Answered step by step

Verified Expert Solution

Question

1 Approved Answer

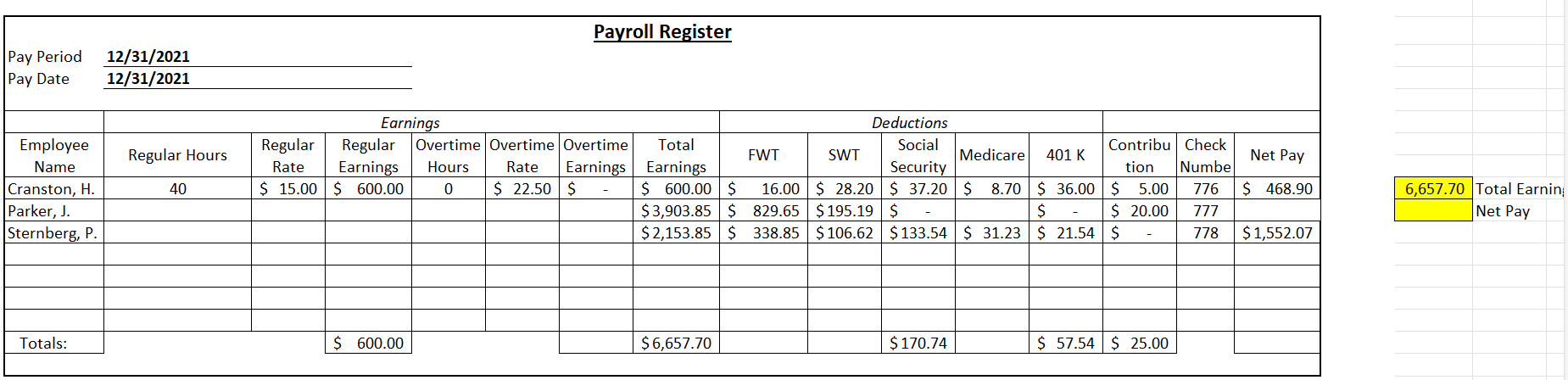

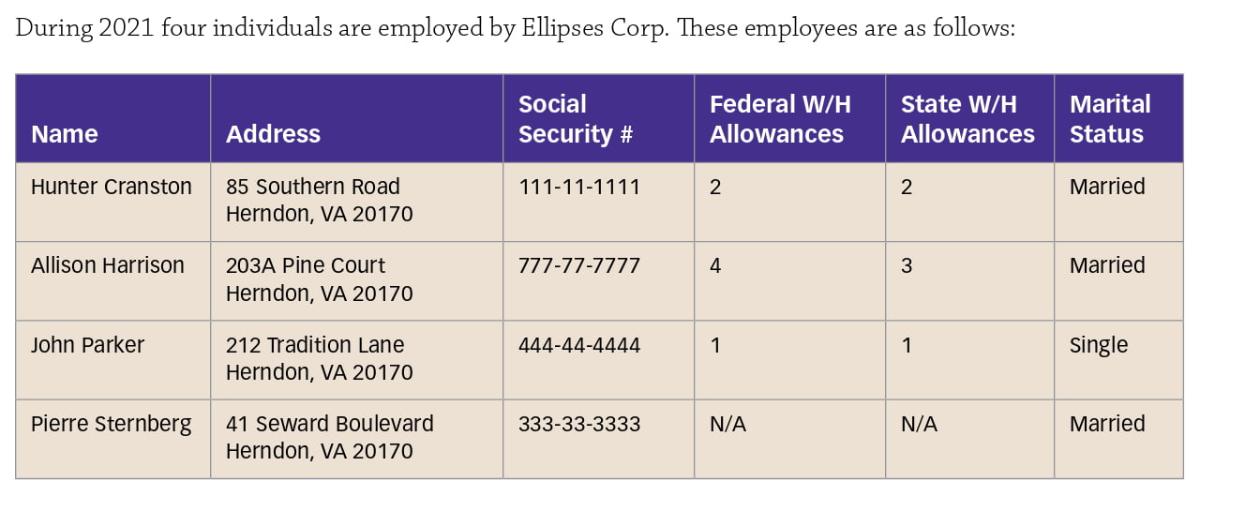

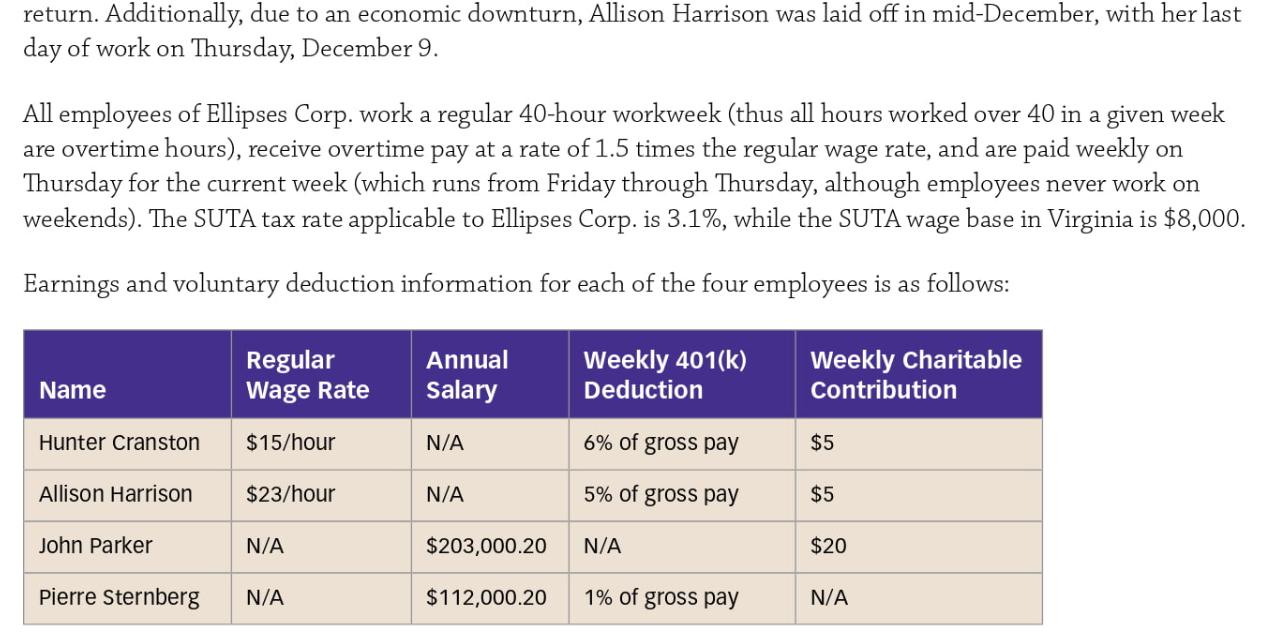

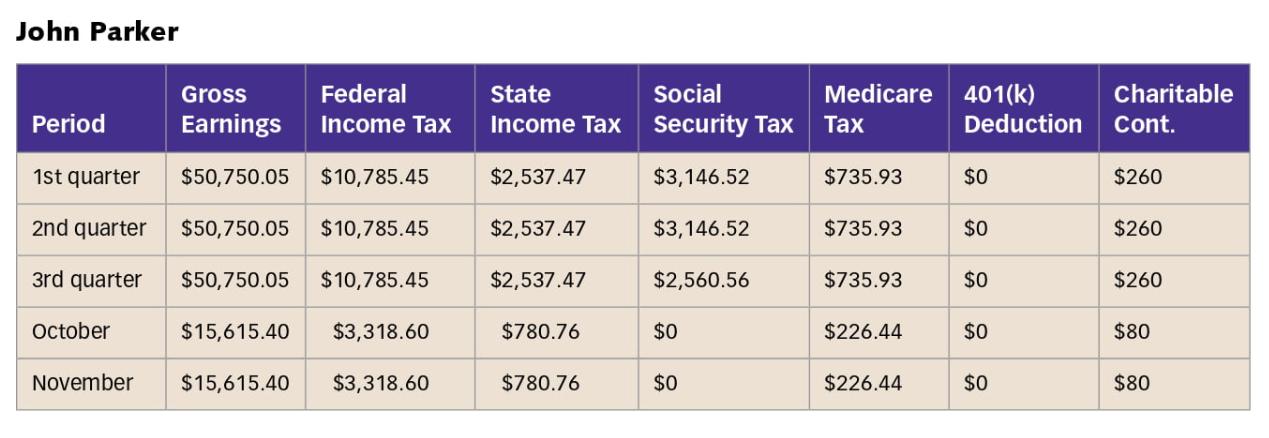

I need to calculate a payroll register and one of the employees has gone over the $200,000 threshold for Medicare in that pay period. Employee

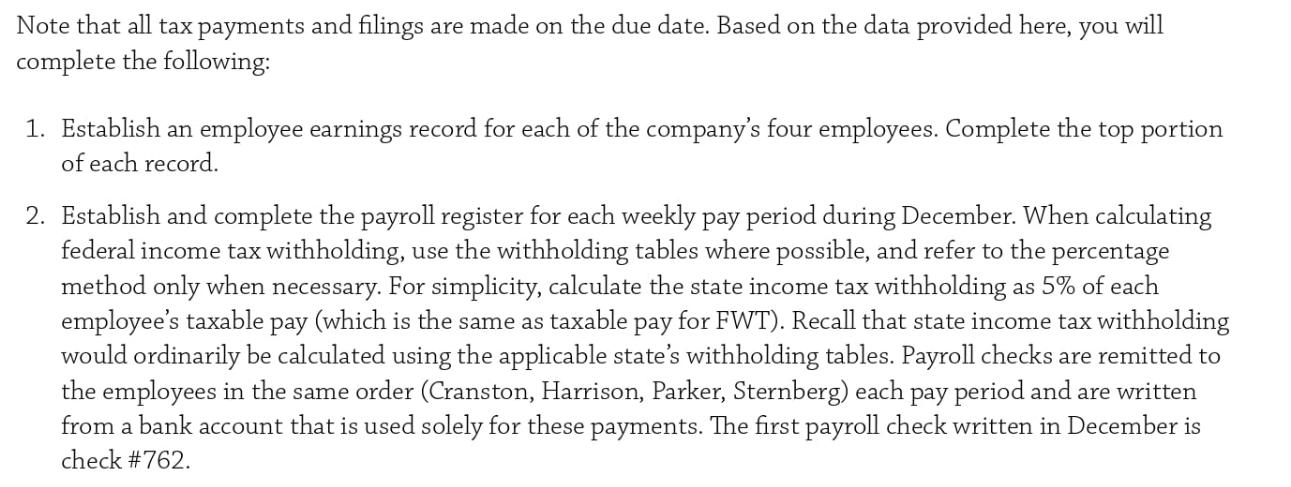

I need to calculate a payroll register and one of the "employees" has gone over the $200,000 threshold for Medicare in that pay period. Employee is John Parker. He earns an annual salary of $203,000.20, contributes $20 for weekly charitable contribution. I just need help figuring out this payroll register for Parker, J. in order to figure out net pay.

Pay Period 12/31/2021 Pay Date 12/31/2021 Employee Name Cranston, H. Parker, J. Sternberg, P. Totals: Regular Hours 40 Payroll Register Earnings Regular Rate Deductions Social Security Medicare 401 K Regular Overtime Overtime Overtime Total FWT SWT Earnings Hours Rate Earnings Earnings $ 15.00 $ 600.000 $ 22.50 $ - $ 600.00 $ 16.00 $28.20 $ 37.20 $ 8.70 $3,903.85 $ 829.65 $195.19 $ $2,153.85 $ 338.85 $106.62 $133.54 $ 31.23 $ 600.00 $ 6,657.70 $ 170.74 Contribu Check Net Pay tion Numbe $36.00 $ 5.00 776 $ 468.90 $ $ 20.00 777 $ 21.54 $ 778 - $ 57.54 $ 25.00 $1,552.07 6,657.70 Total Earnin Net Pay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the payroll register for John Parker well need to determine his gross earnings deductions and net pay for the pay period Lets break it do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started