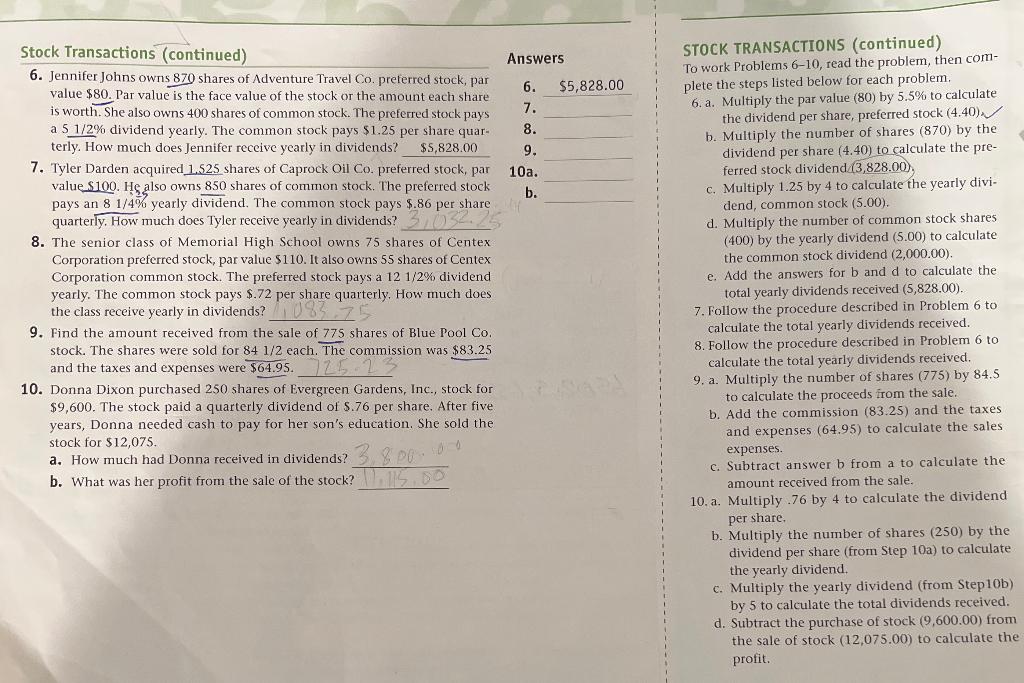

i need to solve these problems from 1-10 with explanation and the instructions to how solve these questions are on the side of each pages

