Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need ur help question 2 principle of finance te.pdf Open with (TOTAL: 25 MARKS) Question 2 a) What are the two (2) advantages of

i need ur help question 2 principle of finance

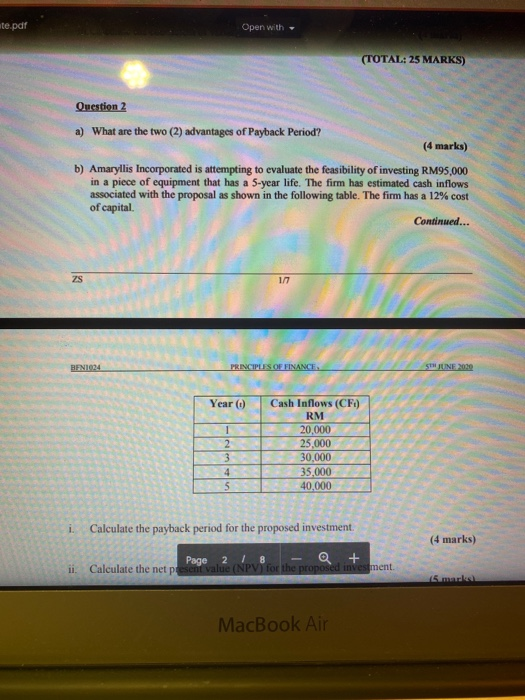

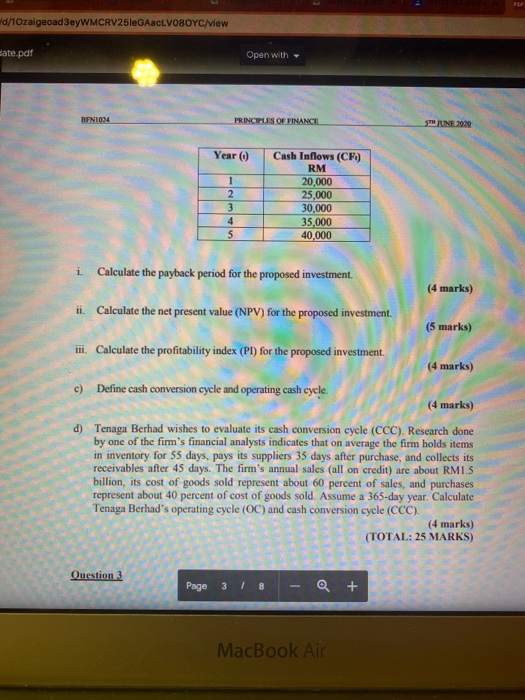

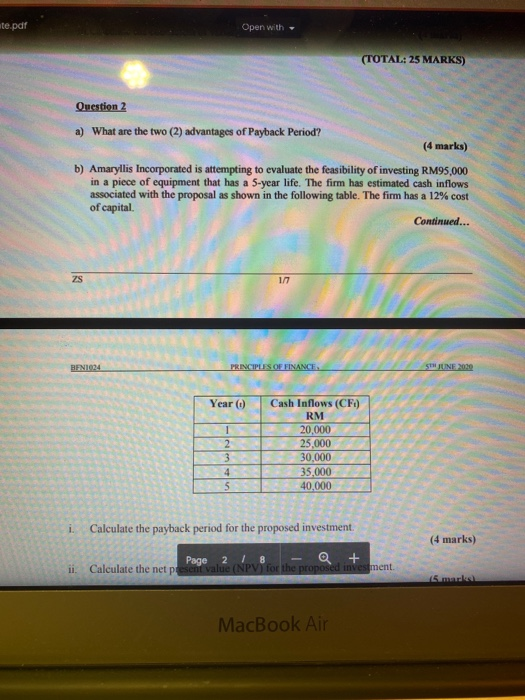

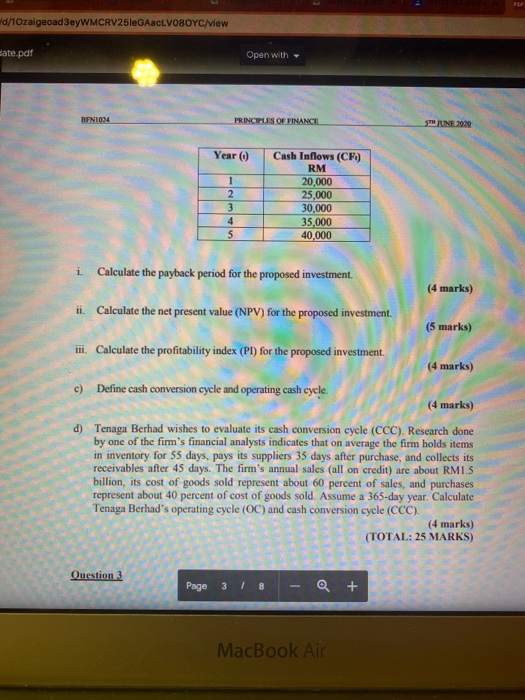

te.pdf Open with (TOTAL: 25 MARKS) Question 2 a) What are the two (2) advantages of Payback Period? (4 marks) b) Amaryllis Incorporated is attempting to evaluate the feasibility of investing RM95,000 in a piece of equipment that has a 5-year life. The firm has estimated cash inflows associated with the proposal as shown in the following table. The firm has a 12% cost of capital Continued... zs 177 BEN1024 PRINCIPLES OF FINANCE 5TH JUNE 2020 Year (0) 1 2 3 4 5 Cash Inflows (CF) RM 20,000 25,000 30,000 35,000 40.000 i. Calculate the payback period for the proposed investment (4 marks) Page 28 a + ii. Calculate the net present value (NPV) for the proposed investment. 5.marks MacBook Air FIF d/10zaigeoad 3eyWMCRV 25leGAacLVOBOYC/view Bate.pdf Open with BENI034 PRINCIPLES OF FINANCE THUNE 2020 Year 1 - Cash Inflows (CF) RM 20,000 25,000 30,000 35,000 40,000 i. Calculate the payback period for the proposed investment. (4 marks) ii. Calculate the net present value (NPV) for the proposed investment. (5 marks) ii. Calculate the profitability index (PI) for the proposed investment. (4 marks) c) Define cash conversion cycle and operating cash cycle. (4 marks) d) Tenaga Berhad wishes to evaluate its cash conversion cycle (CCC), Research done by one of the firm's financial analysts indicates that on average the firm holds items in inventory for 55 days, pays its suppliers 35 days after purchase, and collects its receivables after 45 days. The firm's annual sales (all on credit) are about RM1.5 billion, its cost of goods sold represent about 60 percent of sales, and purchases represent about 40 percent of cost of goods