Answered step by step

Verified Expert Solution

Question

1 Approved Answer

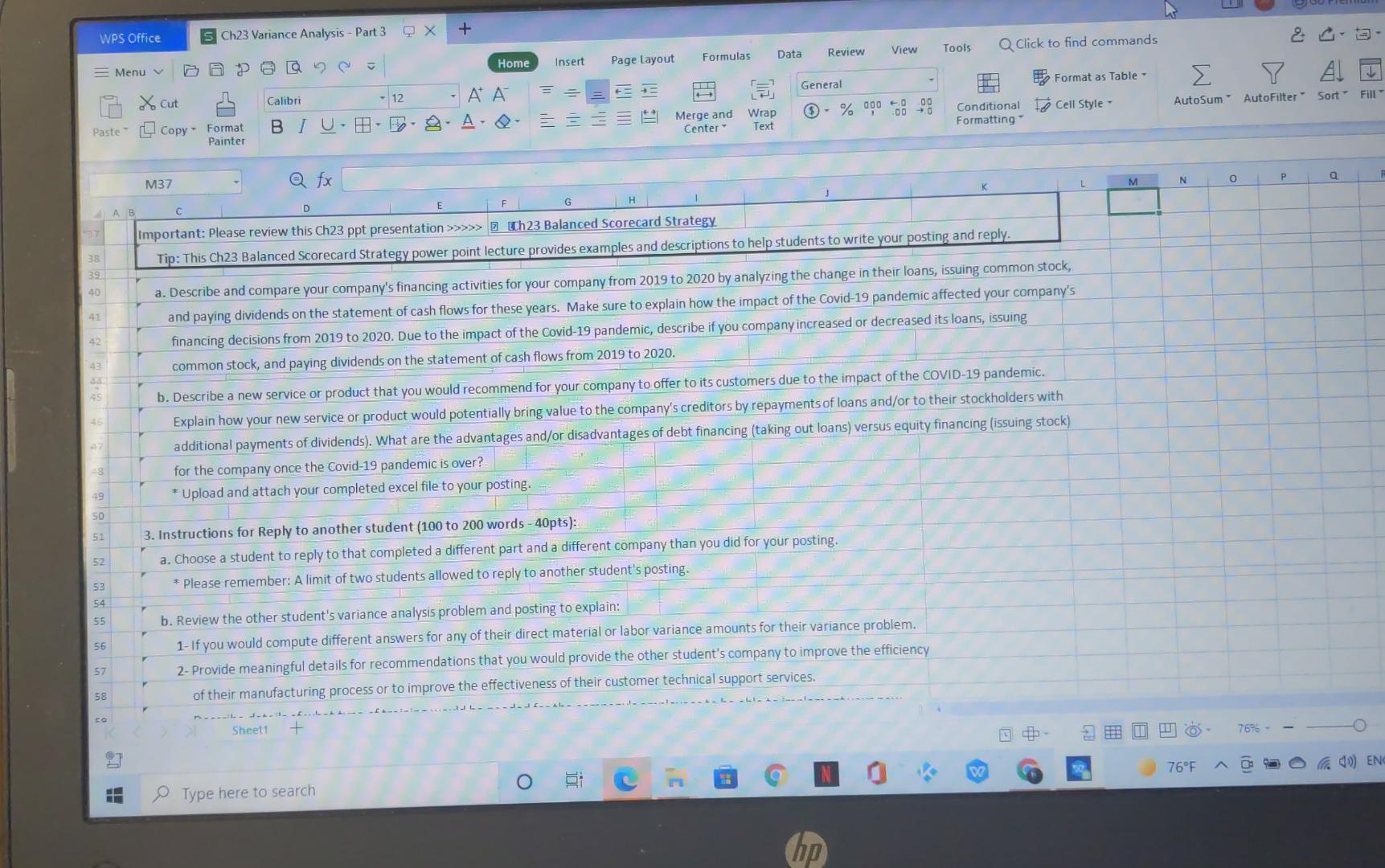

