Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need to know how to create the basic consolidation entry. What is not clear? I have to create the basic consolidation entry for this

I need to know how to create the basic consolidation entry.

What is not clear? I have to create the basic consolidation entry for this and I do not know how to do that. I am paying for this and I have yet to have a question answered. This is the second time I have submitted this question and no one seems to be able to help me. What else do you need to be able to help me?

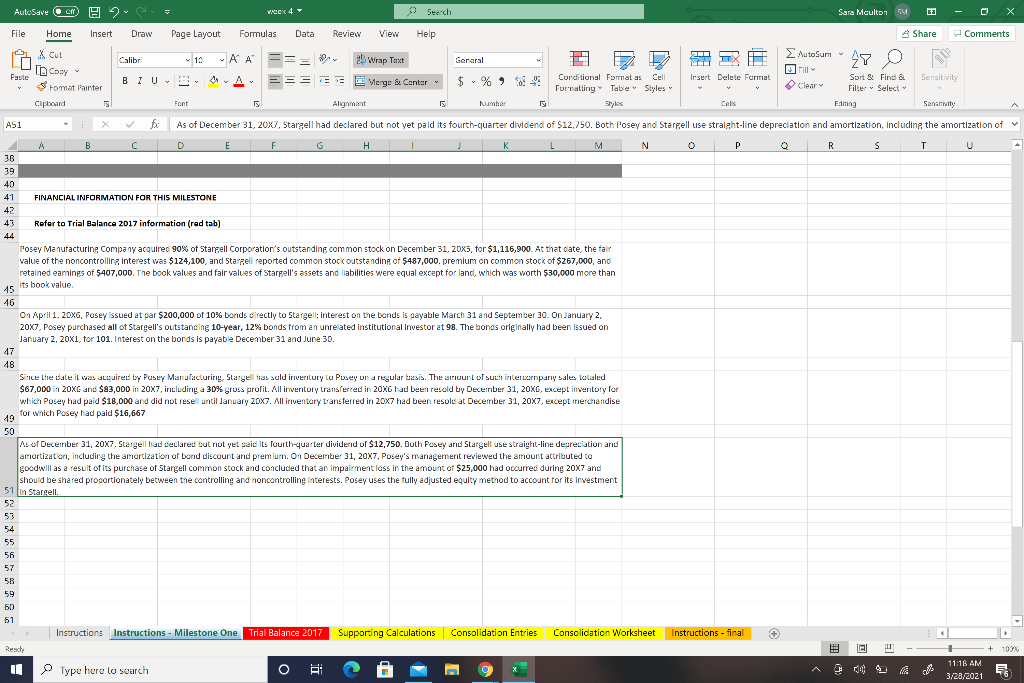

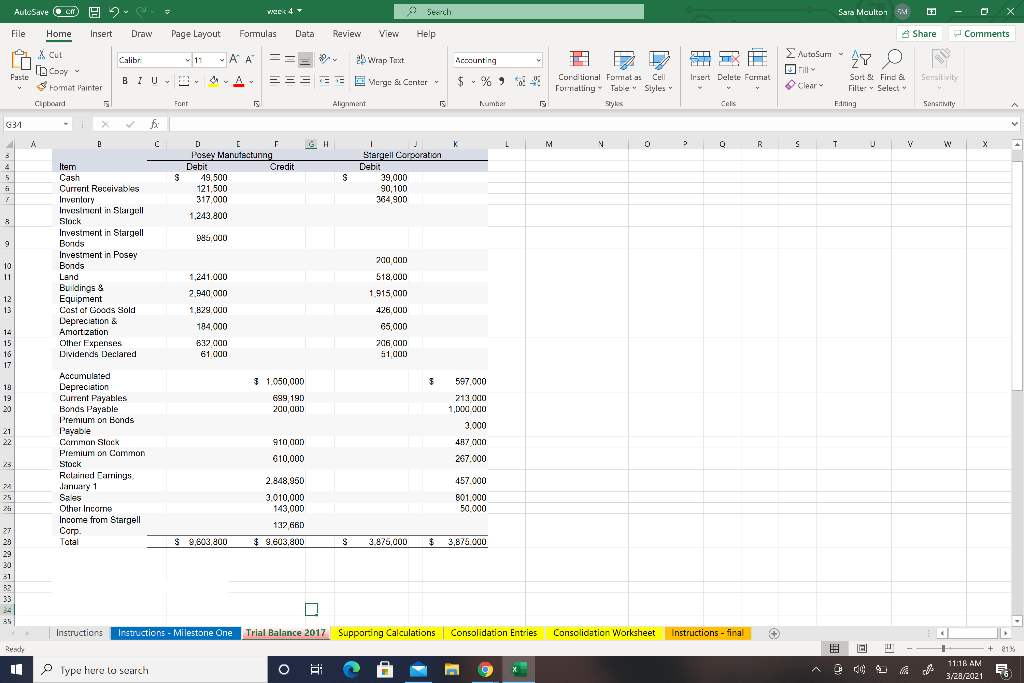

AutoSave 2 WACC 4 Sara Moulton 54 File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments Autosum Calibr 10 - A A Wrap Taxt General LA SLTX Insert Delete Format 29 0 X Cut [Copy Format Painter Cupboard 5 Fyste ===== Sensitivity Merge & Cantar y Conditional Formatas Cell Formatting Table Styles Clear Sort & Fine & Filter Select Editing Font F Alignment Nume Sanctity A51 As of December 31, 20X7, Stargell had declared but not yet paid its fourth-quarter dividend of $12.750. Both Posey and Starfell use stralaht-line depreciation and amortization, including the amortization of v R S T A B C D G . M N P P 36 39 40 FINANCIAL INFORMATION FOR THIS MILESTONE 42 Refer to Trial Balance 2017 information (rad tab) 44 rosey Manufacturing Company acquired 90% of Starfell Corporation's outstanding common stock on December 31, 20X5, for $1,116,900. At that cate, the falir value of the noncontrolling interest was $124,100, and Starzell reported common stock outstanding of 5487,000. premium on common stock of $267,000, and retained earnings of $407,000. The book values and fair values of Starpell's assets and liabilities were equal except for land, which was worth $30,000 more than 45 its book value 46 On April 1, 20X6, Posey issued at par $200,000 of 10% bonds directly to Stargell; interest on the bonds is payable March 31 and September 30. On January 2, 20X7, Posey purchased all of Stargell's outstanding 10-year, 12% bonds from an unreated institutional investor at 98. The bonds originally had been issued on January 2, 20x1, for 101. Interest on the bonds is payable December 31 and June 30. 47 48 Since the date it was acquired by Pusey Manufacturing, Slargell as sold invenitury Lu Pusey on a regular basis. The amount of such intercompany sales lolaled . $67,000 in 20XG and $83,000 in 20X7, including a 30% gross profit. All inventory transferred in 20XG had been resold by December 31, 20X6, except inventory for which Posey had paid $18,000 and did not resell until January 20X7. All inventory transferred in 20x7 had been resolo at December 31, 20X7, except merchandise 49 for wnich Posey had paid $16,667 50 As of December 31, 20x7. Stargell had declared but not yet paid its fourth-quarter dividend of $12,750. Both Posey and Stargell use straight-line depreciation and amortization, including the amortization of bond discount and premium on December 31, 20X7, Posey's management reviewed the amount attributed to goodwill as a result of its purchase of Stargell common stock and concluded that an impairment less in the amount of $25,000 had occurred during 2007 and should be shared proportionately between the controlling and noncontrolling interests. Posey uses the fully adjusted equity method to account for its investment in Stargell 52 53 54 55 56 57 58 59 60 61 Instructions Instructions - Milestone One Trial Balance 2017 Supporting Calculations Consolidation Entries Consolidation Worksheet Instructions - final 51 Resc el I Type here lo search + TON 11:18 AM . 