I need to make sure my adjusting entries and adjusted trial is correct

I need help on my adjusted trial balance its not balancing?

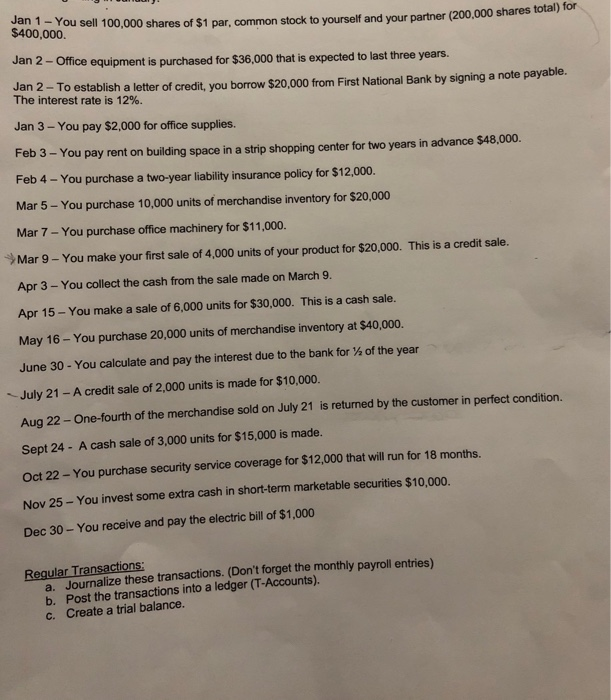

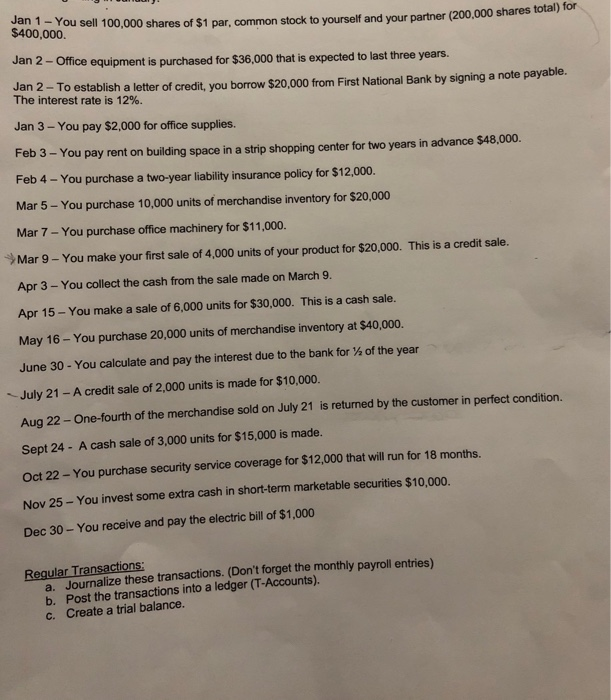

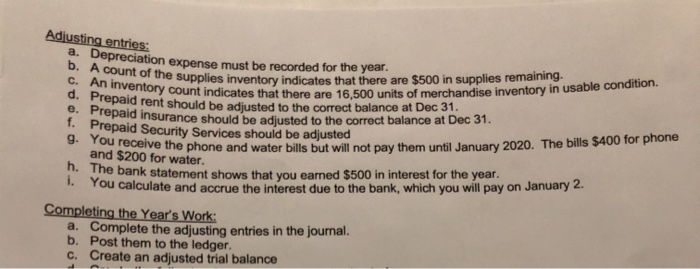

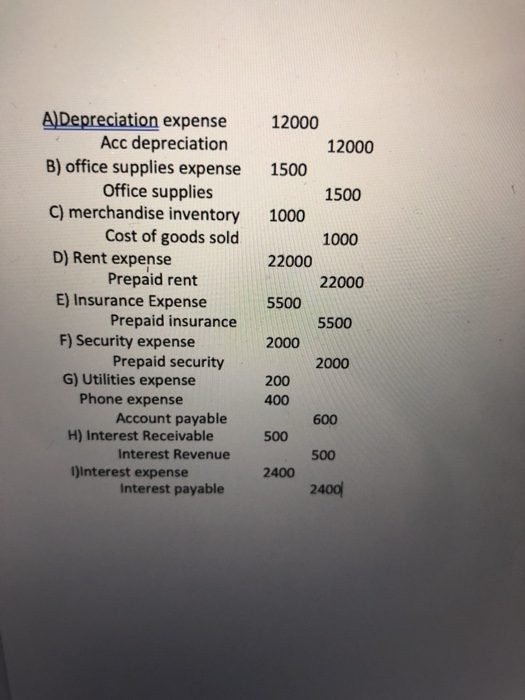

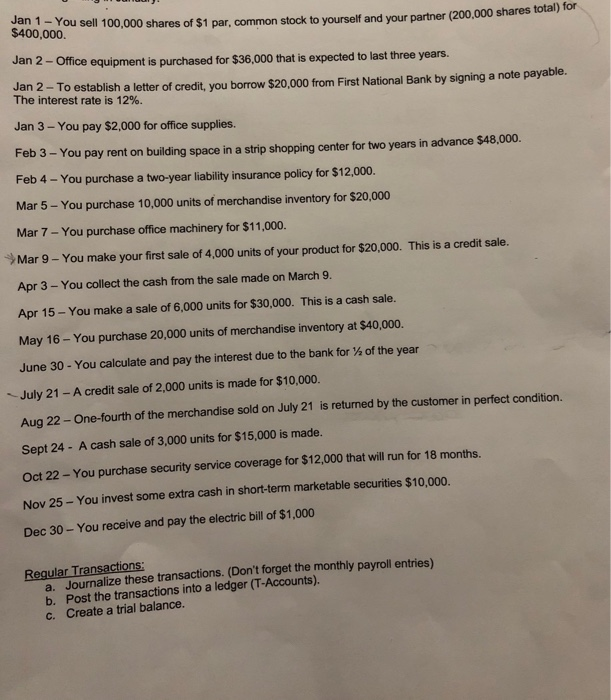

Jan 1 - You sell 100,000 shares of $1 par, common stock to yourself and your partner (200,000 shares total) for $400,000 Jan 2- Office equipment is purchased for $36,000 that is expected to last three years. Jan 2- To establish a letter of credit, you borrow $20,000 from First National Bank by signing a note payable. The interest rate is 12%. Jan 3 - You pay $2,000 for office supplies. Feb 3 - You pay rent on building space in a strip shopping center for two years in advance $48,000. Feb 4 - You purchase a two-year liability insurance policy for $12,000. Mar 5 - You purchase 10,000 units of merchandise inventory for $20,000 Mar 7 - You purchase office machinery for $11,000. Mar 9 - You make your first sale of 4,000 units of your product for $20,000. This is a credit sale. Apr 3 - You collect the cash from the sale made on March 9. Apr 15 - You make a sale of 6,000 units for $30,000. This is a cash sale. May 16 - You purchase 20,000 units of merchandise inventory at $40,000. June 30 - You calculate and pay the interest due to the bank for of the year July 21 - A credit sale of 2,000 units is made for $10,000. Aug 22 - One-fourth of the merchandise sold on July 21 is returned by the customer in perfect condition. Sept 24 - A cash sale of 3,000 units for $15,000 is made. Oct 22 - You purchase security service coverage for $12,000 that will run for 18 months. Nov 25 - You invest some extra cash in short-term marketable securities $10,000. Dec 30 - You receive and pay the electric bill of $1,000 Regular Transactions: a. Journalize these transactions. (Don't forget the monthly payroll entries) b. Post the transactions into a ledger (T-Accounts). c. Create a trial