Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I only need help with A through E in the first picture please! but A through E requires for the whole question to be sent!

I only need help with A through E in the first picture please! but A through E requires for the whole question to be sent!

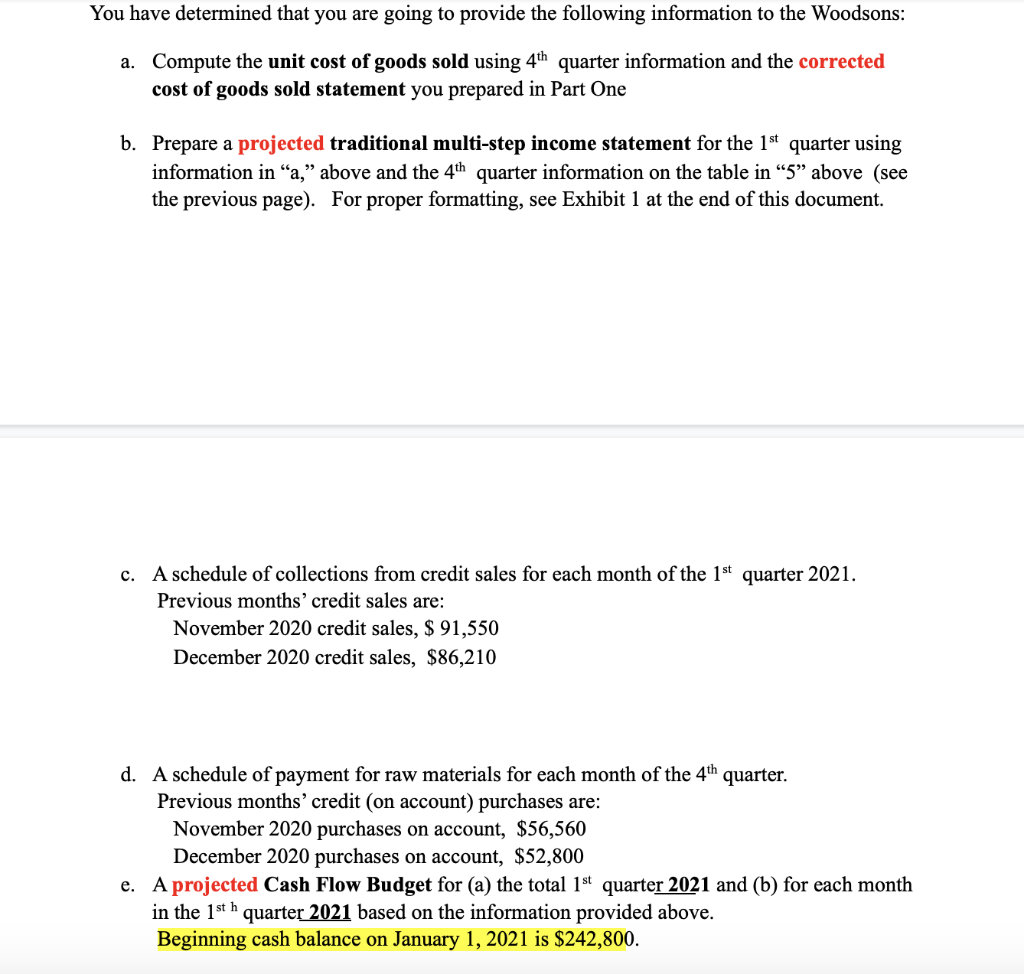

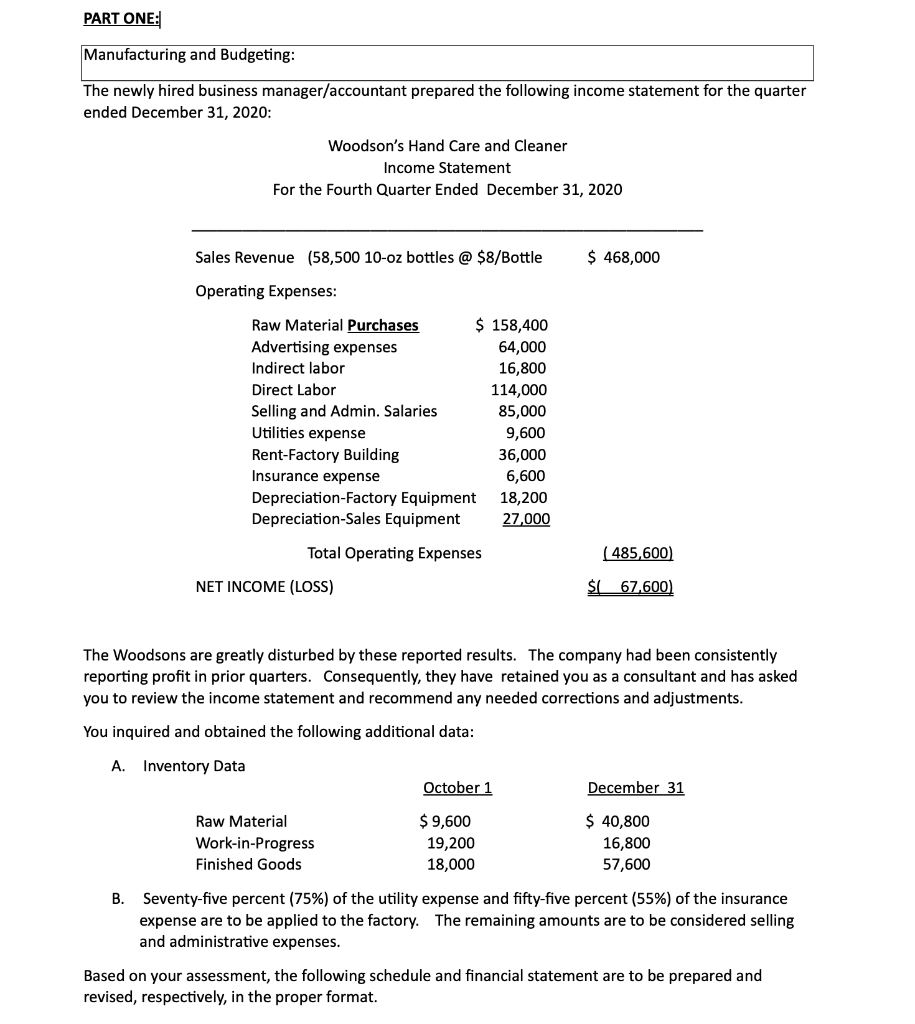

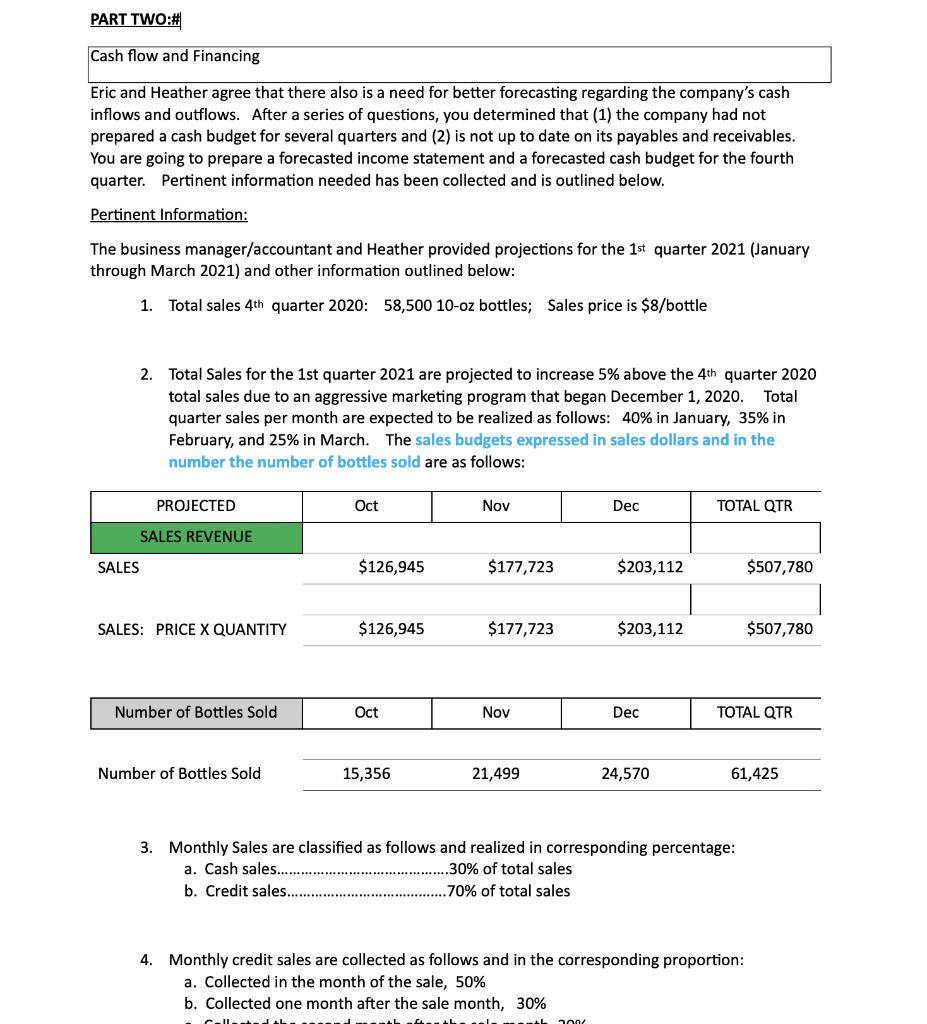

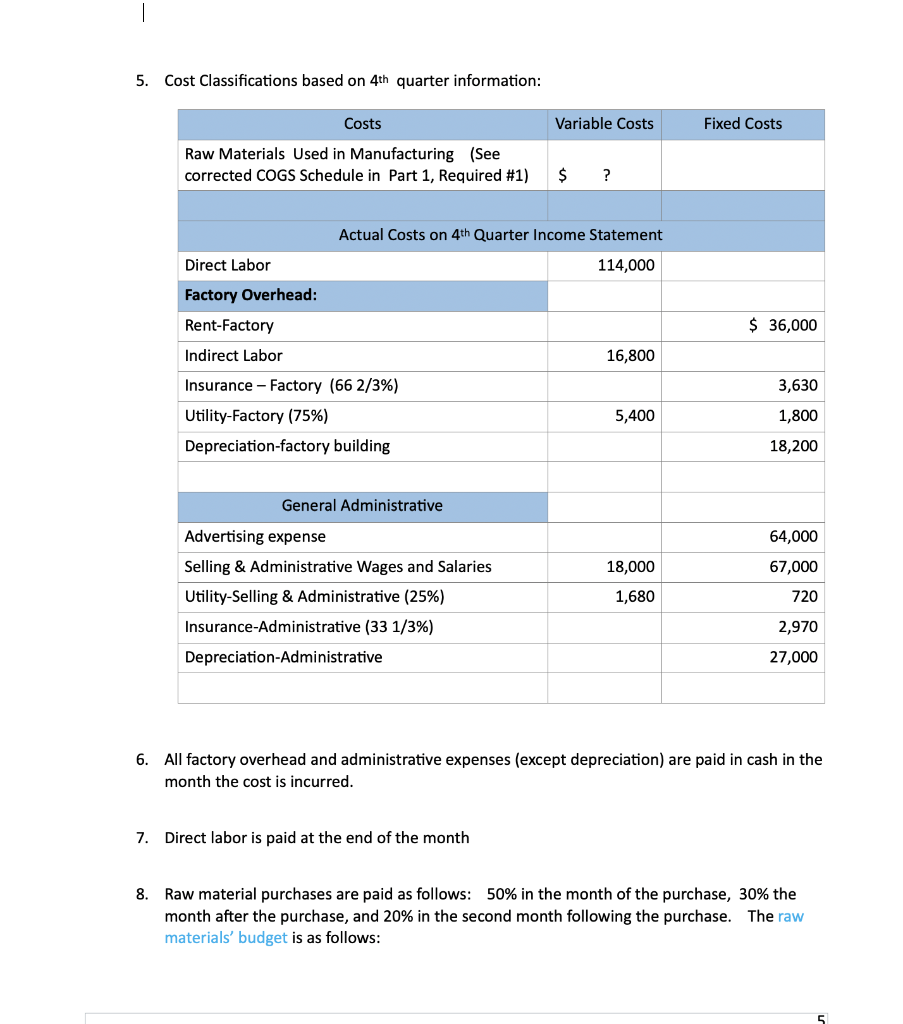

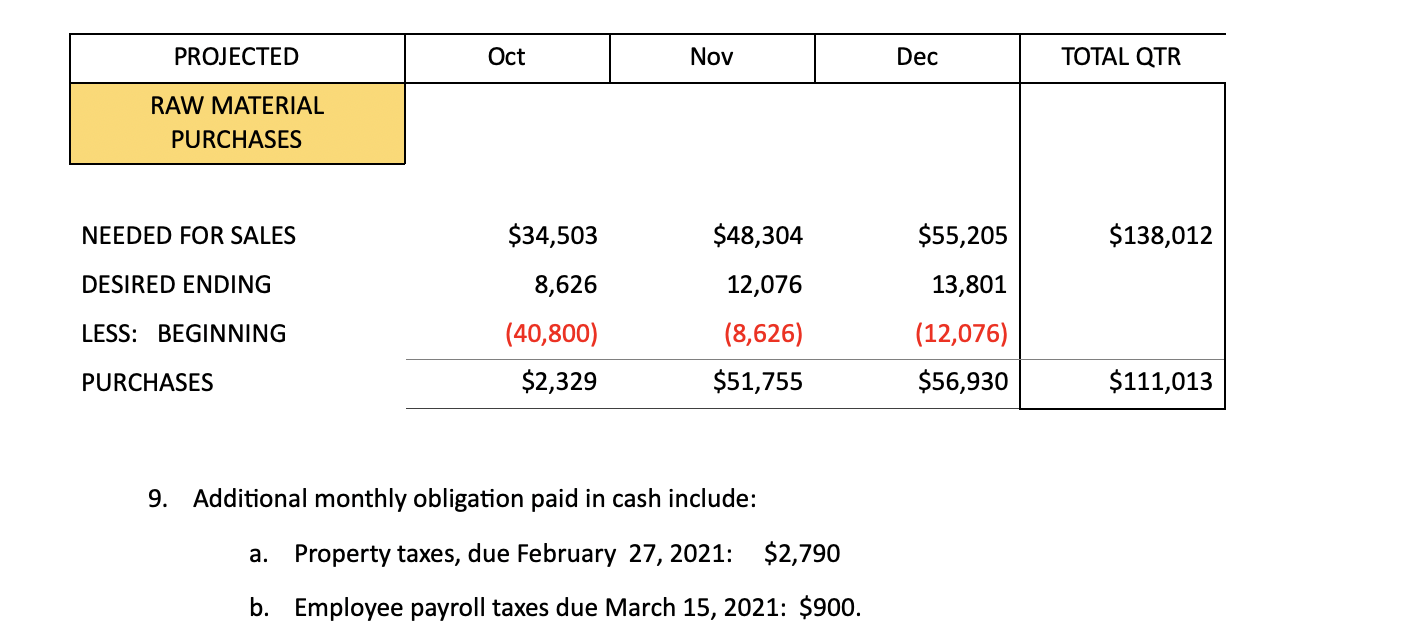

You have determined that you are going to provide the following information to the Woodsons: a. Compute the unit cost of goods sold using 4th quarter information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the 1st quarter using information in a, above and the 4th quarter information on the table in 5 above (see the previous page). For proper formatting, see Exhibit 1 at the end of this document. c. A schedule of collections from credit sales for each month of the 1st quarter 2021. Previous months' credit sales are: November 2020 credit sales, $ 91,550 December 2020 credit sales, $86,210 d. A schedule of payment for raw materials for each month of the 4th quarter. Previous months' credit (on account) purchases are: November 2020 purchases on account, $56,560 December 2020 purchases on account, $52,800 e. A projected Cash Flow Budget for (a) the total 1st quarter 2021 and (b) for each month in the 1st h quarter 2021 based on the information provided above. Beginning cash balance on January 1, 2021 is $242,800. PART ONE: Manufacturing and Budgeting: The newly hired business manager/accountant prepared the