Question

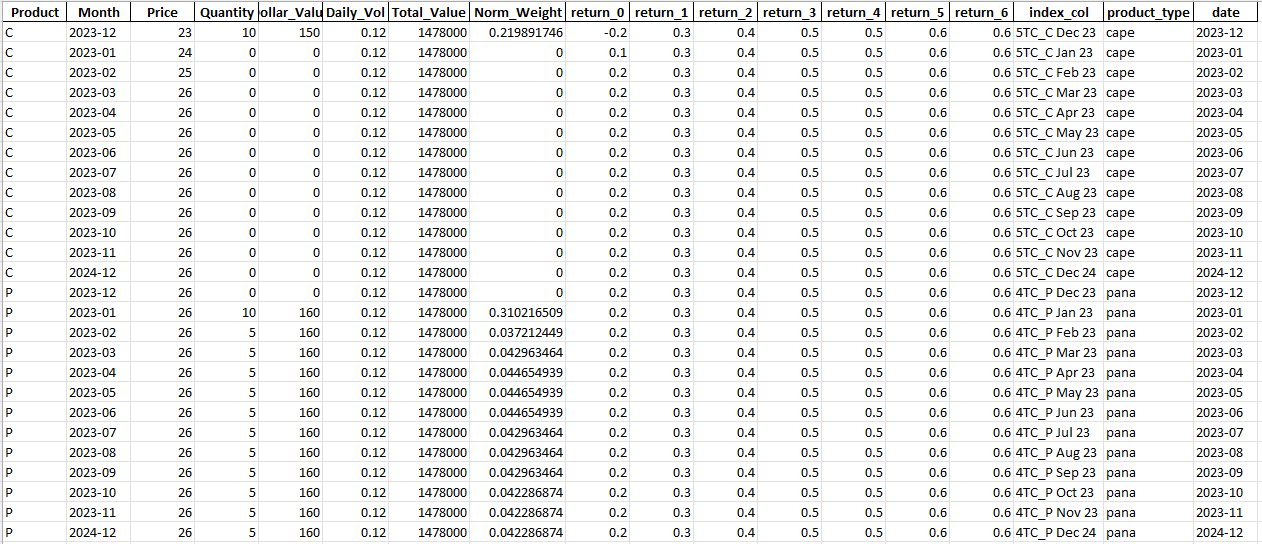

I need to calculate the component VaR with this data using the norm _ weight for the portfolio weight and the return series for the

I need to calculate the component VaR with this data using the normweight for the portfolio weight and the return series for the returns of each security. This is a sample dummy ?data so it only contains return ?to return ?the real dataset will contain return ?to return ?The component VaR is defined as:

dollar component VaR $VaR ?NZalpha sigma ?sum of i ?NZalpha wicovmatrix wsigma ?where NZ is the normal distribution and Z score and alpha is at ?level, w is the weight, i is at ith security. sigma is the volatility.

please give the solution in Python. the expected solution should have component var value for each security

Product Month Price Quantity ollar_Valu Daily_Vol Total_Value Norm_Weight return_0 return_1 return_2 return_3 return_4 |return_5 return_6 index_col product_type date 2023-12 0.6 5TC_C Dec 23 cape 2023-12 2023-01 0.6 5TC C Jan 23 cape 2023-02 0.6 5TC C Feb 23 cape 0.6 5TC_C Mar 23 cape 2023-03 2023-04 0.6 5TC_C Apr 23 cape 2023-05 0.6 5TC_C May 23 cape 2023-06 0.6 5TC C Jun 23 cape 0.6 5TC C Jul 23 cape 2023-07 2023-01 2023-02 2023-03 2023-04 2023-05 2023-06 2023-07 2023-08 2023-09 2023-10 2023-11 2024-12 2023-12 2023-08 0.6 5TC_C Aug 23 cape 2023-09 2023-10 0.6 5TC_C Sep 23 cape 0.6 5TC_C Oct 23 cape 0.6 5TC_C Nov 23 cape 0.6 5TC_C Dec 24 cape 2023-11 2024-12 2023-12 2023-01 0.6 4TC_P Dec 23 pana pana 0.6 4TC P Feb 23 pana 0.6 4TC P Jan 23 2023-01 2023-02 2023-02 2023-03 0.6 4TC P Mar 23 pana 2023-03 2023-04 2023-05 2023-04 2023-05 2023-06 2023-06 2023-07 2023-08 2023-09 2023-10 2023-11 2024-12 C C C C C C C C C C C C C P P P P P P P P P P P P P 23 24 25 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 10 0 0 0 0 0 0 0 0 0 0 0 0 0 10 5 5 5 5 5 5 5 5 5 5 5 150 0 0 0 0 0 0 0 0 0 0 0 0 0 160 160 160 160 160 160 160 160 160 160 160 160 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 1478000 0.219891746 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 1478000 0.310216509 1478000 0.037212449 1478000 0.042963464 1478000 0.044654939 1478000 0.044654939 1478000 0.044654939 1478000 0.042963464 1478000 0.042963464 1478000 0.042963464 1478000 0.042286874 1478000 0.042286874 1478000 0.042286874 0 0 0 0 0 0 0 0 0 0 0 0 0 -0.2 0.1 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.4 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 4TC_P Apr 23 pana 0.6 4TC P May 23 pana 0.6 4TC P Jun 23 pana pana 0.6 4TC_P Aug 23 pana 0.6 4TC P Jul 23 0.6 4TC P Sep 23 pana 0.6 4TC P Oct 23 pana 0.6 4TC_P Nov 23 pana 0.6 4TC_P Dec 24 pana 2023-07 2023-08 2023-09 2023-10 2023-11 2024-12

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the component VaR for each security in Python you can use the following code python Copy import numpy as np Define the data returns nparr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started