Answered step by step

Verified Expert Solution

Question

1 Approved Answer

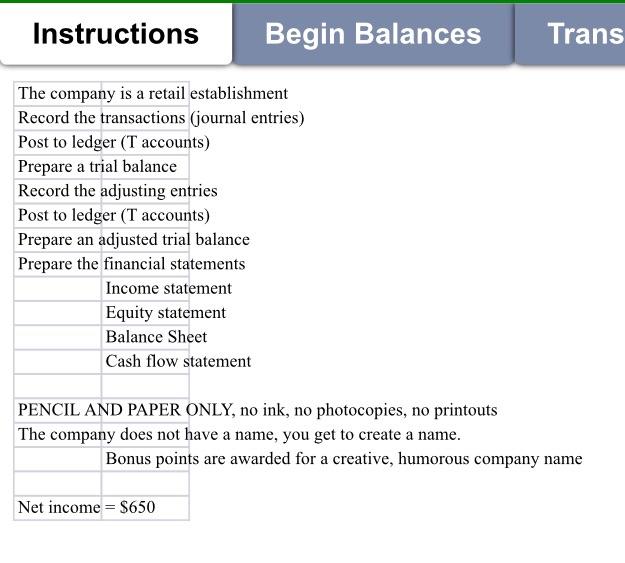

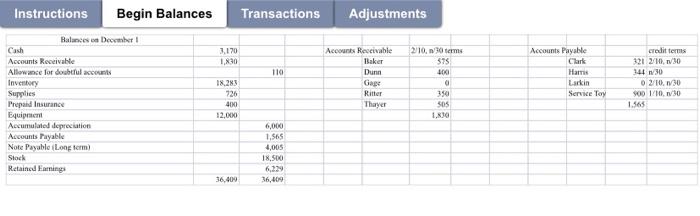

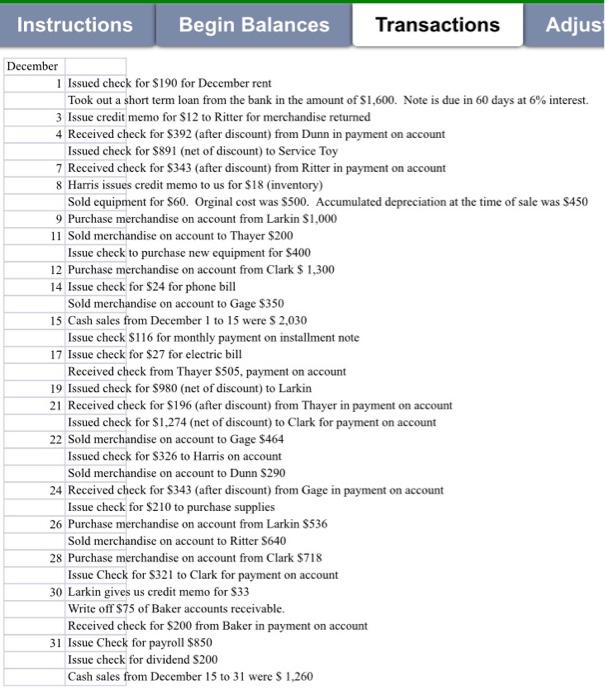

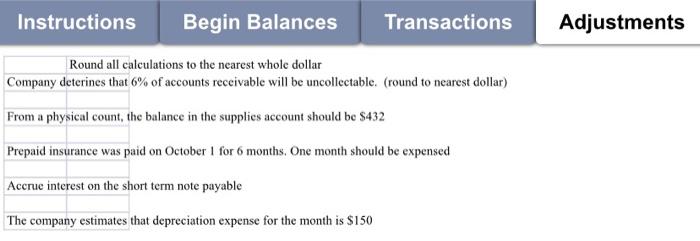

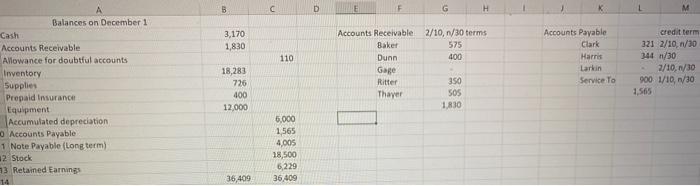

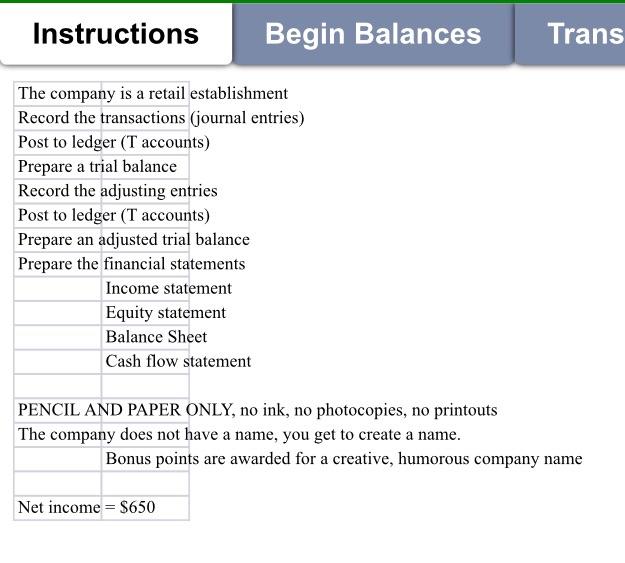

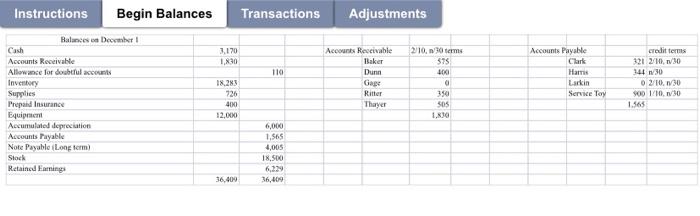

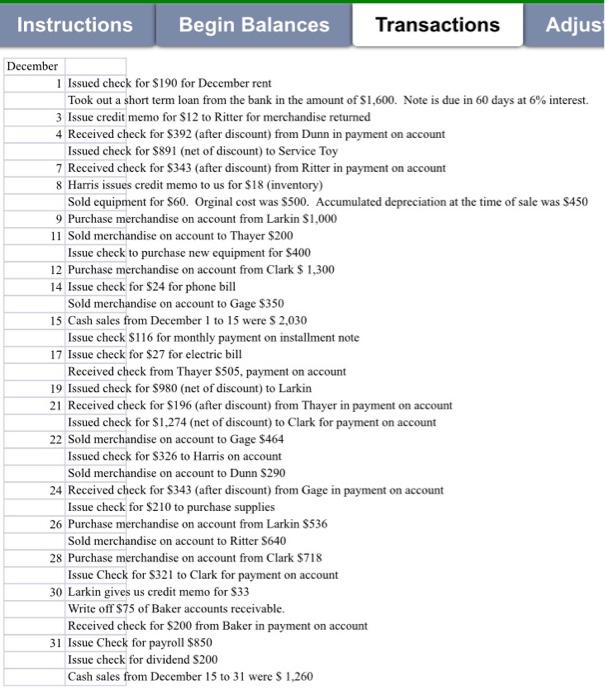

I need this problem solved. First picture is instructions. Second Picture is Begining balences. Third picture is the transactions.Last picture is the adjustments. HELPING ME

I need this problem solved. First picture is instructions. Second Picture is Begining balences. Third picture is the transactions.Last picture is the adjustments. HELPING ME HERE WILL BE MUCH APPRECATED.

I need this problem solved. First picture is instructions. Second Picture is Begining balences. Third picture is the transactions.Last picture is the adjustments. HELPING ME HERE WILL BE MUCH APPRECATED.

