Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to Calculate the WACC for the following companies using the information given below: How do I calculate this using Excel? (step by step

I need to Calculate the WACC for the following companies using the information given below:

How do I calculate this using Excel? (step by step formulas appreciated) Thank you

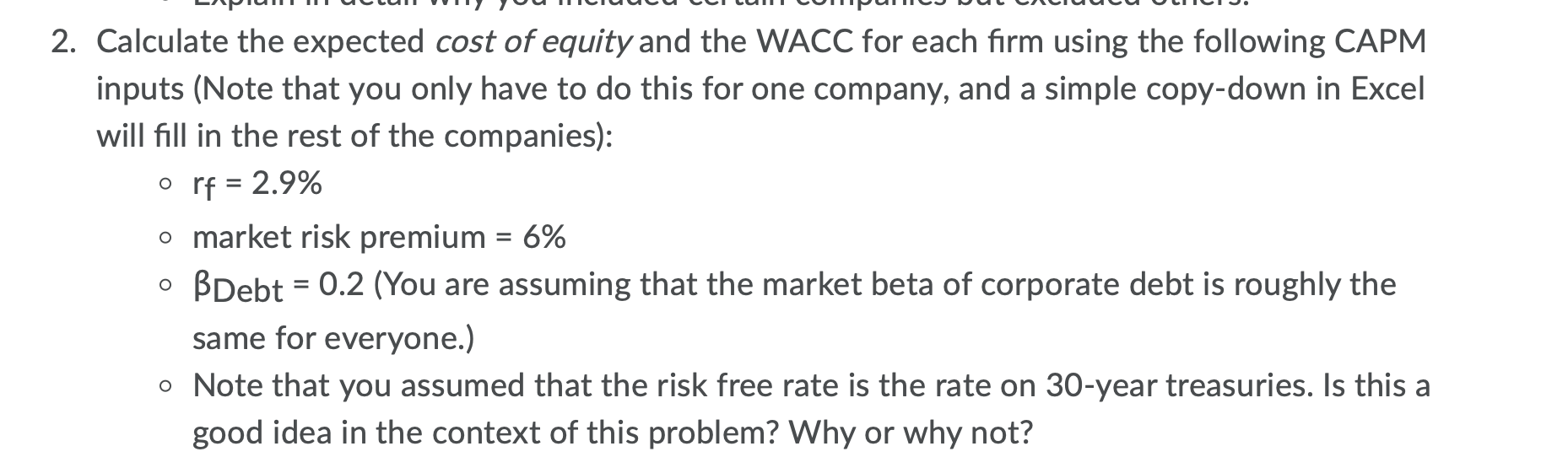

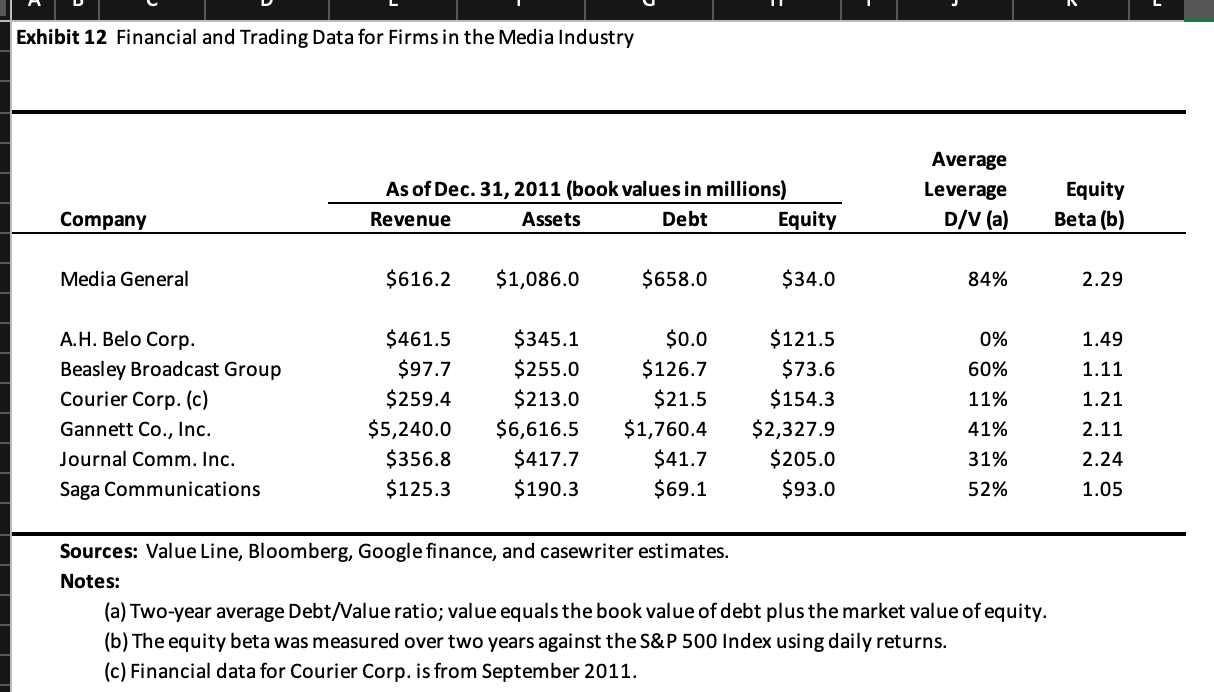

2. Calculate the expected cost of equity and the WACC for each firm using the following CAPM inputs (Note that you only have to do this for one company, and a simple copy-down in Excel will fill in the rest of the companies): o rf = 2.9% o market risk premium = 6% BDebt = 0.2 (You are assuming that the market beta of corporate debt is roughly the o same for everyone.) o Note that you assumed that the risk free rate is the rate on 30-year treasuries. Is this a good idea in the context of this problem? Why or why not? Exhibit 12 Financial and Trading Data for Firms in the Media Industry Average As of Dec. 31, 2011 (book values in millions) Revenue Assets Debt Equity Leverage D/V (a) Equity Beta (b) Company Media General $616.2 $1,086.0 $658.0 $34.0 84% 2.29 0% 1.49 A.H. Belo Corp. Beasley Broadcast Group Courier Corp. (c) 60% 1.11 11% 1.21 $461.5 $97.7 $259.4 $5,240.0 $356.8 $125.3 $345.1 $255.0 $213.0 $6,616.5 $417.7 $190.3 $0.0 $126.7 $21.5 $1,760.4 $41.7 $69.1 $121.5 $73.6 $154.3 $2,327.9 $205.0 $93.0 Gannett Co., Inc. 41% 2.11 Journal Comm. Inc. 31% 2.24 Saga Communications 52% 1.05 Sources: Value Line, Bloomberg, Google finance, and casewriter estimates. Notes: (a) Two-year average Debt/Value ratio; value equals the book value of debt plus the market value of equity. (b) The equity beta was measured over two years against the S&P 500 Index using daily returns. (c) Financial data for Courier Corp. is from September 2011Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started