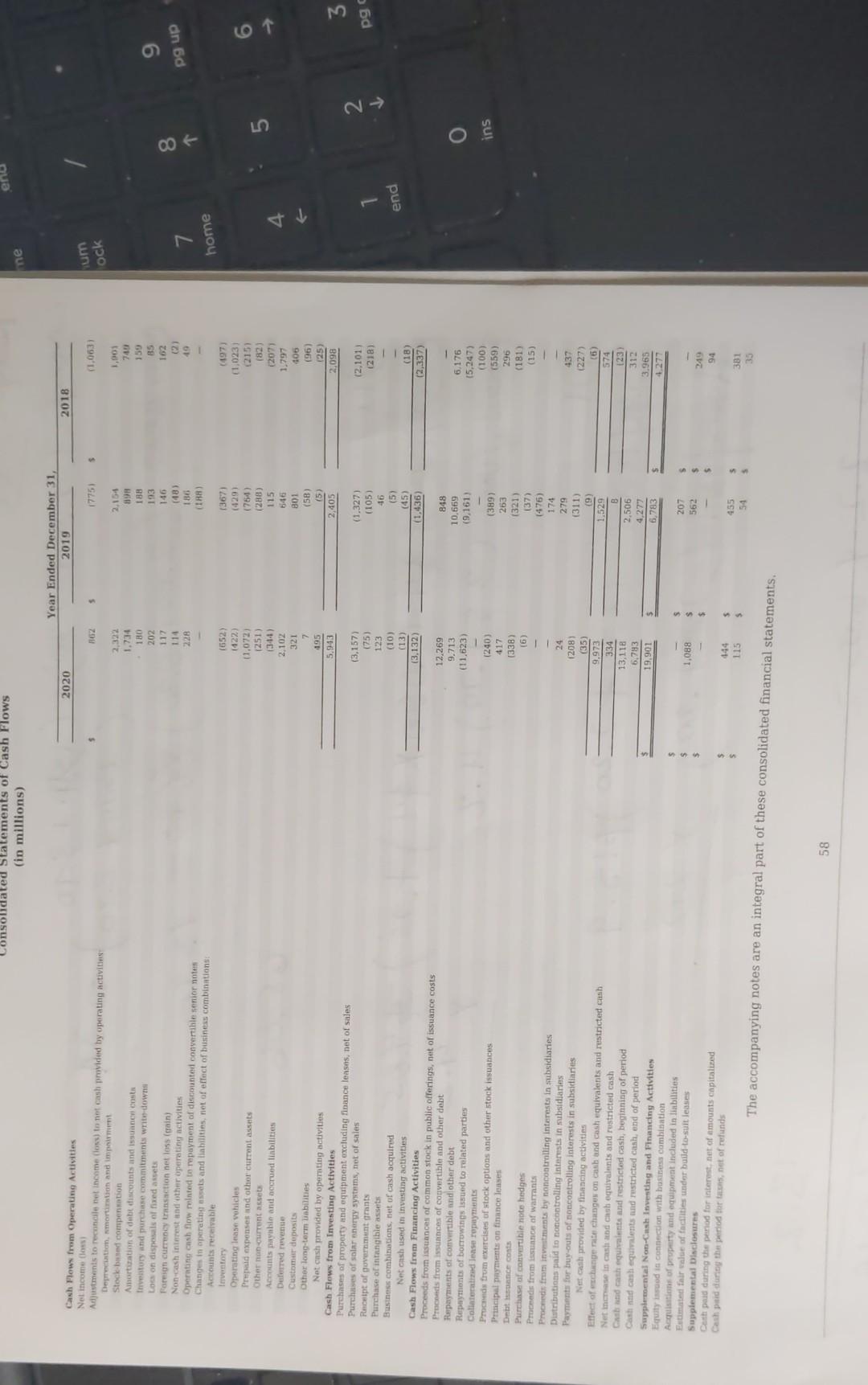

I need to answer A and B part Acording to the Tesla cash flows + WPS Office s Ch23 Variance Analysis - Part 3 QX

