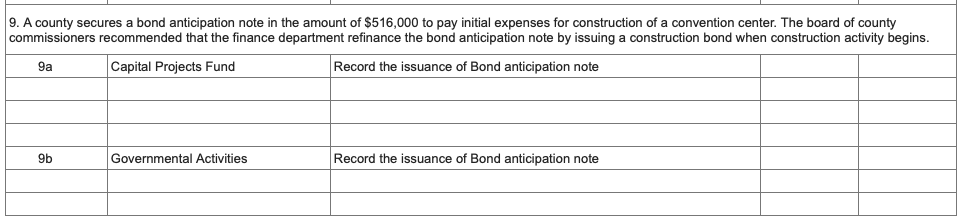

Exercise 6-19 (Algo) Long-term Liability Transactions (LO 6-5) Below are a number of unrelated transactions for the Village of Centerville, some of which affect governmental activities at the government-wide level. None of the transactions has been recorded yet. Required Prepare in general journal form the necessary entries in the governmental activities and appropriate fund journals for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) X Answer is not complete. Transaction Fund / Governmental Activties General Journal Debit Credit 1. The General Fund collected and transferred $620,000 in tax collections to the debt service fund; $530,000 of this amount was used for a principal payment on outstanding serial bonds and the remainder was used to make the interest payment on the outstanding serial bonds. 1a General Fund Record the receipt of cash from tax collections. Cash 620,000 Revenues 620,000 1b Record the transfer of cash collected from taxes to the debt service fund. Other Financing UsesInterfund Transfers Out Cash 620,000 olol 620,000 1c Debt Service Fund Record the transfer of cash collected from taxes to the debt service fund. Cash Other Financing Sources-Interfund Transfers In 1d Record the payment of principal and interest to retire the bonds. Expenditures-Bond Interest Expenditures-Bond Principal Cash 1e Governmental Activities Record the receipt of cash from tax collections. Cash General RevenuesTaxes 1f x Record the payment of principal and interest to retire the bonds. No Journal Entry Required Bonds Payable Cash 2. A $6,200,000 issue of serial bonds to finance a capital project was sold at 106 plus accrued interest in the amount of $62,000. The accrued interest and the premium were recorded in the debt service fund. Accrued interest on bonds sold must be used for interest payments; the premium is designated by state law for eventual payment of bond principal. 2a Capital Projects Fund Record the issuance of bonds Cash Other Financing SourcesProceeds of Bonds 2b Debt Service Fund Record the accrued interest and Premium on bonds Cash Other Financing SourcesPremium on Bonds Payable Revenues 2c Governmental Activities Record the issuance of bonds Cash Bonds Payable Accrued Interest Payable Premium on Bonds Payable 3. The debt service fund made a $130,000 lease payment, of which $18,682 was interest. Funds used to make the lease payment came from a capital grant received by the special revenue fund. Special Revenue Fund Record cash received as capital grant. Cash Revenues 3b Record the transfer of fund for lease payment to the debt service fund. Other Financing SourcesInterfund Transfers Out x Cash c Debt Service Fund Record the transfer of fund for lease payment from the special revenue fund. Cash Other Financing SourcesInterfund Transfers In 3d Record the principal and interest on lease paid. Expenditures-Bond Interest Expenditures-Bond Principal Cash X 3e Governmental Activities Record cash received as capital grant. Cash Revenues X 3f X Record the principal and interest on lease paid. Interest Payable Lease Obligations Payable Cash 4. Tax-supported serial bonds with a $7,400,000 par value were issued in cash to permit refunding of a $7,400,000 par value issue of term bonds. Assume that the term bonds had been issued several years earlier at par. 4a Debt Service Fund Record the issue of tax-supported serial bonds for partial refund of term bonds. Cash Other Financing Sources-Proceeds of Refunding Bonds 4b Record the refund of the par value bonds. Other Financing Uses-Refunded Bonds Expenditures-Bond Principal X X 4c Governmental Activities Record the issue of tax-supported serial bonds for partial refund of term bonds. 4d Record the refund of the par value bonds. 5. Four months prior to year-end, 4 percent special assessment bonds totaling $420,000 were issued to fund a streetlight improvement project in a local subdivision. The bonds are secondarily backed by the village. The first $24,000 installment will be due from property owners six months after the initial bond issuance, but no debt payments are due in the first year. 5a Debt Service Fund Record the issue of special assessment bonds. 5b Record the current and deferred installment receivable from the local subdivision. 5c Governmental Activities Record the issue of special assessment bonds. 5d Record the current and deferred installment receivable from the local subdivision. 5e Record the interest payable on the special assessment debt. 6. A $6,200,000 issue of construction bonds was sold at par by the capital projects fund. Debt issuance costs included administrative fees of $55,800 and prepaid insurance costs of $6,200. Capital Projects Fund Record the issue of construction bonds. 6b Record the debt issuance costs. 6c Governmental Activities Record the issue of construction bonds. 6d Record the debt issuance costs. 7. Due to an unexpected change in interest rates, a village issued a $4,100,000 bond at 98 percent of par value. The bond was issued to fund construction of a bike path, including restrooms and picnic shelters. It is expected that the shortage of cash will be covered by a future transfer from another fund. 7a Capital Projects Fund Record the issuance of bonds 7b Governmental Activities Record the issuance of bonds 8. A town secures a note payable in the amount of $166,000 to pay initial expenses for construction of a new police station. Town administrators plan to repay this note within three months with tax revenues. 8 Capital Projects Fund Record the issuance of Notes payable 8b Governmental Activities Record the issuance of Notes payable 9. A county secures a bond anticipation note in the amount of $516,000 to pay initial expenses for construction of a convention center. The board of county commissioners recommended that the finance department refinance the bond anticipation note by issuing a construction bond when construction activity begins. 9 Capital Projects Fund Record the issuance of Bond anticipation note 9b Governmental Activities Record the issuance of Bond anticipationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started