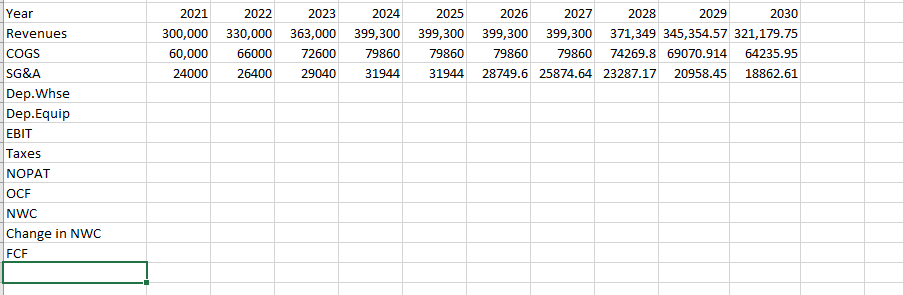

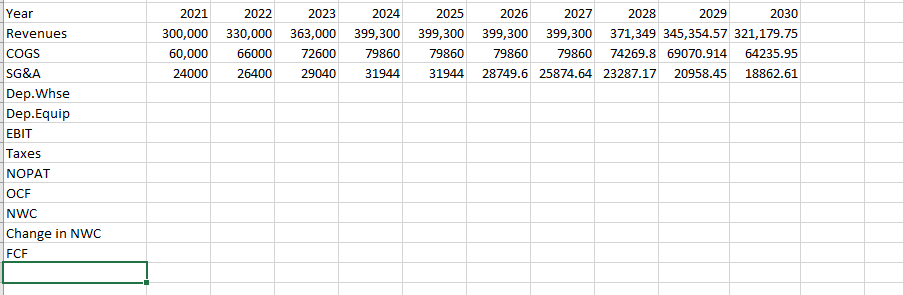

I need to help to find the depreciation of the Warehouse as well as the equipment. Below is the data so far and the other pictures are more information about how to find it.

