Answered step by step

Verified Expert Solution

Question

1 Approved Answer

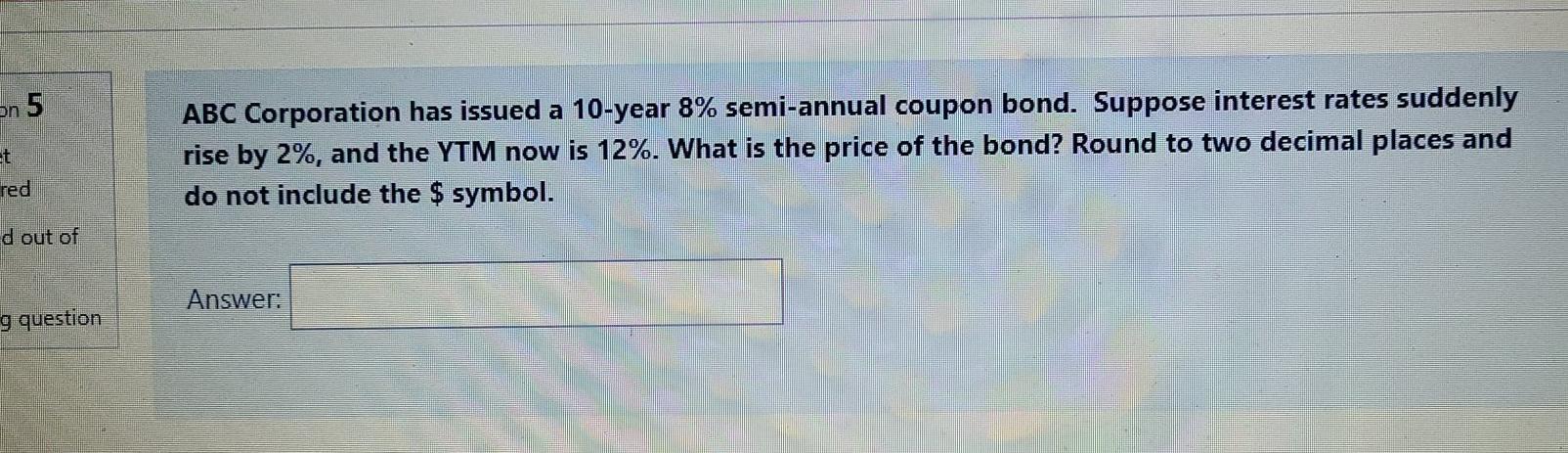

i only need answers. specification is not needed thank you on 5 5 ABC Corporation has issued a 10-year 8% semi-annual coupon bond. Suppose interest