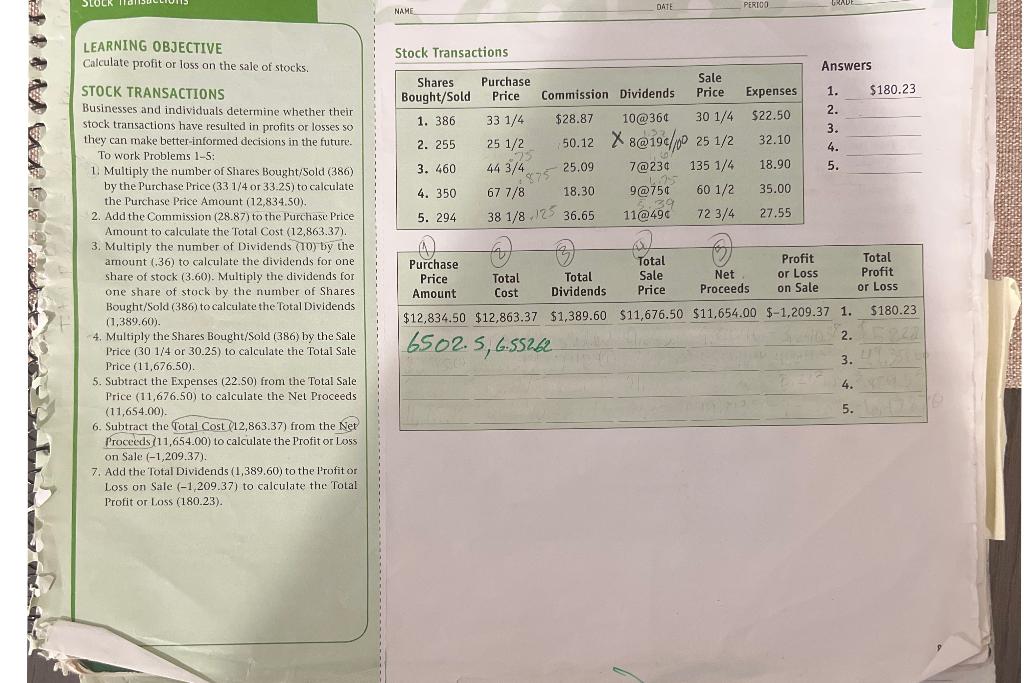

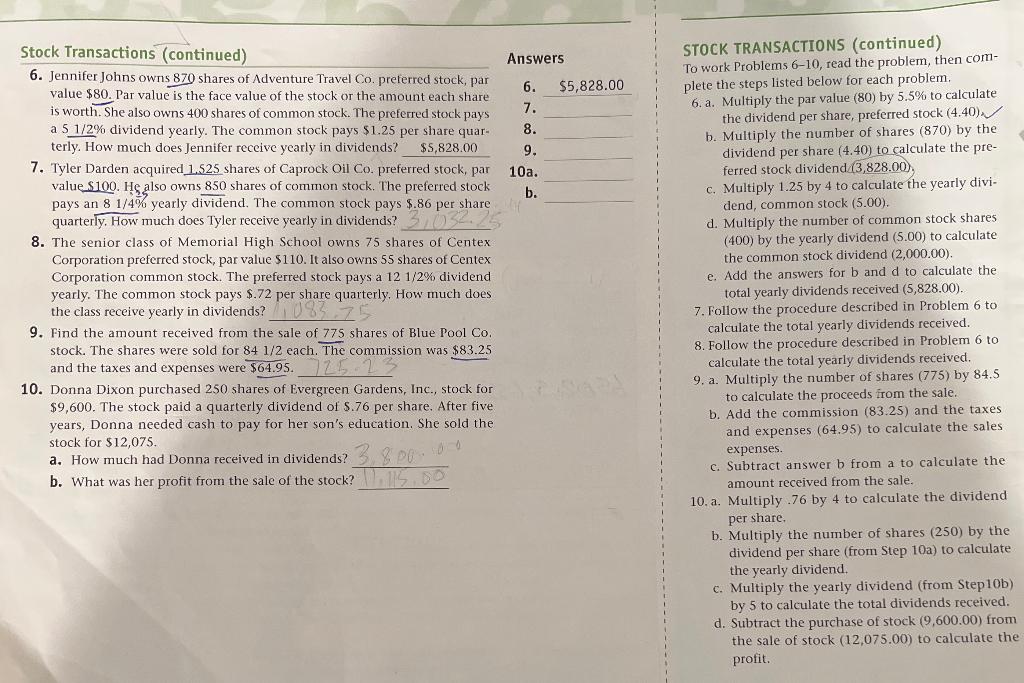

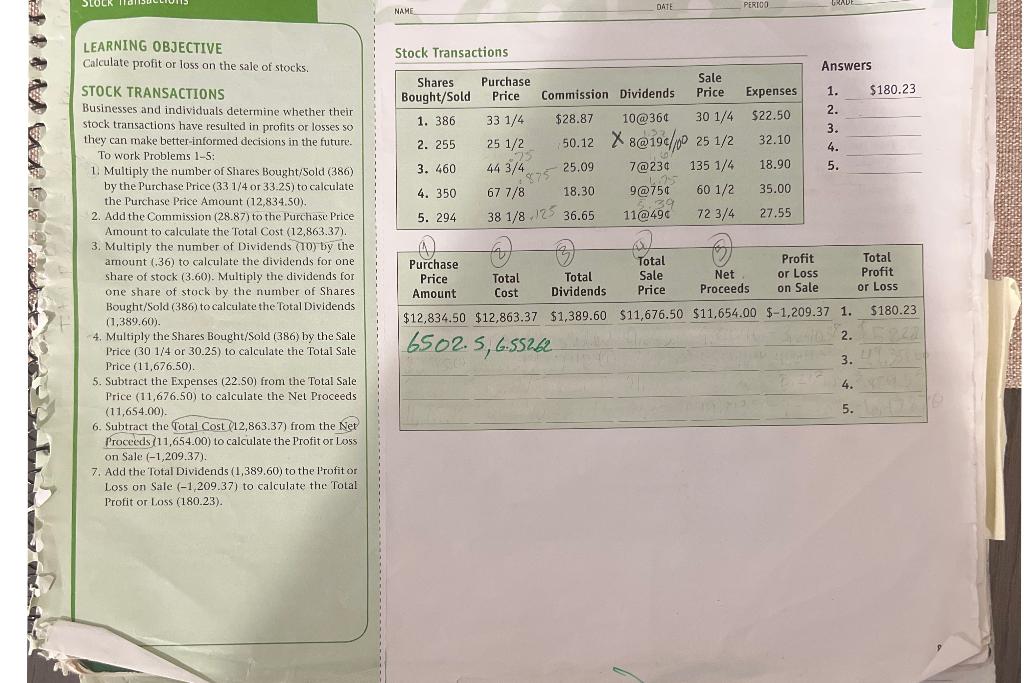

LEARNING OBJECTIVE Stock Transactions Calculate profit or loss on the sale of stocks. Answers STOCK TRANSACTIONS 1. $180.23 Businesses and individuals determine whether their 2. stock transactions have resulted in profits or losses so 3. they can make better-informed decisions in the future. 4. To work Problems 1-5: 1. Multiply the number of Shares Bought/Sold (386) 5. by the Purchase Price (33 1/4 or 33.25 ) to calculate the Purchase Price Amount (12,834.50). 2. Add the Commission (28.87) to the Purchase Price Amount to calculate the Total Cost (12,863.37). 3. Multiply the number of Dividends (10) by the amount (.36) to calculate the dividends for one share of stock (3.60). Multiply the dividends for one share of stock by the number of Shares Bought/Sold (386) to calculate the Total Dividends (1,389,60). 4. Multiply the Shares Bought/Sold (386) by the Sale Price (30 1/4 or 30.25 ) to calculate the Totai Sale Price (11,676.50). 5. Subtract the Expenses (22.50) from the Total Sale Price (11,676.50) to calculate the Net Proceeds (11,654.00). 6. Subtract the Total Cost 12,863.37 ) from the Net Proceeds (11,654.00) to calculate the Profit or Loss on Sale (1,209.37). 7. Add the Total Dividends (1,389,60) to the Profit or Loss on Sale (1,209.37) to calculate the Total Profit or Loss (180.23). Stock Transactions (continued) STOCK TRANSACTIONS (continued) Answers 6. Jennifer Johns owns 870 shares of Adventure Travel Co. preterred stock, par To work Problems 6-10, read the problem, then comvalue $80. Par value is the face value of the stock or the amount each share 6. $5,828.00 plete the steps listed below for each problem. is worth. She also owns 400 shares of common stock. The preferred stock pays 7. 6. a. Multiply the par value (80) by 5.5% to calculate a 51/2% dividend yearly. The common stock pays $1.25 per share quar- 8 . b. Multiply the number of shares (870) by the terly. How much does Jennifer receive yearly in dividends? $5,828.009. 