following income statement for the quarter ended December 31, 2020: Woodson's Hand Care and Cleaner Income Statement For the Fourth Quarter Ended December 31, 2020 Sales Revenue (58,500 10-oz bottles @ $8/Bottle $ 468,000 Operating Expenses: Raw Material Purchases $ 158,400 Advertising expenses 64,000 Indirect labor 16,800 Direct Labor 114,000 Selling and Admin. Salaries 85,000 Utilities expense 9,600 Rent-Factory Building 36,000 Insurance expense 6,600 Depreciation-Factory Equipment 18,200 Depreciation Sales Equipment 27,000 (485,600) Total Operating Expenses NET INCOME (LOSS) $167.600) The Woodsons are greatly disturbed by these reported results. The company had been consistently reporting profit in prior quarters. Consequently, they have retained you as a consultant and has asked you to review the income statement and recommend any needed corrections and adjustments. You inquired and obtained the following additional data: A. Inventory Data October 1 December 31 Raw Material Work-in-Progress Finished Goods $9,600 19,200 $ 40,800 16,800 57,600 18,000 B. Seventy-five percent (75%) of the utility expense and fifty-five percent (55%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format. PART TWO:# Cash flow and Financing Eric and Heather agree that there also is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Heather provided projections for the 1st quarter 2021 (January through March 2021) and other information outlined below: 1. Total sales 4th quarter 2020: 58,500 10-oz bottles; Sales price is $8/bottle 2. Total Sales for the 1st quarter 2021 are projected to increase 5% above the 4th quarter 2020 total sales