Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i only need answer for section e, thank you! Question 5 (25 marks) Lowe Car Manufacturing primarily sells car to customers who buy the cars

i only need answer for section e, thank you!

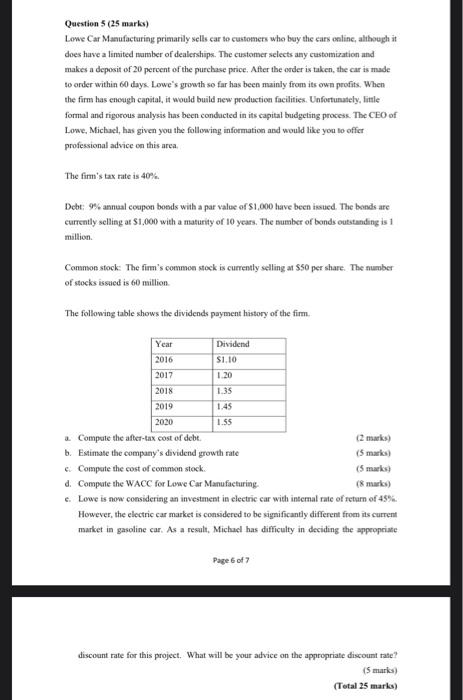

Question 5 (25 marks) Lowe Car Manufacturing primarily sells car to customers who buy the cars online, although it does have a limited number of dealerships. The customer selects any customization and makes a deposit of 20 percent of the purchase price. After the order is taken, the car is made to order within 60 days. Lowe's growth so far has been mainly from its own profits. When the firm has enough capital, it would build new production facilities. Unfortunately, little formal and rigorous analysis has been conducted in its capital budgeting process. The CEO of Lowe, Michael, has given you the following information and would like you to offer professional advice on this area. The firm's tax rate is 40% Debt: 9% annual coupon bonds with a par value of $1,000 have been issued. The bonds are currently selling at $1,000 with a maturity of 10 years. The number of bonds outstanding is 1 million Common stock: The firm's common stock is currently selling at 550 per share. The number of stocks issued is 60 million The following table shows the dividends payment history of the firm, 1.20 1.45 Year Dividend 2016 $1.10 2017 2018 1.35 2019 2020 1.55 Compute the after-tax cost of debt. (2 marks) b. Estimate the company's dividend growth rate (5 marks) e Compute the cost of common stock. (5 marks) d. Compute the WACC for Lowe Car Manufacturing c. Lowe is now considering an investment in electric car with internal rate of return of 45%. However, the electric car market is considered to be significantly different from its current market in gasoline car. As a result, Michael has difficulty in deciding the appropriate Page 6 of 7 discount rate for this project. What will be your advice on the appropriate discount rate? (marks) (Total 25 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started