Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i no longer need this one. can i do this question instead The VP of operations insists at the merger will generate $1M An after

i no longer need this one. can i do this question instead

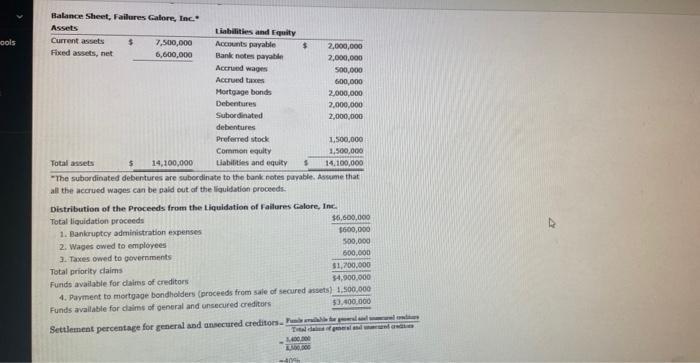

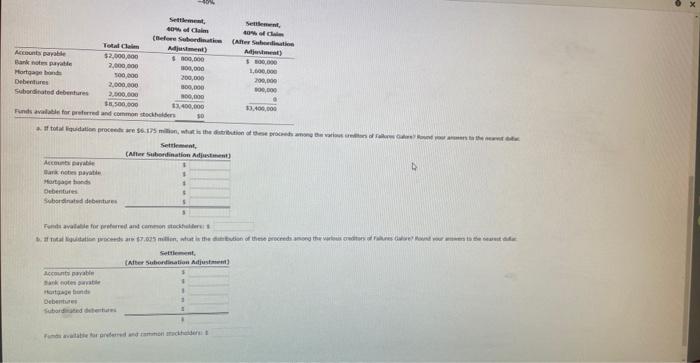

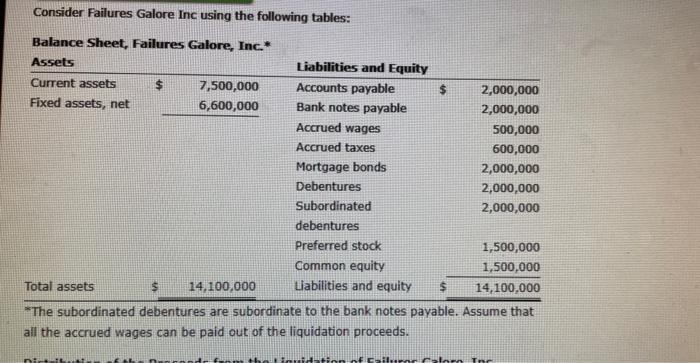

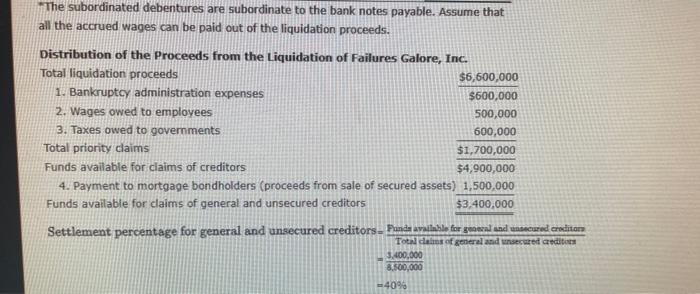

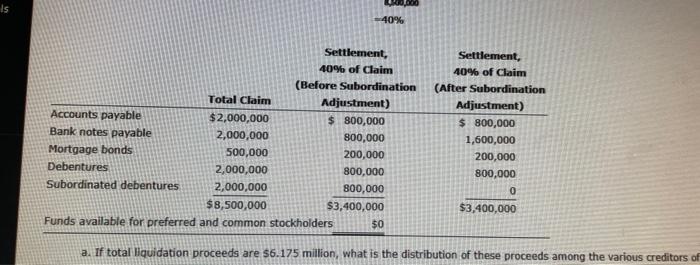

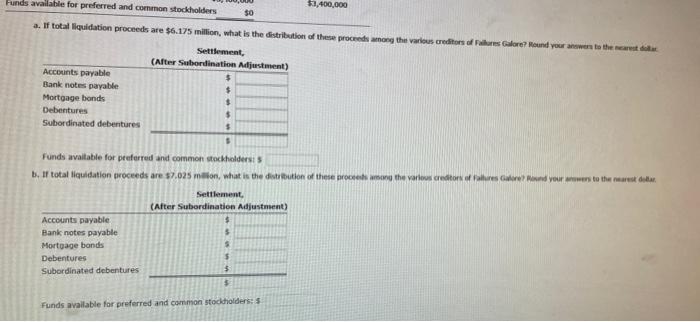

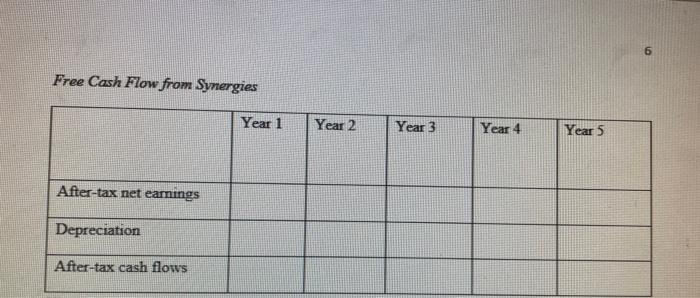

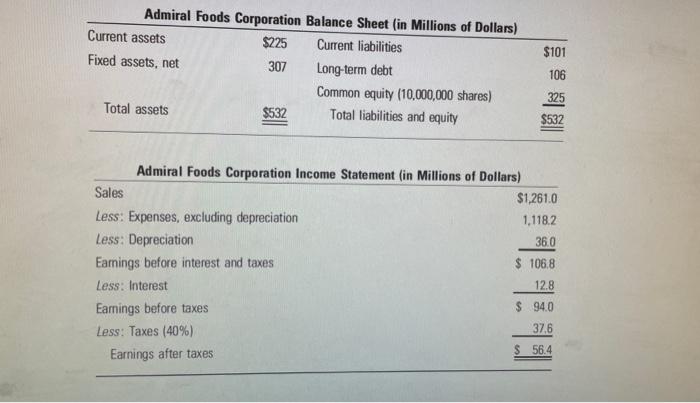

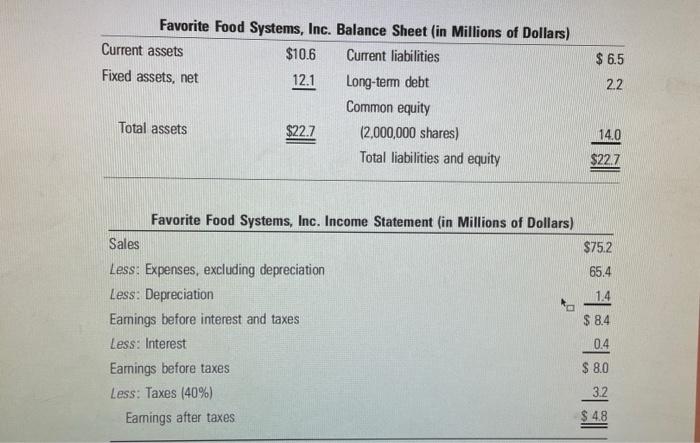

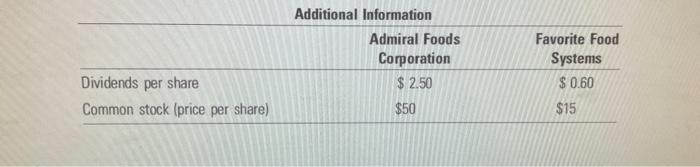

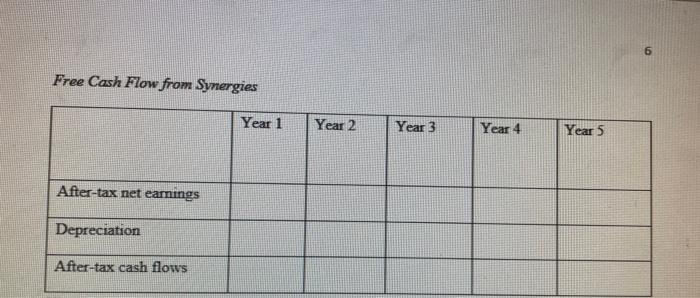

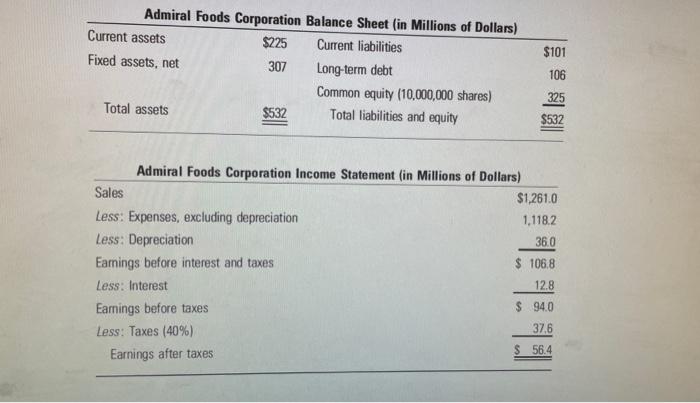

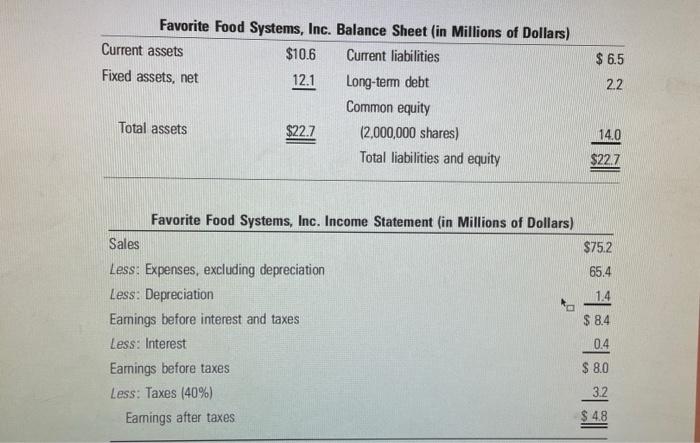

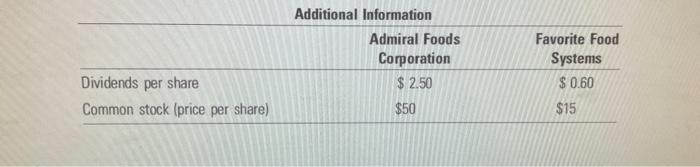

"The subordinated debentures are subcrdinate to the bank notes purable, Assume that: all the accued wapes can be baid out of the liguidation proceeds. Consider Failures Galore Inc using the following tables: *The subordinated debentures are subordinate to the bank notes payable. Assume that all the accrued wages can be paid out of the liquidation proceeds. The subordinated debentures are subordinate to the bank notes payable. Assume that all the accrued wages can be paid out of the liquidation proceeds. Distribution of the Proceeds from the I inuidation nf