I need to answer A and B part Acording to the Tesla cash flows

+ WPS Office s Ch23 Variance Analysis - Part 3 QX - View Tools Q Click to find commands Data Review Formulas Insert Home Page Layout Menu 6 a . Format as Table General Fill AutoFilter Sort 00 AutoSum Cell Style Calibri - 12 BI U. 2. - A A A-2 *- % op P cut Paste L Copy - Format Painter -00 Merge and Wrap Center Text Conditional Formatting @fx N M37 O P M L G H D AB Important: Please review this Ch23 ppt presentation >>>>> 2 Ch23 Balanced Scorecard Strategy Tip: This Ch23 Balanced Scorecard Strategy power point lecture provides examples and descriptions to help students to write your posting and reply. 38 39 40 41 a. Describe and compare your company's financing activities for your company from 2019 to 2020 by analyzing the change in their loans, issuing common stock, and paying dividends on the statement of cash flows for these years. Make sure to explain how the impact of the Covid-19 pandemic affected your company's financing decisions from 2019 to 2020. Due to the impact of the Covid-19 pandemic, describe if you company increased or decreased its loans, issuing common stock, and paying dividends on the statement of cash flows from 2019 to 2020. 2 43 b. Describe a new service or product that you would recommend for your company to offer to its customers due to the impact of the COVID-19 pandemic. Explain how your new service or product would potentially bring value to the company's creditors by repayments of loans and/or to their stockholders with additional payments of dividends). What are the advantages and/or disadvantages of debt financing (taking out loans) versus equity financing (issuing stock) for the company once the Covid-19 pandemic is over? * Upload and attach your completed excel file to your posting. 3 19 50 51 52 3. Instructions for Reply to another student (100 to 200 words - 40pts): a. Choose a student to reply to that completed a different part and a different company than you did for your posting. * Please remember: A limit of two students allowed to reply to another student's posting. 53 54 55 56 b. Review the other student's variance analysis problem and posting to explain: 1- If you would compute different answers for any of their direct material or labor variance amounts for their variance problem. 2- Provide meaningful details for recommendations that you would provide the other student's company to improve the efficiency of their manufacturing process or to improve the effectiveness of their customer technical support services. 57 58 CO Sheet1 + 5 7696 - 76F a 40) ENG 8 o ] I Type here to search (hp eno isolidated Statements of Cash Flows (in millions) ne Year Ended December 31, 2019 2020 2018 HOZ 5 17751 $ (1,0631 ium ock 1,003 2,322 1.734 180 202 117 114 228 2,154 09 188 193 146 (48) 186 (188) 7401 159 15 102 (2) 9 8 og up 7 home T 6 5 1652) 1422 11.072) (251) (344) 2,102 321 7 495 5,943 (367) (429) (754) 288) 115 646 801 (58) (5) 2,405 (497) (1,023 (215) (82) (207) 1.797 106 (96) 125 2,098 (3,157) (75) 3 pg (2,101) (218) L. N> Cash Flows from Operating Activities Nel income on Adjustments to reconcile net income (ons) to net cash provided by operating activities Deprecation, mortiston and impairment Stock-based compensation Amortization of debt discounts and issunnon cost The story and purchase commitments write down Los on disposal of fixed assets Foreign currency transaction net loss (grain) Non-cash interest and other operating activities Operating cash flow rointed to mpayment of discounted convertible senior notes Changes in operating assets and liabilities, net of effect of business combinations: Accounts receivable itory Operating nase vehicles Pred expenses and other current assets Other non-current acts Accounts payable and accruedlinbilities Deferred reven Customer deposits Other long-term abilities Net cash provided by operating activities Cash Flows from Investing Activities Purchases of property and equipment excluding finance leases, net of sales Purchases of solar energy systems, net of sales Receipt of government grants Purchase of intangible assets Business combinations, net of cash acquired Net cash used in investing activities Cash Flows from Financing Activities Proceeds from issuances of common stock in public offerings, net of issuance costs Proceeds from sunces of convertible and other debt Repayments of convertible and other debt Repayments of borrowing issued to related parties Collateralized lease repayments Procedistrum exercises of stock options and other stock issuances Principal payments on finance Jones Dette cont Purchase of convertible note hedges Prices from issuance of warrants Proceeds from investments by noncontrolling interests in subsidiaries Distributions paid to noncontrolling interests in subsidiaries Payments for buy-outs of noncontrolling interests in subsidiaries Net can provided by financing activities Effect of exchange rate changes on cash and cash equivalents and restricted cash Net inomase in cash and cash equivalents and restricted cash Cand cash equivalents and restricted cash, beginning of period mund Supplemental Non-Cush Investing and Financing Activities Equity wood is connection with business combination Acquisitions of property and equipment included in liabilities Estimated fair value of facilities under build-to-sult leases Supplemental Disclosures Cash paid during the period for interest, net of amounts capitalized Cash paid during the period for us, net of refunds 1 end (1.327) (105) 45 (5) (45) (1,436) (10) (13) (3.132 (18) (2,337) 12,269 9.713 11.623 848 10,669 (9,161) 6.176 15,247) (100) (559) 296 (181) (15) (240) 417 (338) (6) ins (389) 263 (321) (37) (476) 174 279 (311) (9) 24 1208) (35) 9.973 334 13.118 6,783 19,901 1.529 437 (227) (6) 574 123 312 3.965 4.277 and cheats and Casa 2,506 Sestricted cash end of period 4,277 6,783 1.088 207 562 5 249 94 144 115 455 54 5 5 381 35 The accompanying notes are an integral part of these consolidated financial statements. 