Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to do the memo analyzes with two strenghts, two weaknesses, and make two recommendations to improve the company. R. Earnings Per Share 2018

I need to do the memo analyzes with two strenghts, two weaknesses, and make two recommendations to improve the company.

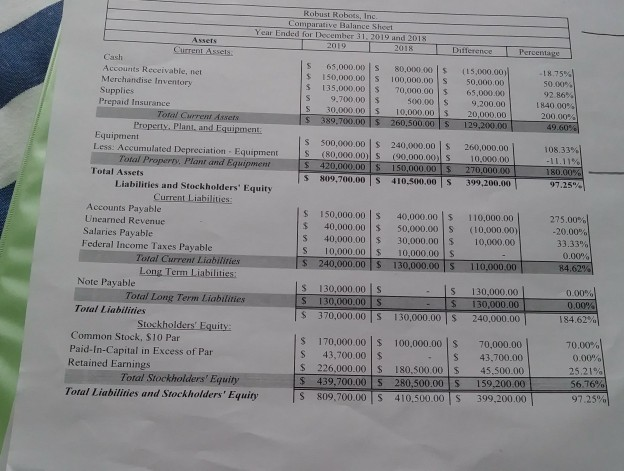

R. Earnings Per Share 2018 JHO 2019 The financial statements provided in this practice set can also be downloaded from Blackboard. An example of a Statement of Cash Flow has been provided at the end of the Practice Set. Download the Excel files (Income Statement and Balance Sheet) from Blackboard and add a column and calculate the ratios for the vertical and horizontal analysis. 5. Acting as an accounting advisor to the firm, prepare a memo in which you analyze the financial statements you prepared in step two and prepare an analysis of the company's financial position. Identify two strengths and two weaknesses in the company. Make two 2 Page OLILY recommendations to improve the company's financial position. Be specific in each of the recommendations and use the ratios to support your analysis. The length should be no more than three paragraphs; one for strengths, one for weaknesses and one for recommendatione 6. Blackboard Instructions a. Memo analyzing the company's strengths and weaknesses with two recommendati In Blackboard you will write a memo using ratios to analyze the strengths and weaknesses of the company. Make sure there are no spelling, grammatical. punctuation errors. b. Add information concerning numbers here and enter Blackboard as specified hai When the answer is in units enter the number as is (See example below i. 280 d. When the answer is for ratios (ie. Current ratio) and has a decimal take the de two decimal spaces (See example below) i. 280.89 e. When ratios are in days/times take out to two decimal places and write days or time after the number (See example below) i. 280.96 days or times f. When the answer is in dollars ALWAYS include a dollar sign and cents even if there zero add.00 (See example below) i $280.00 or $3,800.00 Please follow all instructions. If the answers are formatted incorrectly the answer will be counted wrong. Robust Robots, Inc. Comparative Balance Sheet Year Ended for December 31, 2019 and 2018 2019 2018 Difference Percentage Current Assets $ $ S $ $ 65,000.00 150,000.00 35,000.00 0.700.00 10.000 389,700.00 8000000 100,000.00 S 70,000.00 3 SOOS 10.000. 00 260,500.00 S 15.000.00 50,000.00 6 5,000.0X) 9.200.00 .000.00 129,200.00 1.75 so 92.86% 0 000 200.00 49.60 0 S $ $ $ 500,000.00 $ (R0,000.00 $ S420,000.00 $ $ 809,700.00 S 240,000.00 190,000.00 150,000.00 410,500.00 $ $ $ S 260,000.00 10.000.00 270,000.00 399,200.00 ON 339 11.11 150.00% 97.25% $ S Accounts Receivable, net Merchandise Inventory Supplies Prepaid Insurance Total Current Assets Property. Plant, and Equipment Equipment Less: Accumulated Depreciation Equipment Total Property. Plant and Equipment Total Assets Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Uneamed Revenue Salaries Payable Federal Income Taxes Payable Total Current Liabilities Long Term Liabilities: Note Payable Total Long Term Liabilities Total Liabilities Stockholders' Equity: Common Stock, S10 Par Paid-In-Capital in Excess of Par Retained Earnings Toral Stockholders' Equity Total Liabilities and Stockholders' Equity $ $ $ S $ 150,000.00 40,000.00 40,000.00 10.000.00 240,000.00 $ $ $ $ $ 40,000.00 50,000.00 30,000.00 10.000.00 130,000.00 110,000.00 (10,000.00 10,000.00 275.00 -20.00 33.33% 0.00 84.62% $ 110,000.00 $ S 130,000.00 130,000.00 370,000.00 S S S - $ . IS 130,000.00 $ 130,000.00 30.000.00 240,000.00 0.00 0,00% 184.62% $ $ $ $ $ $ S 170,000.00 43.700.00 226,000.00 439,700.00 809,700.00 $ 5 100,000.00 $ - S 180,500.00 280,500.00 $ 410,500.00 S 70,000.00 43.700.00 45,500.00 159,200.00 399,200.00 70.00% 0.00% 25.21% 56.76% 97.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started