balance. a. Depreciation expense must be recorded for the year. C. An inventory count indicates that there are 16,500 units of merchandise inventory in usable condition. Adjusting entries: d. Prepaid rent should be adjusted to the correct balance at Dec 31. e Prepaid insurance should be adjusted to the correct balance at Dec 31. 9. Sou receive the phone and water bills but will not pay them until January 2020. The bills $400 for phone h. The bank statement shows that you earned $500 in interest for the year. 1. You calculate and accrue the interest due to the bank, which you will pay on January 2. Completing the Year's Work: a. Complete the adjusting entries in the journal. b. Post them to the ledger c. Create an adjusted trial balance A)Depreciation expense Acc depreciation B) office supplies expense Office supplies C) merchandise inventory Cost of goods sold D) Rent expense Prepaid rent E) Insurance Expense Prepaid insurance F) Security expense Prepaid security G) Utilities expense Phone expense Account payable H) Interest Receivable Interest Revenue 1)Interest expense Interest payable 12000 12000 1500 1500 1000 1000 22000 22000 5500 5500 2000 2000 200 400 600 500 500 2400 2400 Jan 1 - You sell 100,000 shares of $1 par, common stock to yourself and your partner (200,000 shares total) for $400,000 Jan 2- Office equipment is purchased for $36,000 that is expected to last three years. Jan 2- To establish a letter of credit, you borrow $20,000 from First National Bank by signing a note payable. The interest rate is 12%. Jan 3 - You pay $2,000 for office supplies. Feb 3 - You pay rent on building space in a strip shopping center for two years in advance $48,000. Feb 4 - You purchase a two-year liability insurance policy for $12,000. Mar 5 - You purchase 10,000 units of merchandise inventory for $20,000 Mar 7 - You purchase office machinery for $11,000. Mar 9 - You make your first sale of 4,000 units of your product for $20,000. This is a credit sale. Apr 3 - You collect the cash from the sale made on March 9. Apr 