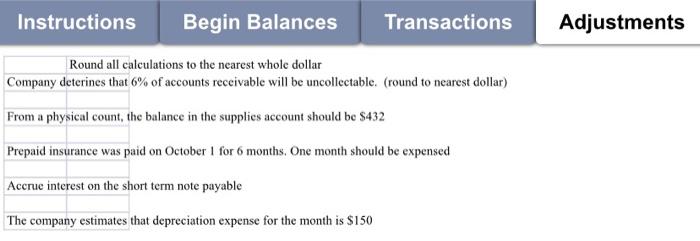

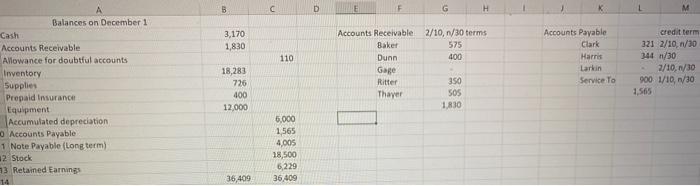

Instructions Begin Balances Trans The company is a retail establishment Record the transactions (journal entries) Post to ledger (T accounts) Prepare a trial balance Record the adjusting entries Post to ledger (T accounts) Prepare an adjusted trial balance Prepare the financial statements Income statement Equity statement Balance Sheet Cash flow statement PENCIL AND PAPER ONLY, no ink, no photocopies, no printouts The company does not have a name, you get to create a name. Bonus points are awarded for a creative, humorous company name Net income = $650 Transactions Adjustments Accounts Receivable 2 10,0 ms 575 LOKI 110 Instructions Begin Balances Balances on December Cash 2,170 Accounts Receivable 1,830 Allowance for doubtful accounts Inventory 18.285 Supplies 726 Prepaid Insurance 400 Equipment 12.000 Accumulated depreciation Accounts Payable Note Payable Long term Stock Retained Earning 36,400 Dunn Gage Ritter Thayer Accounts Payable Clark Hams Larkin Service Toy credits 321 210.0 141130 02/10.30 900 1/10.30 1.565 350 sos 1.30 6,000 4,005 18,500 6,219 36,409 Instructions Begin Balances Transactions Adjus December 1 Issued check for $190 for December rent Took out a short term loan from the bank in the amount of $1,600. Note is due in 60 days at 6% interest. 3 Issue credit memo for $12 to Ritter for merchandise returned 4 Received check for $392 (after discount) from Dunn in payment on account Issued check for $891 (net of discount) to Service Toy 7 Received check for $343 (after discount) from Ritter in payment on account 8 Harris issues credit memo to us for $18 (inventory) Sold equipment for $60. Orginal cost was $500. Accumulated depreciation at the time of sale was $450 9 Purchase merchandise on account from Larkin $1,000 11 Sold merchandise on account to Thayer $200 Issue check to purchase new equipment for $400 12 Purchase merchandise on account from Clark S 1,300 14 Issue check for $24 for phone bill Sold merchandise on account to Gage $350 15 Cash sales from December 1 to 15 were $ 2,030 Issue check $116 for monthly payment on installment note 17 Issue check for $27 for electric bill Received check from Thayer $505, payment on account 19 Issued check for $980 (net of discount) to Larkin 21 Received check for $196 (after discount) from Thayer in payment on account Issued check for $1.274 (net of discount) to Clark for payment on account 22 Sold merchandise on account to Gage $464 Issued check for $326 to Harris on account Sold merchandise on account to Dunn S290 24 Received check for $343 (after discount) from Gage in payment on account Issue check for $210 to purchase supplies 26 Purchase merchandise on account from Larkin $536 Sold merchandise on account to Ritter S640 28 Purchase merchandise on account from Clark $718 Issue Check for $321 to Clark for payment on account 30 Larkin gives us credit memo for $33 Write off $75 of Baker accounts receivable. Received check for $200 from Baker in payment on account 31 Issue Check for payroll $850 Issue check for dividend S200 Cash sales from December 15 to 31 were $ 1,260 Instructions Begin Balances Transactions Adjustments Round all calculations to the nearest whole dollar Company deterines that 6% of accounts receivable will be uncollectable. (round to nearest dollar) From a physical count, the balance in the supplies account should be $432 Prepaid insurance was paid on October 1 for 6 months. One month should be expensed Accrue interest on the short term note payable The company estimates that depreciation expense for the month is $150 Credit Terms 2/10 n/30 Accounting Year 2021 5 C D G H M Accounts Payable 3,170 1,830 2/10, 1/30 terms 575 400 Clark 110 Accounts Receivable Baker Dunn Gage Ritter Thayer Harris Larkin Service To credit term 321 2/10,n/30 344 1/30 7/10, 1/30 900 1/10, 1/30 1,565 Balances on December 1 Cash Accounts Receivable Allowance for doubtful accounts Inventory Supplies Prepaid Insurance Equipment Accumulated depreciation 0 Accounts Payable 1 Note Payable (long term) 2 Stock 3 Retained Earnings 14 18,283 726 400 12.000 350 sos 1,830 