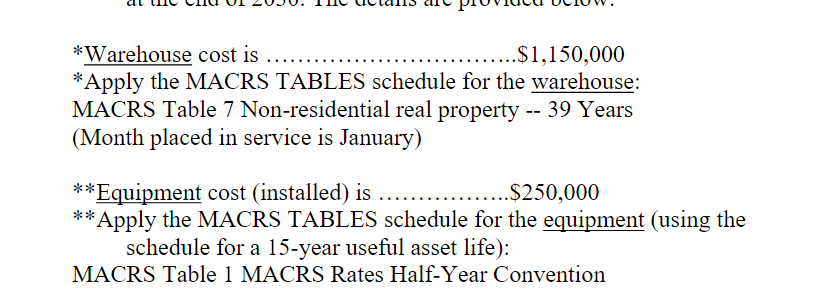

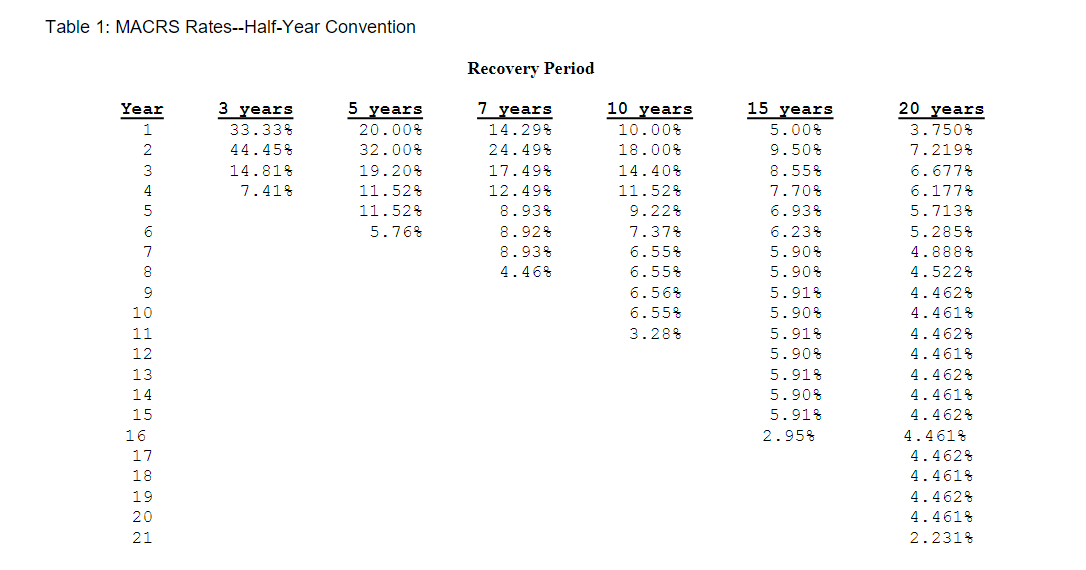

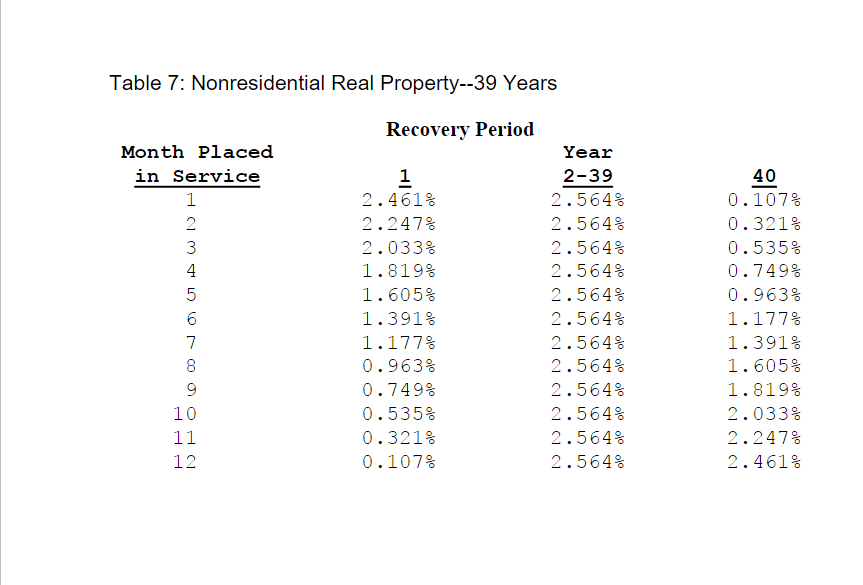

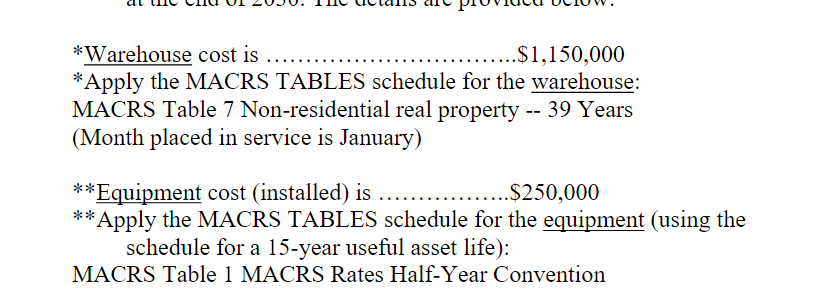

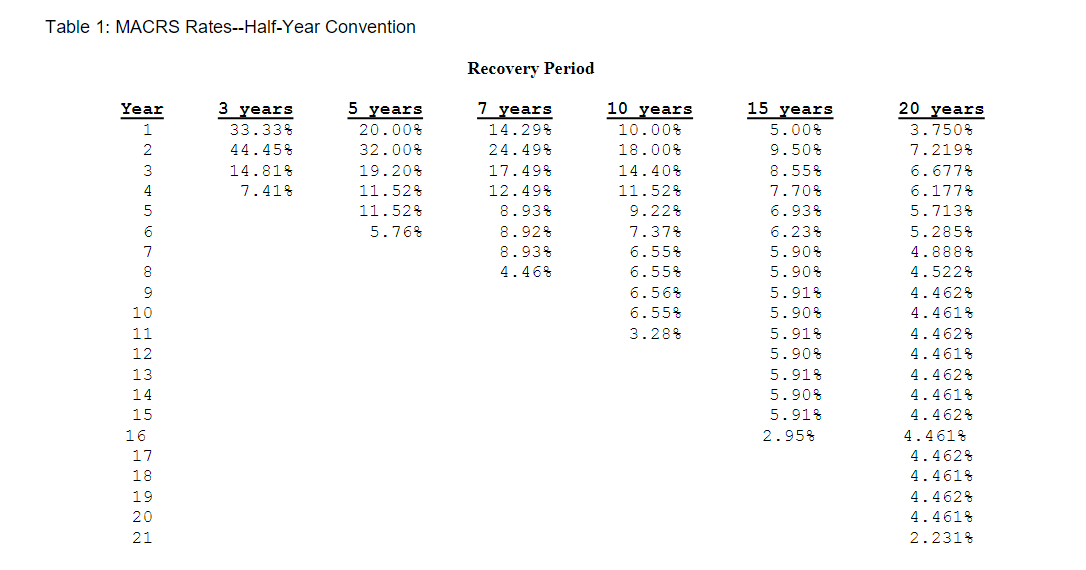

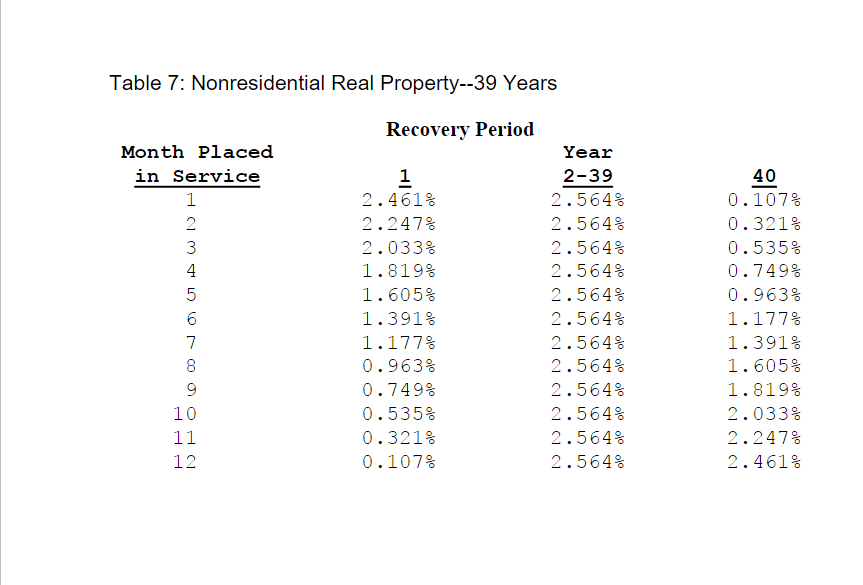

Year Revenues COGS 2021 300,000 60,000 24000 2022 2023 330,000 363,000 66000 72600 26400 29040 2024 2025 399,300 399,300 79860 79860 31944 31944 2026 2027 2028 2029 2030 399,300 399,300 371,349 345,354.57 321,179.75 79860 79860 74269.8 69070.914 64235.95 28749.6 25874.64 23287.17 20958.45 18862.61 SG&A Dep.Whse Dep.Equip EBIT Taxes NOPAT OCF NWC Change in NWC FCF Warehouse cost is .... $1,150,000 *Apply the MACRS TABLES schedule for the warehouse: MACRS Table 7 Non-residential real property -- 39 Years (Month placed in service is January) **Equipment cost (installed) is ....... .$250,000 ** Apply the MACRS TABLES schedule for the equipment (using the schedule for a 15-year useful asset life): MACRS Table 1 MACRS Rates Half-Year Convention Table 1: MACRS Rates--Half-Year Convention Recovery Period Year 1 2 3 4 5 3 years 33.33% 44.458 14.818 7.41% 5 years 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7 years 14.29% 24.498 17.498 12.49% 8.93% 8.92% 8.93% 4.46% 10 