15 - You make a sale of 6,000 units for $30,000. This is a cash sale. May 16 - You purchase 20,000 units of merchandise inventory at $40,000. June 30 - You calculate and pay the interest due to the bank for of the year July 21 - A credit sale of 2,000 units is made for $10,000. Aug 22 - One-fourth of the merchandise sold on July 21 is returned by the customer in perfect condition. Sept 24 - A cash sale of 3,000 units for $15,000 is made. Oct 22 - You purchase security service coverage for $12,000 that will run for 18 months. Nov 25 - You invest some extra cash in short-term marketable securities $10,000. Dec 30 - You receive and pay the electric bill of $1,000 Regular Transactions: a. Journalize these transactions. (Don't forget the monthly payroll entries) b. Post the transactions into a ledger (T-Accounts). c. Create a trial balance. a. Depreciation expense must be recorded for the year. C. An inventory count indicates that there are 16,500 units of merchandise inventory in usable condition. Adjusting entries: d. Prepaid rent should be adjusted to the correct balance at Dec 31. e Prepaid insurance should be adjusted to the correct balance at Dec 31. 9. Sou receive the phone and water bills but will not pay them until January 2020. The bills $400 for phone h. The bank statement shows that you earned $500 in interest for the year. 1. You calculate and accrue the interest due to the bank, which you will pay on January 2. Completing the Year's Work: a. Complete the adjusting entries in the journal. b. Post them to the ledger c. Create an adjusted trial balance A)Depreciation expense Acc depreciation B) office supplies expense Office supplies C) merchandise inventory Cost of goods sold D) Rent expense Prepaid rent E) Insurance Expense Prepaid insurance F) Security expense Prepaid security G) Utilities expense Phone expense Account payable H) Interest Receivable Interest Revenue 1)Interest expense Interest payable 12000 12000 1500 1500 1000 1000 22000 22000 5500 5500 2000 2000 200 400 600 500 500 2400 2400