i only need answers. specification is not needed thank you

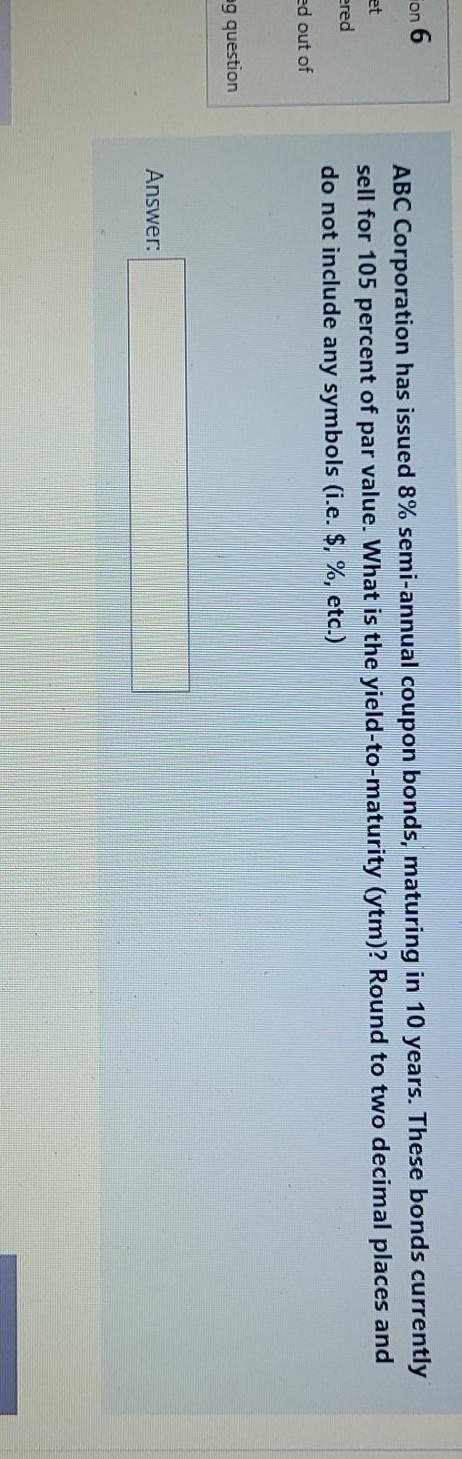

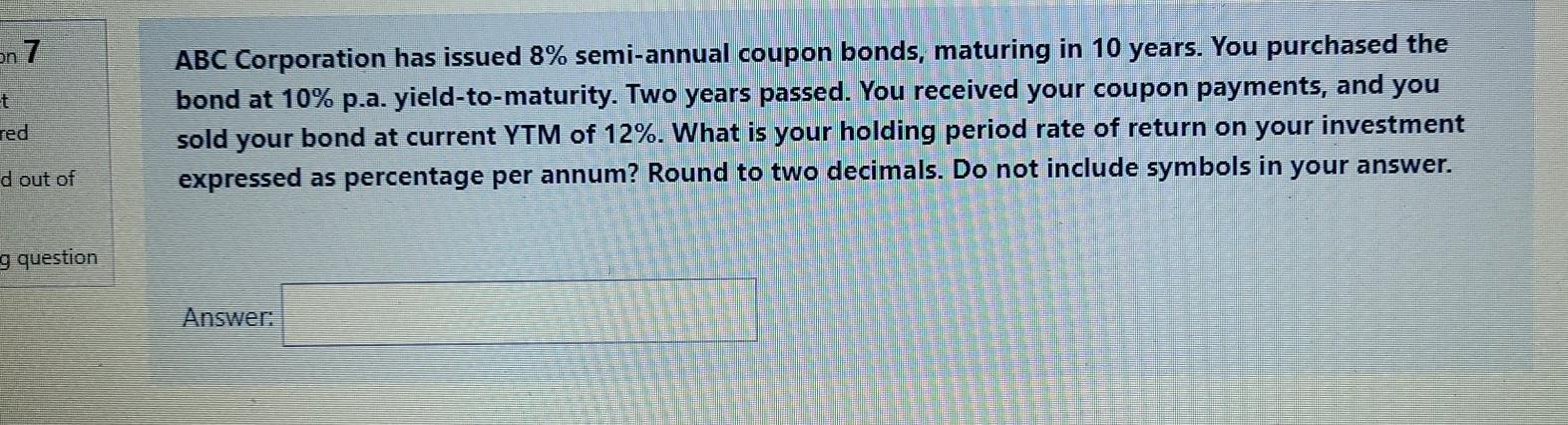

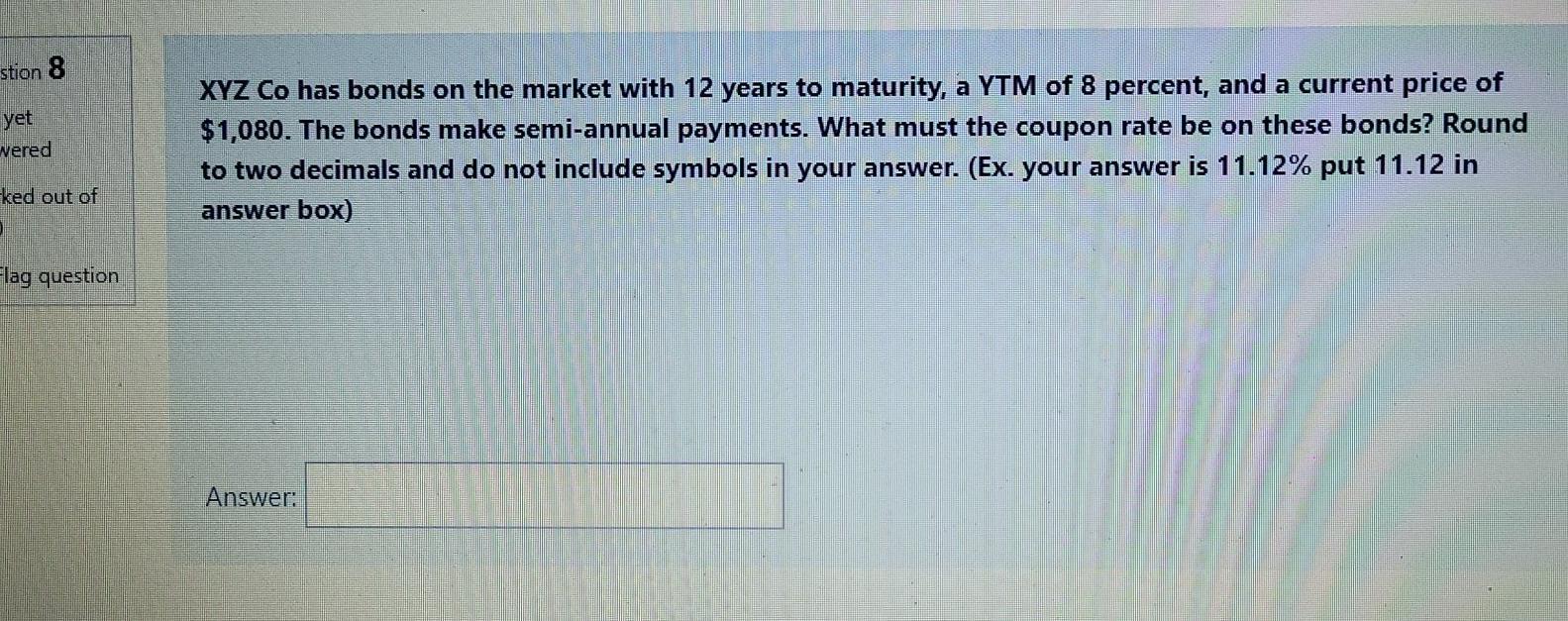

on 5 5 ABC Corporation has issued a 10-year 8% semi-annual coupon bond. Suppose interest rates suddenly rise by 2%, and the YTM now is 12%. What is the price of the bond? Round to two decimal places and do not include the $ symbol. red d out of Answer: g question on 6 et ered ABC Corporation has issued 8% semi-annual coupon bonds, maturing in 10 years. These bonds currently sell for 105 percent of par value. What is the yield-to-maturity (ytm)? Round to two decimal places and do not include any symbols (i.e. $, %, etc.) ed out of Eg question Answer: on 7 t ABC Corporation has issued 8% semi-annual coupon bonds, maturing in 10 years. You purchased the bond at 10% p.a. yield-to-maturity. Two years passed. You received your coupon payments, and you sold your bond at current YTM of 12%. What is your holding period rate of return on your investment expressed as percentage per annum? Round to two decimals. Do not include symbols in your answer. red d out of g question Answer: stion 8 yet vered XYZ Co has bonds on the market with 12 years to maturity, a YTM of 8 percent, and a current price of $1,080. The bonds make semi-annual payments. What must the coupon rate be on these bonds? Round to two decimals and do not include symbols in your answer. (Ex. your answer is 11.12% put 11.12 in answer box) ked out of FlagStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started