I need your input here

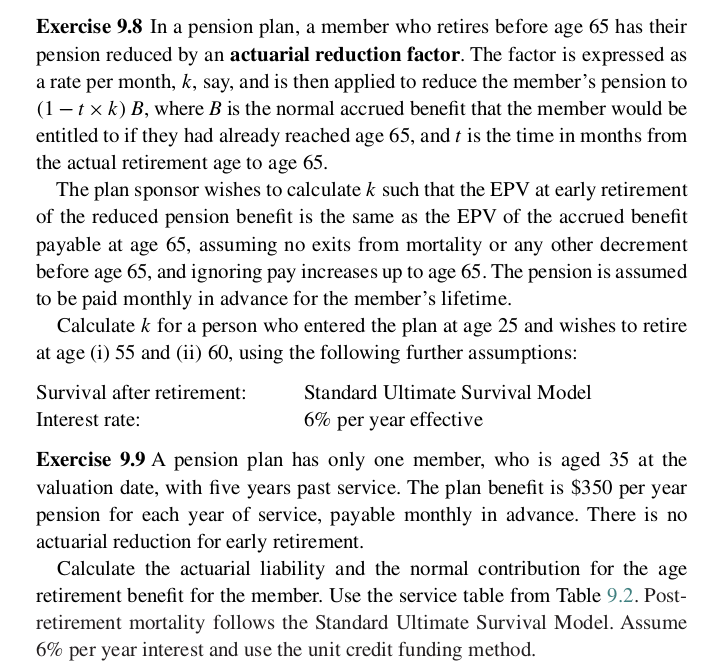

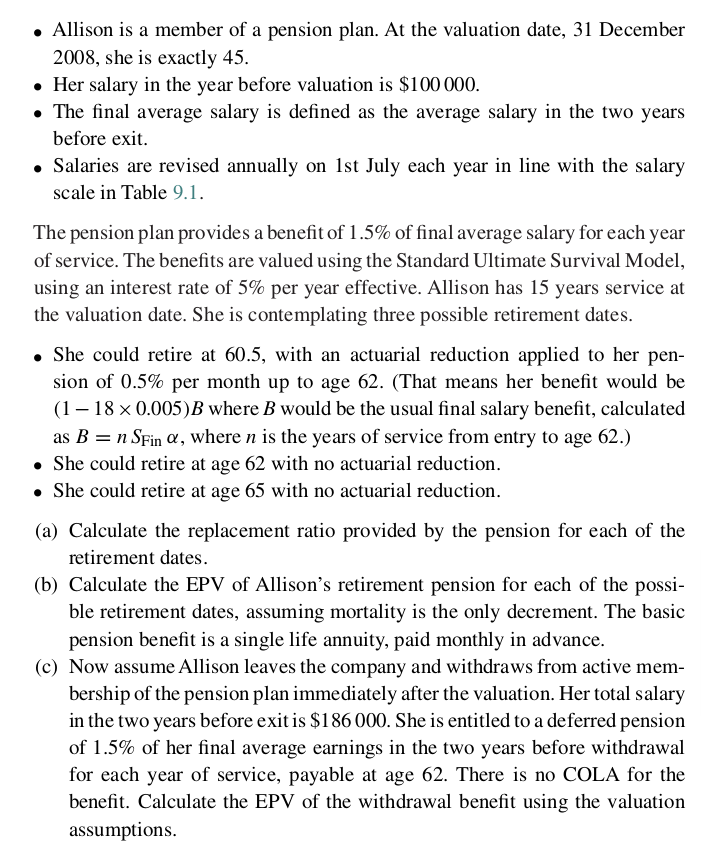

. Allison is a member of a pension plan. At the valuation date, 31 December 2008, she is exactly 45. . Her salary in the year before valuation is $100 000. . The final average salary is defined as the average salary in the two years before exit. . Salaries are revised annually on Ist July each year in line with the salary scale in Table 9.1. The pension plan provides a benefit of 1.5% of final average salary for each year of service. The benefits are valued using the Standard Ultimate Survival Model, using an interest rate of 5% per year effective. Allison has 15 years service at the valuation date. She is contemplating three possible retirement dates. . She could retire at 60.5, with an actuarial reduction applied to her pen- sion of 0.5% per month up to age 62. (That means her benefit would be (1 - 18 x 0.005) B where B would be the usual final salary benefit, calculated as B = n SFin a, where n is the years of service from entry to age 62.) . She could retire at age 62 with no actuarial reduction. . She could retire at age 65 with no actuarial reduction. (a) Calculate the replacement ratio provided by the pension for each of the retirement dates. (b) Calculate the EPV of Allison's retirement pension for each of the possi- ble retirement dates, assuming mortality is the only decrement. The basic pension benefit is a single life annuity, paid monthly in advance. (c) Now assume Allison leaves the company and withdraws from active mem- bership of the pension plan immediately after the valuation. Her total salary in the two years before exit is $186 000. She is entitled to a deferred pension of 1.5% of her final average earnings in the two years before withdrawal for each year of service, payable at age 62. There is no COLA for the benefit. Calculate the EPV of the withdrawal benefit using the valuation assumptions.Exercise 9.3 In a pension plan, a member who retires before age 65 has their pension reduced by an actuarial reduction factor. The factor is expressed as a rate per month, k, say, and is then applied to reduce the member's pension to (l r x k) B, where Bis the normal accrued benet that the member would be entitled to if they had already reached age 65, and r is the time in months from the actual retirement age to age 65. The plan sponsor wishes to calculate it such that the EPV at early retirement of the reduced pension benet is the same as the EPV of the accrued benet payable at age 65, assuming no exits from mortality or any other decrement before age 65, and ignoring pay increases up to age 65. The pension is assumed to be paid monthly in advance for the member's lifetime. Calculate k for a person who entered the plan at age 25 and wishes to retire at age (i) 55 and (ii) 60, using the following further assumptions: Survival after retirement: Standard Ultimate Survival Model Interest rate: 6% per year effective Exercise 9.9 A pension plan has only one member, who is aged 35 at the valuation date, with ve years past service. The plan benet is $350 per year pension for each