sold. Assume a 365-day year. Calculate Tenaga Berhad's operating cycle (OC) and cash conversion cycle (CCC). (4 marks) (TOTAL: 25 MARKS) Question 3 Page 3 / 8 - Q + MacBook Air te.pdf Open with (TOTAL: 25 MARKS) Question 2 a) What are the two (2) advantages of Payback Period? (4 marks) b) Amaryllis Incorporated is attempting to evaluate the feasibility of investing RM95,000 in a piece of equipment that has a 5-year life. The firm has estimated cash inflows associated with the proposal as shown in the following table. The firm has a 12% cost of capital Continued... zs 177 BEN1024 PRINCIPLES OF FINANCE 5TH JUNE 2020 Year (0) 1 2 3 4 5 Cash Inflows (CF) RM 20,000 25,000 30,000 35,000 40.000 i. Calculate the payback period for the proposed investment (4 marks) Page 28 a + ii. Calculate the net present value (NPV) for the proposed investment. 5.marks MacBook Air FIF d/10zaigeoad 3eyWMCRV 25leGAacLVOBOYC/view Bate.pdf Open with BENI034 PRINCIPLES OF FINANCE THUNE 2020 Year 1 - Cash Inflows (CF) RM 20,000 25,000 30,000 35,000 40,000 i. Calculate the payback period for the proposed investment. (4 marks) ii. Calculate the net present value (NPV) for the proposed investment. (5 marks) ii. Calculate the profitability index (PI) for the proposed investment. (4 marks) c) Define cash conversion cycle and operating cash cycle. (4 marks) d) Tenaga Berhad wishes to evaluate its cash conversion cycle (CCC), Research done by one of the firm's financial analysts indicates that on average the firm holds items in inventory for 55 days, pays its suppliers 35 days after purchase, and collects its receivables after 45 days. The firm's annual sales (all on credit) are about RM1.5 billion, its cost of goods sold represent about 60 percent of sales, and purchases represent about 40 percent of cost of goods sold. Assume a 365-day year. Calculate Tenaga Berhad's operating cycle (OC) and cash conversion cycle (CCC). (4 marks) (TOTAL: 25 MARKS) Question 3 Page 3 / 8 - Q + MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started