7. Tyler Darden acquired 1.525 shares of Caprock Oil Co. preferred stock, par 10 . dividend per share (4.40) to calculate the preferred stock dividend (3,828.00). value $100. He also owns 850 shares of common stock. The preferred stock c. Multiply 1.25 by 4 to calculate the yearly divipays an 81/4% yearly dividend. The common stock pays $.86 per share b. dend, common stock (5.00). quarterly. How much does Tyler receive yearly in dividends? d. Multiply the number of common stock shares 8. The senior class of Memorial High School owns 75 shares of Centex (400) by the yearly dividend (5.00) to calculate Corporation preferred stock, par value $110. It also owns 55 shares of Centex the common stock dividend (2,000.00). Corporation common stock. The preferred stock pays a 121/2% dividend e. Add the answers for b and d to calculate the yearly. The common stock pays $.72 per share quarterly. How much does total yearly dividends received (5,828.00). the class receive yearly in dividends? 7. Follow the procedure described in Problem 6 to 9. Find the amount received from the sale of 775 shares of Blue Pool Co. calculate the total yearly dividends received. stock. The shares were sold for 841/2 each. The commission was $83.25 8. Follow the procedure described in Problem 6 to and the taxes and expenses were $64.95. calculate the total yearly dividends received. 10. Donna Dixon purchased 250 shares of Evergreen Gardens, Inc., stock for 9. a. Multiply the number of shares (775) by 84.5 $9,600. The stock paid a quarterly dividend of $.76 per share. After five to calculate the proceeds from the sale. b. Add the commission (83.25) and the taxes years, Donna needed cash to pay for her son's education. She sold the and expenses (64.95) to calculate the sales stock for $12,075. a. How much had Donna received in dividends? expenses. c. Subtract answer b from a to calculate the b. What was her profit from the sale of the stock? amount received from the sale. 10. a. Multiply 76 by 4 to calculate the dividend per share. b. Multiply the number of shares (250) by the dividend per share (from Step 10a) to calculate the yearly dividend. c. Multiply the yearly dividend (from Step 10b) by 5 to calculate the total dividends received. d. Subtract the purchase of stock (9,600.00) from the sale of stock (12,075.00) to calculate the profit