due to an aggressive marketing program that began December 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in January, 35% in February, and 25% in March. The sales budgets expressed in sales dollars and in the number the number of bottles sold are as follows: PROJECTED Oct Nov Dec TOTAL QTR SALES REVENUE SALES $126,945 $177,723 $203,112 $507,780 SALES: PRICE X QUANTITY $126,945 $177,723 $203,112 $507,780 Number of Bottles Sold Oct Nov Dec TOTAL QTR Number of Bottles Sold 15,356 21,499 24,570 61,425 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales..... .30% of total sales b. Credit sales. .70% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 50% b. Collected one month after the sale month, 30% 100 5. Cost Classifications based on 4th quarter information: Costs Variable Costs Fixed Costs Raw Materials used in Manufacturing (See corrected COGS Schedule in Part 1, Required #1) $ ? Actual Costs on 4th Quarter Income Statement Direct Labor 114,000 Factory Overhead: Rent-Factory $ 36,000 Indirect Labor 16,800 3,630 Insurance - Factory (66 2/3%) Utility-Factory (75%) Depreciation-factory building 5,400 1,800 18,200 General Administrative 64,000 18,000 67,000 Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (25%) Insurance-Administrative (33 1/3%) Depreciation Administrative 1,680 720 2,970 27,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 50% in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: PROJECTED Oct Nov Dec TOTAL QTR RAW MATERIAL PURCHASES NEEDED FOR SALES $34,503 $48,304 $55,205 $138,012 DESIRED ENDING 8,626 12,076 13,801 LESS: BEGINNING (40,800) $2,329 (8,626) $51,755 (12,076) $56,930 