Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I Nov 2007 Company XX has a market value of GH50 million. Company YY has a market value of GHe200 million. cost savings will be

I

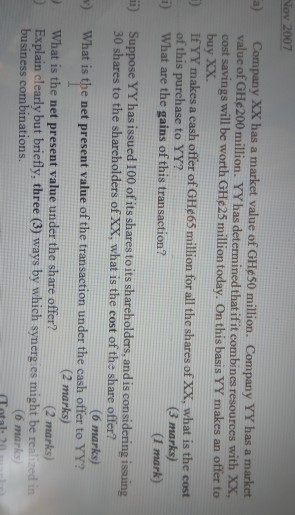

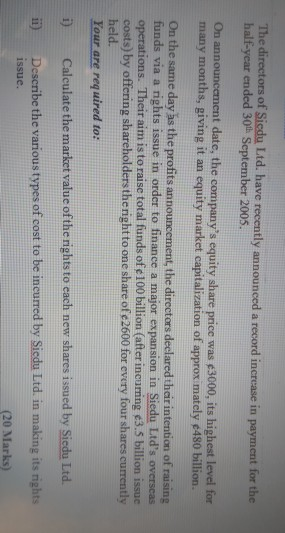

Nov 2007 Company XX has a market value of GH50 million. Company YY has a market value of GHe200 million. cost savings will be worth GHe25 million today. On this basis YY makes an offer to buy XX. If YY makes a cash offer o GHe65 million for all the shares of XX, what is the cost of this purchase to YY? YY has determined that ifit combines resources with XX, (3 marks) i) What are the gains of this transaction? (1 mark) Suppose YY has issued 100 ofts shares to its shareholders, and is considering issuing 30 shares to the sharcholders of XX, what is the cost of the share offer? ) (6 marks) v) What is the net present value of the transaction under the cash offer to YY? (2 marks) What is the net present value under the share offer? Explain clearly but briefly, three (3) ways by which synerg es might be realized in business combinations 6 marks The directors of Siedu Ltd. have recently announced a record incrcase in payment for the half-year ended 30% September 2005. On announcement date, the company's equity share price was e3000, its highest level for many months, giving it an equity market capitalization of approx mately 480 billion. On the same day s the profits announcement, the directors declared thair intention of raising funds via a rights issue in order to finance a major expansion in Siedu Ltd's overseas operations. Their aim is to raise total funds of c100 billion (after incurring e3.5 billion issue costs) by offering shareholdersthe rightto one share of e2600 for every four shares currently held. Your are required to: i) Calculate the market value of the rights to each new shares issued by Siedu Ltd. ii) Describe the various types of cost to be incurred by Siedu Ltd. in making its rights issue. (20 Marks) Nov 2007 Company XX has a market value of GH50 million. Company YY has a market value of GHe200 million. cost savings will be worth GHe25 million today. On this basis YY makes an offer to buy XX. If YY makes a cash offer o GHe65 million for all the shares of XX, what is the cost of this purchase to YY? YY has determined that ifit combines resources with XX, (3 marks) i) What are the gains of this transaction? (1 mark) Suppose YY has issued 100 ofts shares to its shareholders, and is considering issuing 30 shares to the sharcholders of XX, what is the cost of the share offer? ) (6 marks) v) What is the net present value of the transaction under the cash offer to YY? (2 marks) What is the net present value under the share offer? Explain clearly but briefly, three (3) ways by which synerg es might be realized in business combinations 6 marks The directors of Siedu Ltd. have recently announced a record incrcase in payment for the half-year ended 30% September 2005. On announcement date, the company's equity share price was e3000, its highest level for many months, giving it an equity market capitalization of approx mately 480 billion. On the same day s the profits announcement, the directors declared thair intention of raising funds via a rights issue in order to finance a major expansion in Siedu Ltd's overseas operations. Their aim is to raise total funds of c100 billion (after incurring e3.5 billion issue costs) by offering shareholdersthe rightto one share of e2600 for every four shares currently held. Your are required to: i) Calculate the market value of the rights to each new shares issued by Siedu Ltd. ii) Describe the various types of cost to be incurred by Siedu Ltd. in making its rights issue. (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started