years 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.56% 6.55% 3.28% 6 7 8 15 years 5.00% 9.50% 8.55% 7.70% 6.93% 6.23% 5.90% 5.90% 5.91% 5.90% 5.91% 5.90% 5.91% 5.908 5.91% 2.95% 9 10 11 12 13 14 15 16 17 18 19 20 21 20 years 3.750% 7.2198 6.6778 6.1774 5.7138 5.285% 4.8888 4.522% 4.462% 4.461% 4.462% 4.4618 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.4628 4.4618 2.231% Table 7: Nonresidential Real Property--39 Years Recovery Period 40 Month Placed in Service 1 2 3 4 5 6 7 8 9 10 11 12 1 2.461% 2.247% 2.033% 1.819% 1.605% 1.391% 1.177% 0.963% 0.749% 0.535% . 1% 0.107% Year 2-39 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 0.107% 0.321% 0.535% 0.749% 0.963% 1.177% 1.391% 1.605% 1.819% 2.033% 2. 17% 2.461% DEO 2 Year Revenues COGS 2021 300,000 60,000 24000 2022 2023 330,000 363,000 66000 72600 26400 29040 2024 2025 399,300 399,300 79860 79860 31944 31944 2026 2027 2028 2029 2030 399,300 399,300 371,349 345,354.57 321,179.75 79860 79860 74269.8 69070.914 64235.95 28749.6 25874.64 23287.17 20958.45 18862.61 SG&A Dep.Whse Dep.Equip EBIT Taxes NOPAT OCF NWC Change in NWC FCF Warehouse cost is .... $1,150,000 *Apply the MACRS TABLES schedule for the warehouse: MACRS Table 7 Non-residential real property -- 39 Years (Month placed in service is January) **Equipment cost (installed) is ....... .