PURCHASES $111,013 9. Additional monthly obligation paid in cash include: a. Property taxes, due February 27, 2021: $2,790 b. Employee payroll taxes due March 15, 2021: $900. You have determined that you are going to provide the following information to the Woodsons: a. Compute the unit cost of goods sold using 4th quarter information and the corrected cost of goods sold statement you prepared in Part One b. Prepare a projected traditional multi-step income statement for the 1st quarter using information in a, above and the 4th quarter information on the table in 5 above (see the previous page). For proper formatting, see Exhibit 1 at the end of this document. c. A schedule of collections from credit sales for each month of the 1st quarter 2021. Previous months' credit sales are: November 2020 credit sales, $ 91,550 December 2020 credit sales, $86,210 d. A schedule of payment for raw materials for each month of the 4th quarter. Previous months' credit (on account) purchases are: November 2020 purchases on account, $56,560 December 2020 purchases on account, $52,800 e. A projected Cash Flow Budget for (a) the total 1st quarter 2021 and (b) for each month in the 1st h quarter 2021 based on the information provided above. Beginning cash balance on January 1, 2021 is $242,800. PART ONE: Manufacturing and Budgeting: The newly hired business manager/accountant prepared the following income statement for the quarter ended December 31, 2020: Woodson's Hand Care and Cleaner Income Statement For the Fourth Quarter Ended December 31, 2020 Sales Revenue (58,500 10-oz bottles @ $8/Bottle $ 468,000 Operating Expenses: Raw