3/28/2021 O Bi 9 AutoSaver 2. WACC 4 Sara Moulton 54 File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments AutoSum Calibr 1 - A Wrap Text Accounting SLITY 29 0 Fyste X Cut [Copy 3 Format Painter 5 Cupboard BIU A === * Merge Center Insert Delete Format Sensitivity LA Corditional Formats Cell Formatting Table Styles Styles Clear Sort & Find & Filter Select Editing Font F Alignment F Numhar Sanativity G31 > A D D C H K L M 0 3 0 R T v w 3 2 5 S D E F Pasey Manufactung Debit Credit 19.500 121.500 317,000 1.243.800 S Stargell Corporation Debit 39,000 90.100 384,900 3 986.000 9 Item Cash Current Receivables Inventory Investment in Slagell Slock Investment in Stargell Bonds Investment in Posey Bonds Land Buildings & Equipment Cast af Goods Sold Depreciation & Amortzation Other Expenses Dividends Declared 200 cop 10 11 12 13 1,241.000 2,940,000 1,829 000 194,000 532 000 61.000 518.000 1.915.000 426.000 65,000 206 COD 51,000 14 15 16 17 $ 597.000 19 19 20 $ 1.050.000 699 190 200,000 213.000 1.000.000 21 22 910 00D Accumulated Depreciation Current Payables Bonds Payable Premium on Bonds Payable Carman Stack Premium on Common Stock Rclaimed Carrings January 1 Sales Other Incarne Income from Stargell Corp. Total 3.000 487 000 267.000 610,000 23 24 25 26 2.848,950 3.010,000 143,000 132 660 457.000 801.000 50.000 $ 9,603.800 $ 9.603.800 S 3.875,000 $ 3,875.000 27 20 29 30 31 33 35 Instructions Instructions - Milestone One Trial Balance 2017 Supporting Calculations Consolidation Entries Consolidation Worksheet Instructions - final Reach C I Type here lo search - + 81% 11:18 AM 3/28/2021 6 O i 9 AutoSave 2 WACC 4 Sara Moulton 54 File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments Autosum Calibr 10 - A A Wrap Taxt General LA SLTX Insert Delete Format 29 0 X Cut [Copy Format Painter Cupboard 5 Fyste ===== Sensitivity Merge & Cantar y Conditional Formatas Cell Formatting Table Styles Clear Sort & Fine & Filter Select Editing Font F Alignment Nume Sanctity A51 As of December 31, 20X7, Stargell had declared but not yet paid its fourth-quarter dividend of $12.750. Both Posey and Starfell use stralaht-line depreciation and amortization, including the amortization of v R S T A B C D G . M N P P 36 39 40 FINANCIAL INFORMATION FOR THIS MILESTONE 42 Refer to Trial Balance 2017 information (rad tab) 44 rosey Manufacturing Company acquired 90% of Starfell Corporation's outstanding common stock on December 31, 20X5, for $1,116,900. At that cate, the falir value of the noncontrolling interest was $124,100, and Starzell reported common stock outstanding of 5487,000. premium on common stock of $267,000, and retained earnings of $407,000. The book values and fair values of Starpell's assets and liabilities were equal except for land, which was worth $30,000 more than 45 its book value 46 On April 1, 20X6, Posey issued at par $200,000 of 10% bonds directly to Stargell; interest on the bonds is payable March 31 and September 30. On January 2, 20X7, Posey purchased all of Stargell's outstanding 10-year, 12% bonds from an unreated institutional investor at 98. The bonds originally had been issued on January 2, 20x1, for 101. Interest on the bonds is payable December 31 and June 30. 