Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i neeed help with Questions 1-3 Question 1. Carraway Seed Company is issuing a $1,000 par value bond that pays 8 percent annual interest and

i neeed help with Questions 1-3

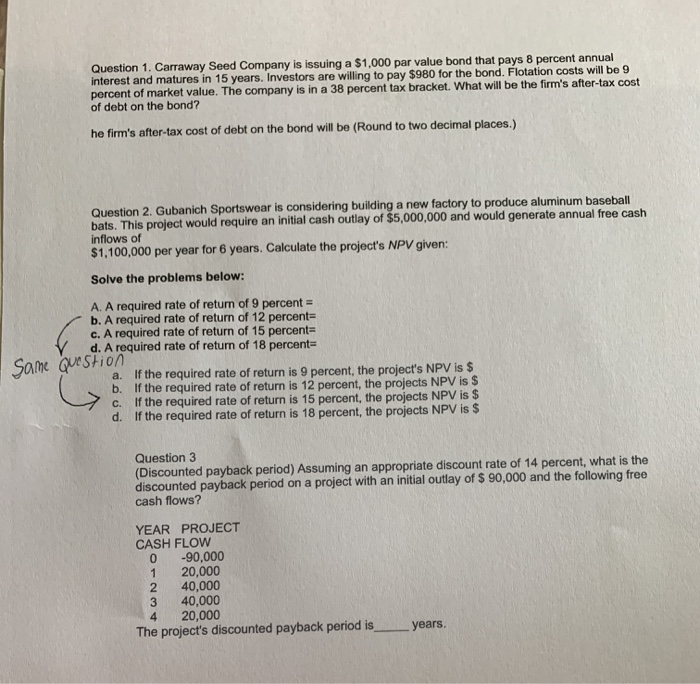

Question 1. Carraway Seed Company is issuing a $1,000 par value bond that pays 8 percent annual interest and matures in 15 years. Investors are willing to pay $980 for the bond. Flotation costs will be 9 percent of market value. The company is in a 38 percent tax bracket. What will be the firm's after-tax cost of debt on the bond? he firm's after-tax cost of debt on the bond will be (Round to two decimal places.) Question 2. Gubanich Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $5,000,000 and would generate annual free cash inflows of $1,100,000 per year for 6 years. Calculate the project's NPV given: Solve the problems below: A. A required rate of return of 9 percent = b. A required rate of return of 12 percent= c. A required rate of return of 15 percent= d. A required rate of return of 18 percent Same question a. If the required rate of return is 9 percent, the project's NPV is $ b. If the required rate of return is 12 percent, the projects NPV is $ C. If the required rate of return is 15 percent, the projects NPV is $ d. If the required rate of return is 18 percent, the projects NPV is $ Question 3 (Discounted payback period) Assuming an appropriate discount rate of 14 percent, what is the discounted payback period on a project with an initial outlay of $ 90,000 and the following free cash flows? YEAR PROJECT CASH FLOW -90,000 1 20,000 2 40,000 3 40,000 4 20,000 The project's discounted payback period is__ years Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started