Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need this solved step by step and by hand. Please no Excel. Thank You! 1 7) (35 points) EmKay, Inc. is considering the purchase

I need this solved step by step and by hand. Please no Excel. Thank You!

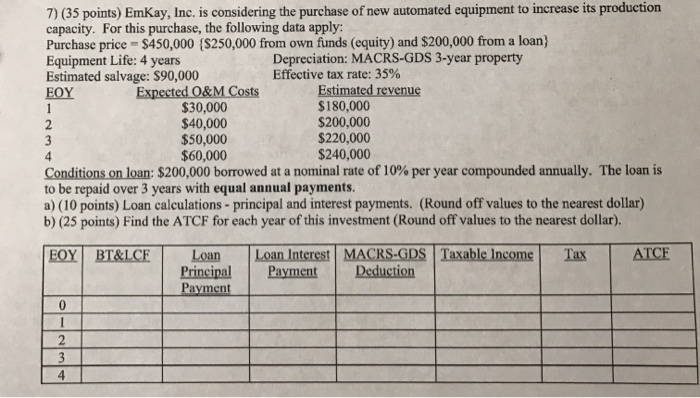

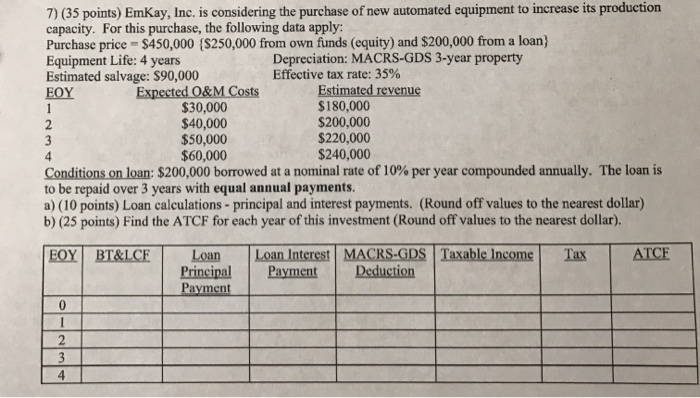

1 7) (35 points) EmKay, Inc. is considering the purchase of new automated equipment to increase its production capacity. For this purchase, the following data apply: Purchase price = $450,000 (S250,000 from own funds (equity) and $200,000 from a loan) Equipment Life: 4 years Depreciation: MACRS-GDS 3-year property Estimated salvage: $90,000 Effective tax rate: 35% EOY Expected O&M Costs Estimated revenue $30,000 $180,000 2 $40,000 $200,000 3 $50,000 $220,000 4 $60,000 $240,000 Conditions on loan: $200,000 borrowed at a nominal rate of 10% per year compounded annually. The loan is to be repaid over 3 years with equal annual payments. a) (10 points) Loan calculations - principal and interest payments. (Round off values to the nearest dollar) b) (25 points) Find the ATCF for each year of this investment (Round off values to the nearest dollar). EOY BT&LCE Tax ATCE Loan Principal Payment Loan Interest MACRS-GDS Taxable Income Payment Deduction 0 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started