47 48 Since the date it was acquired by Pusey Manufacturing, Slargell as sold invenitury Lu Pusey on a regular basis. The amount of such intercompany sales lolaled . $67,000 in 20XG and $83,000 in 20X7, including a 30% gross profit. All inventory transferred in 20XG had been resold by December 31, 20X6, except inventory for which Posey had paid $18,000 and did not resell until January 20X7. All inventory transferred in 20x7 had been resolo at December 31, 20X7, except merchandise 49 for wnich Posey had paid $16,667 50 As of December 31, 20x7. Stargell had declared but not yet paid its fourth-quarter dividend of $12,750. Both Posey and Stargell use straight-line depreciation and amortization, including the amortization of bond discount and premium on December 31, 20X7, Posey's management reviewed the amount attributed to goodwill as a result of its purchase of Stargell common stock and concluded that an impairment less in the amount of $25,000 had occurred during 2007 and should be shared proportionately between the controlling and noncontrolling interests. Posey uses the fully adjusted equity method to account for its investment in Stargell 52 53 54 55 56 57 58 59 60 61 Instructions Instructions - Milestone One Trial Balance 2017 Supporting Calculations Consolidation Entries Consolidation Worksheet Instructions - final 51 Resc el I Type here lo search + TON 11:18 AM . 3/28/2021 O Bi 9 AutoSaver 2. WACC 4 Sara Moulton 54 File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments AutoSum Calibr 1 - A Wrap Text Accounting SLITY 29 0 Fyste X Cut [Copy 3 Format Painter 5 Cupboard BIU A === * Merge Center Insert Delete Format Sensitivity LA Corditional Formats Cell Formatting Table Styles Styles Clear Sort & Find & Filter Select Editing Font F Alignment F Numhar Sanativity G31 > A D D C H K L M 0 3 0 R T v w 3 2 5 S D E F Pasey Manufactung Debit Credit 19.500 121.500 317,000 1.243.800 S Stargell Corporation Debit 39,000 90.100 384,900 3 986.000 9 Item Cash Current Receivables Inventory Investment in Slagell Slock Investment in Stargell Bonds Investment in Posey Bonds Land Buildings & Equipment Cast af Goods Sold Depreciation & Amortzation Other Expenses Dividends Declared 200 cop 10 11 12 13 1,241.000 2,940,000 1,829 000 194,000 532 000 61.000 518.000 1.915.000 426.000 65,000 206 COD 51,000 14 15 16 17 $ 597.000 19 19 20 $ 1.050.000 699 190 200,000 213.000 1.000.000 21 22 910 00D Accumulated Depreciation Current Payables Bonds Payable Premium on Bonds Payable Carman Stack Premium on Common Stock Rclaimed Carrings January 1 Sales Other Incarne Income from Stargell Corp. Total 3.000 487 000 267.000 610,000 23 24 25 26 2.848,950 3.010,000 143,000 132 660 457.000 801.000 50.000 $ 9,603.800 $ 9.603.800 S 3.875,000 $ 3,875.000 27 20 29 30 31 33 35 Instructions Instructions - Milestone One Trial Balance 2017 Supporting Calculations Consolidation Entries Consolidation Worksheet Instructions - final Reach C I Type here lo search - + 81% 11:18 AM 3/28/2021 6 O i 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started