5,000 1565 4,005 18,500 6,229 36,409 36,409 Instructions Begin Balances Trans The company is a retail establishment Record the transactions (journal entries) Post to ledger (T accounts) Prepare a trial balance Record the adjusting entries Post to ledger (T accounts) Prepare an adjusted trial balance Prepare the financial statements Income statement Equity statement Balance Sheet Cash flow statement PENCIL AND PAPER ONLY, no ink, no photocopies, no printouts The company does not have a name, you get to create a name. Bonus points are awarded for a creative, humorous company name Net income = $650 Transactions Adjustments Accounts Receivable 2 10,0 ms 575 LOKI 110 Instructions Begin Balances Balances on December Cash 2,170 Accounts Receivable 1,830 Allowance for doubtful accounts Inventory 18.285 Supplies 726 Prepaid Insurance 400 Equipment 12.000 Accumulated depreciation Accounts Payable Note Payable Long term Stock Retained Earning 36,400 Dunn Gage Ritter Thayer Accounts Payable Clark Hams Larkin Service Toy credits 321 210.0 141130 02/10.30 900 1/10.30 1.565 350 sos 1.30 6,000 4,005 18,500 6,219 36,409 Instructions Begin Balances Transactions Adjus December 1 Issued check for $190 for December rent Took out a short term loan from the bank in the amount of $1,600. Note is due in 60 days at 6% interest. 3 Issue credit memo for $12 to Ritter for merchandise returned 4 Received check for $392 (after discount) from Dunn in payment on account Issued check for $891 (net of discount) to Service Toy 7 Received check for $343 (after discount) from Ritter in payment on account 8 Harris issues credit memo to us for $18 (inventory) Sold equipment for $60. Orginal cost was $500. Accumulated depreciation at the time of sale was $450 9 Purchase merchandise on account from Larkin $1,000 11 Sold merchandise on account to Thayer $200 Issue check to purchase new equipment for $400 12 Purchase merchandise on account from Clark S 1,300 14 Issue check for $24 for phone bill Sold merchandise on account to Gage $350 15 Cash sales from December 1 to 15 were $ 2,030 Issue check $116 for monthly payment on installment note 17 Issue check for $27 for electric bill Received check from Thayer $505, payment on account 19 Issued check for $980 (net of discount) to Larkin 21 Received check for $196 (after discount) from Thayer in payment on account Issued check for $1.274 (net of discount) to Clark for payment on account 22 Sold merchandise on account to Gage $464 Issued check for $326 to Harris on account Sold merchandise on account to Dunn S290 24 Received check for $343 (after discount) from Gage in payment on account Issue check for $210 to purchase supplies 26 Purchase merchandise on account from Larkin $536 Sold merchandise on account to Ritter S640 28 Purchase merchandise on account from Clark $718 Issue Check for $321 to Clark for payment on account 30 Larkin gives us credit memo for $33 Write off $75 of Baker accounts receivable. Received check for $200 from Baker in payment on account 31 Issue Check for payroll $850 Issue check for dividend S200 Cash sales from December 15 to 31 were $ 1,260 Instructions Begin Balances Transactions Adjustments Round all calculations to the nearest whole dollar Company deterines that 6% of accounts receivable will be uncollectable. (round to nearest dollar) From a physical count, the balance in the supplies account should be $432 Prepaid insurance was paid on October 1 for 6 months. One month should be expensed Accrue interest on the short term note payable The company estimates that depreciation expense for the month is $150 Credit Terms 2/10 n/30 Accounting Year 2021 5 C D G H M Accounts Payable 3,170 1,830 2/10, 1/30 terms 575 400 Clark 110 Accounts Receivable Baker Dunn Gage Ritter Thayer Harris Larkin Service To credit term 321 2/10,n/30 344 1/30 7/10, 1/30 900 1/10, 1/30 1,565 Balances on December 1 Cash Accounts Receivable Allowance for doubtful accounts Inventory Supplies Prepaid Insurance Equipment Accumulated depreciation 0 Accounts Payable 1 Note Payable (long term) 2 Stock 3 Retained Earnings 14 18,283 726 400 12.000 350 sos 1,830 5,000 1565 4,005 18,500 6,229 36,409 36,409

