Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to continue doing this question: https://www.chegg.com/homework-help/questions-and-answers/problem-2-cross-hedging-assume-producer-graduation-rings-college-students-want-secure-supp-q47675016?trackid=jV5jU998 Here is the original: Please continue with part C! Problem 2: Cross-hedging Assume you are producer of

I need to continue doing this question: https://www.chegg.com/homework-help/questions-and-answers/problem-2-cross-hedging-assume-producer-graduation-rings-college-students-want-secure-supp-q47675016?trackid=jV5jU998

Here is the original:

Please continue with part C!

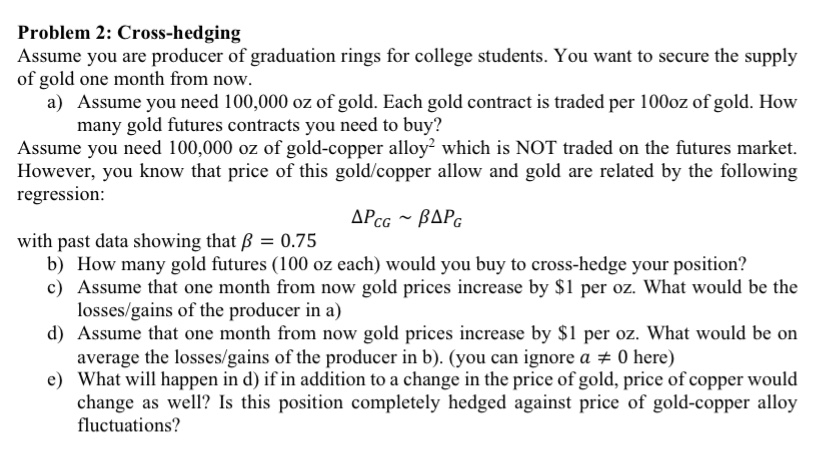

Problem 2: Cross-hedging Assume you are producer of graduation rings for college students. You want to secure the supply of gold one month from now. a) Assume you need 100,000 oz of gold. Each gold contract is traded per 100oz of gold. How many gold futures contracts you need to buy? Assume you need 100,000 oz of gold-copper alloywhich is NOT traded on the futures market. However, you know that price of this gold/copper allow and gold are related by the following regression: APCG - BAPG with past data showing that B = 0.75 b) How many gold futures (100 oz each) would you buy to cross-hedge your position? c) Assume that one month from now gold prices increase by $1 per oz. What would be the losses/gains of the producer in a) d) Assume that one month from now gold prices increase by $1 per oz. What would be on average the losses/gains of the producer in b). (you can ignore a 0 here) e) What will happen in d) if in addition to a change in the price of gold, price of copper would change as well? Is this position completely hedged against price of gold-copper alloy fluctuations? Problem 2: Cross-hedging Assume you are producer of graduation rings for college students. You want to secure the supply of gold one month from now. a) Assume you need 100,000 oz of gold. Each gold contract is traded per 100oz of gold. How many gold futures contracts you need to buy? Assume you need 100,000 oz of gold-copper alloywhich is NOT traded on the futures market. However, you know that price of this gold/copper allow and gold are related by the following regression: APCG - BAPG with past data showing that B = 0.75 b) How many gold futures (100 oz each) would you buy to cross-hedge your position? c) Assume that one month from now gold prices increase by $1 per oz. What would be the losses/gains of the producer in a) d) Assume that one month from now gold prices increase by $1 per oz. What would be on average the losses/gains of the producer in b). (you can ignore a 0 here) e) What will happen in d) if in addition to a change in the price of gold, price of copper would change as well? Is this position completely hedged against price of gold-copper alloy fluctuationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started