$250,000 ** Apply the MACRS TABLES schedule for the equipment (using the schedule for a 15-year useful asset life): MACRS Table 1 MACRS Rates Half-Year Convention Table 1: MACRS Rates--Half-Year Convention Recovery Period Year 1 2 3 4 5 3 years 33.33% 44.458 14.818 7.41% 5 years 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7 years 14.29% 24.498 17.498 12.49% 8.93% 8.92% 8.93% 4.46% 10 years 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.56% 6.55% 3.28% 6 7 8 15 years 5.00% 9.50% 8.55% 7.70% 6.93% 6.23% 5.90% 5.90% 5.91% 5.90% 5.91% 5.90% 5.91% 5.908 5.91% 2.95% 9 10 11 12 13 14 15 16 17 18 19 20 21 20 years 3.750% 7.2198 6.6778 6.1774 5.7138 5.285% 4.8888 4.522% 4.462% 4.461% 4.462% 4.4618 4.462% 4.461% 4.462% 4.461% 4.462% 4.461% 4.4628 4.4618 2.231% Table 7: Nonresidential Real Property--39 Years Recovery Period 40 Month Placed in Service 1 2 3 4 5 6 7 8 9 10 11 12 1 2.461% 2.247% 2.033% 1.819% 1.605% 1.391% 1.177% 0.963% 0.749% 0.535% . 1% 0.107% Year 2-39 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 0.107% 0.321% 0.535% 0.749% 0.963% 1.177% 1.391% 1.605% 1.819% 2.033% 2. 17% 2.461% DEO 2