I need typed precise steps for requirement 2 and 3

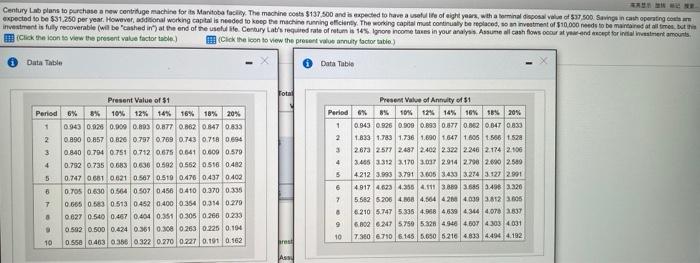

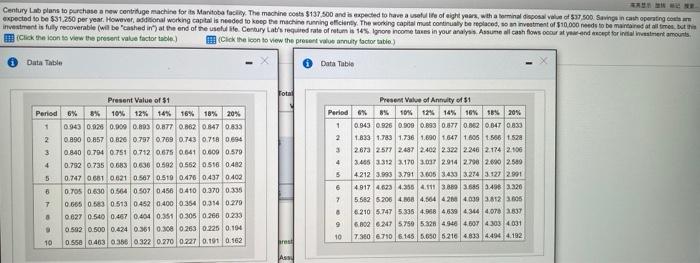

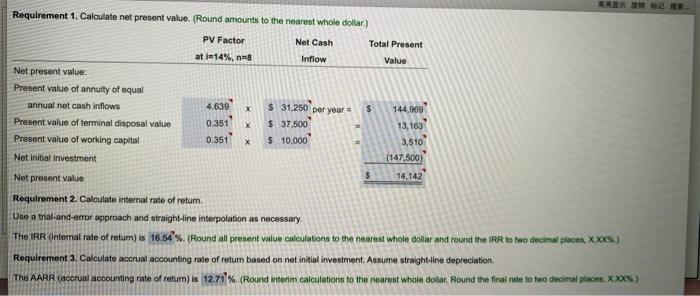

Century Lab plans to purchase a new centrifuge machine for is Manitoba facility. The machine costs $137.500 and is expected to have a set of eight years, the terminal disposal value of 537.000 Savingen choperating expected to be $31.250 per year. However, additional working capital is needed to keep the machine running elicity. The working capital must continually be replaced, som investment of $10.000 needs to be marred at all times, but investment is fully recoverable (will be caushed int") at the end of the use He Century Lat's required rate of retum la 145gnorencome taxes in your analys Amune di cash flows occur atywand recept for intl Wassinent amounts Click the loon to the present value factor table) Click the icon to view the presente annuity factor tablo Data Table Data Table Total Present Value of $1 Period 6% 8% 10% 12% 14% 16% 18% 20% 1 0943 0:32 0,909 0.803 0.877 0.862 0.847 0.833 2 0 890 0.857 0.820 07070709 0743 071 0.694 3 0840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 4 0.752 0.735 0683 0.636 0.592 0.562 0.516 0.482 5 0.747 0.6510621 0.587 0.510 0.470 0.437 0.402 8 0.705 0.630 S 0.57 0.456 0.410 0.370 0.335 7 0.665 0.68 0.513 0.452 0.400 0.364 0.31 0.279 0 0.627 0.540 0.467 0,404 0.351 0.305 0.206 0233 0.502 0.500 0.424 0.36103000263 0.225 0.194 10 0.55 0.463 360322 0.270 0.227 0.19 0.162 Present Value of Annuity of 1 Period 8% 10% 12% 14% 10% 10% 20% + 0.943 0.326 0.909 0.893 0.877 0.862 0047 0.833 2 1890 1783 1738 1.690 1647 1606 1.566. sza 3 2673 2577 2.487 2.402 2322 2246 2174 2.406 4 3.465 3.312 31703.007 2.914 2.708 2.660 2580 5 4.212 3.995 3.791 3.605 3430 3.274 31272901 6 4017 4.623 4.355 4.111 3.80 3.560.498 3.320 7 5582 5206 MB 4.664 424030 3123005 8 6210 5.747 5335 40 454 40 9 6.802 62475750 5328 45484607 430314091 10 7.350 6710 6.145.650 6.216 4833 4.49 4.192 Requirement 1. Calculate net present value. (Round amounts to the nearest whole dollar) PV Factor Net Cash Total Present at 1-14%, n=8 Inflow Value Net present value: Present value of annuity of equal annual net cash inflows 4.639 x $ 31,250 per year S 144.959 Present value of terminal disposal value 0.351 x $ 37.500 13,163 Present value of working capital 0.351 $ 10,000 3,510 Net initial investment (147,500) Net present value 14.142 Requirement 2. Calculate internal rate of retur, Use a trial-and-error approach and straight-line interpolation as necessary The IRR (Internal rate of retum) is 16.54%. (Round all prosent value calculations to the nearest whole dollar and round the IRR to two decimal places. XXX) Requirement 3. Calculate accrual accounting rate of return based on net initial investment. Assume straight-line depreciation The AARR (accrual accounting rate of return) is 12.71% (Round Interim calculations to the nearest whole doilar. Round the final rate to to decimal places, xxx