year of service, payable monthly in advance. There is no actuarial reduction for early retirement. Calculate the actuarial liability and the normal contribution for the age retirement benet for the member. Use the service table from Table 9.2. Post- retirement mortality follows the Stande Ultimate Survival Model. Assume 6% per year interest and use the unit credit funding method. {i} the age nearest birthday {which is regarded as the member's exact age] at the valuation date, {ii} the annual salary rate at the valuation date, and {iii} the total past earnings in service {prior to the valuation date.) For each age, the totals of {ii} and {iii} are recorded and the following is an extract from the data. Age :1: No. of members Total past earnings rTotal of annual salary aged .1: for members aged I rates for members aged 3 ' ' Assuming that the basis of the Tables provided is appropriate, nd the liability at the valuation date for the benets payable to the members aged 25, and determine whether the future contributions payable in respect of these members are more or less than sufcient to cover the benets. A pension scheme provides each member who retires {for any reason] with annual pension equal to 5% x nal salary per year of service. Final salary is the average income over the last 3 years of service, and fractions of a year of service are 1E included when calculating the pension. Assuming that equal contributions are payable by the member and his employer, that in the event of death in service a benet is payable equal to the return without interest of both the member's and the employer's contributions, and that in the event of withdrawal from service a return without interest is made of the member's contributions, calculate the appropriate contribution rate payable by both the member and his employer in respect of a new entrant aged 4t}. You are consulting actuary to a small pension scheme, which has just been established. You have decided to use the pension fund tables in Formulae and Tables for Actuarial Examinations as the basis for all calculations. The scheme provides the following benets to employees: {i} on retirement {for illhealth reasons or otherwise], a pension of 315th of annual pension able salary, averaged over the previous three years, for each year of future service including fractions; {ii} on withdrawal or death in service, a return of the member's contributions, accumulated at 3% per annum compound interest. Employees contribute 2%. of salary to the scheme. Pensionable salary is dened as salary less i'dml. Salaries are revised continuously, and contributions are made continuously. Details of the current membership are as follows. member age current salary rate {.5} 1 45 351W 2 45 251W 3 35 15,300 4 35 151% {a} The employer has decided to contribute the proportion of total salaries which, together with the employees" contributions, will exactly pay for the benets. Calculate the employers contribution rate. {b} A new employee, aged 35 and with current salary rate 8,133}, is about to be hired. Calculate the surplus or deciency in the pension fund after this new member joins