58 + WPS Office s Ch23 Variance Analysis - Part 3 QX - View Tools Q Click to find commands Data Review Formulas Insert Home Page Layout Menu 6 a . Format as Table General Fill AutoFilter Sort 00 AutoSum Cell Style Calibri - 12 BI U. 2. - A A A-2 *- % op P cut Paste L Copy - Format Painter -00 Merge and Wrap Center Text Conditional Formatting @fx N M37 O P M L G H D AB Important: Please review this Ch23 ppt presentation >>>>> 2 Ch23 Balanced Scorecard Strategy Tip: This Ch23 Balanced Scorecard Strategy power point lecture provides examples and descriptions to help students to write your posting and reply. 38 39 40 41 a. Describe and compare your company's financing activities for your company from 2019 to 2020 by analyzing the change in their loans, issuing common stock, and paying dividends on the statement of cash flows for these years. Make sure to explain how the impact of the Covid-19 pandemic affected your company's financing decisions from 2019 to 2020. Due to the impact of the Covid-19 pandemic, describe if you company increased or decreased its loans, issuing common stock, and paying dividends on the statement of cash flows from 2019 to 2020. 2 43 b. Describe a new service or product that you would recommend for your company to offer to its customers due to the impact of the COVID-19 pandemic. Explain how your new service or product would potentially bring value to the company's creditors by repayments of loans and/or to their stockholders with additional payments of dividends). What are the advantages and/or disadvantages of debt financing (taking out loans) versus equity financing (issuing stock) for the company once the Covid-19 pandemic is over? * Upload and attach your completed excel file to your posting. 3 19 50 51 52 3. Instructions for Reply to another student (100 to 200 words - 40pts): a. Choose a student to reply to that completed a different part and a different company than you did for your posting. * Please remember: A limit of two students allowed to reply to another student's posting. 53 54 55 56 b. Review the other student's variance analysis problem and posting to explain: 1- If you would compute different answers for any of their direct material or labor variance amounts for their variance problem. 2- Provide meaningful details for recommendations that you would provide the other student's company to improve the efficiency of their manufacturing process or to improve the effectiveness of their customer technical support services. 57 58 CO Sheet1 + 5 7696 - 76F a 40) ENG 8 o ] I Type here to search (hp eno isolidated Statements of Cash Flows (in millions) ne Year Ended December 31, 2019 2020 2018 HOZ 5 17751 $ (1,0631 ium ock 1,003 2,322 1.734 180 202 117 114 228 2,154 09 188 193 146 (48) 186 (188) 7401 159 15 102 (2) 9 8 og up 7 home T 6 5 1652) 1422 11.072) (251) (344) 2,102 321 7 495 5,943 (367) (429) (754) 288) 115 646 801 (58) (5) 2,405 (497) (1,023 (215) (82) (207) 1.797 106 (96) 125 2,098 (3,157) (75) 3 pg (2,101) (218) L. N> Cash Flows from Operating Activities Nel income on Adjustments to reconcile net income (ons) to net cash provided by operating activities Deprecation, mortiston and impairment Stock-based compensation Amortization of debt discounts and issunnon cost The story and purchase commitments write down Los on disposal of fixed assets Foreign currency transaction net loss (grain) Non-cash interest and other operating activities Operating cash flow rointed to mpayment of discounted convertible senior notes Changes in operating assets and liabilities, net of effect of business combinations: Accounts receivable itory Operating nase vehicles Pred expenses and other current assets Other non-current acts Accounts payable and accruedlinbilities Deferred reven Customer deposits Other long-term abilities Net cash provided by operating activities Cash Flows from Investing Activities Purchases of property and equipment excluding finance leases, net of sales Purchases of solar energy systems, net of sales Receipt of government grants Purchase of intangible assets Business combinations, net of cash acquired Net cash used in investing activities Cash Flows from Financing Activities Proceeds from issuances of common stock in public offerings, net of issuance costs Proceeds from sunces of convertible and other debt Repayments of convertible and other debt Repayments of borrowing issued to related parties Collateralized lease repayments Procedistrum exercises of stock options and other stock issuances Principal payments on finance Jones Dette cont Purchase of convertible note hedges Prices from issuance of warrants Proceeds from investments by noncontrolling interests in subsidiaries Distributions paid to noncontrolling interests in subsidiaries Payments for buy-outs of noncontrolling interests in subsidiaries Net can provided by financing activities Effect of exchange rate changes on cash and cash equivalents and restricted cash Net inomase in cash and cash equivalents and restricted cash Cand cash equivalents and restricted cash, beginning of period mund Supplemental Non-Cush Investing and Financing Activities Equity wood is connection with business combination Acquisitions of property and equipment included in liabilities Estimated fair value of facilities under build-to-sult leases Supplemental Disclosures Cash paid during the period for interest, net of amounts capitalized Cash paid during the period for us, net of refunds 1 end (1.327) (105) 45 (5) (45) (1,436) (10) (13) (3.132 (18) (2,337) 12,269 9.713 11.623 848 10,669 (9,161) 6.176 15,247) (100) (559) 296 (181) (15) (240) 417 (338) (6) ins (389) 263 (321) (37) (476) 174 279 (311) (9) 24 1208) (35) 9.973 334 13.118 6,783 19,901 1.529 437 (227) (6) 574 123 312 3.965 4.277 and cheats and Casa 2,506 Sestricted cash end of period 4,277 6,783 1.088 207 562 5 249 94 144 115 455 54 5 5 381 35 The accompanying notes are an integral part of these consolidated financial statements. 58

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started