Cailurac Calno True =3.500,0003,400,000 a. If total liquidation proceeds are 56.175 million, what is the distribution of these proceeds among the various creditors of Funds avaitable for peuferred and cornmot stockholderst 5 Funds avallable far preferred and common stocldolders: 5 . Free Cash Flow firom Synergies Admiral Foods Corporation Balance Sheet (in Millions of Dollars) Admiral Foods Corporation Income Statement (in Millions of Dollars) Favorite Fond Sustame Ine Rolaman Chand diz. Matu: \begin{tabular}{lcc} \hline & Additional Information & Favorite Food Systems \\ \hline Dividends per share & Comoration & $0.60 \\ Common stock (price per share) & $2.50 & $15 \\ \hline \end{tabular} Terminal Value Here, provide an explanation of the terminal value (1-2 sentences). Include a table Table 9 Terminal Value [insert table-create your own] "The subordinated debentures are subcrdinate to the bank notes purable, Assume that: all the accued wapes can be baid out of the liguidation proceeds. Consider Failures Galore Inc using the following tables: *The subordinated debentures are subordinate to the bank notes payable. Assume that all the accrued wages can be paid out of the liquidation proceeds. The subordinated debentures are subordinate to the bank notes payable. Assume that all the accrued wages can be paid out of the liquidation proceeds. Distribution of the Proceeds from the I inuidation nf Cailurac Calno True =3.500,0003,400,000 a. If total liquidation proceeds are 56.175 million, what is the distribution of these proceeds among the various creditors of Funds avaitable for peuferred and cornmot stockholderst 5 Funds avallable far preferred and common stocldolders: 5 . Free Cash Flow firom Synergies Admiral Foods Corporation Balance Sheet (in Millions of Dollars) Admiral Foods Corporation Income Statement (in Millions of Dollars) Favorite Fond Sustame Ine Rolaman Chand diz. Matu: \begin{tabular}{lcc} \hline & Additional Information & Favorite Food Systems \\ \hline Dividends per share & Comoration & $0.60 \\ Common stock (price per share) & $2.50 & $15 \\ \hline \end{tabular} Terminal Value Here, provide an explanation of the terminal value (1-2 sentences). Include a table Table 9 Terminal Value [insert table-create your own] The VP of operations insists at the merger will generate $1M An after tax earnings each year from synergies, due to favorite using Admiral products and it's cost of good sold. Calculate the free cash lows from the synergies for five years, assuming $100,000 of depreciation for each year develop the terminal your value of the synergies based on the fifth year at the cash flows. Assume the growth rate of the synergistic cash flows after the terminal year is 1.0%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started