Instructions Begin Balances Trans The company is a retail establishment Record the transactions (journal entries) Post to ledger (T accounts) Prepare a trial balance Record the adjusting entries Post to ledger (T accounts) Prepare an adjusted trial balance Prepare the financial statements Income statement Equity statement Balance Sheet Cash flow statement PENCIL AND PAPER ONLY, no ink, no photocopies, no printouts The company does not have a name, you get to create a name. Bonus points are awarded for a creative, humorous company name Net income = $650 Transactions Adjustments Accounts Receivable 2 10,0 ms 575 LOKI 110 Instructions Begin Balances Balances on December Cash 2,170 Accounts Receivable 1,830 Allowance for doubtful accounts Inventory 18.285 Supplies 726 Prepaid Insurance 400 Equipment 12.000 Accumulated depreciation Accounts Payable Note Payable Long term Stock Retained Earning 36,400 Dunn Gage Ritter Thayer Accounts Payable Clark Hams Larkin Service Toy credits 321 210.0 141130 02/10.30 900 1/10.30 1.565 350 sos 1.30 6,000 4,005 18,500 6,219 36,409 Instructions Begin Balances Transactions Adjus December 1 Issued check for $190 for December rent Took out a short term loan from the bank in the amount of $1,600. Note is due in 60 days at 6% interest. 3 Issue credit memo for $12 to Ritter for merchandise returned 4 Received check for $392 (after discount) from Dunn in payment on account Issued check for $891 (net of discount) to Service Toy 7 Received check for $343 (after discount) from Ritter in payment on account 8 Harris issues credit memo to us for $18 (inventory) Sold equipment for $60. Orginal cost was $500. Accumulated depreciation at the time of sale was $450 9 Purchase merchandise on account from Larkin $1,000 11 Sold merchandise on account to Thayer $200 Issue check to purchase new equipment for $400 12 Purchase merchandise on account from Clark S 1,300 14 Issue check for $24 for phone bill Sold merchandise on account to Gage $350 15 Cash sales from December 1 to 15 were $ 2,030 Issue check $116 for monthly payment on installment note 17 Issue check for $27 for electric bill Received check from Thayer $505, payment on account 19 Issued check for $980 (net of discount) to Larkin 21 Received check for $196 (after discount) from Thayer in payment on account Issued check for $1.274 (net of discount) to Clark for payment on account 22 Sold merchandise on account to Gage $464 Issued check for $326 to Harris on account Sold merchandise on account to Dunn S290 24 Received check for $343 (after discount) from Gage in payment on account Issue check for $210 to purchase supplies 26 Purchase merchandise on account from Larkin $536 Sold merchandise on account to Ritter S640 28 Purchase merchandise on account from Clark $718 Issue Check for $321 to Clark for payment on account 30 Larkin gives us credit memo for $33 Write off $75 of Baker accounts receivable. Received check for $200 from Baker in payment on account 31 Issue Check for payroll $850 Issue check for dividend S200 Cash sales from December 15 to 31 were $ 1,260 Instructions Begin Balances Transactions Adjustments Round all calculations to the nearest whole dollar Company deterines that 6% of accounts receivable will be uncollectable. (round to nearest dollar) From a physical count, the balance in the supplies account should be $432 Prepaid insurance was paid on October 1 for 6 months. One month should be expensed Accrue interest on the short term note payable The company estimates that depreciation expense for the month is $150 Credit Terms 2/10 n/30 Accounting Year 2021 5 C D G H M Accounts Payable 3,170 1,830 2/10, 1/30 terms 575 400 Clark 110 Accounts Receivable Baker Dunn Gage Ritter Thayer Harris Larkin Service To credit term 321 2/10,n/30 344 1/30 7/10, 1/30 900 1/10, 1/30 1,565 Balances on December 1 Cash Accounts Receivable Allowance for doubtful accounts Inventory Supplies Prepaid Insurance Equipment Accumulated depreciation 0 Accounts Payable 1 Note Payable (long term) 2 Stock 3 Retained Earnings 14 18,283 726 400 12.000 350 sos 1,830 5,000 1565 4,005 18,500 6,229 36,409 36,409 Instructions Begin Balances Trans The company is a retail establishment Record the transactions (journal entries) Post to ledger (T