Material Purchases $ 158,400 Advertising expenses 64,000 Indirect labor 16,800 Direct Labor 114,000 Selling and Admin. Salaries 85,000 Utilities expense 9,600 Rent-Factory Building 36,000 Insurance expense 6,600 Depreciation-Factory Equipment 18,200 Depreciation Sales Equipment 27,000 (485,600) Total Operating Expenses NET INCOME (LOSS) $167.600) The Woodsons are greatly disturbed by these reported results. The company had been consistently reporting profit in prior quarters. Consequently, they have retained you as a consultant and has asked you to review the income statement and recommend any needed corrections and adjustments. You inquired and obtained the following additional data: A. Inventory Data October 1 December 31 Raw Material Work-in-Progress Finished Goods $9,600 19,200 $ 40,800 16,800 57,600 18,000 B. Seventy-five percent (75%) of the utility expense and fifty-five percent (55%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format. PART TWO:# Cash flow and Financing Eric and Heather agree that there also is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Heather provided projections for the 1st quarter 2021 (January through March 2021) and other information outlined below: 1. Total sales 4th quarter 2020: 58,500 10-oz bottles; Sales price is $8/bottle 2. Total Sales for the 1st quarter 2021 are projected to increase 5% above the 4th quarter 2020 total sales due to an aggressive marketing program that began December 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in January, 35% in February, and 25% in March. The sales budgets expressed in sales dollars and in the number the number of