Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need this in the next 45 min! Second time uploading Suppose you lend your friend $7.344 today for the next 13 years. Your friend

I need this in the next 45 min! Second time uploading

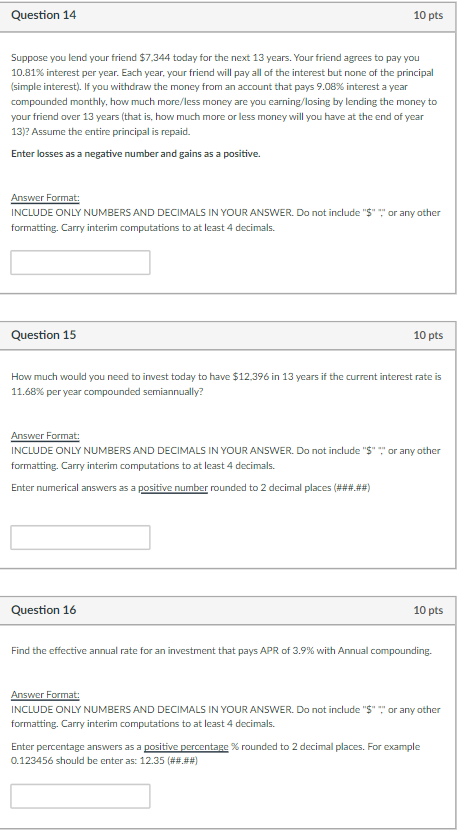

Suppose you lend your friend $7.344 today for the next 13 years. Your friend agrees to pay you 10.81% interest per year. Each year, your friend will pay all of the interest but none of the principal (simple interest). If you withdraw the money from an account that pays 9.08% interest a year compounded monthly, how much more/less money are you earning/losing by lending the money to your friend over 13 years (that is, how much more or less money will you have at the end of year 13)? Assume the entire principal is repaid. Enter losses as a negative number and gains as a positive. Answer Format: INCLUDE ONLY NUMBERS AND DECIMALS IN YOUR ANSWER. Do not include " \( \$ " \)quot;quot;quot; ", or any other formatting. Carry interim computations to at least 4 decimals. Question 15 10 pts How much would you need to invest today to have $12.396 in 13 years if the current interest rate is 11.68% per year compounded semiannually? Answer Format: INCLUDE ONLY NUMBERS AND DECIMALS IN YOUR ANSWER. Do not include " \( \$ " \) ", or any other formatting. Carry interim computations to at least 4 decimals. Enter numerical answers as a positive number rounded to 2 decimal places (\#\#\#..\#\#) Question 16 10 pts Find the effective annual rate for an investment that pays APR of 3.9% with Annual compounding. Answer Format: INCLUDE ONLY NUMBERS AND DECIMALS IN YOUR ANSWER. Do not include " \( \$ " \) "." or any other formatting. Carry interim computations to at least 4 decimals. Enter percentage answers as a positive percentage % rounded to 2 decimal places. For example 0.123456 should be enter as: 12.35 (\#\#.\#\#)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started