accounts) Prepare a trial balance Record the adjusting entries Post to ledger (T accounts) Prepare an adjusted trial balance Prepare the financial statements Income statement Equity statement Balance Sheet Cash flow statement PENCIL AND PAPER ONLY, no ink, no photocopies, no printouts The company does not have a name, you get to create a name. Bonus points are awarded for a creative, humorous company name Net income = $650 Transactions Adjustments Accounts Receivable 2 10,0 ms 575 LOKI 110 Instructions Begin Balances Balances on December Cash 2,170 Accounts Receivable 1,830 Allowance for doubtful accounts Inventory 18.285 Supplies 726 Prepaid Insurance 400 Equipment 12.000 Accumulated depreciation Accounts Payable Note Payable Long term Stock Retained Earning 36,400 Dunn Gage Ritter Thayer Accounts Payable Clark Hams Larkin Service Toy credits 321 210.0 141130 02/10.30 900 1/10.30 1.565 350 sos 1.30 6,000 4,005 18,500 6,219 36,409 Instructions Begin Balances Transactions Adjus December 1 Issued check for $190 for December rent Took out a short term loan from the bank in the amount of $1,600. Note is due in 60 days at 6% interest. 3 Issue credit memo for $12 to Ritter for merchandise returned 4 Received check for $392 (after discount) from Dunn in payment on account Issued check for $891 (net of discount) to Service Toy 7 Received check for $343 (after discount) from Ritter in payment on account 8 Harris issues credit memo to us for $18 (inventory) Sold equipment for $60. Orginal cost was $500. Accumulated depreciation at the time of sale was $450 9 Purchase merchandise on account from Larkin $1,000 11 Sold merchandise on account to Thayer $200 Issue check to purchase new equipment for $400 12 Purchase merchandise on account from Clark S 1,300 14 Issue check for $24 for phone bill Sold merchandise on account to Gage $350 15 Cash sales from December 1 to 15 were $ 2,030 Issue check $116 for monthly payment on installment note 17 Issue check for $27 for electric bill Received check from Thayer $505, payment on account 19 Issued check for $980 (net of discount) to Larkin 21 Received check for $196 (after discount) from Thayer in payment on account Issued check for $1.274 (net of discount) to Clark for payment on account 22 Sold merchandise on account to Gage $464 Issued check for $326 to Harris on account Sold merchandise on account to Dunn S290 24 Received check for $343 (after discount) from Gage in payment on account Issue check for $210 to purchase supplies 26 Purchase merchandise on account from Larkin $536 Sold merchandise on account to Ritter S640 28 Purchase merchandise on account from Clark $718 Issue Check for $321 to Clark for payment on account 30 Larkin gives us credit memo for $33 Write off $75 of Baker accounts receivable. Received check for $200 from Baker in payment on account 31 Issue Check for payroll $850 Issue check for dividend S200 Cash sales from December 15 to 31 were $ 1,260 Instructions Begin Balances Transactions Adjustments Round all calculations to the nearest whole dollar Company deterines that 6% of accounts receivable will be uncollectable. (round to nearest dollar) From a physical count, the balance in the supplies account should be $432 Prepaid insurance was paid on October 1 for 6 months. One month should be expensed Accrue interest on the short term note payable The company estimates that depreciation expense for the month is $150 Credit Terms 2/10 n/30 Accounting Year 2021 5 C D G H M Accounts Payable 3,170 1,830 2/10, 1/30 terms 575 400 Clark 110 Accounts Receivable Baker Dunn Gage Ritter Thayer Harris Larkin Service To credit term 321 2/10,n/30 344 1/30 7/10, 1/30 900 1/10, 1/30 1,565 Balances on December 1 Cash Accounts Receivable Allowance for doubtful accounts Inventory Supplies Prepaid Insurance Equipment Accumulated depreciation 0 Accounts Payable 1 Note Payable (long term) 2 Stock 3 Retained Earnings 14 18,283 726 400 12.000 350 sos 1,830 5,000 1565 4,005 18,500 6,229 36,409 36,409

I need this problem solved. First picture is instructions. Second Picture is Begining balences.

Third picture is the transactions.Last picture is the adjustments. HELPING ME HERE WILL BE MUCH APPRECATED.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started