Answered step by step

Verified Expert Solution

Question

1 Approved Answer

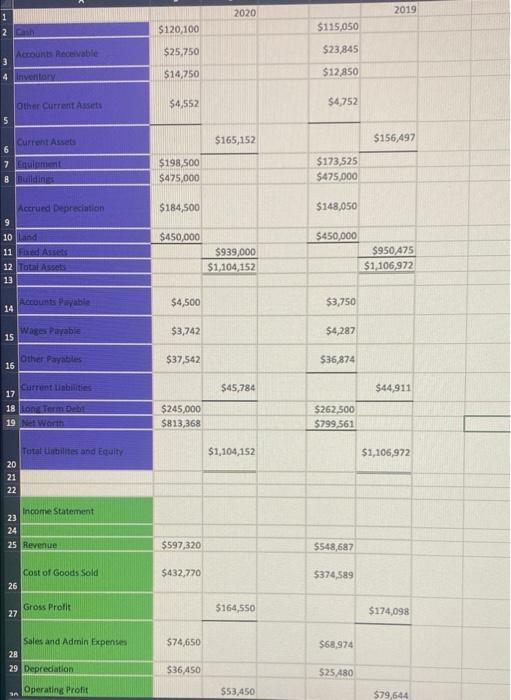

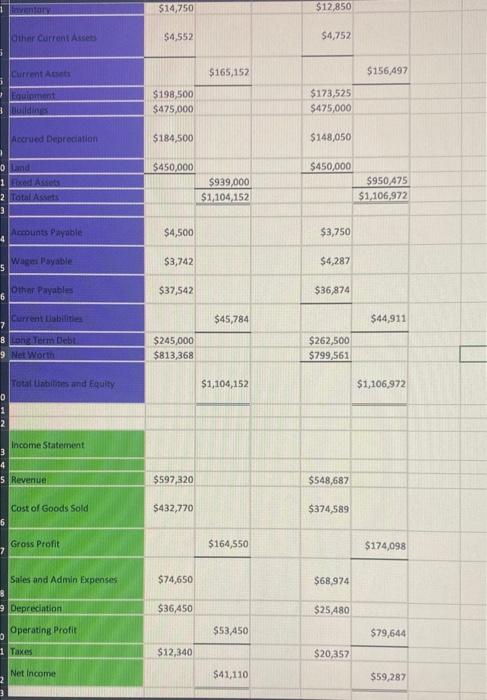

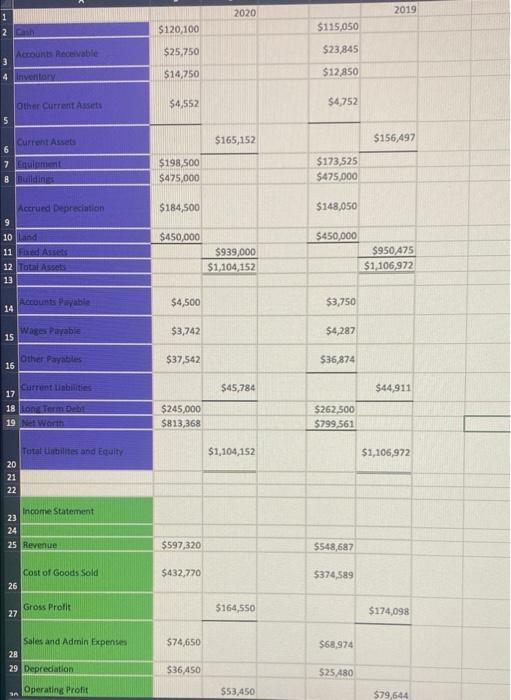

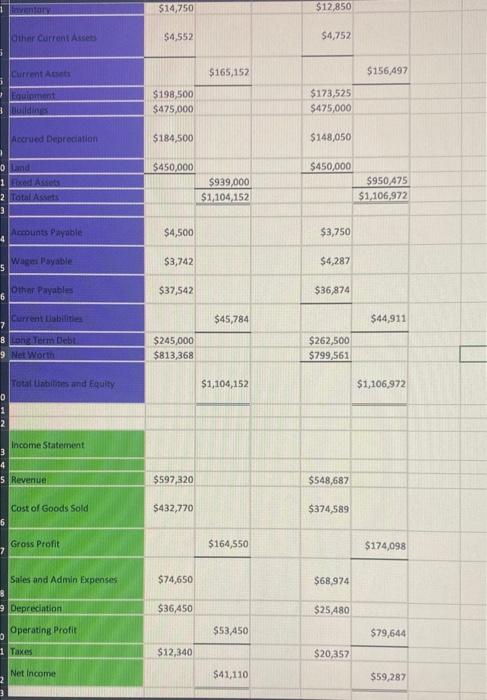

i need you to plz make a statement of cashflows with the information given in the balance sheet and income statement 2020 2019 1 2

i need you to plz make a statement of cashflows with the information given in the balance sheet and income statement

2020 2019 1 2 Cash N- $120,100 $115,050 $25,750 $23,845 Accounts Receivable 4 Inventory $14,750 $12,850 Other Current Assets $4,552 $4,752 5 Current Assets $165,152 $156,497 7 Equipment B Building $198.500 $475,000 $173,525 $475.000 Accrued Depreciation $184,500 $148,050 9 10 Land 11 Fed Assets 12 Total Assets 13 $450,000 $939,000 $1,104,152 $450,000 $950 475 $1,106,972 Account Payable $4,500 $3,750 14 Wages Payable 15 $3,742 $4,287 Other Payables 16 $37,542 $36,874 17 Current Libilities $45,784 $44,911 18 Long Term Debt 19 Net Worth $245,000 $813,368 $262,500 $799,561 $1,104,152 $1,106,972 Total bites and Equity 20 21 22 Income Statement 23 24 25 Revenue $597,320 $548,687 Cost of Goods Sold $432,770 $374,589 26 Gross Profit 27 $164,550 $174,098 $74,650 $68974 Sales and Admin Expenses 28 29 Deprecation $36.450 $25 480 Operating Profit SA $53,450 $79,644 1 leto $14,750 $12,850 Other Current Access $4,552 $4,752 Current Att $165,152 $156497 Equine 3 buildings $198,500 $475,000 $173,525 $475,000 Accrued Depreciation $184,500 $ 148,050 $450,000 o Land 1 xed Asset 2 Total Ass 3 $939,000 $1,104,152 $450,000 $950 475 $1,106,972 Accounts Payable $4,500 $3,750 Wages Payable $3,742 $4,287 Other Payables $37,542 $36,874 6 $45,784 $44,911 Current Liabilita 7 B Long Term Debt 9 Net Worth $245,000 $813,368 $262,500 $799,561 $1,104,152 $1,106,972 Total abilities and Equity 0 1 2 Income Statement 4 5 Revenue $597,320 $548,687 Cost of Goods Sold $432,770 $374,589 6 Gross Profit $164,550 $174,098 Sales and Admin Expenses $74,650 $68,974 9 Depreciation $36,450 $25,480 Operating Profit $53,450 $79,644 1 Taxes $12,340 $20,357 Net Income $41,110 $59,287

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started