bottles sold are as follows: PROJECTED Oct Nov Dec TOTAL QTR SALES REVENUE SALES $126,945 $177,723 $203,112 $507,780 SALES: PRICE X QUANTITY $126,945 $177,723 $203,112 $507,780 Number of Bottles Sold Oct Nov Dec TOTAL QTR Number of Bottles Sold 15,356 21,499 24,570 61,425 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales..... .30% of total sales b. Credit sales. .70% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 50% b. Collected one month after the sale month, 30% 100 5. Cost Classifications based on 4th quarter information: Costs Variable Costs Fixed Costs Raw Materials used in Manufacturing (See corrected COGS Schedule in Part 1, Required #1) $ ? Actual Costs on 4th Quarter Income Statement Direct Labor 114,000 Factory Overhead: Rent-Factory $ 36,000 Indirect Labor 16,800 3,630 Insurance - Factory (66 2/3%) Utility-Factory (75%) Depreciation-factory building 5,400 1,800 18,200 General Administrative 64,000 18,000 67,000 Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (25%) Insurance-Administrative (33 1/3%) Depreciation Administrative 1,680 720 2,970 27,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 50% in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: PROJECTED Oct Nov Dec TOTAL QTR RAW MATERIAL PURCHASES NEEDED FOR SALES $34,503 $48,304 $55,205 $138,012 DESIRED ENDING 8,626 12,076 13,801 LESS: BEGINNING (40,800) $2,329 (8,626) $51,755 (12,076) $56,930 PURCHASES $111,013 9. Additional monthly obligation paid in cash include: a. Property taxes, due February 27, 2021: $2,790 b. Employee payroll taxes due March 15, 2021: $900Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started