Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*i nned help filling out the 1040, schedule 1 and schedule 8812 Note: This problem is for the 2022 tax year. Lance H. and Wanda

*i nned help filling out the 1040, schedule 1 and schedule 8812

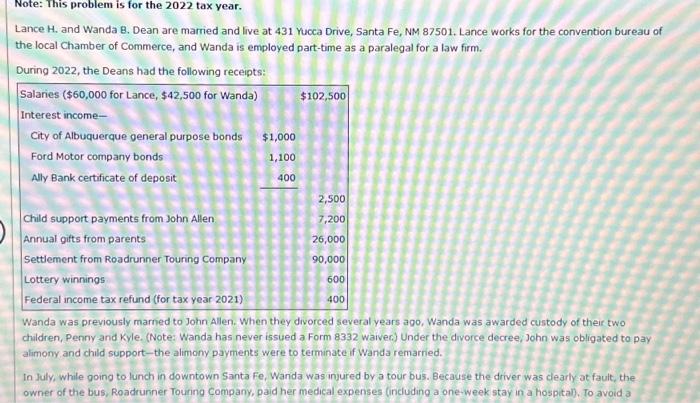

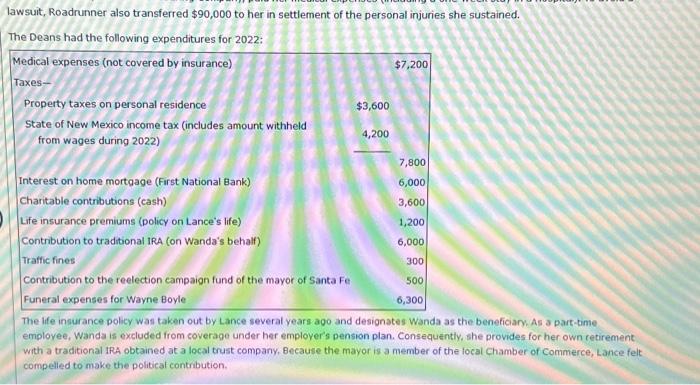

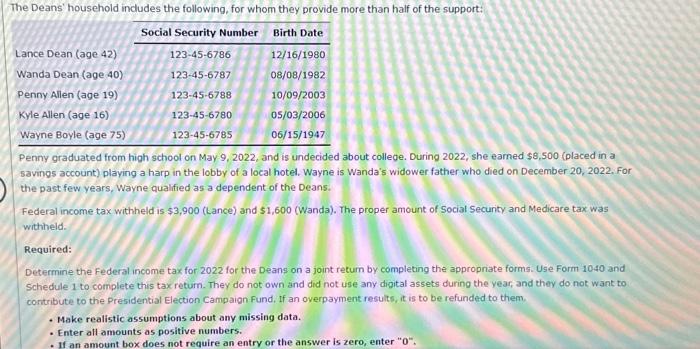

Note: This problem is for the 2022 tax year. Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2022, the Deans had the following receipts: Salaries ($60,000 for Lance, $42,500 for Wanda) Interest income- City of Albuquerque general purpose bonds Ford Motor company bonds Ally Bank certificate of deposit Child support payments from John Allen Annual gifts from parents Settlement from Roadrunner Touring Company Lottery winnings Federal income tax refund (for tax year 2021) $1,000 1,100 400 $102,500 2,500 7,200 26,000 90,000 600 400 Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John was obligated to pay alimony and child support-the alimony payments were to terminate if Wanda remarried. In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. Because the driver was clearly at fault, the owner of the bus, Roadrunner Touring Company, paid her medical expenses (including a one-week stay in a hospital). To avoid a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started