Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to know how it was calculated, specifically the allocation of deficit part. 4. As of January 1, 2024, the partnership of Carlin, Yearly,

I need to know how it was calculated, specifically the allocation of deficit part.

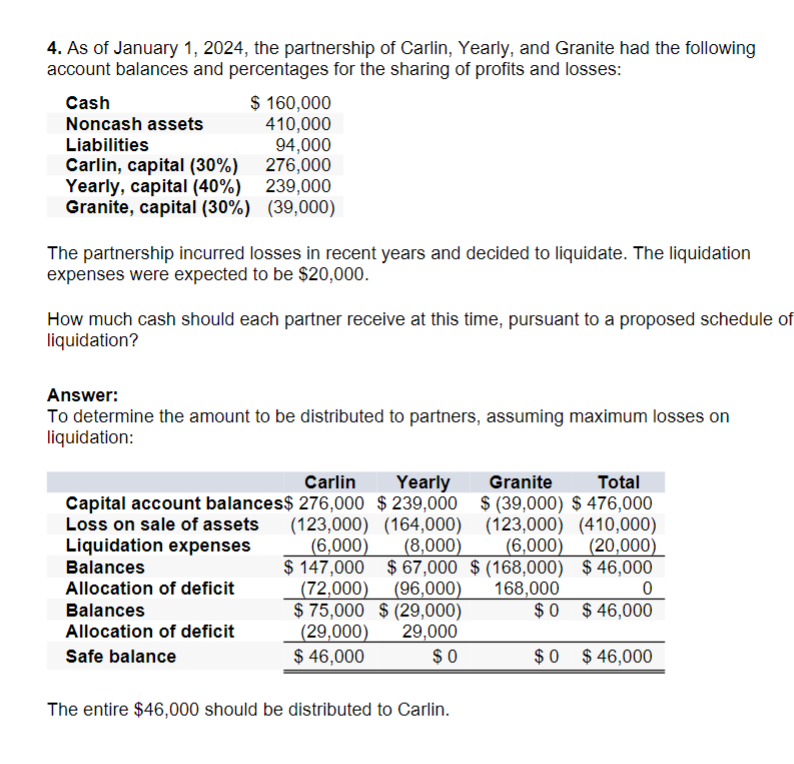

4. As of January 1, 2024, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses: The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000. How much cash should each partner receive at this time, pursuant to a proposed schedule liquidation? Answer: To determine the amount to be distributed to partners, assuming maximum losses on liquidation: The entire $46,000 should be distributed to Carlin

4. As of January 1, 2024, the partnership of Carlin, Yearly, and Granite had the following account balances and percentages for the sharing of profits and losses: The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $20,000. How much cash should each partner receive at this time, pursuant to a proposed schedule liquidation? Answer: To determine the amount to be distributed to partners, assuming maximum losses on liquidation: The entire $46,000 should be distributed to Carlin Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started